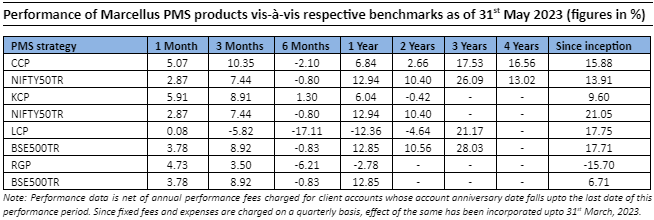

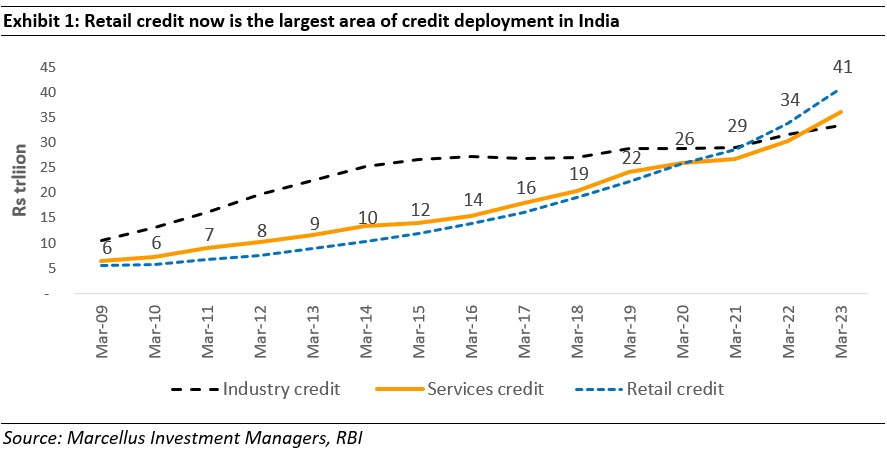

In the last couple of years, India’s financial services sector has crossed a significant milestone – for the first time the size of retail credit (i.e. credit extended to consumers) is now larger than corporate credit. In this newsletter, we discuss reasons behind the success of high-quality lenders (like HDFC Bank, Chola Investment & Finance and Kotak Bank) which interestingly possess characteristics similar to those of successful retailers (like D-Mart and Titan). Specifically, we look at three key areas of competence for these champion franchises: (a) razor sharp focus on productivity and cost of operations to improve unit economics; (b) superior risk management to manage asset quality and leverage levels; and (c) an obsession to serve the customer with the best product (at the lowest cost) & thereby build enduring trust.

Consumption and Retail credit form a key engine for a country’s economic growth

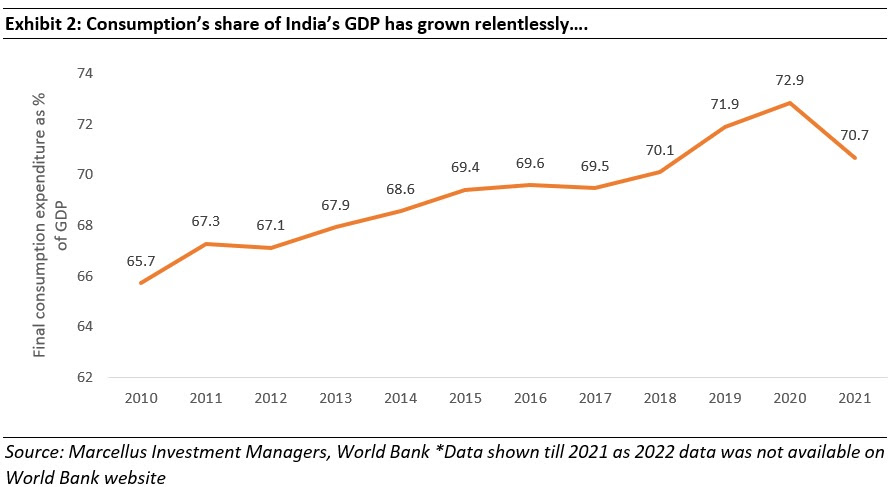

A country’s economic growth (as measured by GDP) is dependent on four key parameters – Consumption, Investments, Government spending and Net exports. Amongst these parameters, consumption typically forms the biggest part of a country’s GDP thus underscoring its importance as a driver of overall GDP growth.

