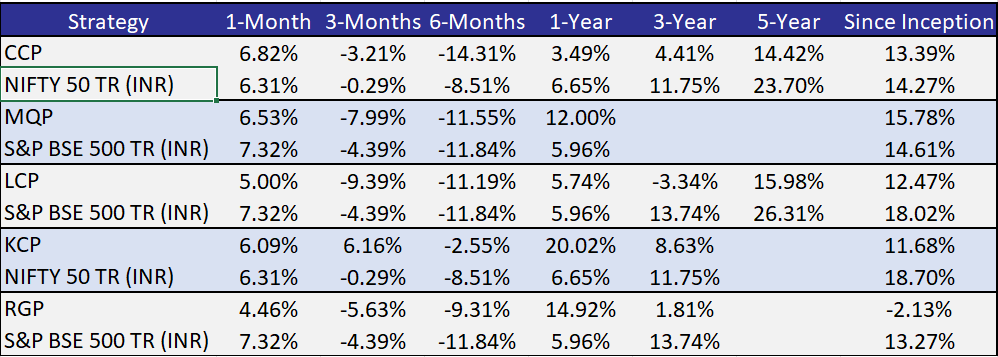

Note: For all strategies except GCP, Performance data shown is net of fixed fees and expenses charged till March 31st, 2025 and is net of annual performance fees (Except for Little Champs Portfolio) charged for client accounts whose account anniversary/performance calculation date falls upto the last date of this performance period. Since, for Little Champs Portfolio, performances fees are charged on cumulative gains at the third anniversary, of the respective client account, the effect of the same has been incorporated for client accounts whose third account anniversary falls upto the last date of this performance period. Performance data is not verified either by Securities and Exchange Board of India, IFSCA or U.S. Securities and Exchange Commission.

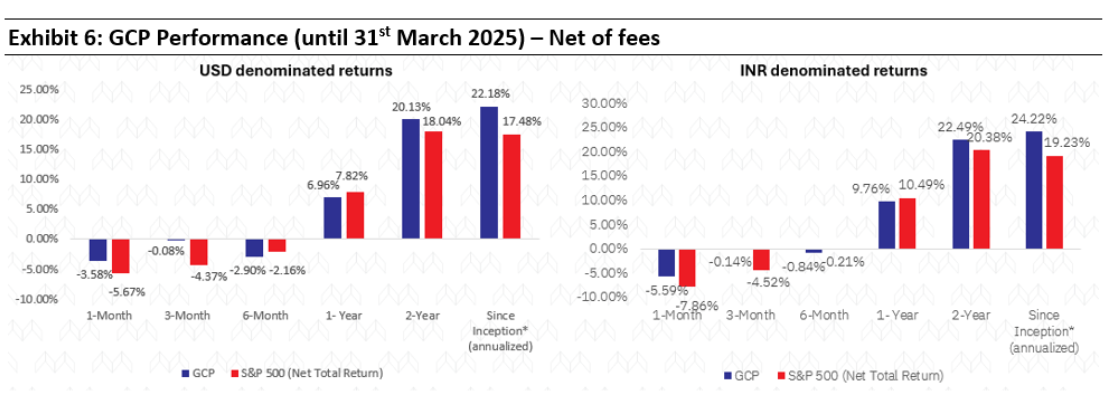

For GCP, performance data is shown gross of taxes and net of fees & expenses charged till end of last month on client account. Returns more than 1 year are annualized. Performance is the combined performance of our RI and NRI strategies. GCP USD returns are converted into INR using exchange rate published by RBI. Source: https://www.rbi.org.in/scripts/ReferenceRateArchive.aspx

*For relative performance of particular Investment Approach to other Portfolio Managers within the selected strategy, please refer https://www.apmiindia.org/apmi/WSIAConsolidateReport.htm?action=showReportMenu Under PMS Provider Name please select Marcellus Investment Managers Private Limited and select your Investment Approach Name for viewing the stated disclosure.

Note: APMI provides performance data of Portfolio Managers managing domestic strategies only. Hence, GCP is excluded.

