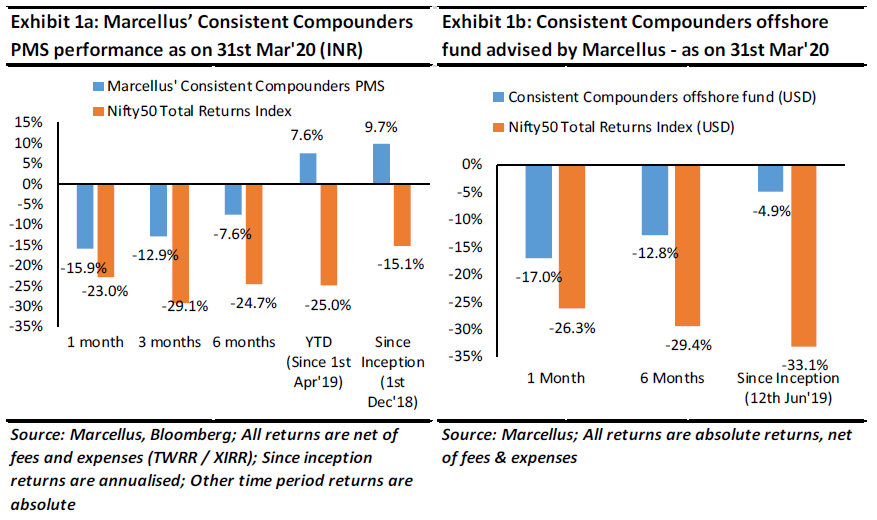

In FY20, Marcellus’ CCP PMS has delivered healthy absolute returns (+7.6% vs -25.0% for Nifty50 Total Return Index) alongside resilience during the recent stock market correction (since 1st Jan 2020: -12.9% for Marcellus CCP vs -29.1% for Nifty50 TRI). Beyond the period of business disruption from the ongoing lockdown, fundamentals of Marcellus’ CCP companies are likely to remain exceptionally strong due to: a) insignificant exposure to global demand and global supply chains; b) high exposure to small ticket daily essential products and services; and c) the opportunity to accelerate market share gains given the challenges faced by weaker/smaller competitors. Hence, the share price recovery after every such crisis happens sooner and sharper for CCP companies (vs the broader market) and timing entry / exits in such a portfolio tends to be a futile exercise.

Performance update – as on 31st March 2020

We have a coverage universe of around 25 stocks, which have historically delivered a high degree of consistency in ROCE and revenue growth rates. Our research team of seven analysts focuses on understanding the reasons why companies in our coverage universe have consistently delivered superior financial performance. Based on this understanding, we construct a concentrated portfolio of companies with an intended average holding period of stocks of 8-10 years or longer. The latest performance of our PMS and offshore fund (USD denominated) portfolios is shown in the charts below.

Fundamentals of CCP companies are likely to remain robust with opportunities to accelerate market share

Although there is short term uncertainty around when the lockdown related to Covid-19 will be lifted, we believe that the domestic lockdown related to the outbreak will be behind us after another 6 months (if not much sooner) i.e. offices, manufacturing plants and road transport infrastructure will be operating as normal. Bearing in mind this assumption, let us look at how the fundamentals of our portfolio companies are likely to be affected by this crisis.

Next 3-5 year view of India’s economic growth:

In a recent blog (click here), we had highlighted that four times in the last 40 years, a US recession alongside falling US bond yields and falling oil prices has been followed by a strong economic recovery in India. In fact, India has NEVER witnessed an economic recovery without a US recession preceding it! Now, all three conditions for an Indian economic recovery – a US recession, smashed crude prices and falling US Government bond yields are – in place.

Exposure to recession in some of the western economies or to global supply chains:

12 out of our 13 portfolio companies have insignificant exposure (less than 2-3% of revenues) to exports for deriving their revenues. Divis Labs is the only portfolio company which is exposed to the export of APIs used in the manufacture of drugs like cough syrups and pain killers. Given that these drugs are essential in nature and Divis Labs controls 40%-70% market share globally in the manufacturing of these APIs, it is unlikely that there will be any adverse impact on demand for Divis Labs’ products. In fact, Divis stands to benefit if its Western Big Pharma customers increase their procurement from Divis at the expense of Chinese suppliers.

As highlighted in our 11th March webinar (click here), 6 out of 13 companies in our portfolio import upto 20% of their raw materials and hence are dependent on global supply chains. However, these imports are of chemicals and other commodities which are easy to substitute across geographies and companies – in some cases like Pidilite’s VAM procurement, imports can be substituted by in-house manufacturing of such raw materials.

