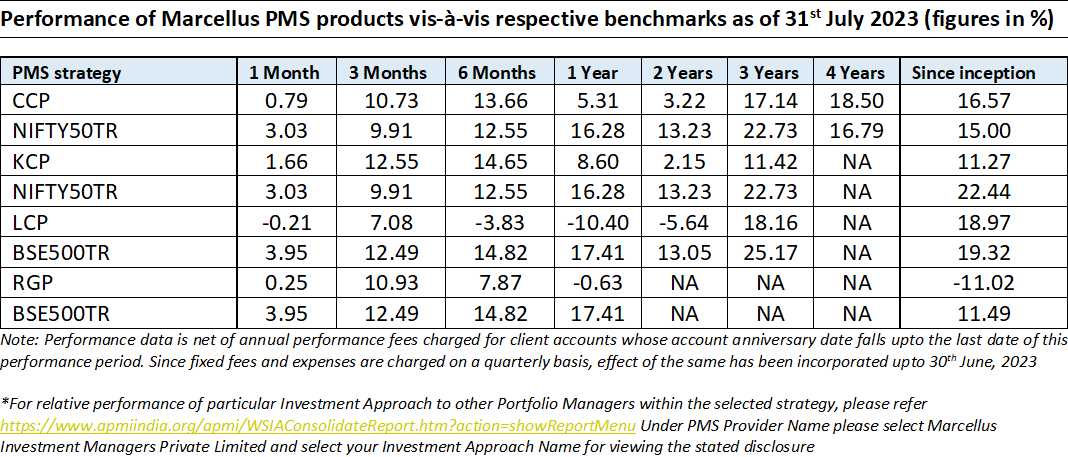

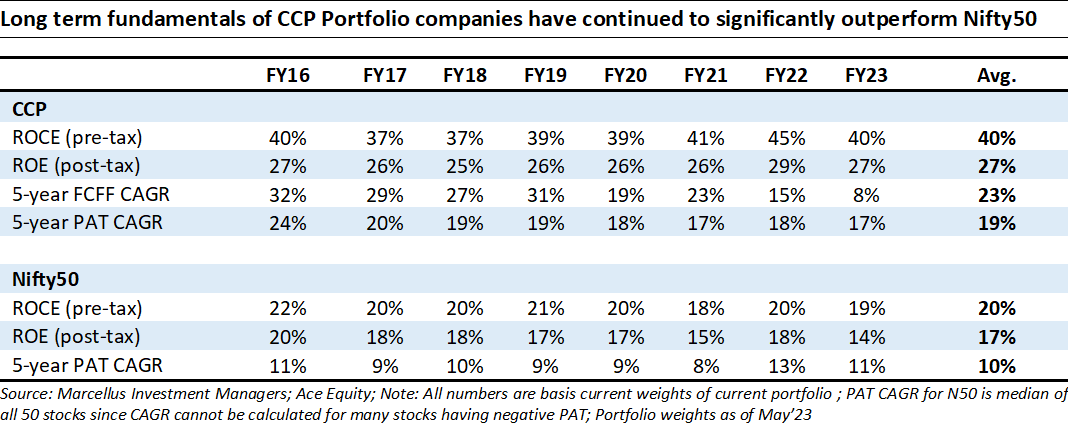

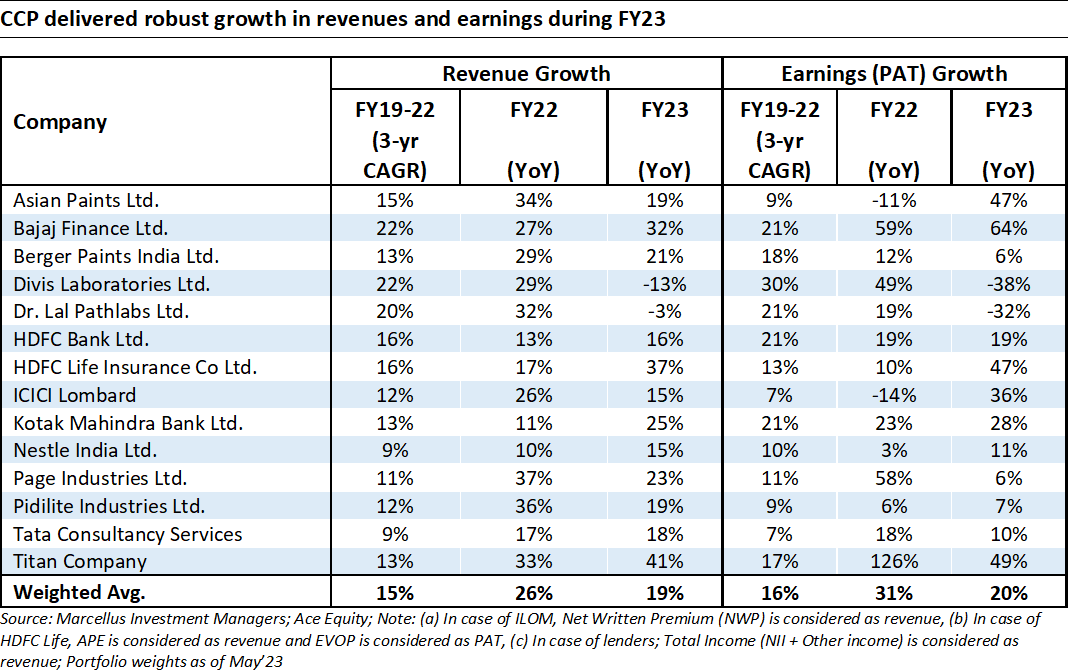

Consistent Compounders Portfolio (CCP)

Fundamentals of CCP companies have delivered healthy progress in FY23, with weighted average PAT (profits after tax) growth of 20% YoY in FY23, backed by a revenue growth of 19% YoY in FY23. 1QFY24 results reported so far have exhibited exceptional strength, representative of market share gains from competitors and successful execution of new business growth initiatives / tech investments / opportunistic capital allocation decisions implemented over the last three years of volatility in the external environment.

Share price performance of most stocks in the CCP portfolio was sluggish during FY23 due to a variety of temporary factors. As a result, the gap between fundamentals of our portfolio companies and their share prices widened to over 35% (refer to our Mar’23 newsletter). Over the last 3 months, we have started witnessing a reversal of this gap as share prices catchup with the underlying fundamentals of our portfolio companies. As highlighted in our past webinars (click here), periods of share prices lagging significantly behind fundamentals, have been followed by a strong recovery in such share price performance for high quality companies like HDFC Bank and Asian Paints.