Consistent Compounders Portfolio (CCP)

Businesses and equity markets are going through a period of heightened volatility due to the uncertainty around the implication of ongoing global tariff wars and domestic macro factors like weakening consumption demand, slowing government capex and no significant rise in private capex. Here is our perspective on how CCP portfolio is positioned in the current environment:

- Limited direct exposure to global trade in CCP : On a weighted average basis, CCP portfolio has approx..20% of its profits coming from businesses carried out outside India – including export led businesses such as Divis and HCL Tech, and Cayman Islands based business of Narayana Hrudayalaya. Of this exposure to businesses carried outside India, less than half is carried out with the US, hence only a small direct exposure to US exports at a portfolio level. Moreover, there are several offsetting factors at play while considering the implications on this non-India business exposure of our portfolio companies, such as: a) pricing power of companies such as Divis in their API and CDMO exports that are inputs for essential drugs globally, including the US; and b) lack of any direct exposure to tariff wars for healthcare offered by Narayana to the population of Cayman Islands (NH is one of the largest allocations in CCP and half of its consolidated profits are generated in Cayman Islands).

- ‘Quality’ is likely to outperform vs the broader market in a difficult external environment : Nifty50’s EPS CAGR over FY21-24 was a staggering 24.3% (Source: Avendus Spark) – a cyclically high period for the market. This supported Nifty50’s Index performance of 15.0% over the same period. With India’s nominal GDP growth rate hovering around the 10-12% mark, fundamentals of the broader stock market (and hence of the Nifty50 Index as a benchmark) are not likely to be more than 2-3% points higher than the economic growth rate over the long term. Hence, after delivering an EPS CAGR of 24.3% over FY21-24, we expect mean reversion for the Nifty50’s EPS growth in future. Moreover, unlike FY21-24 which was marked by cyclical tailwinds such as strong government capex driving a broad-based and healthy economic growth, over the next 12-24 months, businesses in general will face macro headwinds, both from global as well as domestic factors. In this backdrop, we expect fundamental moats and capital allocation of high quality businesses to drive resilience, superior earnings growth and capital allocation opportunities. We continue to remain quality oriented and absolute return oriented – hence we will continue to avoid exposures to certain sectors which don’t meet our stock selection criteria, even if they are a meaningful part of the broader benchmark indices and/or might generate healthy share price returns in the short term for the index. This approach we believe is best placed to navigate well through the ongoing difficult external environment.

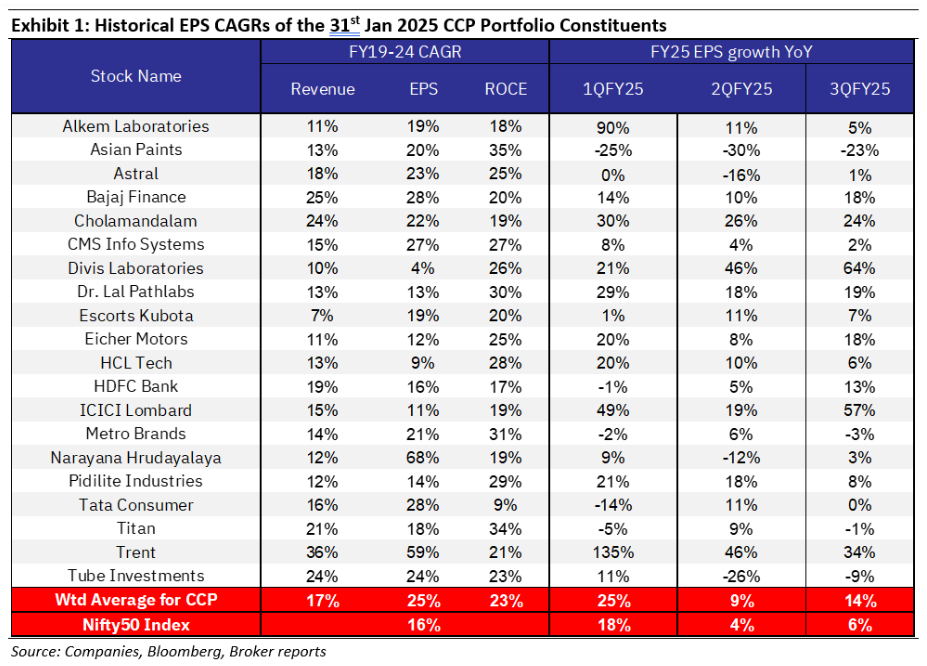

- CCP has delivered mid-teens earnings growth in the first nine months of FY25 and the changes made the portfolio in 2024 have helped further enhance the portfolio’s expected EPS CAGR: The table below highlights how the EPS growth of our current portfolio has been in FY25 so far – healthy and consistent despite a weak external macro environment (reflected in the Nifty50’s weak EPS growth during FY25).

