PORTFOLIO UPDATE:

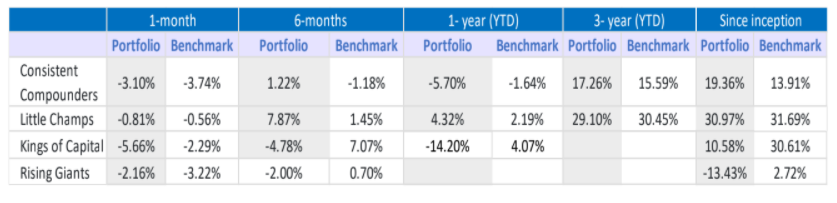

Performance data is net of annual performance fees (Except for Little Champs Portfolio) charged for client accounts whose account anniversary date falls up to the last date of this performance period. Since fixed fees and expenses are charged on a quarterly basis, effect of the same has been incorporated up to 30th September 2022. For Little Champs portfolio, since performance fees are charged on cumulative gains at the third anniversary of the respective client account, the effect of the same has not been incorporated in the performance data. (The returns are as on 30th September 2022)

Inception Date & Benchmark:

Consistent Compounders Portfolio: Inception: 1st Dec,2018 Benchmark: Nifty 50 TRI

Little Champs Portfolio: Inception:28th Aug,2019 Benchmark: S&P BSE Small Cap TRI

Kings of Capital Portfolio: Inception:28th July ,2020 Benchmark: Bank Nifty 50 TRI

Rising Giants Portfolio: Inception:27th Dec ,2021 Benchmark: BSE 500 TRI

Please find below links to our latest newsletters and presentations:

**For product/sales related queries please write to sales@marcellus.in**

OPERATIONS UPDATE:

- Release of New Version of PMS Forms.

We are happy to release the New Version of the PMS forms and Fee Schedules with reduce numbers of signature by >50% in count, added regulatory changes, digital adoption changes, changes thru Feedback from clients and internal stakeholders including Risk & Compliance.

Some of the listed Changes are mentioned:

✓ Reduction in form sign by 50% from the last version.

✓ Considering the digitization adaption KYC details of all applicants is comprehensively consolidated in one page. ✓ Consolidated Negative security/Stock restriction information in single table along additional clause for negative security applicability for existing all strategy where first applicant is same.

✓ Repetitive information i.e, Client name, date, Place etc is removed.

✓ Reduction in KYC form Pages due to consolidation of client info.

✓ POA witness sign reduced to one from earlier two.

✓ Handwritten clause has been simplified without changing the context

✓ Inclusion of unique Version no’s to each constituent of the form.

We have uploaded the new version forms on the website and below is the link.

https://marcellus.in/marcellus-forms/ – Account Opening Forms.

- Marcellus Web CIF – Resident Indian Investors

We have taken one step forward with digitization to deliver better user experience for our new investors and partners. We have gone live with online Web CIF (link below) for Resident Indian clients wherein all client details can be filled and submitted to Marcellus along with an upload of all the requisite KYC documents; you no longer need to fill in the excel spreadsheet for Resident Indian clients.

Process Steps to fill in the Web CIF (Resident Indian)

- Kindly keep a soft copy of all KYC documents in PDF/JPEG format handy before filling the form • Link to access Web CIF – https://investor-resources.marcellus.in/generate-shorturl-cif-distributor • Fill the basic details and click on generate URL.

- Copy the URL and paste in new web page to access Client Information Form

- Fill in the mandatory details on the Web CIF page and upload all KYC documents, Investor details filled in the form should match with KYC documents.

- At the end, insert captcha and then click on ‘Submit’

- An acknowledgement email will be sent to you on receipt of Web CIF details at Marcellus • Marcellus team will validate the complete information in CIF and KYC documents and proceed further with form preparation.

- Digital Sign-Up for Existing Client

- Existing Client Sign-up is basically for the clients who have an Active investment with Marcellus and wish to sign up a new strategy through signing only an Investment Approach.

- With this utility all the Resident Individual clients who are signing the document in India can make use of this digital initiatives.

Key derived benefits from this Initiatives are:

- Reduction in TAT for processing of Existing account

- No paperwork involved, 100% digital

- Eliminate Discrepancies with quick Fund Deployments

- Less coordination with Distributors / Client

- Better client onboarding experience

Extended 100 % Form Filling support for NRI and Non-Individual client offered by Marcellus.

- In our endeavor to smoothen the process of NRI Account opening, we have taken it upon ourselves to pre-fill the NRI application forms for our Partner/Distributor clients.

- We have facilitated a separate process wherein, based on the “Client Information & KYC documents”, we at Marcellus, will prepare the PMS Account opening booklet for your clients.

- The Prefilled Forms with all the requisite Sign & IPV markings, will be couriered to the preferred address of the Partners/Client.

Key benefits of this Process are listed down:

✓ Enable KRA check and identify need for IPV/OSV upfront and filter AML Validation.

✓ Improvise TAT of account opening and enable clients to invest sooner.

✓ Eliminate Re-iteration of seeking information and ratification from client to solve observations. ✓ Service & Operations efficiency at both Marcellus and Business Partner end.

Process Steps for the Marcellus Form Support:

✓ Download the Client Information Form [CIF] for NRI client through link shared below.

