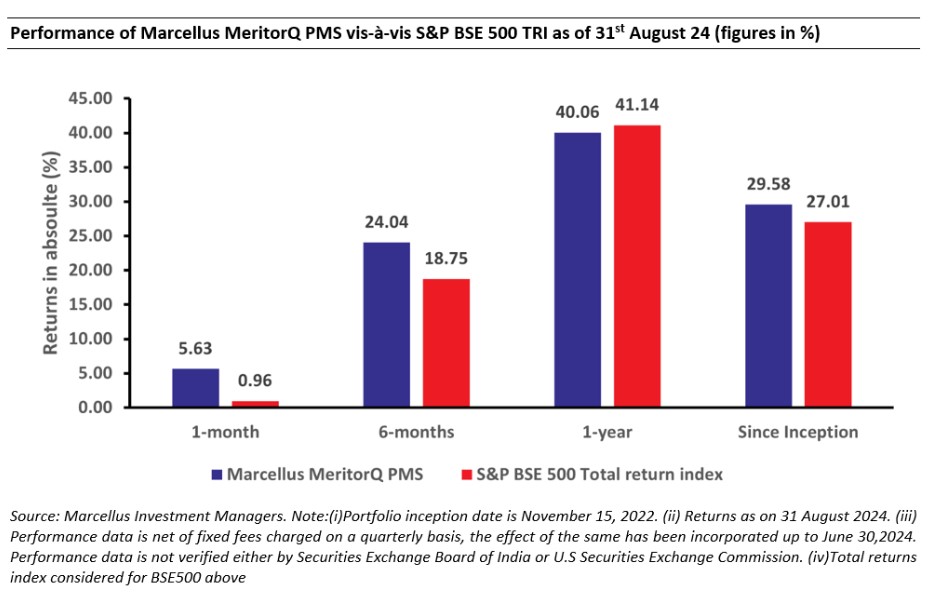

In this newsletter, we look at current market valuation levels implied by the cyclically adjusted price to earnings ratio (CAPE). Going by past history, our analysis suggests that at current CAPE levels, Indian investors should be more cautious on forward-looking market returns. Irrespective of market valuation, we believe MeritorQ’s low-risk approach of picking profitable, low-debt and undervalued companies can help preserve and grow investor’s wealth over long term.

*For relative performance of particular Investment Approach to other Portfolio Managers within the selected strategy, please refer this link . Under PMS Provider Name please select Marcellus Investment Managers Private Limited and select your Investment Approach Name for viewing the stated disclosure

What is CAPE?

It has been said that the most powerful force in financial markets is mean reversion. The rough idea is that an asset can’t move far away from “fair value” indefinitely. This holds true for equities more than any other asset class (for example, commodities like gold, metals etc.) as valuation of a company cannot keep drifting higher than its earnings forever, just due to higher demand for company’s shares. Comparing the share price with fundamental measures like earnings, cash flow or book value of a company then tells us if the share price is reasonably valued compared to its fundamentals.

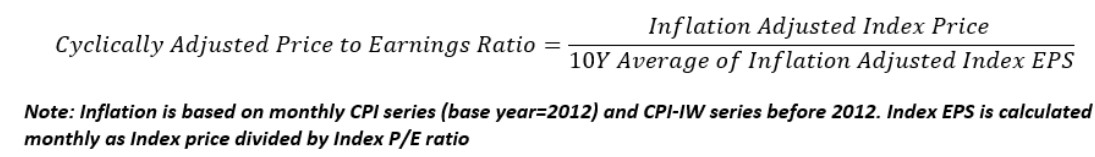

In 1988, Campbell and Shiller proposed the idea of “CAPE” “Cyclically Adjusted Price to E arnings ratio”. Earnings are first adjusted for inflation over a trailing 10-year period to ensure that they are comparable to each other. To mitigate the impact of transient spikes or drops in earnings due to economic booms or recessions, earnings are averaged over a business cycle (typically 10 years), offering a clearer picture of the underlying long-term earnings power. We can think of CAPE as a relatively stable and noise-free price to earnings ratio. Despite its shortcomings, studies in various countries and time periods show an inverse relationship between starting CAPE values of the market index and future “real” equity returns (adjusted for inflation).

Where does CAPE stand today?