Global Compounders (GCP)

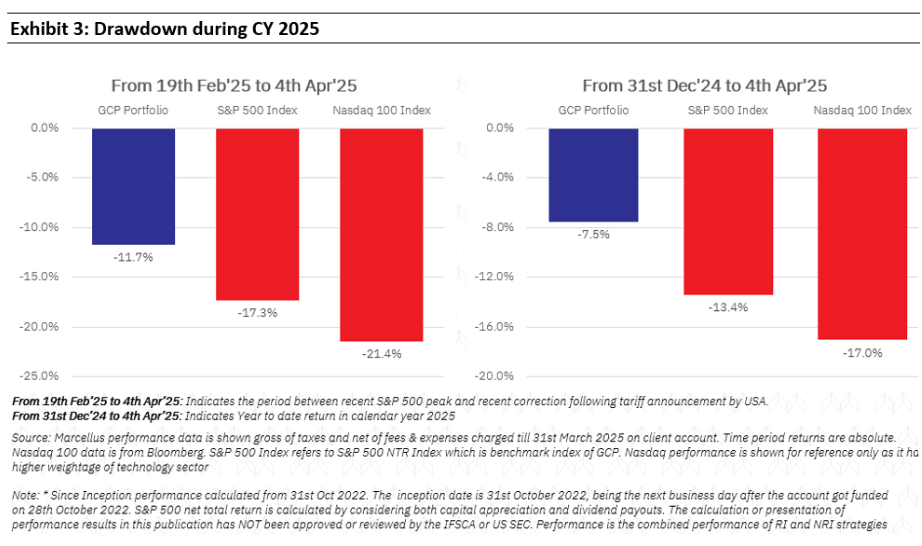

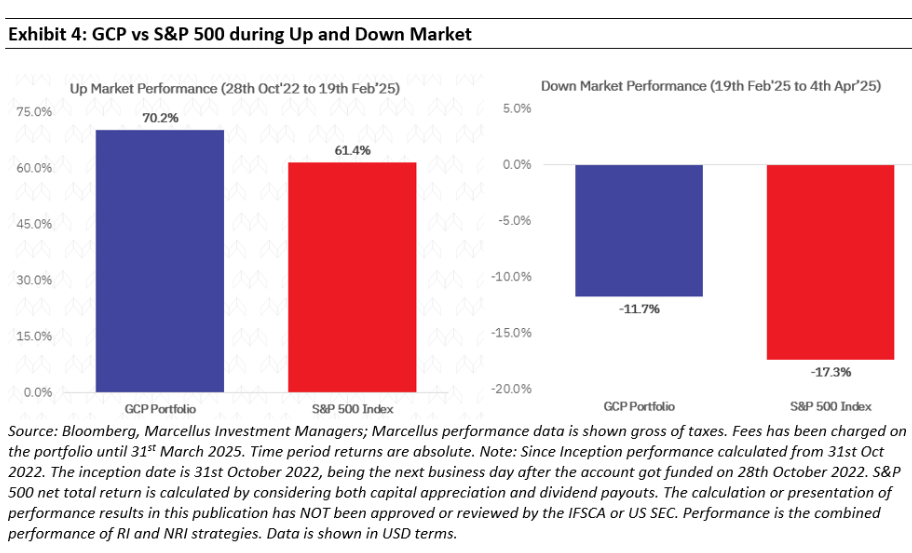

March proved to be a highly eventful month. The continuous stream of headlines, which had started to taper off by the third week of February, returned in full force. Speculation around tariff measures involving Mexico, Canada, Europe, and China dominated discussions. Adding to market anxiety, major companies like Walmart issued weak forward guidance, triggering some panic. As a result, the S&P 500 ended March in the red, retracting approximately 6% from its peak. However, the beginning of April brought even more turbulence. On April 2, dubbed “Liberation Day,” initial “reciprocal” tariffs were announced. These tariffs were far harsher than anticipated, leading to a sharp negative market reaction.