Deepening of the ongoing financial crisis due to rise in NPAs and tightened liquidity in the near term:

The ongoing ‘lockdown’ in domestic economic activity will certainly lead to short term (2-4 months) suppression in revenues, earnings and cash flows of businesses across most parts of the economy. Undoubtedly this will result in a rise in NPAs and reduction in loan book growth rates for lenders during the 2-4 months period of lockdown.

In our 1st November 2019 newsletter (click here), we had explained how great lenders undergo a temporary deterioration in their financials during such a crisis, but are best placed to consolidate their market share once the crisis is over. This newsletter shows the journey of HDFC Bank during the global financial crisis of 2008 and of HDFC Ltd during the 1997-98 NBFC crisis (just to emphasis the depth of the 1998 crisis – the Government infused Rs. 2,550 Cr into three PSU banks, IFCI had to be bailed out with a Rs. 1,000 Cr package, NPAs of IDBI increased to 18%, Global Trust Bank’s networth turned negative, the number of NBFCs dropped to 7,855 in Mar’99 from 55,995 in Mar’95 i.e. over 80% of NBFCs were shut down).

We believe that Bajaj Finance, HDFC Bank and Kotak Mahindra Bank are best positioned to consolidate lending market share over the next 3-4 years because of a combination of: a) a strong liabilities franchise with favorable Assets Liabilities Management (ALM) profile; b) comfortable capital adequacy ratios; c) superior quality of loan book compared to their competitors; and d) superior collections capabilities vs peers. Hence, any short-term moderation in earnings growth trajectory of these firms is likely to be more than offset by acceleration in earnings growth through market share gains over the next 3 years.

Resilience of non-financials stocks in our holding portfolio:

All our portfolio companies sell products and services which are small ticket, day- to-day essentials consumed by Indian middle-class households. Unlike spends on tourism / entertainment / leisure / luxury categories, demand for products and services of our portfolio companies is highly utility oriented and hence cannot be cancelled easily. For instance: a) you cannot defer the purchase of packaged foods like baby milk, Covid tests, essential medicines etc; b) you can delay by few weeks, the purchase of innerwear, footwear, diagnostic tests, etc; and c) you can delay by few months, the repainting or furniture repair in your home. Moreover, no matter how our lifestyle changes after such a crisis, habits and consumption patterns of these products are not likely to change or get substituted in the foreseeable future.

Most interestingly, many of our portfolio companies are likely to strengthen their competitive positioning during this crisis through a combination of the following factors:

-

Support offered to channel partners:

During one of our recent channel checks, a distributor of Page Industries (Jockey innerwear) told us “In a normal situation, Page’s channel partners are offered upto 30-45 days of credit compared to 90-120 days of credit available from almost all competing brands of mens and womens innerwear. During a crisis like demonetization or the ongoing crisis, Page extends an extra 60 days of credit to distributors, which cannot be matched by Page’s competitors because these competitors’ balance sheets are not so strong and they do not want to extend a total of 6 months of credit to their channel partners. Such support from Page helps strengthen the firm’s relationship with their channel over the longer term”. We expect this phenomenon to be true for almost all our portfolio companies which deal with distributors and dealers. Another such example is of Dr. Lal Pathlabs where the firm helps their franchisees by trying to renegotiate downwards rentals for collection centers laboratories.

Utilise benefits from last year’s corporate tax rate cuts to suffocate competition:

As highlighted in our 1st October 2019 newsletter (click here), all our portfolio companies have been the biggest beneficiaries in their respective industries, of the corporate tax rate cuts announced last year. At a time when competitors struggle due to the cash flow implications of the ongoing crisis on their balance sheet, the incremental cash flow available to our portfolio companies from tax rate cuts is likely to be used to gain market share through product price cuts, higher employee benefits, accelerated capex, support to channel partners and vendors, etc.

-

Possible benefits of in-house labour work force:

Footwear and innerwear are the two most labour intensive manufacturing industries. Relaxo and Page have in-house manufacturing labour workforce being full time employees (vs contract labour and outsourced manufacturing for their peers). Hence, there is a high possibility that Relaxo and Page will be able to resume normalcy in their manufacturing setups much sooner than that of their competitors, given the mass exodus of contract laborers that many cities in India have witnessed over the past few weeks.

