Just as the Moneyball approach in baseball (as explained by Michael Lewis in his book by the same name) helped a team of seemingly average players consistently win matches, in Marcellus’ MeritorQ, we select good quality and undervalued companies (rather than betting on singular ‘quality’ or ‘value’ investment opportunities) to deliver superior risk-adjusted returns. The clear value addition from each additional screening and selection rule in MeritorQ, as seen in the back-tested performance, is testimony to the robustness of this approach.

‘Moneyball’ and Quality Investing: A Match Made in Heaven

Contrary to the popular belief that successful teams win due to 1 or 2 superstars, the ‘Moneyball’ approach used in 2002 for the first time by Billy Beane, coach of the Oakland Athletics baseball team, showed that a team of players selected using data and statistical analysis can produce exceptional results. Michael Lewis immortalised Moneyball in his book by the same name published in 2003.

In Moneyball, when rival teams see a flaw in a player like a pitcher’s unusual throwing motion or an injury that affects the player’s throwing (but not his hitting)— they would knock down his value. In such situations, Billy Beane would dig into the numbers to find players he liked. Beane would then put them on a wish list and pick them up when the market discounted the player’s value because something was amiss. Similarly in investing, when investors detect a problem at a company, they tend to knock down the price of its stock. What Beane did was the baseball equivalent of what Warren Buffett does: Buy good companies when they’re cheap and out of favour.

Extending this same line of logic to investing, we at Marcellus have, using data and statistical analysis, devised MeritorQ – a quantitative strategy that invests in profitable yet undervalued companies to deliver superior risk-adjusted returns.

Buying high quality assets without paying premium prices is just as much value investing as buying average quality assets at discount prices. Including measures of quality along with measures of value in the same portfolio effectively makes ‘value’ a more effective strategy, as it distinguishes between stocks at low or high valuation multiples for justified reasons (for example profitable, stable businesses with clean accounts) from those at similar multiples without such a reason. Combining quality and price signals, as we have done in in MeritorQ, yields substantial performance improvements over traditional standalone value and quality strategies.

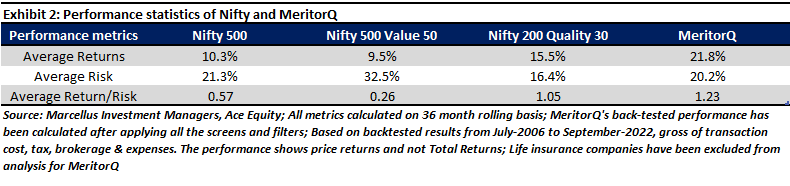

To demonstrate this, we compare MeritorQ with standalone “Value” and “Quality” strategies. “Value” style of investing is proxied with NIFTY 500 Value 50 index and “Quality” with NIFTY 200 Quality 30 Index.

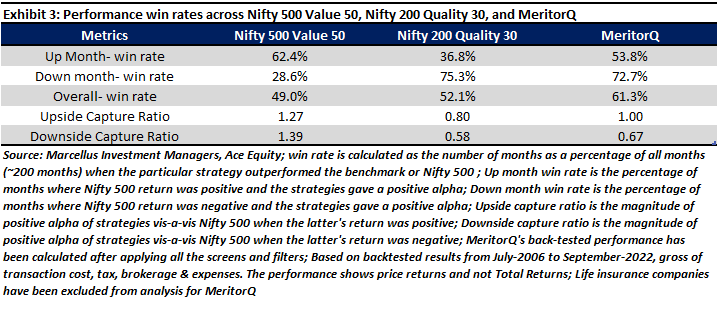

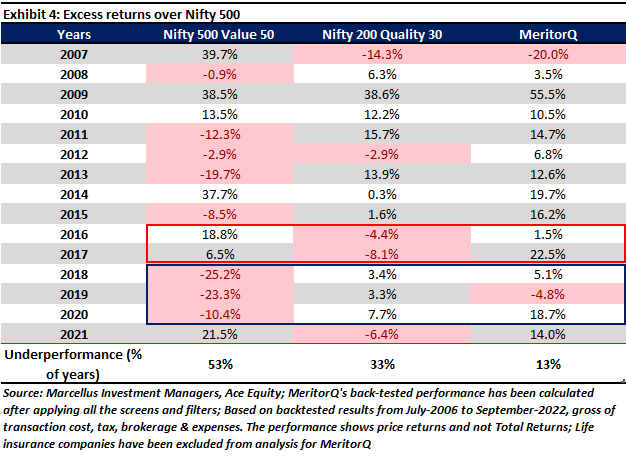

Our approach of combining value and quality also shows more consistent performance in the back-test (see exhibit 3). In fact, in exhibit 4 we can see that MeritorQ as a strategy has outperformed Nifty 500 more consistently than Nifty Value 50 and Nifty Quality 30 indexes and whenever only quality has underperformed, value has done relatively well and vice versa. This should not come as a surprise as returns for value and quality strategies typically tend to be uncorrelated and hence underperform/outperform during different stages of economic cycle.