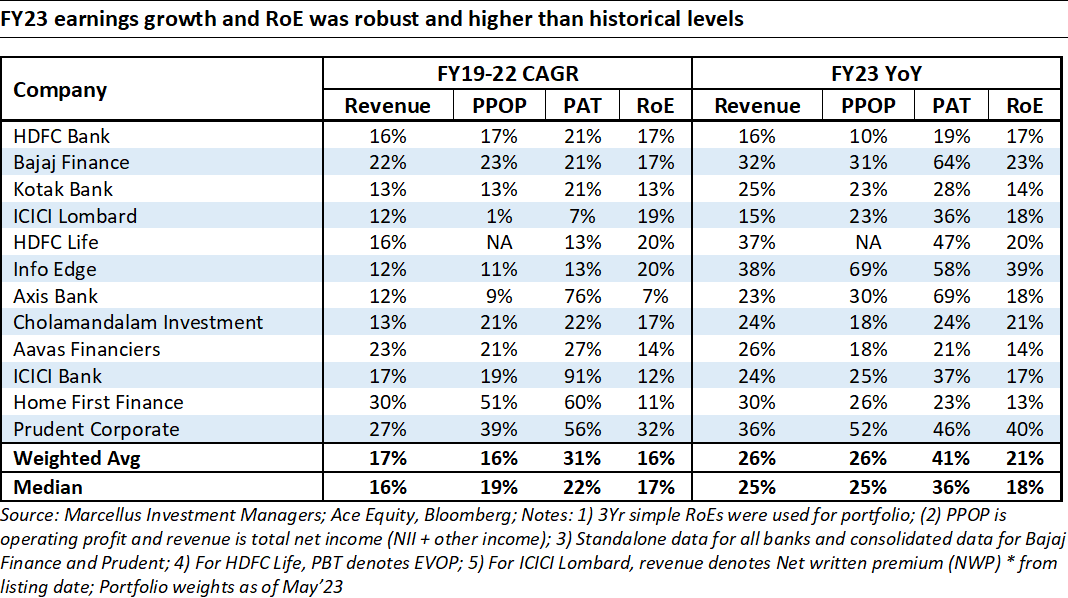

Kings of Capital Portfolio (KCP)

During Q1FY24, Kings of Capital portfolio companies continued their robust loan and profit growth performance on the back of a strong FY23. The record high net interest margins (NIMs) seen during Q3 and Q4FY23 saw some moderation during Q1FY24 albeit at a pace lower than earlier expected. This trend of NIM moderation is likely to continue for the next couple of quarters but we currently believe that FY24 NIMs for most lenders in the portfolio will be similar to FY23 NIMs. Q1FY24 was characterised by further market share gains for most lenders in the portfolio led by Cholamandalam Inv & Finance (40% YoY loan growth), Bajaj Finance (32% YoY loan growth) and Home First Finance (33% YoY loan growth). We believe FY24 will be characterised by headwinds on margins and deposit growth for the banking sector and that is when high quality lenders in our portfolio will differentiate themselves further vs the rest of the industry. The savings plays in the portfolio – ICICI Lombard, HDFC Life and Prudent Corporate also reported healthy growth and profitability despite Q1 being a seasonally soft quarter. There have been no additions/ deletions to the portfolio during YTDFY24.

Despite the ~15% run up in KCP over the past three months, given the solid fundamentals and the wide disconnect between stock prices and earnings growth, we believe stock prices of Kings of Capital stocks still have significant upside potential.