-

Benefits of owning / controlling the supply chain:

Once the lockdown on road infrastructure is lifted, supply chains of different companies will come back to normalcy at different speeds. For instance, distributor-based supply chains will come back sooner than wholesaler-based supply chains due to the unorganized/ indirect nature and greater stress on working capital of a wholesaler vs a distributor. Firms which have fewer layers in their channel compared to others will get back to normalcy quicker. Firms like Page Industries and Relaxo are unique relative to their competitors due to their reliance only on distributors rather than wholesalers. Others like Pidilite and Nestle have a greater proportion of direct distributors compared to their competitors who are more dependent indirect distribution channels. Firms like Asian Paints and Berger do NOT have any channel partners in their supply chain barring the paint dealers on the high street. Dr. Lal Pathlabs, with its B2C business model (direct control on franchisees, lab technicians and equipment used by these lab technicians) will be better placed than competitors like Thyrocare which are more B2B in nature and do not such direct control on their supply chain infrastructure.

-

Market share shift from unorganized to organized players, and from small/weak players to large/stronger players:

Several of our portfolio companies have been massive beneficiaries of events like demonetization and GST implementation due to the shift of market share from unorganized to organized players after these events. Due to the factors mentioned in the bullet points above, we expect this momentum of market share gains from unorganized players to continue for our portfolio companies after the COVID-19 disruption is behind us. This will apply to industries like footwear, paints, innerwear, packaged foods, adhesives and even pathology chains – opportunity to both consolidate the sector through bolt-on acquisition of weaker balance sheet path labs as well as recruit new footfalls during the crisis because smaller path labs are not allowed to do COVID-19 tests.

Hence, while we expect the ongoing crisis to cause short term disruption in revenues and earnings of our portfolio companies, we expect these short term negatives to be more than offset by the longer term positives that are likely to emerge from the ongoing crisis (as the popular saying goes ‘When the going gets tough…’).

Share price recovery after such a crisis for CCP companies vs the broader market

Just like we cannot time an exit before a stock market crash, we also cannot time entry before a stock market recovery. In fact, here are some data points which indicate that whilst it might make a lot of sense to time entry and exit from the broader market / a mediocre quality portfolio, the same exercise is not worthwhile when it comes to a portfolio of Consistent Compounders.

CCP stocks fall less than the broader market during periods of market stress:

As highlighted in exhibit 1a above, Marcellus’ CCP portfolio has not only remained resilient compared to the broader market, it has also delivered a healthy absolute return of +7.6% over the past 12 months, unlike the -25.0% return of Nifty50 over the same period. This is neither surprising nor unusual. As highlighted in our 1st September 2019 titled “Why Consistent Compounders outperform during periods of market stress”, in 60-70% of the instances of stock market crash on a 1-year basis, Consistent Compounders deliver a positive return only because of their stronger fundamentals compared to the broader market. In Appendix 1 of our book ‘Coffee Can Investing: The Low Risk Route to Stupendous Wealth’, we have shown that the maximum drawdown of a portfolio of CCP companies during the 2008 crash was approximately 30% compared to the approximately 65% fall in indices like Nifty50 / Sensex (a typical CCP portfolio in 2008 would have consisted of stocks such as HDFC Bank, Asian Paints, HDFC Ltd, Infosys, Cipla, Hero Motocorp etc.)

This phenomenon is not unique to India. A recent report from Morningstar (click here) on the US stock market during the ongoing COVID-19 crash, has concluded that “The shares of the highest-quality companies, as defined by Morningstar Equity Research, have lost less than the broad U.S. stock market and considerably less than low-quality stocks.”

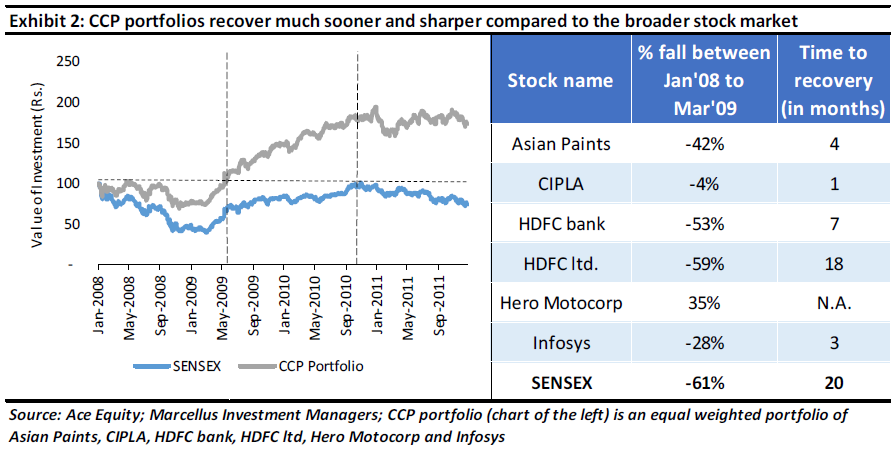

CCP portfolios recover much sooner and sharper compared to the broader stock market:

After a 14 month long fall in the stock market during the 2008 global financial crisis, the market bottomed out on 9th March 2009. As shown in the exhibit below a typical CCP portfolio in 2008 would have recovered back to its pre-crash levels within 3 months of the market bottoming out compared to a long drawn 20-months recovery period for the Nifty50 to get back to its pre-crash levels.