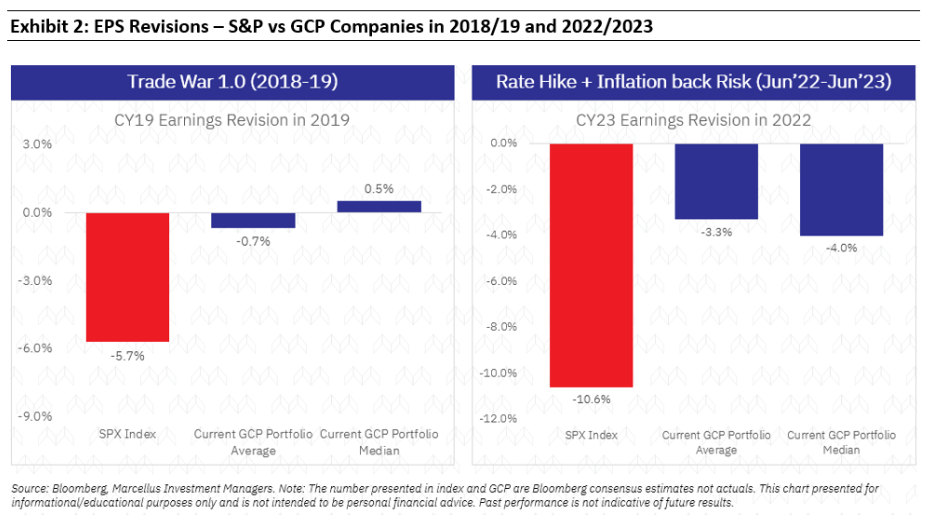

- Tariffs could increase raw material costs, negatively impacting the earnings per share (EPS) estimates of many companies and reflecting broadly at the S&P 500 index level.

- Rising inflation could hurt demand and increase the cost of capital.

- The interplay of these factors could potentially lead to a recession—though this is not our base case scenario. While we recognize that consumer sentiment remains subdued, the data surrounding leverage levels for both consumers and large corporations suggests a more stable backdrop, mitigating the risk of a downward spiral. While consumption may not be surging, there is no compelling evidence to indicate that it is collapsing either.

Portfolio Adjustments

We made minimal changes to the portfolio during this period as market dislocations increased our list of buying opportunities.

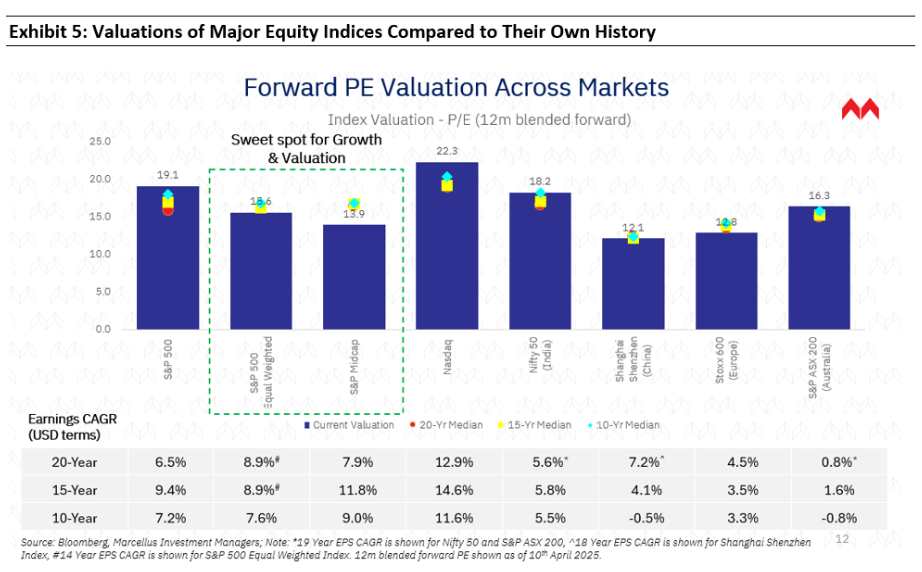

Valuation Insights

Since Inception’ performance calculated from 31st Oct 2022. The inception date is 31st October 2022, being the next business day after the account got funded on 28th October 2022. S&P 500 net total return is calculated by considering both capital appreciation and dividend payouts.