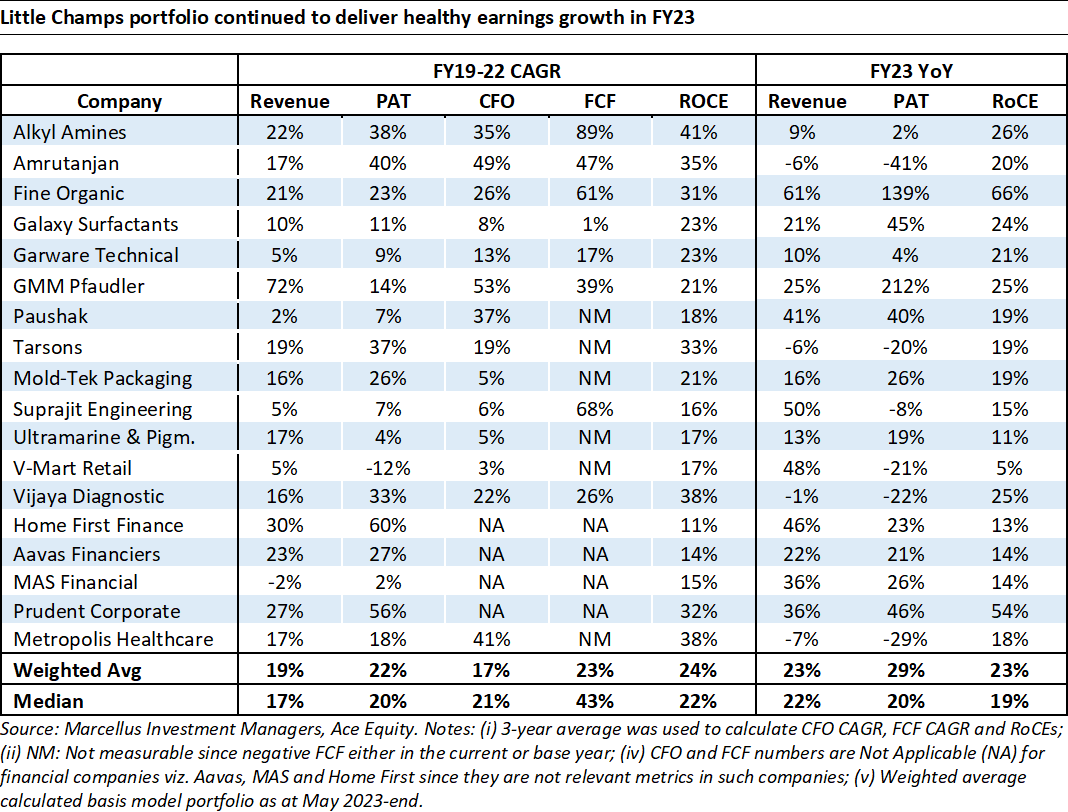

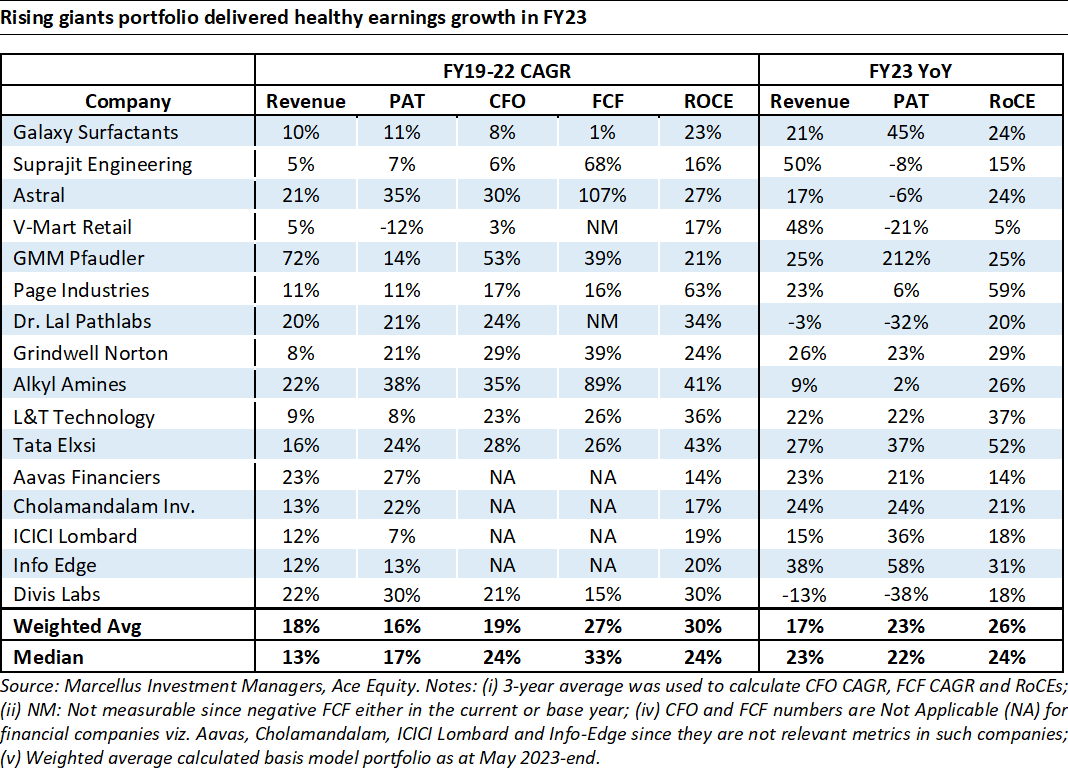

Little Champs portfolio (LCP) & Rising Giants Portfolio (RGP)