In India, over the last decade or so, even as India Inc has been reluctant to drive Investments growth, private consumption has held its own. As a result, the share of consumption in India’s GDP has seen a continuous increase (see exhibit below).

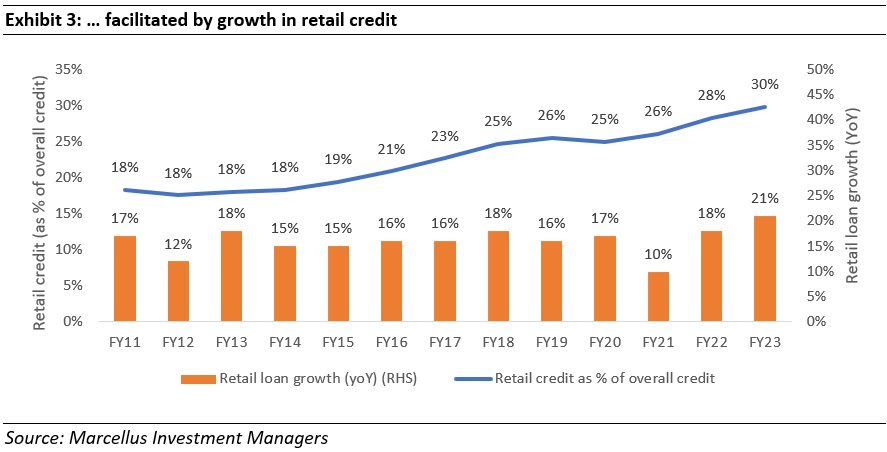

This upward trend in consumption in turn has been facilitated significantly by the growth of retail credit in the country. As can be seen in the chart below, retail credit in India has growth at healthy double digit rate annual run rate since FY11. Consequently, the share of retail credit to overall credit has seen a continuous increase (from 18% in FY11 to 30% in FY23) In our Sep’21 dated blog, we’d discussed how across the world we have seen that as a country grows richer and more developed, the relationship between economic growth and overall credit growth weakens while that between economic growth and retail credit growth holds strong. India’s experience over the past decade is straight out of this playbook.

In our Sep’21 dated blog, we’d discussed how across the world we have seen that as a country grows richer and more developed, the relationship between economic growth and overall credit growth weakens while that between economic growth and retail credit growth holds strong. India’s experience over the past decade is straight out of this playbook.

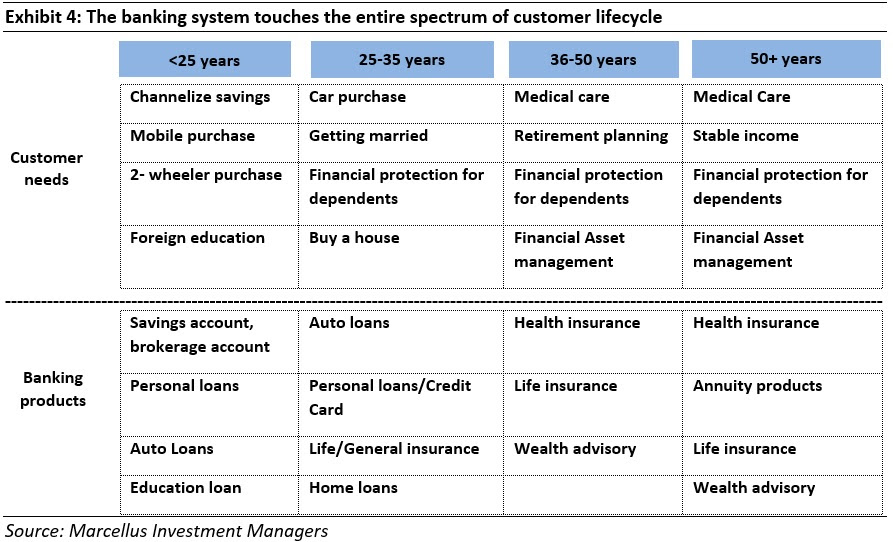

As a country develops, better education and better paid jobs facilitate consumption of high value products and services. The banking system of the country too becomes more comfortable with the credit profile of its customers and looks at various ways of engagement with the customer across his/her lifecycle. For example, as shown in the chart below, the engagement of a customer with retail banking may start as early as 18 years of age. Thereafter a gamut of product offerings across savings, credit and insurance keeps the customer constantly engaged in some or the other manner with the banking ecosystem well into their golden years.

