In our February 2020 newsletter we had highlighted the 22% rally in the BSE Smallcap index from August 2019-end to early February 2020. Since then the BSE Smallcap Index is down 10%. As in February 2020 when investors seemed to be turning euphoric and today when they are turning bearish, we advocate buying clean & dominant franchises with high RoCEs & high reinvestment rates. Such companies deliver superior earnings growth and share price returns. Similarly, whilst our Little Champs portfolio could see some short-term impact of disruptions in global trade, we do not have long term concerns and expect business for these firms to bounce-back strongly as the uncertainties fade over the coming months.

Performance update of the live Little Champs Portfolio

At Marcellus, the key objective of the “Little Champs” Portfolio is to own a portfolio of about 15 sector leading franchises with a stellar track record of capital allocation, clean accounts & corporate governance and at the same time high growth potential. While we intend to fill our portfolio with winners, we want to be particularly sure of staying away from dubious names where we are not convinced about the cleanliness of the accounts or the integrity of the promoters (even though business potential may sound promising) as the fruits of company’s performance may not get shared with minority shareholders. We intend to keep the portfolio churn low (not more than 25-30% per annum) to reap the benefits of compounding as well as minimize the impact of trading costs.

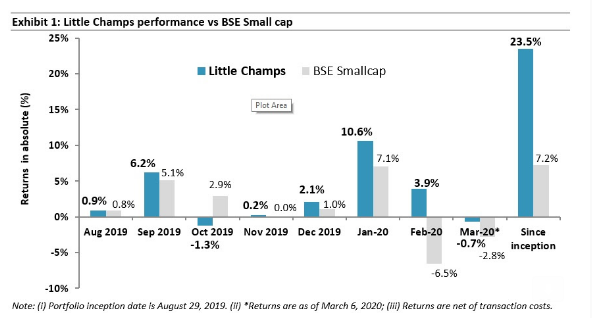

The Little Champs Portfolio went live on August 29, 2019. The performance so far is shown in the below table:

We buy small cap companies with high RoCEs combined with high reinvestment rates

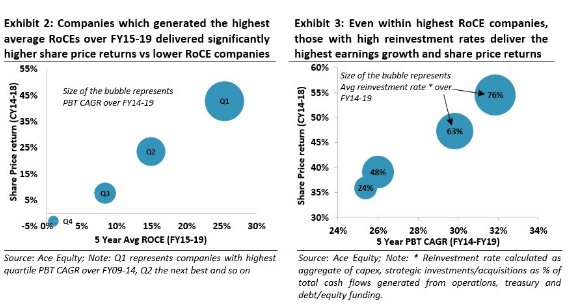

An analysis of Indian small cap companies (excluding Financial Services stocks) with market caps ranging from Rs1bn to Rs35bn (the universe for the Little Champs portfolio) indicates that companies with high RoCEs invariably deliver high share price returns as shown in Exhibit 2 below. This correlation between the RoCE and the share price return is quite logical. Companies with deep rooted competitive advantages deliver returns on capital employed substantially higher than their cost of capital. This results in strong free cash flows for these companies and enables them to sustain their growth and earnings over the longer term.

However, high RoCE by itself would not be of much use if the company is not able to find avenues to redeploy the surplus cash flows at the current high level of RoCE. On the other hand, companies which are able to maintain a combination of high re-investment rates amidst high RoCEs typically deliver the highest share price returns (see Exhibit 3 below).

However, maintaining this combination is a lot easier said than done as there may be only limited avenues for growth within the core business and companies have to necessarily look at diversification either organically (new products, new geographies) or inorganically through acquisitions. Marcellus’ Consistent Compounders Portfolio’s February 2020 newsletter details out the challenges that many firms with great core franchise face in sensibly allocating their surplus cash flows as most of the diversification measures (mainly inorganic) historically did not yield the desired results.

Very few companies can combine high RoCEs with high reinvestment rates

There is an extremely small set of small cap companies in India which are able to achieve the above combination of high RoCEs and high reinvestment rates over the longer term. However, this is one of the key traits we look for while shortlisting the stocks for our Little Champs portfolio. It goes without saying that achieving this require: (a) the work ethic to grow the organisation larger such as instilling process oriented culture, devolution of power & responsibilities to build scale etc; (b) the capital allocation skills to rationally and patiently invest in building long term competitive advantages; and (c) the skill and the drive to run efficient manufacturing operations such as keeping the working capital cycles tight.

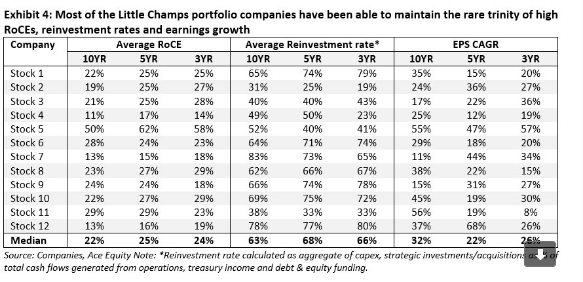

On a median basis, the Little Champs portfolio (excluding the two lenders in the portfolio) have delivered 3/5/10 year average RoCE of 24%/25%/22% respectively. Besides sustaining healthy RoCE levels, the portfolio stocks have also been able to maintain high reinvestment rates resulting in strong earnings CAGR over the 3/5/10 year periods. Please note that we are not considering the two financial services stocks that we own in our Little Champs portfolio while presenting the analysis shown below.