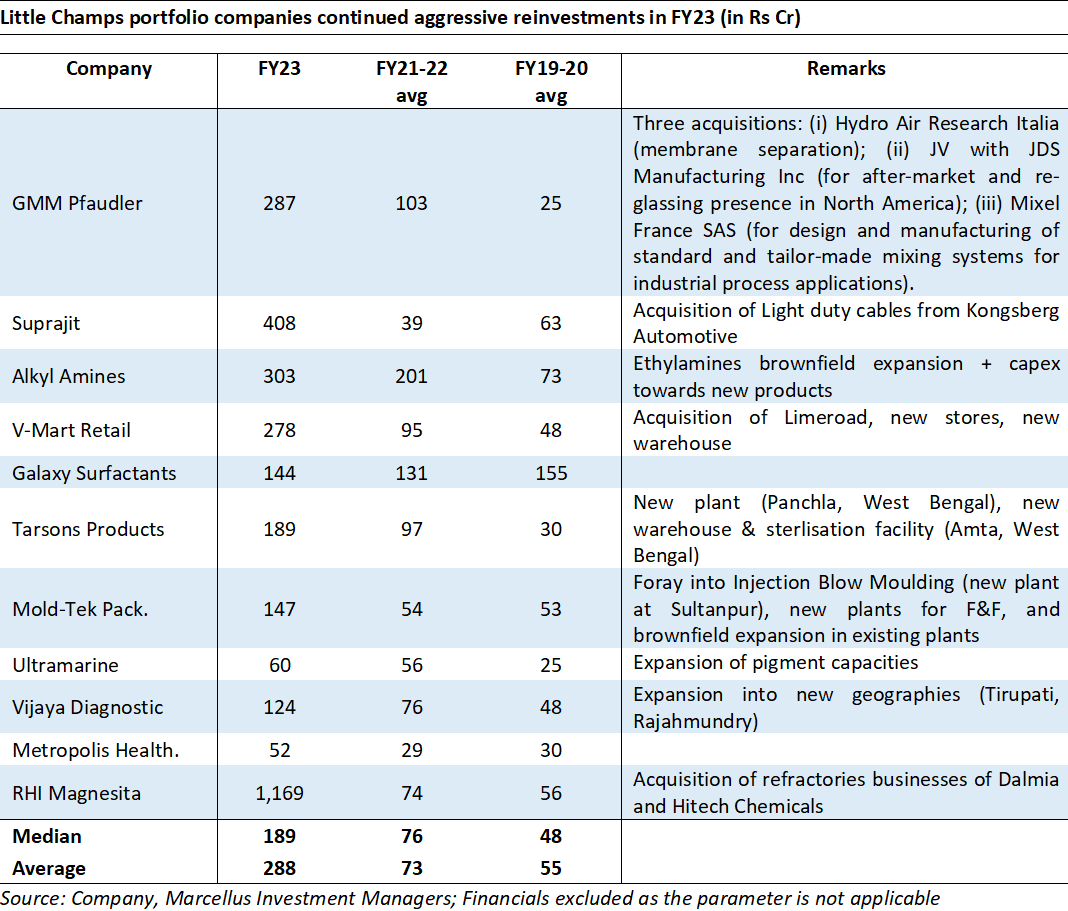

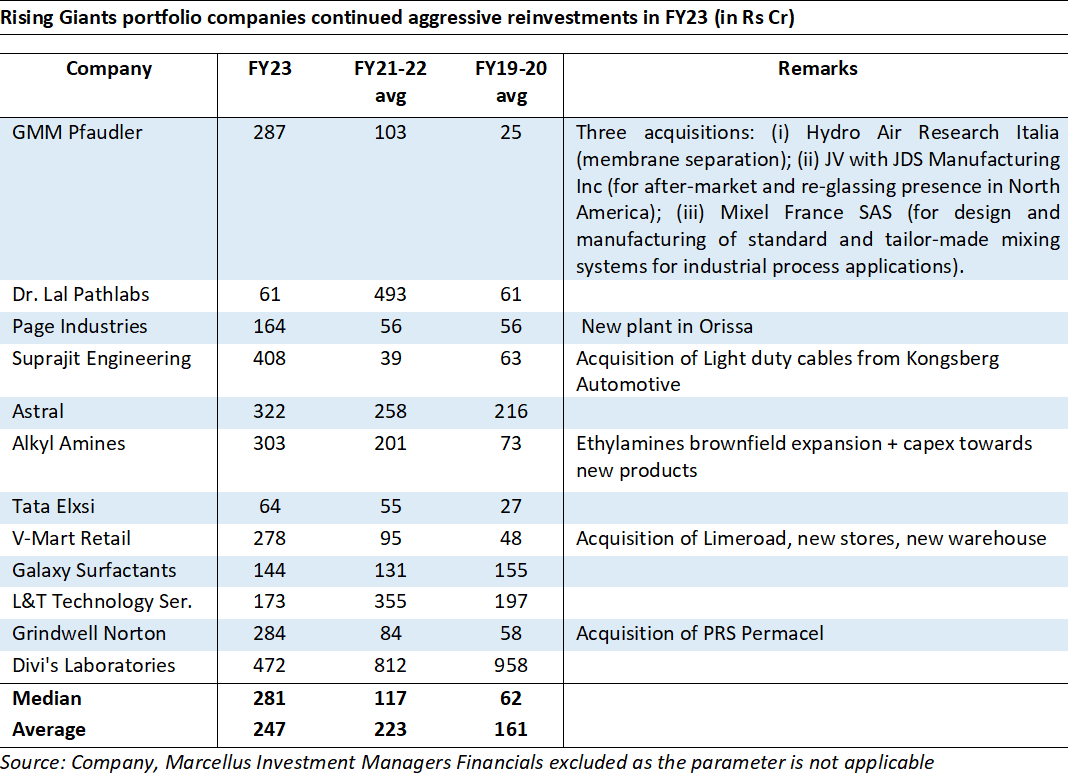

Despite the macro headwinds, Little Champs and Rising Giants portfolio companies continued to reinvest in the business with FY23 reinvestment levels at the portfolio median/average even surpassing the previous annual average highs of FY21/FY22. This step up in reinvestments is a result of both:

- The increasing size and scale of the companies resulting in significant internal accruals (operating cash); and

- Rising opportunities for consolidation due to challenges faced by many of the competitors of the portfolio companies brought upon by Covid-19, rising cost structure particularly for those having manufacturing facilities in the western geographies.

- A conscious effort to add new growth drivers by the portfolio through geographical expansion/and or new product adjacencies.

All of the above has been achieved without unduly leveraging the balance sheet with many of the portfolio companies having net cash surplus as at FY23-end.

The high level of reinvestments in FY23 and recent years has provided enhanced visibility on the earnings performance for the portfolio over the next 3-5 years.

Changes to the Little Champs portfolio: Addition of RHI Magnesita

RHI Magnesita India (RHIM India) is the Indian subsidiary of RHI Magnesita (RHIM Global), a global leader in manufacturing & servicing of refractories with ~30% market share (ex-China). Refractories are non-metallic material having very high melting points enabling its usage as an internal lining in furnaces, kilns or any other vessels in the Metal, Cement and Glass industries.

Our key investment thesis in RHI Magnesita India revolves around the following points:

- Highly critical nature of refractories: Even though refractory accounts for only 2-3% of the overall cost, without refractories the customer’s plants cannot commence production. Additionally, refractories go through general wear and tear and hence need to be replaced at regular intervals, which is a very tedious process and entails plant shutdowns which may take as long as a day. Given the low-cost but critical impact of refractories, a customer demands products with the highest quality and longest life, thereby reducing the downtime risks.

- RHI’s Quality and R&D focus: RHIM India’ leadership in the Indian refractory market is underpinned by its superior product quality. This superior product quality is a result of RHIM Global’s high focus on R&D (1700+ active patents) and ability to continuously come out with better quality products that have longer lives. Our channel checks suggest that RHIM India is a dominant player in the refractory industry with 40%+ market share in the Basic Oxygen furnace + Laddle segments.

- Significant reinvestments by RHIM India in the recent years: In the last 5 years, RHIM India has been on an acquisition spree wherein it has added various flywheels and gained new capabilities. For instance, by merging all the subsidiaries of RHIM Global into RHIM India (listed entity), RHIM Global has aligned its interest with that of the minority shareholders. Similarly, the Dalmia acquisition has further fortified RHIM India’s moat through access to an extensive manufacturing base as well as facilitating entry into the Cement/Industrial and Blast Furnace refractory segments.

If you want to read our other published material, please visit https://marcellus.in/