Brinton Johns & Brad Slingerlend’s 2014 paper, ‘Complexity Investing’, discusses how it’sfutile to forecast

extreme event like pandemics, stockmarket crashes and tech disruptions. These events belong to complex

ecosystems with unpredictable outcomes and a tendency towards polarization i.e. a few winners prevail

– those who constantly adapt, keep building on their strengths and thus end up taking most of the spoils.

These ideas are relevant now more than ever given the upheavals we have seen recently – events like

Covid19 and the Ukraine War drive consolidation of profits in favour of market leaders. We highlight that

the Rising Giants with their combination of robustness (a resilient core built around strong moats, focus

on efficiencies, cash generation) and optionalities (sensible capital allocation focused on new growth

drivers) are best placed to benefit from an unpredictable world.

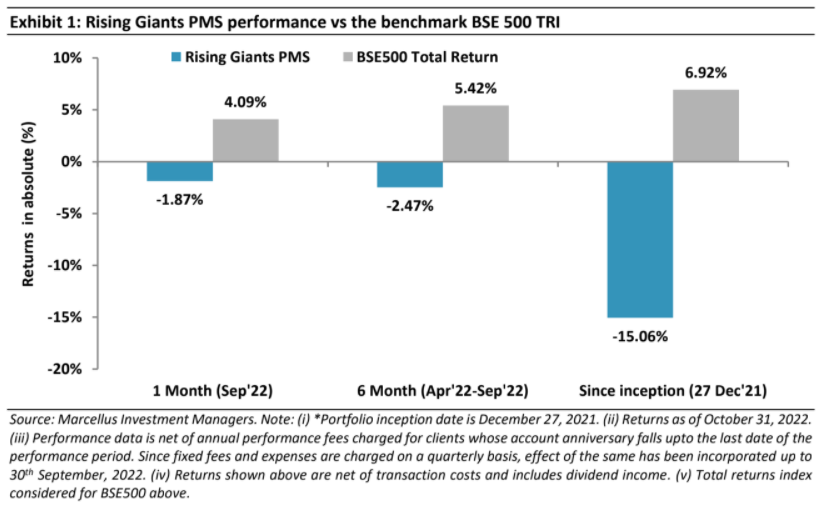

Performance update for the Rising Giants PMS

This portfolio intends to invest primarily in high quality mid-sized companies (less than Rs 75,000 crores market-capitalisation, predominantly in the Rs 7,000 crores – 75,000 crores range) with: 1) Well moated dominant franchises in niche segments; 2) A track record of prudent capital allocation with high reinvestment in the core business and continuous focus on adjacencies for growth; and 3) Clean accounts and corporate governance. From a universe of ~450 companies in this segment, a portfolio is constructed of 15-20 companies which make it past Marcellus’ proprietary forensic accounting & capital allocation filters as well as our bottom-up stock selection & position sizing frameworks.

The futility of predicting macro events and extreme outcomes

“Some things benefit from shocks; they thrive and grow when exposed to volatility, randomness, disorder, and stressors and love adventure, risk, and uncertainty” – ‘Antifragile: Things That Gain from Disorder’

(2012) by Nassim Nicholas Taleb

In their seminal 2014 paper titled ‘Complexity Investing’, Brinton Johns & Brad Slingerlend make some hard hitting points on futility of forecasting in an ever evolving world:

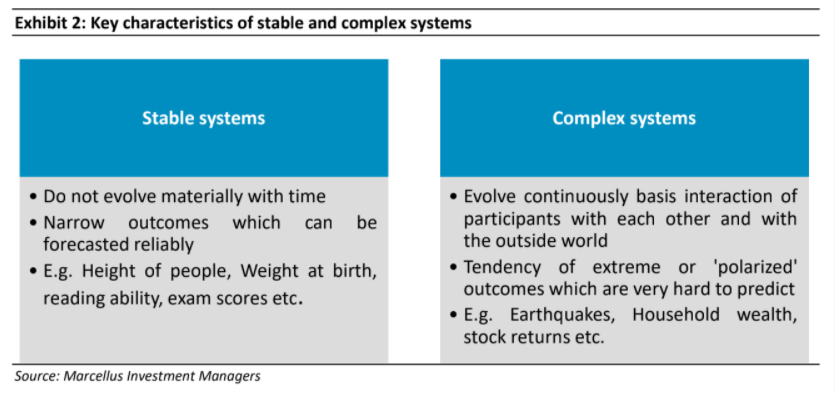

▪ The often-used Bell curves or Normal distribution curves are great for forecasting in stable systems with narrow outcomes but terrible for making predictions about extreme outcomes in complex adaptive systems such as the real world and financial markets. This is so because the latter systems keep evolving with multiple interrelationships. For example, the heights of adult males in the USA fall in a stable & narrow band of 61-81 inches (~5.3 – 6.6 ft) and hence the probability of a male reaching a height of say 8-9 feet can be reliably forecasted to be almost nil. On the other hand, extreme events such as pandemic breakouts, stock market crashes, technological disruptions are difficult to predict using such a method as they’re the outcome of an interplay of multiple inputs.

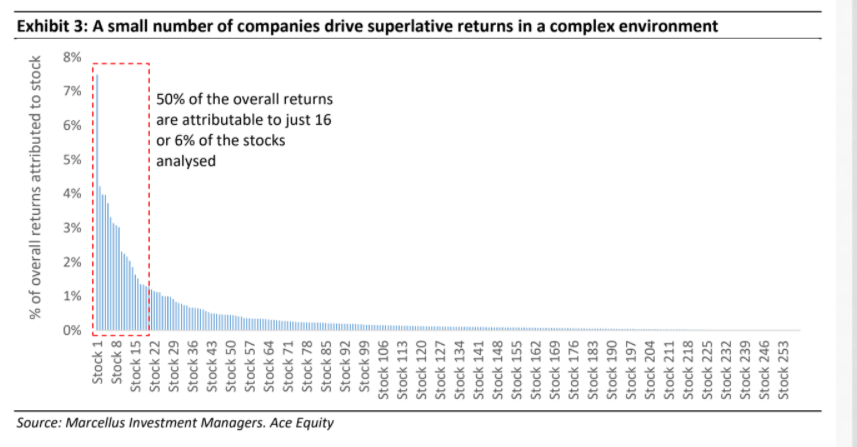

▪ In a complex environment, only a few winners prevail i.e. those who constantly adapt, keep building on their strengths and thus end up taking most of the spoils. The Pareto Principle, the Power Law and the 80/20 rule are all famous outcomes of such a scenario wherein 80% of the spoils are attributed to 20% of participants.

▪ The most appropriate portfolio strategy given the above two dynamics is to invest in companies that are ‘path independent’ i.e. companies that have the best chance of succeeding irrespective of the future unpredictable state of the world. This is done via a combination of two properties – resilience and optionality. Resilient companies are those that are less optimised on maximising short-term returns and more focused on their ability to adapt and evolve to changing conditions, surviving and even capitalising upon extreme events. These are generally high return on capital, high incremental margin, recurring revenue, cash generative businesses. Further, this resilient core can be used to fund a series of ‘Optionality’ investments around the core or adjacent competencies. Optionality refers to a large potential payoff resulting from a relatively small investment and acts as a continuing growth driver for a business.

Brinton Johns & Brad Slingerlend’s thesis is obviously super relevant to the world today. Neither Covid-19 nor the Ukrainian war were built into analysts’ or economists’ forecasts. More generally, as night follows day, the tomorrow’s world will bring more such ‘unpredictable’ shocks. In fact, the ‘complexity investing’ thought process discussed above is especially relevant to Indian equities and to the Indian corporate world in general as:

▪ Over the past 30 years the Indian economy become more integrated with global capital and trade flows. As a result, Indian corporates are now far more exposed to exogenous shocks. These shocks can arise outside India (eg. the GFC, Covid-19) and/or within India (eg. demonetisation, GST, the collapse of IL&FS/DHFL/etc.).

▪ The resulting impact on the distribution of stock returns (which are an outcome of operating in a complex environment) can be seen in the chart below. Amongst the top 500 listed companies in India (as of August 31, 2022), only 259 companies have a price history lasting 20 years (i.e. from Aug’02- Aug’22). If one had invested an equal amount of Rs 100 in each of these 259 companies and left such investment untouched, the resulting investment would’ve grown at ~31% CAGR (from Rs. 25,900 to Rs. 59.6 lakhs). However, most of that return can be attributed to only a handful of stocks – only 16 (i.e. 6% of the stocks) companies contribute to 50% of the overall returns. While this ‘polarization’ of outcomes is the key property of complex environments, it’s nearly impossible to predict in advance.