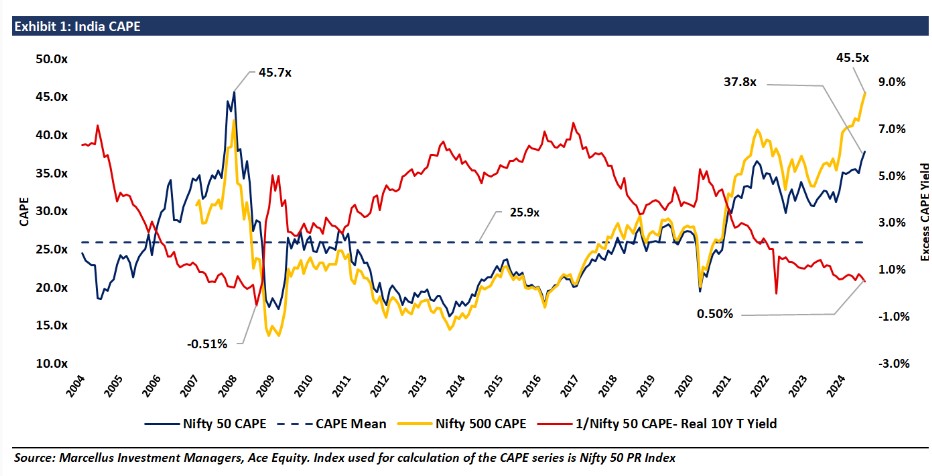

Exhibit 1 shows the historical CAPE series of Nifty 50 and Nifty 500 Index over last 20 years. As of end-July, Nifty 50 CAPE stood at 37.8x which was roughly 97th percentile of CAPE values since Jan-2004. Nifty 50 CAPE was roughly 2 standard deviations away from Nifty 50’s historical average CAPE of 25.9x.

CAPE of Nifty 500 Index which includes small and midcaps, was even higher at 45.5x which was roughly 99.5 percentile of Nifty 500 CAPE value since Jan-2007! This should not come as a surprise as small and midcaps have relatively outperformed large caps over last four years. Exhibit 1 also shows that valuations implied by CAPE have been rising since 2020 and are currently comparable to pre-2008 levels which was reached just before the global financial crisis.

Since equity and debt are among the two major asset classes in India, one could look at the spread between the earnings yield implied by CAPE of Nifty 50 and inflation adjusted India 10 Yr bond yield (this then becomes the real bond yield). The lower this spread the more expensive are equities compared to debt. This spread, shown with a red line in Exhibit 1, stood at 0.5% as of July-2024 which was 94th percentile of spread values since Jan-2004.

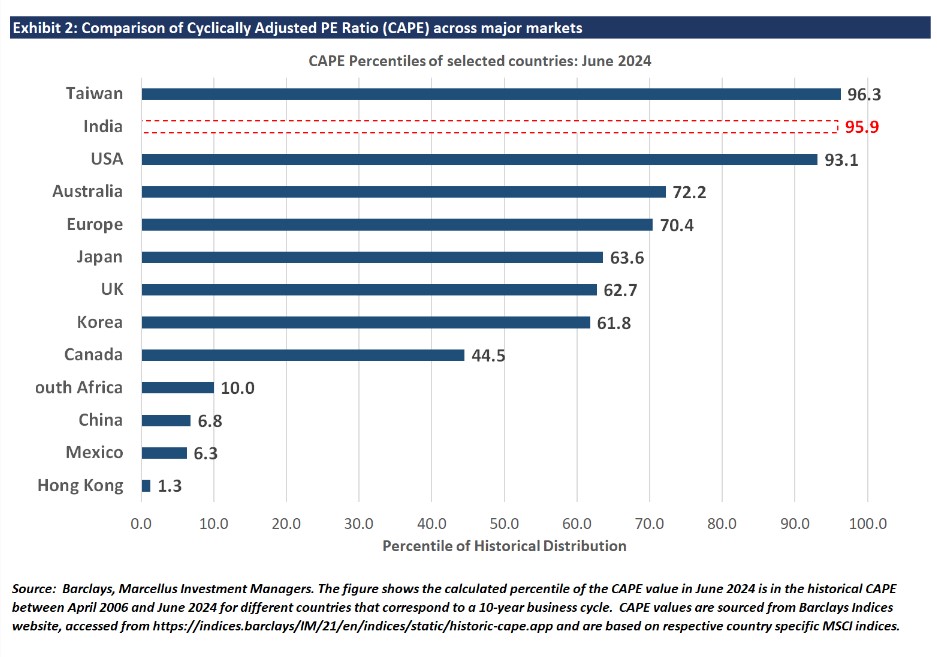

While the analysis above shows the CAPE of Nifty 50 and Nifty 500 versus its own history, Exhibit 2 shows that the Indian market CAPE (calculated on MSCI India Index) was amongst the second most highest when compared to other major markets as June-end.