Interestingly, most of the Little Champs companies have been able to maintain high reinvestment rates without going in for any significant acquisitions which also explains the sustenance of high RoCEs for these companies (as discussed earlier, successful inorganic growth has rarely been seen in Indian corporate life). Our analysis suggest Little Champs have been able to achieve their sustainably high levels organic growth due to the following reasons:

- Businesses that were earlier local in nature, became regional and finally gained national presence. The success template here has been to build a pan-India brand, a national distribution network and thereby chipping away share from the unorganised local plays or grow the addressable market pie. Improved integration within the economy be it communication (including internet), mode of travel (road, air) etc. have helped break-down barriers which hitherto helped informal businesses flourish.

- Businesses that were successful in replicating the leadership in one category across multiple categories. This has been driven by profitably deploying the cashflows from the core businesses into adjacencies i.e. a new product segment. Companies have been able to leverage the cash flows, product understanding as also the distribution/customer relationships of the core business to build profitable adjacencies.

- Businesses that were able to successfully capture a significant part of the global pie. These not only include export-oriented companies but also players able to substitute high level of imports into India. The underlying drivers for success here have not only been leveraging the low-cost Indian manufacturing advantage, but also coming up with innovative products or processes that induces customers to shift from existing vendors.

Coronavirus and impact on Little Champs investment strategy

For understandable reasons, there has been growing investor concerns surrounding Coronavirus. Whilst there are still several uncertainties regarding when the disease will finally be brought under control, we see limited long term impact of the Coronavirus on the fundamentals of the companies we invest in due to the following reasons:

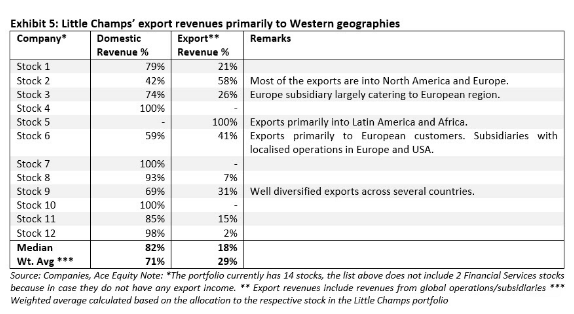

- From a demand perspective, there are 5 portfolio companies (portfolio allocation of ~40-45%) which have meaningful exports (more than 25% of their revenues). However, the exports as well as the global operations of these companies are pre-dominantly into Western geographies.

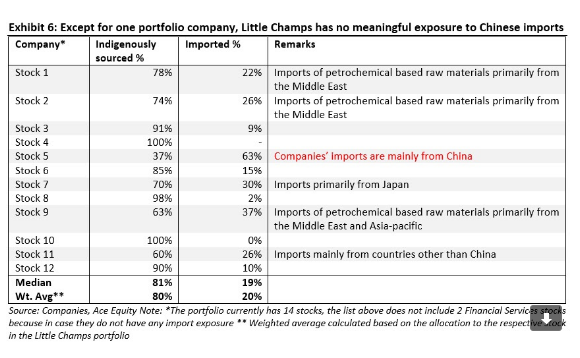

From a supply disruption perspective, barring one portfolio company (8% portfolio allocation) none of the other companies rely directly on any meaningful imports from China. However, there will be an indirect impact on the auto-ancillary companies in the portfolio (15-20% portfolio allocation) where the user industry (i.e. automobile OEMs) source components from China and hence are exposed to the ongoing supply chain disruption in China. We believe these supply chain disruptions can have a short-term impact on the earnings of these companies. We expect supply chain disruptions could be made up over the next 6-12 months as sourcing from China can be substituted from other geographies.

History has been a witness to many similar events like SARS, MERS, Ebola or even demonetisation (which practically shut the whole of Indian economy for about 2-3 months). Such events had only a temporary impact on business activity which bounced back quite sharply as the uncertainties faded away.

Further, there will be a few offsetting factors in the short term which will help the Little Champs companies like: (a) buffer of a few months of raw material inventory that are maintained by the companies especially for their imported components; (b) a sharp fall in crude oil prices which is positive for earnings of many of our portfolio companies; (c) liquidity easing measures by central banks globally to mitigate the impact of Coronavirus; and (d) some companies in our portfolio benefit from substitution of Chinese manufacturing by these Indian companies.

As such, while we remain to be watchful of the events unfolding in front of us (particularly since the spread of the virus in India), we continue deploying clients’ monies in buying the Little Champs stocks. These are clean, well-managed franchises with sustainable competitive advantages and they are likely to be able to continue growing their businesses inspite of the short run disruption posed by the virus.

Regards

Team Marcellus