▪ The reason for the above skew in returns is also explained by looking at one layer deeper i.e the fundamentals of the companies. Marcellus blog titled ‘India’s top 20 Leviathans’ Awe-inspiring Dominance’ published in February 2021 (https://marcellus.in/blogs/indias-top-20-leviathans-awe inspiring-dominance/) explains how top-20 profit generators in India accounted for bulk of the total profit generated by the entire Indian corporate sector (on a rolling 3-year average, nearly 90% in FY20).

Robustness + Optionality = the route to Antifragility

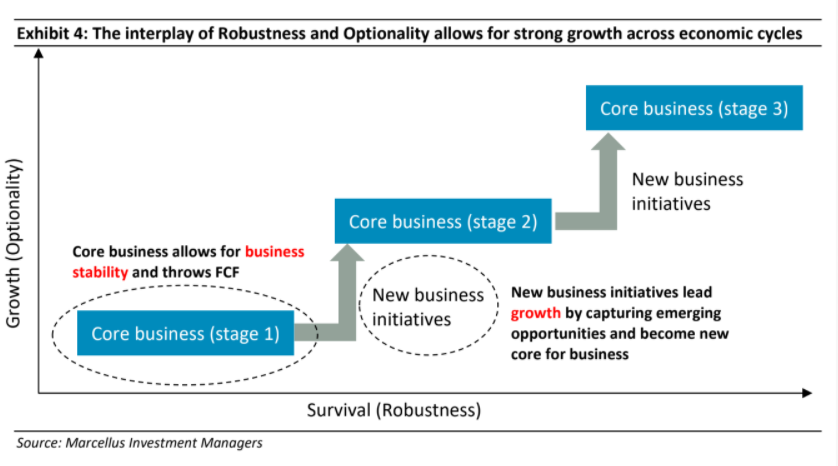

In the world of business, robust companies are less optimized for ‘growth at any cost’ and more focused on their longevity. The path to do so lies in being cash flow generative and developing a cushion which can be called upon in adverse scenarios.

Robustness helps a company survive and generate stable earnings. However, without growth such stocks might end up having bond like characteristics with high dividend payouts (or, even worse, cash accumulating on the balance sheet) year after year. Hence, alongside surviving, companies need to find avenues for growth so as to reward their shareholders optimally. This is where ‘optionality’ comes in. The word derives its meaning from the financial derivative wherein the buyer hasthe option but not the obligation to exercise the instrument on the expiry date. In the case of a favourable outcome, the owner of the option generates a handsome upside.

In the business world, the young companies or ‘start-ups’ exemplify the use such an optionality as they bet on fast growth resulting from capturing the potentially huge markets in a number of emerging areas. Early investors in such companies stand to multiply their investment corpus if it grows into a large, stable, profitable business.

While robustness without ‘optionality’ can mar growth prospects, solely depending on optionality can endanger your very survival if you do not have a reliable source of capital to fund losses in the initial few years of a young business (as we’ve witnessed over last 6 months or so with external funding drying up for many such firms). Therefore, a combination of both characteristics – Robustness and Optionality – is what works the best as Robustness lays the foundation for Optionality to fructify into a core business successfully.

The interplay between Robustness and Optionality is captured in the chart below. The core business provides the necessary stability to the business while new business initiatives help provide new growth avenues. With time such, new initiatives themselves become a part of overall core and the trend continues.

How Rising Giants exemplify Robustness and Optionality

The Rising Giants have a resilient core built around…

▪ Strong competitive moats

Companies in the Rising Giants portfolio have built dominant franchises on the back of strong moats around value creation for their customers which would be very challenging for competitors to replicate. We explain the drivers of moats for some of the portfolio companies below:

– Astral was the first company (around 2004) to conduct meetings of groups of plumbers to create awareness of its CPVC pipe range and its advantages over the prevalent industry pipe standard at the time. Its technical collaboration with Lubrizol and its own insistence on not compromising on its quality standards allowed it to create a demand base with the plumber and builder communities. It also went a step further and communicated its offering to end customers through extensive branding activities creating a pull from end customers which in turn benefited the firm’s distributors and dealers as well.