This level of customer engagement is akin to what’s seen in the consumer retail ecosystem (with franchises like D-Mart, Titan, Trent, etc.). While financial services and retail deal with inherently different products and services, both sectors are end-customer facing (B2C) and therefore have to contend with similar demands with respect to product availability, quality, customer service, etc.

It follows therefore that to keep a customer constantly (and profitably) engaged in a highly competitive business environment, the best retail lenders need to think and operate in a manner which is similar to the best consumer retail companies. In the remainder of this note, we focus on three key areas which are as important to a retail grocery or fashion outlet as they are to a retail lending franchise: (a) sustained growth in revenues/AUM driven by increase in both distribution and productivity; (b) astute risk management; and (c) developing & maintaining customer trust.

Tenet #1: Growth driven by increasing distribution AND improving productivity

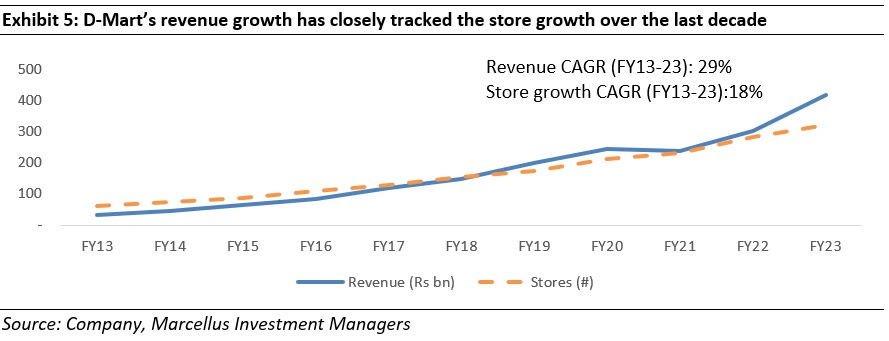

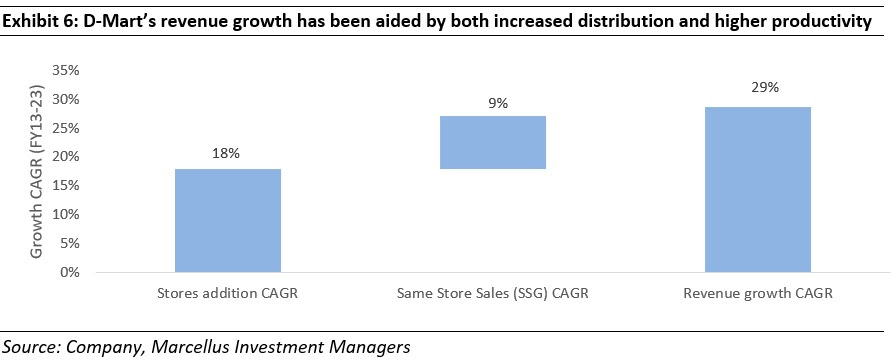

For any retail franchise, growth is commensurate with increasing customer touchpoints via opening of new stores. For example, D-Mart’s revenue has grown in lockstep with the number of stores as the grocery retailer has increased its footprint.

However, the reader would notice that D-Mart’s rate of revenue growth exceeds the rate of store addition by ~10% implying that D-Mart’s sales per store has grown consistently over the past decade. This is a key point of differentiation for the best retailers vis-à-vis their peers wherein firms like D-Mart have been able to increase the sales from the same stores consistently both via higher utilization of the store space as well as optimization of the assortment mix.