The calculation or presentation of performance results in this publication has NOT been approved or reviewed by the IFSCA or SEC. Performance is the combined performance of RI and NRI strategies.

March month marked a strong recovery in Indian markets, it was the first month of positive returns for the broader markets after declining for five straight months. KCP (post fees) NAV was up ~6.09%, in-line with 6.31 and 6.66% for Nifty and Bank Nifty respectively. Over the past 6, 12 and 24 months, the Kings of Capital portfolio has outperformed the Nifty and Bank Nifty indices as the euphoria and investor interest in public sector banks and tier-II private banks has subsided over the past couple of quarters. Furthermore, KCP’s 1-year performance ranks in the top quartile when compared with mutual funds focused on the BFSI sector. Source: Value Research

As the quarter concluded, pre-earnings updates for Q4 indicated a deceleration in loan growth, consistent with the slowdown in credit growth reported by the RBI for the banking sector. This trend correlates with the broader economic deceleration. While growth appears to be moderating, asset quality is not deteriorating to the extent initially anticipated. Preliminary data from select microfinance lenders suggests that the sector has overcome the most severe challenges, evidenced by improved collection efficiencies and renewed confidence to lend. Similarly, affordable housing financiers are reporting stable asset quality.

As growth becomes scarce, the market tends to reward companies demonstrating consistent growth outperformance.

In an external world which has turned volatile with the outlook cloudy given the tariff-war, we believe financials are well placed as they are 100% domestically focused. Meanwhile, a policy pivot by the regulator focused on cutting interest rates, maintaining adequate liquidity and relatively easier on regulations bodes well for financial services companies.

For 3QFY25, the Little Champs PMS portfolio recorded allocation weighted earnings growth of 17% YoY. This is in addition to the 22% YoY growth witnessed in 2QFY25 earnings. The key drivers of the double-digit earnings growth in the LCP portfolio in the recent quarters have been:

- Most Exports oriented companies in LCP portfolio has recorded double-digit growth in 3QFY25; and

- Rural oriented stocks (such as Dodla Dairy, Godrej Agrovet) have done well in terms of earnings growth.