– GMM Pfaudler supplies chemical process equipment for which quality is a key attribute. Especially in Glass lined Equipment (GLE) – where the vessels are used to mix compounds for chemical / API synthesis, a single crack in the enamel can lead to the loss of an entire batch of pharmaceuticals or chemicals followed by weeks of downtime for the factory. Clients in the industry (chemical / pharma giants) value quality and GMM is able to provide it.

– From Aavas, a customer is able to avail loans at 12-14% interest rates vs. 20%+ rates prevalent in unorganised lending alongside a quick Turn Around Time for loan approvals (enabled by digital initiatives). Banks which lend to Aavas are able to earn an healthy spread (cost of deposit – ~4% vs. lending at ~7-8%) and can also procure affordable housing loans to meet their Priority Sector Lending requirements without having to manage the idiosyncrasies of the affordable housing segment themselves.

– Info Edge’s value stems from its’ recruitment vertical Naukri.com. The majority of the job postings are for junior-level positions at companies in sectors such as IT / ITES, Infra & BFSI. For these positions recruiters value the available supply of resumes on the platform. The fact that >50% of Naukri revenues (35%+ of Info Edge revenues) come from ‘Resume Access Database’ (i.e. recruiters paying to view resumes) is a testament to this value proposition.

– Dr Lal’s key offering to the end customer is based on convenience enabled through hub & spoke collection centres and automation of labs to deliver a faster turnaround of reports. It has also built doctor trust by maintaining acute focus on accuracy and introduction of advanced tests. Further, the benefits of higher scale are passed on to the consumer as is evident from the fact that Dr Lal has not taken any meaningful price hikes in the last 5 years while maintaining profitability.

▪ Relentless focus on efficiencies:

Profit margin improvement has been another key driver of earnings growth for the RG portfolio companies. Such margin expansion is not driven by an increase in pricing but by: (i) Efficiency measures, initiated by these companies such as cost reduction initiatives (optimising power & fuel, logistics costs, value engineering etc); and (ii) Improvement in the product mix

Another important area of focus for the Rising Giants is reduction in working capital brought upon by: (i) Superior bargaining power relative to customers and suppliers; and (ii) Technology related investments in driving efficiencies at the backend like distributor management systems, supply chain tools, inventory management software, etc. More details on drivers of working capital improvement for the portfolio companies can be read in our April 2022 Rising Giants newsletter.

The result: Stable revenue base, high margins and healthy RoCE across cycles

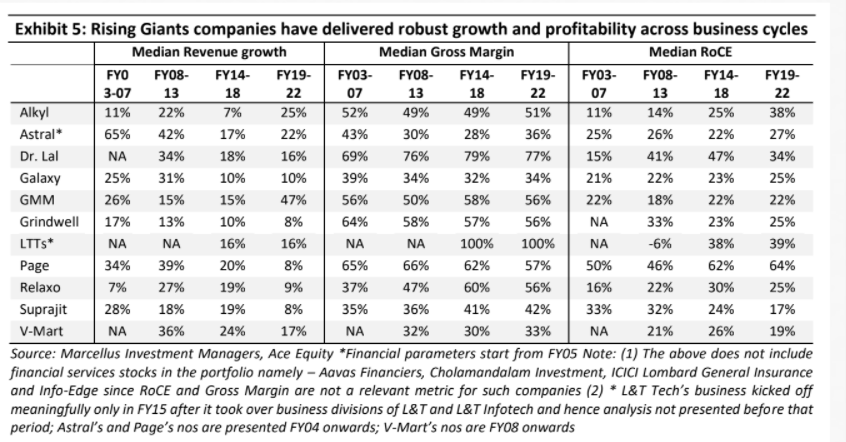

Thanks to the robustness of the Rising Giants’ businesses allied with consistent improvement in the core business, over the last two decades, most RG companies have delivered solid fundamentals – both on the growth and on the ROCE front (see table below).