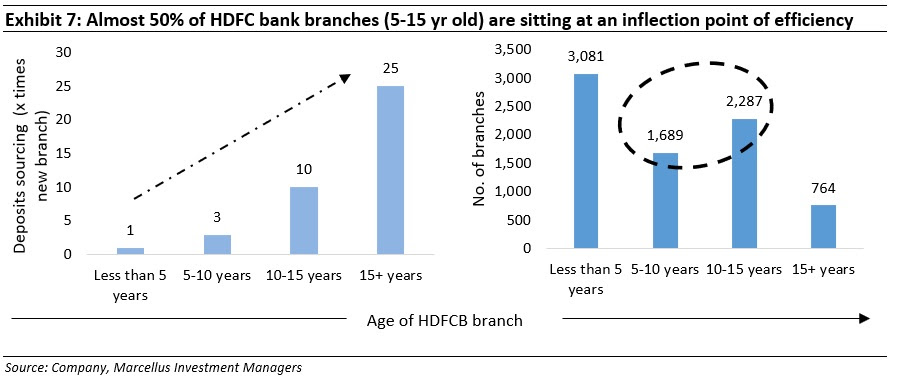

The best retail lenders also drive the productivity of their branches upwards as a key enabler of business growth. For example, HDFC Bank branches witness an order of magnitude jump (~25x) in deposits sourcing as a branch matures from less than 5 years old to more than 15 years old.

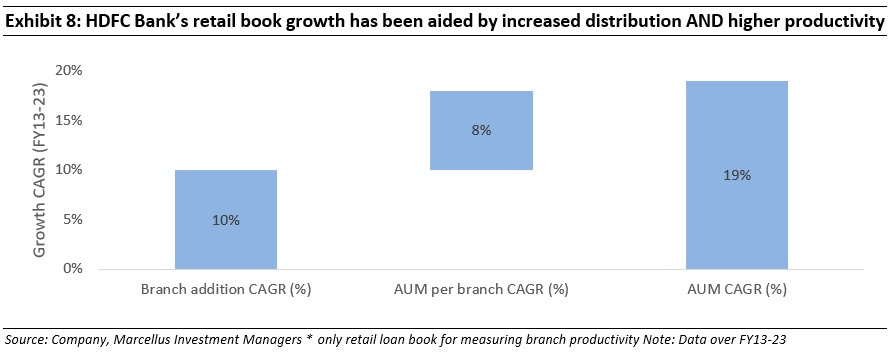

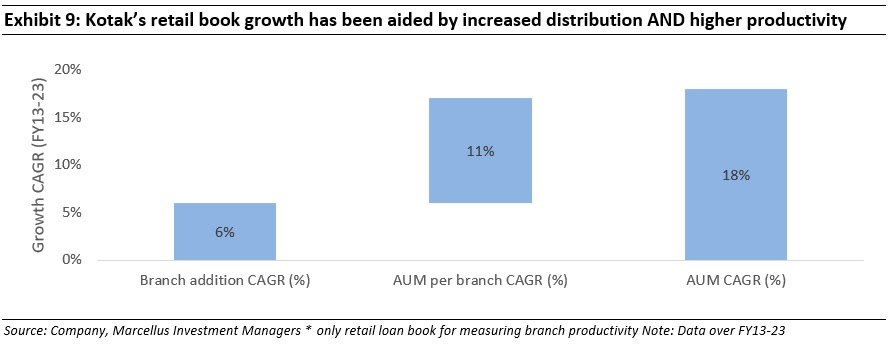

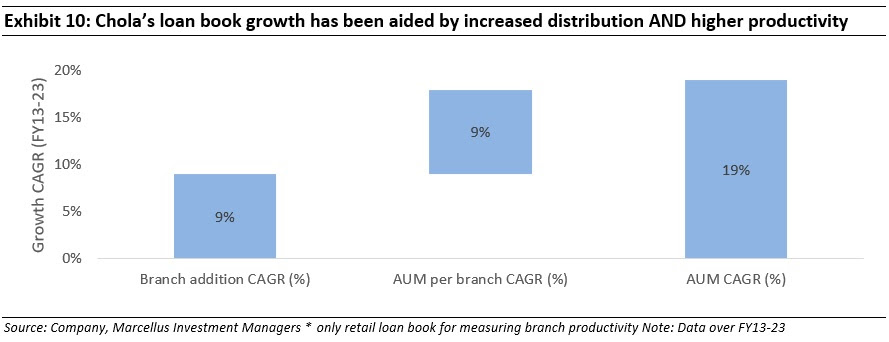

The impact of increasing branch efficiency is visible in HDFC Bank’s retail loan growth – over the past decade, loan growth for the bank has been 19% whereas the number of branches has grown by 10%. Other lenders in our portfolios like Kotak Mahindra Bank, Bajaj Finance and Chola Investment & Finance have also benefited from improvements in productivity over the past decade (see exhibits below).