Implications for forward looking returns

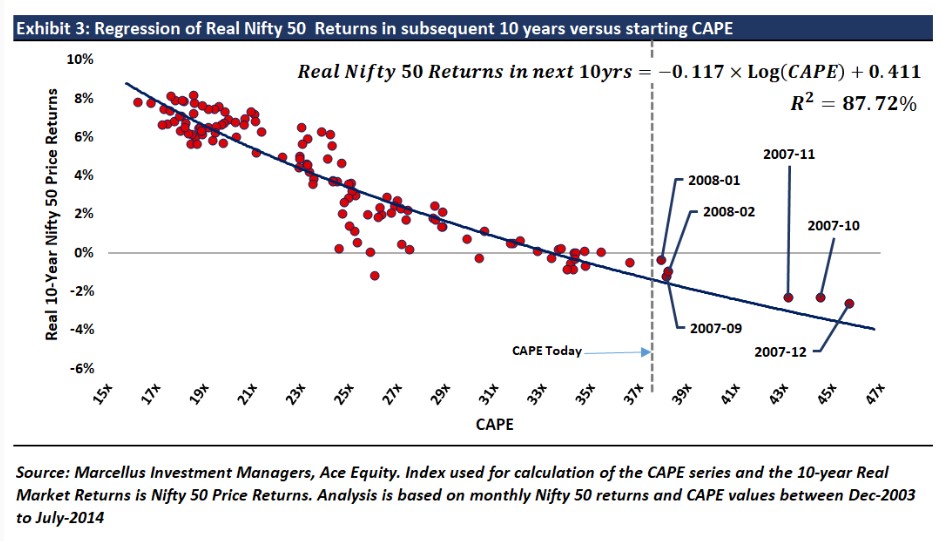

CAPE has been shown to be an effective gauge of forward-looking long-term returns in US and other international equity markets. To check whether this holds true for India, we regress the starting CAPE of Nifty 50 every month between Dec-2003 to July-2014 against the subsequent 10-year inflation adjusted real returns of Nifty 50. Results as shown in Exhibit 3 imply a statistically significant inverse relationship between starting CAPE and subsequent long-term returns, hence confirming our hypothesis. Small cap Index returns being cyclical, show even stronger inverse relationship between starting CAPE and subsequent returns (not shown here for sake of brevity).

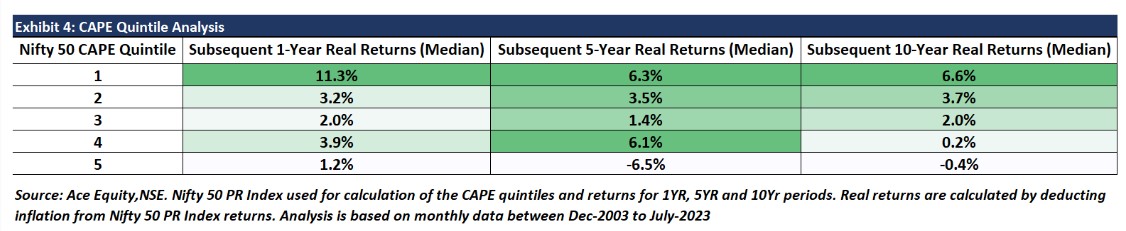

Exhibit 3 also shows that subsequent inflation adjusted 10-year returns of Nifty 50 have been negative every time its CAPE has been above 35x (which is the case today). Exhibit 4 shows median real returns on CAPE quintiles formed monthly between Dec-2003 to July-2023 and subsequent 1, 5 and 10-year inflation adjusted annualized returns. Here again we see that inflation adjusted market returns are better for the cheapest quintile 1 for all horizons. Similarly, real market returns have been mostly low or negative over different horizons in the most expensive quintile 5, where markets are today.