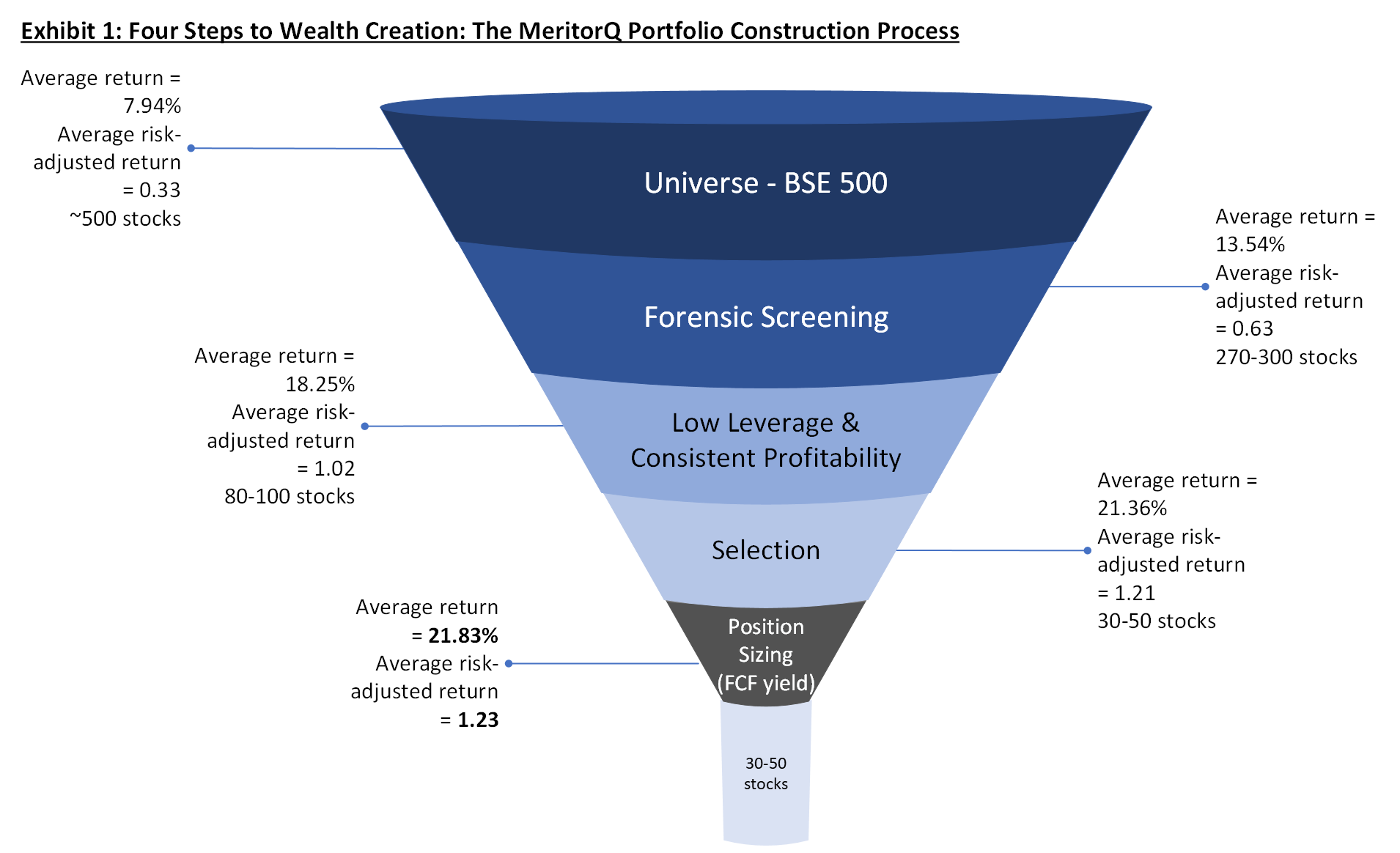

Exhibit 1 on the cover page of this note shows the portfolio construction process for MeritorQ. We will now explain step-by-step the MeritorQ portfolio construction steps.

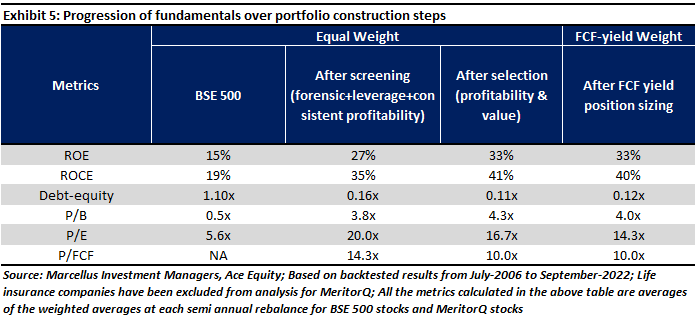

Firstly, we see that over the past 15 years, the BSE 500 equal weighted portfolio delivers lower returns than cost of capital over this period with significantly higher risk than its market cap weighted counterpart (see exhibit 1). What this tells us that eliminating low quality stocks from the BSE500 will lead to better returns. Hence, we begin the portfolio construction process with forensic screening.