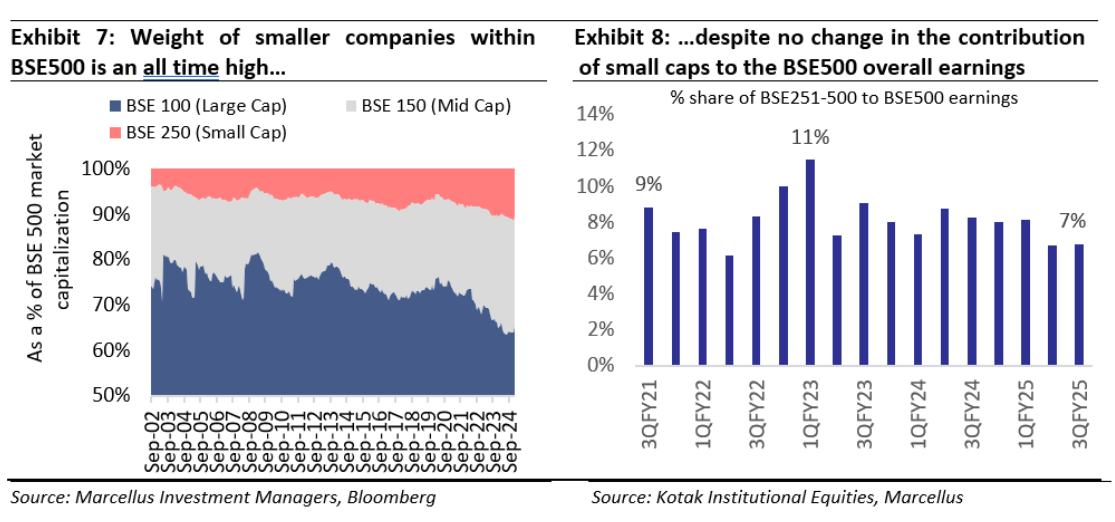

In contrast, there has been a decisive slowdown in the broader corporate earnings with average YoY PAT growth for BSE500 companies moderating to single digits from 1QFY25. Infact the deceleration in the earnings growth has been much sharper for the smaller cap stocks within BSE 500 – with average double digit YoY PAT declines in 251st to 500thranked market cap companies within BSE500.

Given this persistent weakness in the index constituents’ earnings over the last few quarters, we have seen consensus downgrading their estimates for many of the BSE500 companies. Here too, the estimates downgrades have been sharper for the smaller cap stocks (251st – 500thmarket cap) within the BSE 500. We believe the corporate earnings slowdown cycles which seem to have kicked off in the last 2 quarters are likely to last for some time now. In this context, the 30% YoY earnings growth

(Source: Bloomberg consensus estimates)for the smaller cap companies for FY26E built in by consensus look clearly at risk amidst the slowdown in domestic consumption and uncertainties around the global trade.