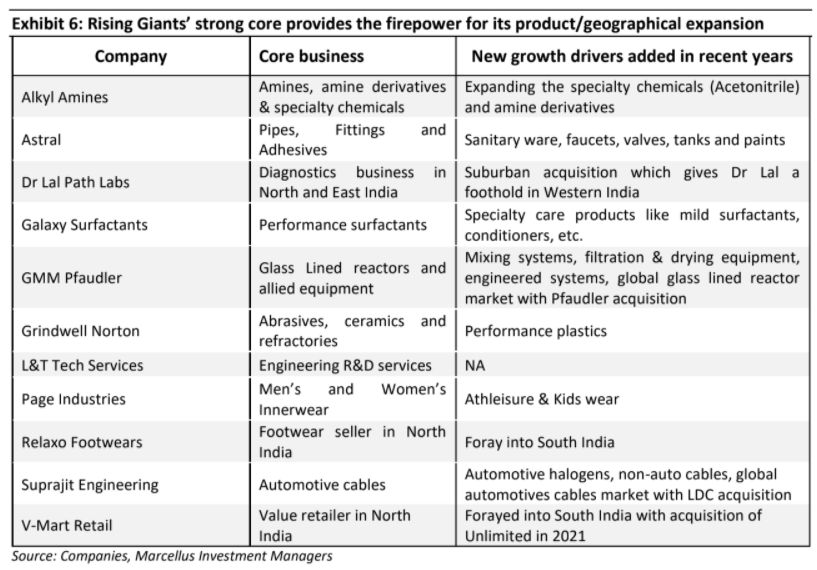

Our Sep’22 letter discusses how the RG companies have increased their investments in FY22 (more than 2x of FY19-21 average) towards both organic/inorganic additions of new growth drivers- many of which would serve as an embedded optionality for the company. The table below summarizes such new focus areas.

Processes put in place for future success of embedded optionality in business

Rising Giants have not only built a strong core over the years but have also put systems and processes in

place for the success of their optionality related investments. A key tenet of this is the demarcation or decentralization of responsibilities with independent, focused business heads put in charge of scaling up new business initiatives. For example, amongst the RG companies:

– For Suprajit, N S Mohan (non-promoter) as the MD and Group CEO is responsible for all the operational matters including the subsidiaries. There are COOs for each of the key businesses who all report to N S Mohan. Mr Rai’s sons Akhilesh and Ashutosh look at new integration of acquisitions, improvement programs and IT initiatives/Suprajit Technology Centre focussing on new products, R&D, etc. respectively. Jim Ryan would continue to lead the newly acquired LDC business.

– CIFC has added three new product categories – SME loans, CSEL (consumer & Small Enterprise Loans) and SBPL (Secured Business and Personal Loans) with separate heads to run each vertical independently while the group’s senior management looks at overall strategy and capital allocation decisions

– For Dr. Lal, Bharat Uppilliappan as the CEO of the firm looks at the overall strategy and new initiatives like Control Tower, expansion in smaller towns, driving home collection etc. Erstwhile COO – Mr. Shankha Banerjee has been appointed as CEO of newly acquired Suburban Diagnostics with full ownership of its network expansion (as per our PD checks)

– At GMM, there’s a clear demarcation between the Indian / International business. Aseem Joshi was hired around a year back to run the Indian business, with India CFO Manish Poddar. Thomas Kehl and Alexander Poempner run Pfaudler International. Promoter family (Ashok & Tarak Patel) are not involved in daily running of the business with Tarak in charge of only overall strategy

– LTTS operates under five verticals – Transportation, Telecom & Hi-Tech, Industrial Products, Plant Engineering & Medical Devices. Vertical Heads are responsible for the respective vertical’s growth initiatives, P&L, etc.

Conclusion: The Rising Giants companies are in a sweet spot

The sweetest spot to capture the potential returns from a combination of these two characteristics – resilience and optionality can be found in companies that form the Rising Giants portfolio. The core of the Rising Giants companies is mature enough such that adverse scenarios (pandemics, wars, political upheavals, economic downturns, etc) should not lead to a material deterioration in the strength of the franchise and its growth initiatives. And yet, these firms are still modest enough in size (median market is Rs 23 K crores)such that incremental new initiatives will impart a significant uplift in the future free cashflow growth prospects.