We caveat the above analysis by noting that market valuation metrics like CAPE can at the best guide investors on possible future return scenarios and should not be considered for market timing. Also, since CAPE uses average of last 10-year earnings to smoothen out the effect of business cycles, it will be slower to change, in case there has been a regime change post-Covid. Hence, in periods of high growth, the 10-year average real EPS is biased downward because recent higher earnings are underrepresented; the result is that CAPE is artificially pushed higher. For example, Nifty 50 EPS has grown by 22.3% annualized over last 3 years aided partly by post-Covid topline recovery (FY22-23) and then from commodity cool-off (FY 23-24). If this growth can be sustained into the future, then investors can expect similar growth in the broad index, assuming no change in valuations from current levels.

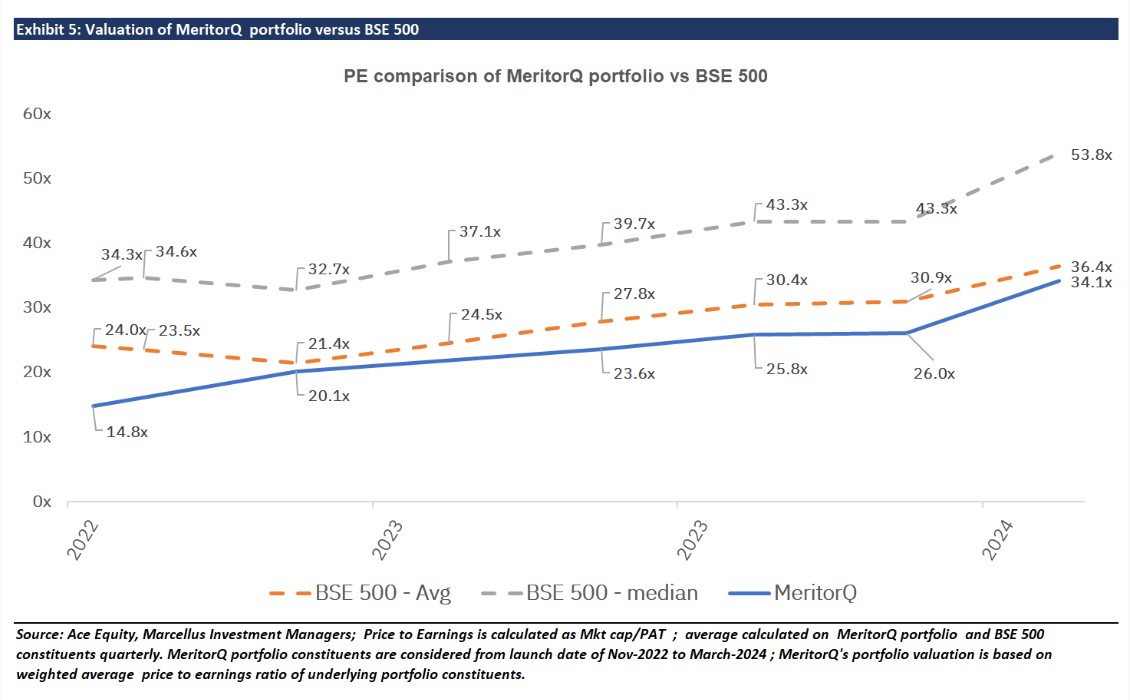

For MeritorQ portfolio, we note that price to earnings ratio (PE) of the portfolio has been below the PE of the average stock in the investment universe since inception. This is shown in Exhibit 5.

Secondly, MeritorQ’s lower valuations versus the benchmark has sustained despite the strategy’s focus on clean, profitable, cash flow generating companies. Thirdly, MeritorQ’s multi-cap investment universe in MeritorQ allows flexible allocation across large, mid, and small cap stocks based on their fundamentals and valuations. As a result, large cap weightage in current portfolio stands at 41% from 15% in November-2022.

Investment returns ultimately come from three sources: earnings growth, dividends received, and change in the earnings multiple. Our approach in MeritorQ could be summarized as taking care of fundamentals by focusing on quality while controlling valuation risk by seeking to avoid overreach on free cash flow multiple. This in our opinion should be help the strategy, in case, the broad index valuations indeed revert back to more normal levels.