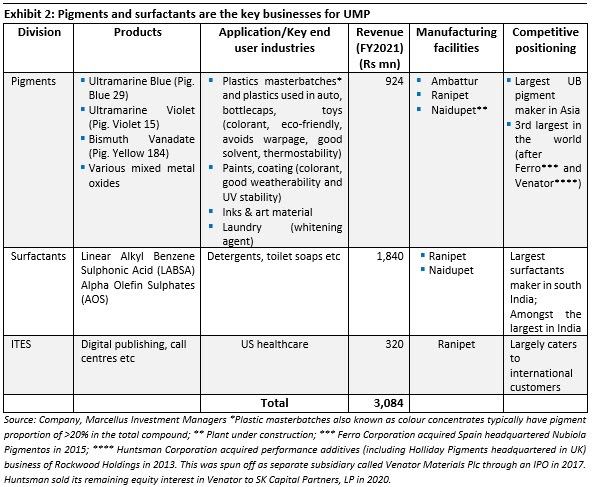

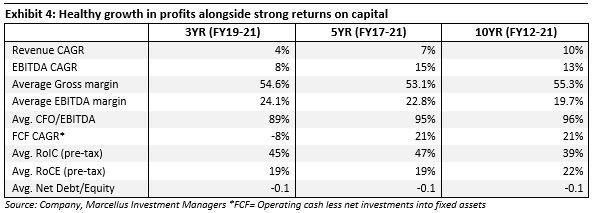

This month we place the spotlight on Ultramarine & Pigments Limited (UMP), a top 3 global manufacturer of inorganic Ultramarine Blue pigment (and the leader in India and Asia-Pacific) and amongst the top manufacturer of anionic surfactants in India. Ultramarine’s pigment business enjoys significant manufacturing complexities around yield, purity and consistency particularly for industrial grade pigments. The surfactant business enjoys locational advantages since Ultramarine is the only large-scale surfactant player in south India. Helmed by technocrats, the company is focused on enhancing the product mix in both pigments (high performance pigments like Ultramarine Violet) and surfactants (specialty products for personal care) thus increasing the entry barriers. New environmental regulation is the key risk for this firm.

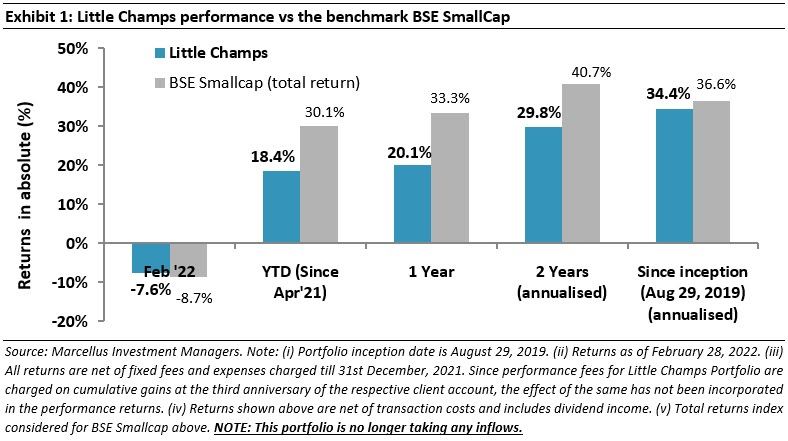

Performance update for the Little Champs Portfolio

At Marcellus, the key objective of our Little Champs Portfolio is to own a portfolio of about 15-20 sector leading franchises with a stellar track record of capital allocation, clean accounts & corporate governance and at the same time high growth potential. While we intend to fill our portfolio with winners, we want to be sure of staying away from dubious names where we are not convinced about the cleanliness of accounts or the integrity of the promoters (even though the business potential may sound promising) as the fruits of company’s performance may not get shared with minority shareholders. We intend to keep the portfolio churn low (not more than 25-30% per annum) to reap the benefits of compounding as well as minimize trading costs. The Little Champs Portfolio went live on August 29, 2019. The performance so far is shown in the below table.

Portfolio updates: Exit from Lumax Industries, addition of Paushak and Tarsons Products

We have made the following changes to portfolio in the recent months.

A. Exit from Lumax Industries

The key reasons for this exit are:

- Increased competition in the passenger vehicle automotive lighting industry particularly in the new age LED technologies. Lumax has incurred capital expenditure of close to Rs5,347 mn from FY17 to FY21. Rising competition raises concern surrounding the return on this incremental capital employed and thus the overall blended RoCE of the company.