Forensic screening: As we have highlighted previously in our books and in in our newsletters, companies with governance issues and accounting irregularities in a broad-based index like the BSE 500 can lead to permanent loss of capital. As we had pointed out in our book ‘Diamonds in the Dust: Consistent Compounding for Extraordinary Wealth Creation’ (2021), “A closer analysis of the stocks exiting the BSE 500 over the last five to ten years indicates that most of the exits had little to do with business downturns but were mainly on account of corporate governance/accounting lapses and/or capital misallocation at these firms…On their way out, most of these stocks saw significant erosion in their shareholders’ wealth. On average, the companies which exited the index in 2019 had lost 30% of their December 2009 market capitalization.”

Our proprietary forensic screen filters out such companies to precisely mitigate this risk, leading to an improvement of 30 points (0.33 jumps to 0.63) in risk-adjusted return as seen over the 16 year back-test period.

Screening for low leverage and consistent profitability: The next layer of picking high quality companies is ensuring that they are not only consistently profitable but also are not driving their earnings on the back of borrowed money. This is important given the proclivity of highly leveraged firms to unravel just as quickly as they rose to the top. By adding this screen, a risk-adjusted performance enhancement of 39 points (0.63 jumps to 1.02) is seen in the back-tested results.

Stock Selection: A dilemma that is often faced by investors is whether to invest in ‘high quality’ stocks or in ‘value-for-money’ stocks. Why can’t we have best of both worlds? This is exactly the thought process that was applied when producing this screening step: the intersection of profitability and value is what drives stock selection in this step. Going by just academic definition of identifying “value” stocks often used in traditional quantitative portfolios, would lead us to distressed, unprofitable companies with potentially questionable accounting practices. We prefer free cash flow yield (i.e. P/FCF) as the value metric in-line with our view enunciated in the February 2021 CCP newsletter. As we have explained in several of our webinars and in our books, FCF is a more reliable indicator of future returns than earnings or book value.

The idea of the whole being greater than sum of its individual parts is the crux of this step and can be quite vividly seen in the risk adjusted performance when both profitability and value factors are applied to the portfolio of stocks (risk-adjusted performance enhancement of 19 points i.e. 1.02 jumps to 1.21) – see exhibit 1.

Position sizing using free cashflow (FCF): This step adds another 2 points (1.21 goes to 1.23) to the overall back-tested risk-adjusted performance of the portfolio.

The Result – A Portfolio with undervalued (using free cashflow yield) Quality Stocks

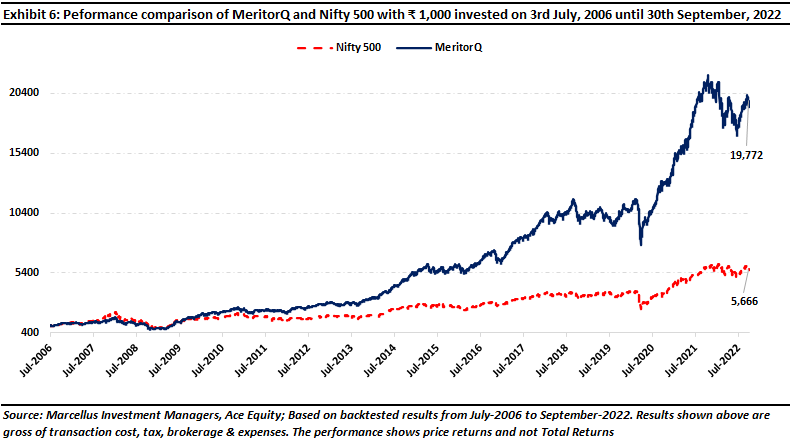

Using these four steps helps us build a portfolio of approximately 35-50 stocks that is rebalanced at a fixed semi-annual frequency in April and October every year. Regular rebalancing helps in picking up undervalued companies, getting rid of those which have appreciated significantly (so no longer undervalued) and reflecting any change in company fundamentals (as evidenced by return ratios, leverage, and free cash flow generation ability). The result is a strategy which is financially robust and profitable yet has relatively undervalued stocks with reasonable portfolio churn (around 50% per annum), making MeritorQ a uniquely placed quantitative strategy. Applying this strategy over the past 16 years whilst avoiding look-ahead bias (i.e. we wait for the relevant financial year to end, then wait for another 30 days and then build the portfolio) produces the results shown in the exhibit below.

Given the theme of this newsletter we wanted to close with another relevant investment lesson from Moneyball. Unlike other teams, when Oakland Athletics were playing their match on the field, their general manager Billy Beane would hit the gym. He feared that he’d do something rash if he saw his players or the coach make mistakes during the game. As Billy Beane said in a podcast, “When I watch a game, I get a visceral reaction to something that happens – which is probably not a good idea when you’re the boss, when you can actually pick up the phone and do something. That probably isn’t logical and rational based on some temporary experience you just felt in a game. So a lot of times it’s to remove myself from what is happening and ultimately make better decisions when the game is over and you’ve got the results in front of you.” (source: Business Insider)

In a similar way, we recommend investors to have at least a three-year investment horizon in mind while investing in MeritorQ and avoid focusing on short term portfolio performance or reacting based on market volatility.

If you would like to know more about MeritorQ, please write to sales@marcellus.in.