This rapid recovery in share prices of CCP portfolios after the market has bottomed out, is because of a combination of the following factors:

- CCP companies might strengthen their fundamentals during such crisis and come out stronger on the other side of the crisis – as highlighted in earlier in this newsletter.

- Before the stock market crash, share price performance of CCP companies is fully supported by their earnings and fundamentals (see Exhibits 2 and 3 of our 1st March 2020 newsletter on this subject – click here). The same might not be true for the performance of Nifty50 / Sensex.

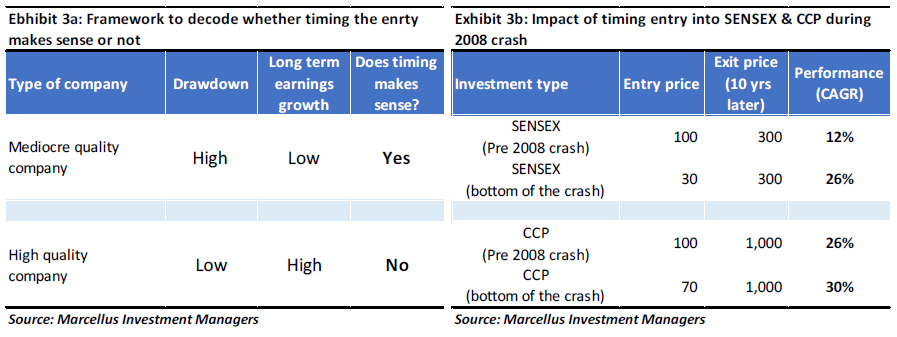

Successful timing of entry / exit in a mediocre asset class makes sense, but not in a CCP portfolio:

The exhibit 3a on the left below shows a framework around this and the exhibit 3b on the right below gives an example of this framework.

Entry into a mediocre quality stock just before the 2008 crash would be expected to deliver 10-12% CAGR over the next decade, in-line with earnings growth potential of the underlying asset. However, given the approximately 70% drawdown in such stock during the 2008 crash, timing an entry right at the bottom of the crash would have delivered a 10-year CAGR of 26% instead. The difference between 12% (without timing) and 26% (with perfect timing) is not only big, it also changes the relevance of compounding for such a portfolio consisting of mediocre. At 12% CAGR, an investor might just be able to meet their increase in cost of living over a decade. However, at 26% CAGR, the investor would have created substantial wealth over and above the inflation in their cost of living.

On the contrary, timing entry / exit from a CCP type of portfolio during the global financial crisis of 2008 would have only shifted an investor’s CAGR from 26% to 30% – surely, not worth the effort given the costs involved around: a) risk of getting the timing wrong; b) transaction costs; and c) intense focus on share prices rather than on fundamental research (or your day job) during such times of stock market crash.

Investment implications

We cannot predict the depth and duration of any stock market crash. However, during every such period of distress, Consistent Compounders deliver the most resilient share price performance with recovery in their stock prices being much sooner and sharper than the rest of the market. This makes timing entry / exits in such a portfolio a futile exercise. Hence, instead of focusing on how the event is unfolding in the short term (for example – carefully tracking the number of affected Covid-19 cases in India and across the world), we focus on only two aspects of our portfolio companies: a) will these firms be able to survive this crisis and will the demand for their products return to normalcy few months after the crisis?; and b) can these firms further strengthen their competitive positioning due to the crisis and hence lead the consolidation of market share over the next 3-5 years?

Based on the answers to these two questions, we stay fully invested through the stock market crash in such Consistent Compounders in order to deliver healthy and consistent portfolio compounding with low volatility.

Reminder for option to change your fees structure for FY21

A reminder to all our existing clients CCP PMS client – like every year, you have the option of changing your fees structure for the next 12 months, from amongst the three fees-options that we offer. If you would like to exercise this option, please send an email to clientsupport@marcellus.in before 30th April 2020. Please ignore this reminder if you do not wish to change the fees structure applicable on your Marcellus CCP PMS account.