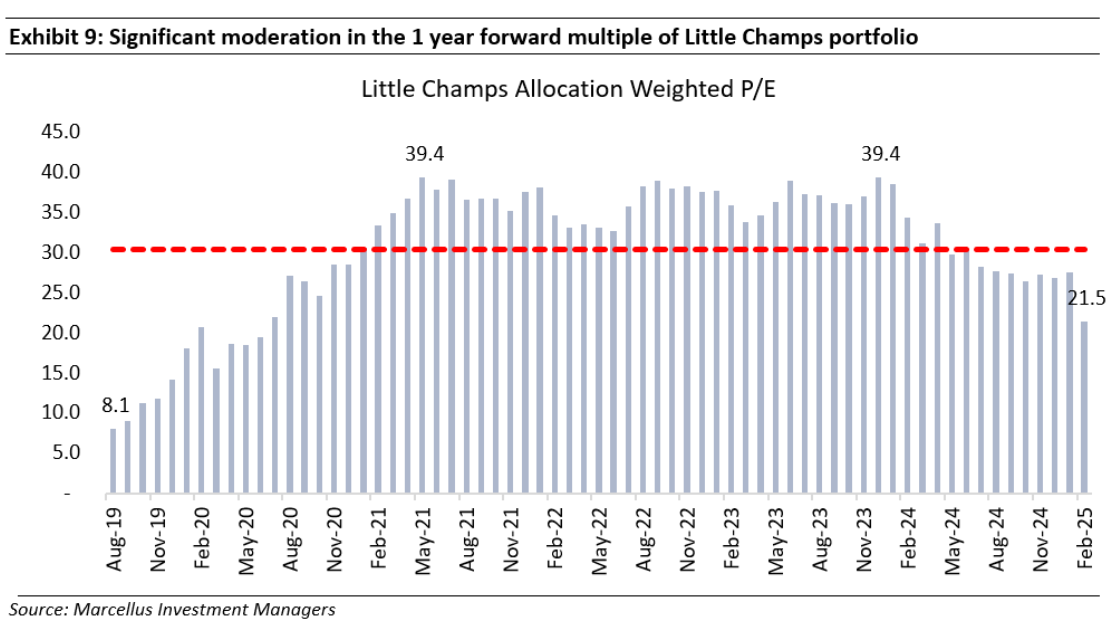

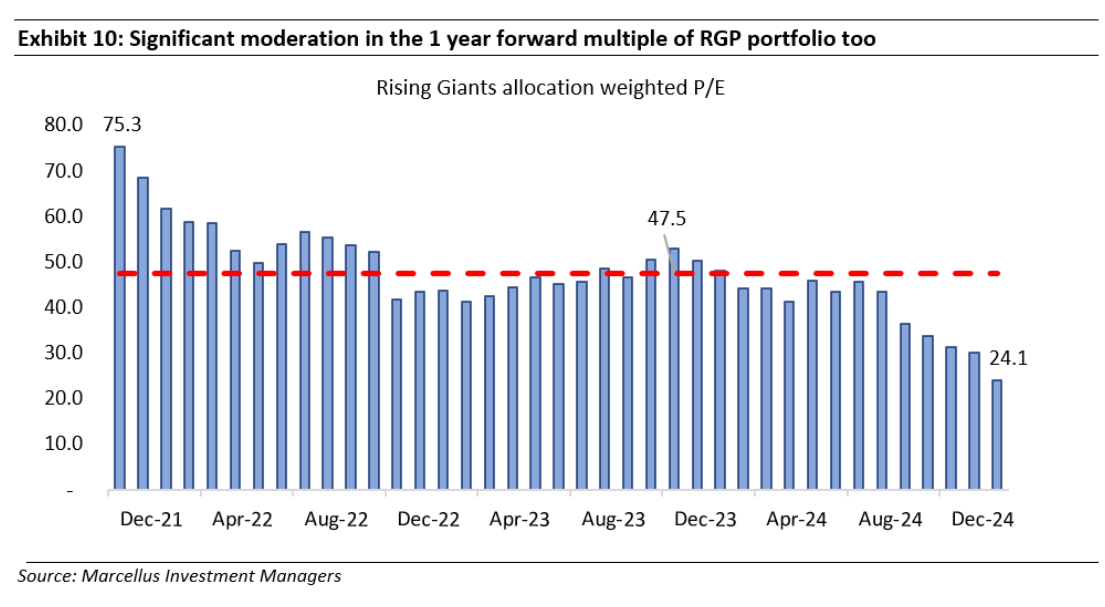

On the positive side, the valuation multiples for both LCP portfolio and RGP portfolios have come down sharply from the highs of the previous periods as visible in the below exhibit.

Given our concern around the small-mid caps valuation in general together with deceleration in the earnings and further – we do anticipate further correction in the space.

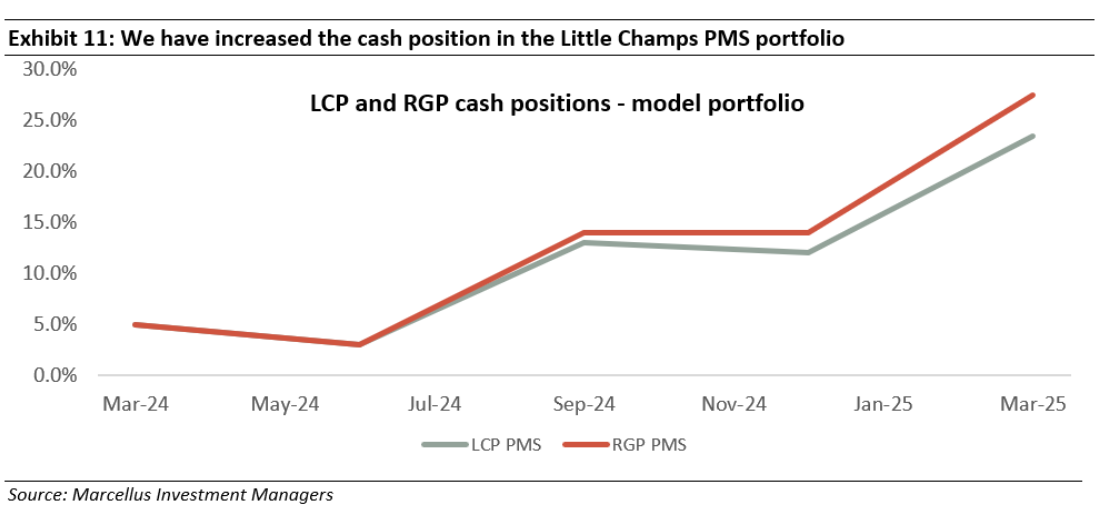

In this context, we have increased the cash positions in both the LCP and RGP strategies. This we have been doing through the year as shown in the below exhibit.

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/insights?filter

Please refer to the following link for our Responsible Investing Policy, our ESG Integration Framework and results of ESG scoring: https://marcellus.in/responsible-investing