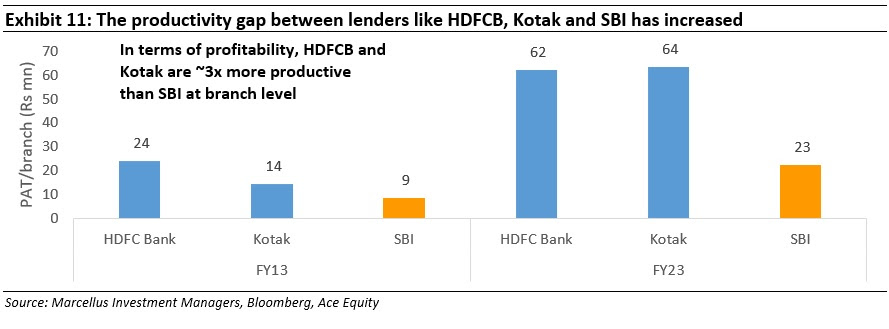

These improvements in productivity alongside low operational costs feed directly into a bank’s core profitability or Return on Assets (RoA) (see our Feb’23 newsletter to understand the link between RoA and long-term shareholder returns and how KCP lenders benefit shareholders with their consistently high RoA).

As a result, the per branch profitability of the lenders we have invested in is vastly superior than their competitors’ (see exhibit below). Tenet #2: Risk management- the backbone of longevity

Tenet #2: Risk management- the backbone of longevity

Growth in and of itself doesn’t mean much if it’s not paired with prudent risk management. History is littered with examples of companies that have imploded during their quest to grow very fast.

In retail, the biggest risk arises from sub-optimal inventory management – or the inability to sell the inventory quickly enough. Mistakes in inventory management can happen due to two reasons:

- having the wrong product in terms of design, price, utility, etc.; and/or

- having excess/insufficient quantity of the product.

Poor inventory management is RoCE dilutive as it keeps the retailer’s capital stuck in working capital – thus increasing the total capital employed (the denominator in RoCE). Further, even the profitability (the numerator in RoCE) takes a hit as liquidation of wrong inventory often happens at steep discounts (~50% discounts seen in apparel/~100% in case of perishable items like fresh foods).

Successful retailers are able to manage inventory risk through a combination of private labels (which provides the ability to control the product design and pricing as per the consumer tastes) and strong systems & processes to control the type & quantity of inventory being ordered from vendors.

Retailers that choose to scale up their store presence without robust processes around inventory management need to rely on external capital (mostly debt) to fund such an expansion. On the other hand, successful Indian retailers have first perfected the retail model that suits their product and audience and then stepped up – using their own internal accruals (driven by high levels of profitability) as the source of capital.

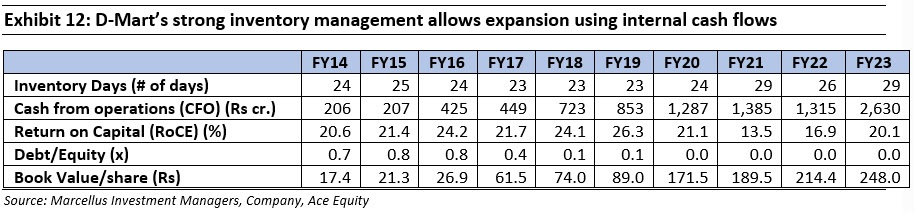

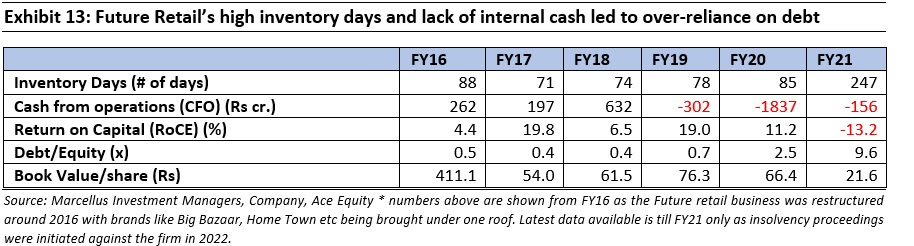

Consider the contrasting tales of D-Mart and Future Retail. While the former has expanded its store presence over the last decade funded mainly by internal accruals, the latter relied on debt to do so. The impact of good/bad inventory management (as measured by inventory days) is visible on operational cash flows (CFO) and well on the net worth (book value) of the two firms (see table below).

