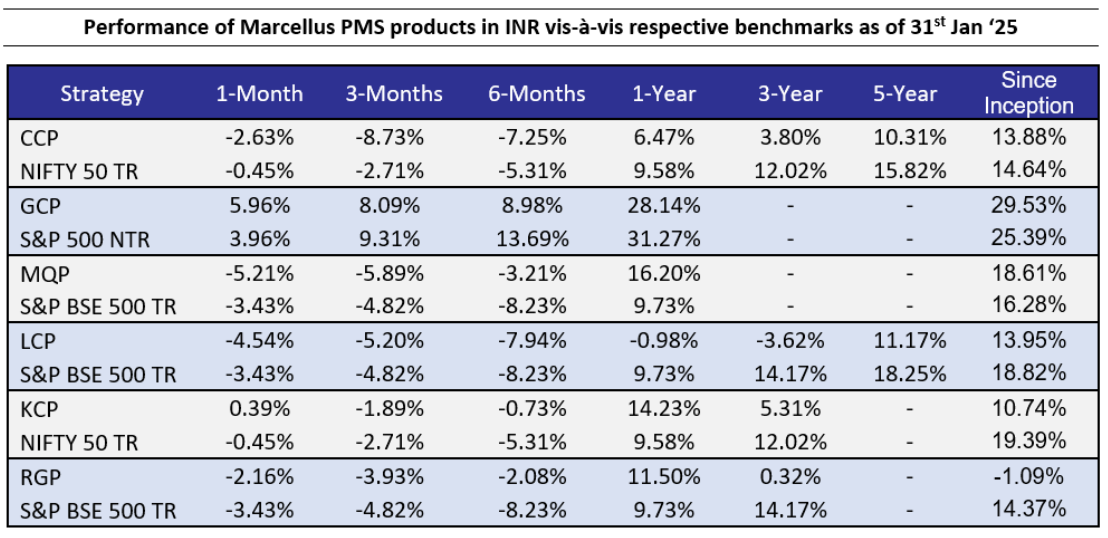

Note: For all strategies except GCP, Performance data shown is net of fixed fees and expenses charged till December 31st , 2024 and is net of annual performance fees (Except for Little Champs Portfolio) charged for client accounts whose account anniversary/performance calculation date falls upto the last date of this performance period. Since, for Little Champs Portfolio, performances fees are charged on cumulative gains at the third anniversary, of the respective client account, the effect of the same has been incorporated for client accounts whose third account anniversary falls upto the last date of this performance period. Performance data is not verified either by Securities and Exchange Board of India or U.S. Securities and Exchange Commission.

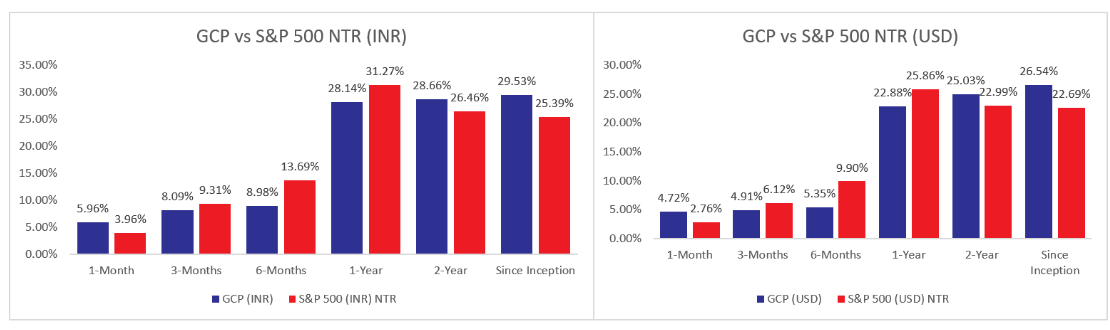

For GCP, performance data is shown gross of taxes and net of fees & expenses charged till end of last month on client account. Returns more than 1 year are annualized. The performance shown is the combined performance of GCP’s RI and NRI strategies.

*For relative performance of particular Investment Approach to other Portfolio Managers within the selected strategy, please refer https://www.apmiindia.org/apmi/WSIAConsolidateReport.htm?action=showReportMenu Under PMS Provider Name please select Marcellus Investment Managers Private Limited and select your Investment Approach Name for viewing the stated disclosure.

Note: APMI provides performance data of Portfolio Managers managing domestic strategies only. Hence, GCP is excluded.

Given this backdrop, it becomes important to invest in companies with profit growth and cash generation driven through the presence of strong moats, focus on incremental operating efficiencies and a disciplined approach towards capital allocation. In that regard, we see our portfolio companies well placed with healthy earnings growth, both in absolute terms as well as relative to the broader market and strong balance sheets ready to allocate surplus capital to benefit in a challenging external environment.