✓ NRI (Non-US): https://marcellus.in/new-cif-for-nri-clients-ver-2-0/

✓ US-NRI Partner: https://marcellus.in/new-cif-for-nri-US-partner-clients-ver-2-0/

✓ US-Resident Foreign Nationals Partner: https://marcellus.in/new-cif-for-fnr-USpartner-clients-ver-2-0/ ✓ Non Individual : https://marcellus.in/new-cif-for-non-individual-clients-ver-2-0/

✓ Fill in complete client (s) details in CIF and refer to supporting KYC documents to be shared along with CIF. ✓ Ensure to share CLEAR scan copies of supporting documents & confirm dispatch address details. ✓ Email CIF and Supporting KYC documents to clientsupport@marcellus.in for validation. ✓ Respective SRM will validate the complete information in CIF and supporting KYC documents. ✓ If Validation is complete, team will carry of necessary KRA AML checks and prepare the Prefilled form based on the CIF & KYC documents.

✓ In case of need for IPV & OSV respective SRM will reach back to Partners.

✓ Prefilled forms will be couriered to the requested address with T+1 days of the complete validation date.

Important Notes:

- All information in CIF is mandatory and will be used in filling of complete form.

- Incomplete CIF, or missing info. or unclear documents will be rejected by SRM at the time of validation process and will not be processed for form preparations.

- Request clients to share clear images of the proof scan copies requested and in the readable format, unclear copies will not be accepted.

- All CIF submitted before 12:00 pm will be considered for validation on same day and dispatch by next working day. ➢ All CIF Received after 12.00 PM will be considered for dispatch on T+2 working day.

- Ensure to mention the “Dispatchment Address” in the CIF.

- Investor Communication campaign for Unfunded Accounts and Form sent for signing but yet to be received at Marcellus.

We have initiated a campaign for Unfunded Accounts and Form sent for signing yet to be received at Marcellus through Calls & Email from our end based on the below criteria.

- The prefilled forms are dispatched, and the forms are not received for more than 15 days

- The accounts have been opened and unfunded for over 15 days.

A Weekly MIS is also sent to the Product team with the count of the forms awaited and unfunded accounts to track on the progress. In case you wish to have a detail of such cases, please do reach out to your respective Marcellus SRMs. Request your co-operation also to push on these cases.

Bank Account Holding Pattern: Acceptable and Unacceptable Practices:

| Bank Accounts Registration Scenario (vs PMS account holding) | Subscription (Inflow) | Redemption (Outflow) |

| Same Holders – Any Order | Yes | Yes |

| Fewer Holders – Any Order | Yes | Yes |

| More Holders – Any Order | No | No |

Explanation of the above table :-

1) If Bank account has all the a/c holders same as PMS a/c (in any order) then this account can be registered.

| Clients personal bank account | Clients PMS account | Allowed (YES/NO) |

| Client A | Client A | Yes |

| Client A + Client B | Client A + Client B | Yes |

| Client A + Client B | Client B + Client A | Yes |

2) If Bank account has few of the a/c holders from PMS a/c as its holders (in any order) then this account can also be registered.

| Clients PMS bank account | Allowed (YES/NO) | |

| Client A + Client B | Yes | |

| Client B + Client A | Yes | |

| Client A + Client B | Yes |

3) If the Bank account has some additional a/c holders in addition to one present in the PMS account then we cannot register.

| Clients personal bank account | Clients PMS account | Allowed (YES/NO) |

| Client A + Client B | Client A | No |

| Client A | Client B + Client C | No |

| Client A | Client B | No |

| Client A + Client B | Client B | No |

**For operational related queries please write to clientsupport@marcellus.in**

Copyright © 2022 Marcellus Investment Managers Pvt Ltd, All rights reserved

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this material/email in any shape or form. Marcellus Investment Managers Private Limited (“Marcellus”) is regulated by the Securities and Exchange Board of India (“SEBI”) as a provider of Portfolio Management Services. Marcellus is also a US Securities & Exchange Commission (“US SEC”) registered Investment Advisor. No content of this publication including the performance related information is verified by SEBI or US SEC. If any recipient or reader of this material is based outside India and USA, please note that Marcellus may not be regulated in such jurisdiction and this material is not a solicitation to use Marcellus’s services. This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. No liability whatsoever is assumed by Marcellus as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus may be unable to exercise control or ensure or guarantee the integrity of the text of the material/email message and the text is not warranted as to its completeness and accuracy. The material, names and branding of the investment style do not provide any impression or a claim that these products/strategies achieve the respective objectives. Further, past performance is not indicative of future results. Marcellus and/or its associates, the authors of this material (including their relatives) may have financial interest by way of investments in the companies covered in this material. Marcellus does not receive compensation from the companies for their coverage in this material. Marcellus does not provide any market making service to any company covered in this material. In the past 12 months, Marcellus and its associates have never i) managed or co-managed any public offering of securities; ii) have not offered investment banking or merchant banking or brokerage services; or iii) have received any compensation or other benefits from the company or third party in connection with this coverage. Authors of this material have never served the companies in a capacity of a director, officer or an employee.

This material may contain confidential or proprietary information and user shall take prior written consent from Marcellus before any reproduction in any form.