In retail banking, risk management hinges on the lenders’ ability to assess repayment/default risk of the customers. We’ve written extensively about risk management of high/low quality lenders in the past and therefore won’t delve into the details here (readers can refer to our notes dated Dec’22 and Mar’23 for a detailed discussion on this topic).

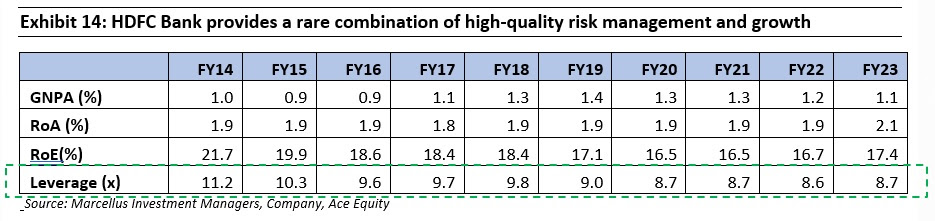

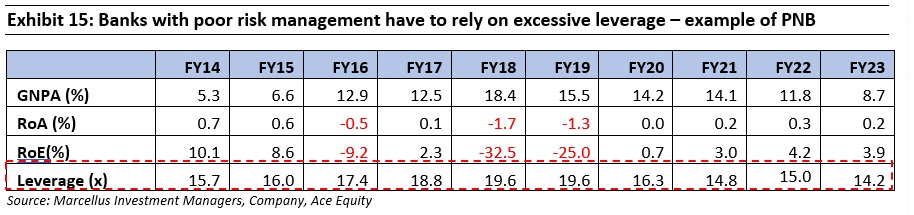

As in the case of retailers, wherein retailers who do not generate cashflow from their operations have to depend on debt for expansion, lenders who do not generate adequate RoE for reinvestment have to depend on higher leverage and repeated equity issuance for growth. The higher leverage limits the ability of the lender to withstand adverse events impacting its loan book. The table below shows how high operating profitability (RoA) and prudent risk management (GNPA) allow HDFC Bank to generate high returns on equity (RoE) without taking on too much leverage. PNB’s situation, on the other hand, is the polar opposite.

Tenet #3: Developing and maintaining customer trust

“‘Shocked’ Yes Bank customers queue up at branches to withdraw money” – Hindustan Times, Mar’2020

Once (widely) considered to a growing challenger to India’s best run private banks, in Mar’20, Yes Bank was placed under a moratorium by the RBI with the central bank capping deposit withdrawals at ₹50,000 per account for a month. The RBI action came after the bank failed to raise capital to address potential loan losses – which had wiped out the equity holders of the company over the 2018-20 period.

The aforementioned example of customer trust being broken in the banking industry is not a one-off scenario. In recent months, we’ve seen banks like SVB and First Republic slide into towards bankruptcy in a matter od days once their customers lost their faith in them (see our Mar’23 dated newsletter for in-depth discussion of what went wrong with SVB and how KCP lenders perform in comparison).

Such examples highlight the importance of third key element for a successful retail franchise – customer trust. Much like for consumer retail, retail banking is also highly dependent on a customer’s trust for business to have any sort of longevity. Consumer retail companies are able to develop such trust through transparency in their products/services (e.g. Titan as discussed below) as well as excellent customer service (e.g. Amazon’s best in class return policy).

In India, Titan has been able to build such trust on the back of product transparency offered via the Karatometer concept. Traditionally, Mom and pop retailers dominated the jewellery industry (~70% market share) on the back of historic relationships with the matriarch in the house (i.e. being a customer’s ‘family jeweller’). Most jewellers derive their profit margins from changes in commodity prices even as they charged low making charges. To shore up their profits, they misused the trust placed in them and sold gold of lower purity (i.e. lower caratage) as compared to what the customer was charged for. In addition to using gold jewellery as ornaments, Indians also attach investment value to gold. Customers often exchange old gold jewellery to upgrade to new design or pledge/ sell jewellery to generate liquid cash. In such a market, under-caratage is a major breach of trust for customers with a clear financial impact.