The width of the sectoral exposure that we have added to our quality universe over the last 12 months, gives us options to pick high quality businesses in sectors which are not significantly exposed to the broader economic slowdown e.g. healthcare (hospitals, pharma, diagnostics), private capex around manufacturing, exports, IT services etc. Several of our portfolio companies are implementing business initiatives that expand their target markets, add new revenue growth drivers and hence create resilience in their profits – for instance, Tube, Divis, Trent, Eicher etc. Several of our portfolio companies are also sitting on surplus cash piles which are likely to get utilised towards incremental organic and inorganic growth opportunities e.g. CMS, Escorts, Dr. Lal Pathlabs, Alkem etc.

As the year began, the portfolio delivered a strong start, outperforming the S&P 500 by approximately 200 basis points. The most significant developments this month came from China’s DeepSeek and renewed discussions on Trump’s tariffs. While the latter was largely in line with expectations—likely serving as a negotiating tactic with potential back-and-forth among trading partners—the real news was DeepSeek.

For some time, we have highlighted the increasingly narrow leadership in the U.S. equity market, with performance concentrated in a handful of large tech stocks. This concentration has led to frothy headline multiples for the S&P 500, even as the broader market remains far more reasonably valued. As a result, our portfolio has maintained a lower exposure to mega-cap stocks—30% in companies above $250 billion, compared to 55% for the market—primarily due to our cautious stance on tech. Our concerns about the sustainability of the current data canter boom, particularly beyond 2026, have now been echoed more broadly following DeepSeek’s emergence.

While Nvidia’s software moat (CUDA) remains formidable, we have long recognized potential threats to its extraordinary profitability. These include architectural innovation (e.g., Cerebras, Groq), vertical integration by major customers (Google and Amazon developing in-house chips), diminishing GPU returns, and now, disruptive breakthroughs like DeepSeek. What took the market by surprise was the capability of DeepSeek’s models—outperforming Meta’s LLaMA and competing with OpenAI’s latest releases. Moreover, DeepSeek’s efficiency extends beyond training to inference, making it significantly cheaper to deploy in the cloud.

If DeepSeek’s claims hold, even partially, the implications for the semiconductor cycle could be profound. While Nvidia may face margin compression, companies like TSMC and ASML are relatively better insulated, given their role as pure volume plays rather than beneficiaries of chip pricing cycles. Unlike Nvidia, they are less vulnerable to architectural shifts or vertical integration.

History suggests that markets eventually erode artificial bottlenecks sustaining super-normal profits—especially in high-stakes industries like AI. With multiple disruptive forces at play, from technological innovation to the commoditization of AI, this serves as a timely reminder of the risks embedded in tech investing—risks that today’s valuations often overlook.

While the future remains uncertain, we believe our current semiconductor exposure is well-balanced for this stage of the cycle. We discussed these themes in detail in our weekly 3 Long 3 Shorts series: Has DeepSeek Popped the AI Bubble?

No major changes were made to the portfolio in January, though a few adjustments may be executed by the time this letter reaches you. With earnings season in full swing, most of our holdings delivered results in line with our expectations—except for one: Danaher.

Danaher is a leading tools supplier to the biopharma industry. Over the past two years, we have been tracking a cyclical bottoming in its revenue trajectory following the post-COVID demand boom. While signs of a bottom are emerging (evidenced by high single-digit order growth), the company continues to struggle with integrating its recent acquisitions—IDT, Aldevron, and Abcam.

Historically, Danaher’s business system has been a key driver of value creation in M&A, and our thesis was anchored on this strength. However, having followed the company closely for over a decade, we are concerned by the underwhelming execution in these recent deals. Since Rainer Blair took over as CEO in late 2020, performance has been mixed. Our channel checks on management remain positive, but results have been disappointing.

Valuation-wise, Danaher now trades at ~26-27x forward FY25 earnings, with mid-teens expected compounding (assuming a normal demand backdrop with Danaher’s historical operational capabilities intact) —an attractive setup, all else equal. However, this remains one of the most closely monitored positions in our portfolio.

We continue to find compelling opportunities in select subsectors where valuations remain attractive. A clear distinction has emerged: the market is rewarding companies that deliver on earnings while punishing those that fall short. Among the underperformers, we are selectively identifying cases where challenges are transitory, creating potential valuation arbitrage opportunities.

Our disciplined approach to relative valuation may result in some short-term underperformance—particularly over the past six months—compared to a more aggressive trading strategy. However, this approach avoids unnecessary portfolio churn, which carries tax implications for investors. We remain confident in its long-term benefits and continue to focus on building a resilient and well-balanced portfolio for the year ahead.