- In light of the above, we have downgraded Lumax industries’ longevity scores and earnings growth forecast. This results in the stock sliding down the ladder in the Little Champs stock selection and position sizing framework.

B. Addition of Paushak

Paushak is the leading supplier of phosgene derivatives in India. Phosgene derivatives are some of the most basic & essential industrial chemical compounds that find application in multiple industries like pharmaceutical, agro-chemicals, personal care, etc. Owing to the highly hazardous nature of phosgene, the licensing regime in India is very stringent and this creates barriers to entry. These regulatory barriers to entry coupled with Paushak’s focus on specialty phosgene derivatives, its professional management team and continued R&D for producing more complex and value-added derivatives have enabled Paushak to grow its Revenues and PAT at ~17% CAGR and ~26% CAGR respectively for the last 10 years ending FY21 (for the 3 years ending FY21, revenue & PAT growth is 11% & 21% respectively). Paushak’s healthy growth has been accompanied by an average pre-tax ROCE of ~24% over the last 10 years (~21% average in the last 3 years).

C. Addition of Tarsons Products

Incorporated in 1983, Tarsons Products is engaged in the manufacturing of Plastic Labware Products and sells these products in India as well as in the export market (which accounts for a third of the firm’s revenues). The main customer segments for the company are research organizations, academia institutes, pharmaceutical companies, Contract Research Organizations (CROs), diagnostic companies and hospitals. Tarsons’ leadership in the Indian plastic labware market is underpinned by its in-house manufacturing capabilities and a strong distribution network. Manufacturing the product in-house has enabled the company to price its products very competitively. The precision required around manufacturing a large number of SKUs and the capital-intensive nature of the business act as high barriers to entry in the domestic market. On the other hand, the niche size of the industry (total revenues Rs12 bn) makes it unfeasible for MNC manufacturers to commence manufacturing in India. The company has grown its revenue at 13% CAGR over the last 5 years (FY16-21) and PAT at 49% CAGR with average ROCEs of 30%. With its new plant, Tarsons is expanding its capacities by more than 2x and is also expanding into new segments like Polymerase chain reaction (PCR) and Cell culture which are currently dominated by MNC players in India.

Stock in the Spotlight: Ultramarine & Pigments

This month we detail our investment rationale for Ultramarine & Pigments. In the previous months we have written on: Garware Technical Fibres (August 2020), GMM Pfaudler (September 2020), V-Mart Retail (October 2020), Alkyl Amines (November 2020), Suprajit Engineering (December 2020), Mold-Tek Packaging (February 2021), Amrutanjan (April 2021), Fine Organics (May 2021) and Galaxy Surfactants (December 2021).

Company and management background

Ultramarine & Pigments Limited (UMP), incorporated in 1960 in Mumbai, started as a trading company for the Ultramarine Blue (UB) pigment. In 1962, the first unit for in-house manufacturing of UB pigment was set up in Ambattur (Chennai, Tamil Nadu) through a technical agreement with a large German chemical company. The anionic surfactants division was started in mid-1970s in Ranipet (Tamil Nadu) initially with Linear Alkyl Benzene Sulphonic Acid (LABSA), a common surfactant used for detergents. In late 1990s another anionic surfactant Alpha Olefin Sulphate (AOS) was added to the portfolio. The pigment and surfactants divisions continue to be Ultramarine’s mainstays accounting for 90% of total revenues in FY2021. Excluding ITES, 20% of the revenues come from exports (the majority from the pigments segment).

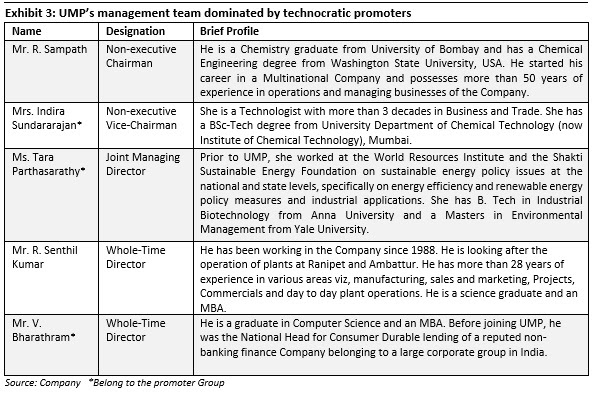

The company has historically been managed by the promoter family members. Currently the third generation of the promoter are also involved in the business.

|

|

|

|