In FY99, to address this issue and build customer trust, Tanishq introduced the concept of Karatometer – a machine used to gauge purity of the gold and followed it up with an exchange policy to exchange the impure gold with pure gold. The company absorbed the losses arising from such transactions (upto 2 carats differential) and considered it to be a part of the customer acquisition cost. Having taken an industry disrupting step, Tanishq went on to become a symbol of purity and established itself as by far the most trusted and most profitable jeweller in India.

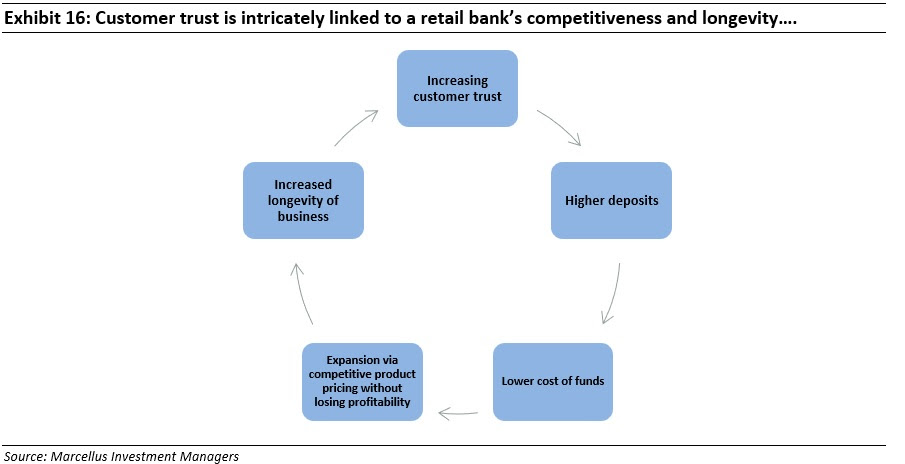

In retail banking because the underlying product (money) is essentially a commodity, the trust gets built mainly from a bank’s past operational performance. The lower the risk a customer assigns to bank failure, the higher is the trust placed in the bank. This is especially true for the deposits side of the balance sheet wherein a customer will choose to put his/her hard-earned savings only in a bank which is expected to be around forever.

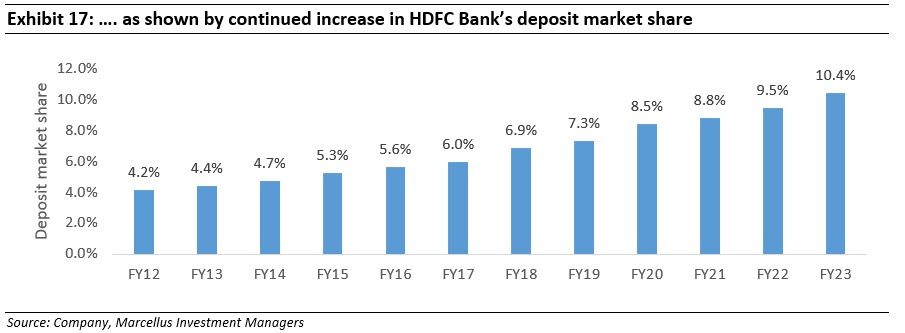

Having established itself as a preferred choice, the customer stickiness/inertia in retail banking can be very high (how many of us chop and change our salary accounts?), allowing such banks to keep their cost of funds low vs. the banks which are struggling to get a commensurate amount of deposits. Such low-cost deposits in turn allow great lending franchises to expand aggressively vs. peers.

Over the coming decade, the retail lending in India is likely to get further impetus from the ‘tech stack’ being built in the country with three layers – UPI, ONDC and the Account Aggregators (AA) platform acting together to improve the access and distribution of products/services as well as credit within the country (see our Sep’22 blog for detailed discussion on India’s digital journey). An expanding customer base combined with focus on key parameters discussed earlier – productivity, risk management and customer trust mean that the runway for the best retail banking franchises (and their wealth compounding potential) is a long one.