Since Inception’ performance calculated from 31st Oct 2022. The inception date is 31st October 2022, being the next business day after the account got funded on 28th October 2022. S&P 500 net total return is calculated by considering both capital appreciation and dividend payouts.

The calculation or presentation of performance results in this publication has NOT been approved or reviewed by the IFSCA or SEC. Performance is the combined performance of RI and NRI strategies.

January turned out to be another good month for KCP, the broader market correction continued with Nifty 50 and Nifty Bank declining 0.4% and 2.5% respectively during the month, however, KCP continued to navigate well with post fees NAV up 0.4% during the month. Over the past 6, 12 and 24 months, the Kings of Capital portfolio has outperformed the Bank Nifty Index as the euphoria and investor interest in public sector banks, tier-II private banks has subsided over the past couple of quarters.

January was a busy month with over 80% of the portfolio companies reporting Q3 results. Majority of the results were largely in-line with expectations. Whilst growth across the sector has moderated (banking sector credit and deposit growth now at ~11% YoY), the key worry/talking point was AQ – trends where better than street’s soft expectations. For now, stress largely continues to remain product specific and not proliferating to the broader lending universe.

We continue to maintain portfolio discipline on valuations and are avoiding chasing themes that stretch beyond comfortable valuations, our move to exit from capital market space was driven by the same rationale. Building on the same, we have made a couple of additions to the portfolio, we have bought India’s most well-run MFI, after the space has gone through extremely challenging times in the last 1 year and stock is down ~50% from the peak. Similarly, Go Digit’s valuations have corrected and offer decent margin of safety. Details about the same are below.

Source: Marcellus Investment Managers, annual filings of respective companies

While many of the Little Champs and Rising Giants portfolio companies would be reporting their 3QFY25 earnings over the coming days, based on the 3QFY25 numbers of the companies who have reported so far, we see continued recovery in earnings in both the portfolios.

On the other hand, however, we are seeing the reverse in our LCP and RGP portfolios. LCP portfolio earnings, after seeing down declining trends through FY24, has staged a strong comeback. For instance, for the most recent quarter, Little Champs witnessed 22% growth in the allocation weighted earnings. Similarly, Rising Giants portfolio companies’ earnings continue to hold up. We attribute these healthy trends in earnings to the following factors:

- Green shoots in the Export markets: Export markets which served as Achilles heel for the both portfolios in FY24 have come to the rescue when the domestic macro is not looking good. Most of the Exports oriented companies in both the portfolios have recorded strong double-digit growth in 2QFY25.

- Rural oriented stocks holding up well: Dodla Dairy, Godrej Agrovet have done well. We have also recently bought Escorts as we expect tractor volumes to witness a revival in from 2HFY25.

We have added the following stocks to the Rising Giants portfolio in the month of January 2025:

- Increase the pace of growth by venturing in more geographies: Company has set up subsidiaries in Europe and Latin America and has reactivated a dormant subsidiary in America. All these entities would work towards business development.

- Turning Egyptian manufacturing operations into export hub for EU, America and LatAm. Egypt has geographic proximity to EU and has free trade agreements with EU (EFTA and EU), US (QIZ) and LatAm (MERCOSUR); and

- Adoption of different business development style for very high value Tri-K products through lateral hiring of Rusmir Niksic (ex-Croda) as CEO and addition of two US B&W experts on Tri-K’s BoD – Kevin Gallagher and Fred Khoury. The intent is to grow at faster rate through broader spectrum of formulation offerings and wider network of clients.

In line with the communication done in the December 2024 webinar, the Investments team and the Investment committee has decided to reorient the Rising Giants portfolio’s focus towards small and mid-cap names in the recent months. To that end, we have been trimming the positions in the large cap stocks in the portfolio (typically >Rs75,000 crore market cap). It was agreed to completely exit from the following large cap positions in the portfolio: ICICI Lombard General Insurance Company Limited, Cholamandalam Investment and Finance Company Limited, Divis Laboratories Limited and Eicher Motors Limited.

We have added Tega Industries Limited, SKF India Limited, Galaxy Surfactants Limited and Creditaccess Grameen Limited to the Little Champs portfolio in the month of January 2025. For rationales for adding these names, please refer to the portfolio additions write up section under the Rising Giants section above.

On the other hand, we have exited from PDS Limited to make space for the above additions where we see higher IRRs.

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/

Please refer to the following link for our Responsible Investing Policy, our ESG Integration Framework and Results of ESG scoring: https://marcellus.in/responsible-investing