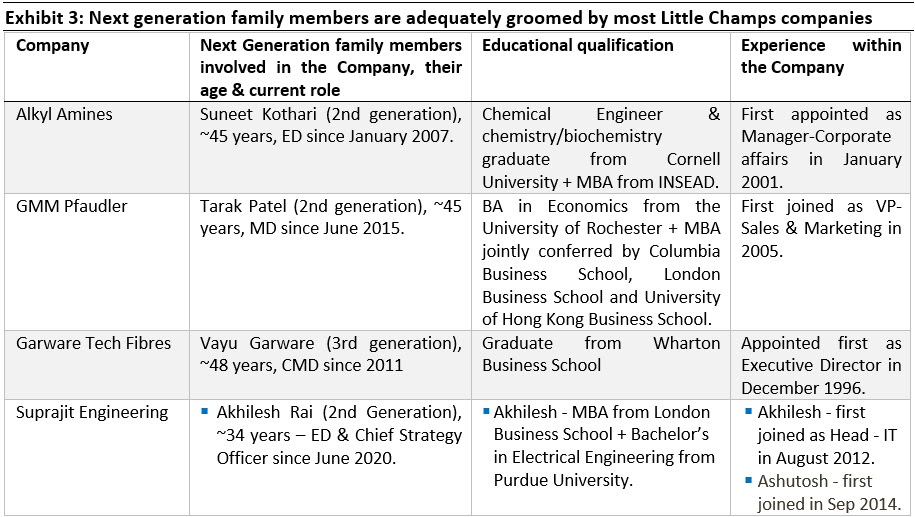

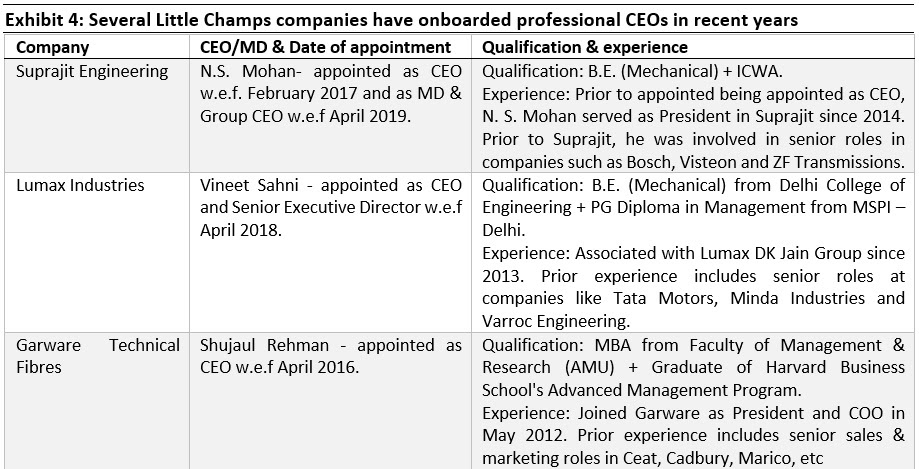

The degree to which a firm institutionalizes it’s systems & processes is one of the biggest sources of differentiation between a high quality versus a mediocre franchise. Hence in Marcellus’ Longevity Framework, our research on “succession planning” focuses on softer aspects such as the institutionalization of the business, the quality of the independent Board Directors and clarity on the next generation family successors’ roles. Most Little Champs portfolio companies have made rapid strides in succession planning in recent years thanks to a well thought through succession roadmap, the proliferation of professionals in key roles, the democratisation of company ownership through stock options and through high-quality independent director appointments.

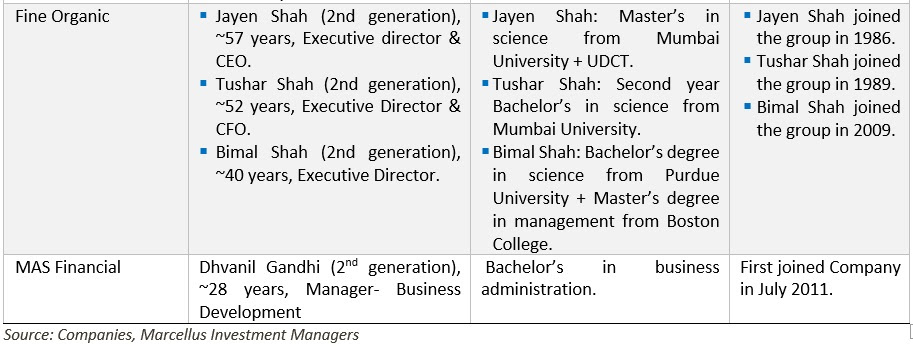

Performance update for the Little Champs Portfolio

At Marcellus, the key objective of our Little Champs Portfolio is to own a portfolio of about 15-20 sector leading franchises with a stellar track record of capital allocation, clean accounts & corporate governance and at the same time high growth potential. While we intend to fill our portfolio with winners, we want to be sure of staying away from dubious names where we are not convinced about the cleanliness of accounts or the integrity of the promoters (even though the business potential may sound promising) as the fruits of company’s performance may not get shared with minority shareholders. We intend to keep the portfolio churn low (not more than 25-30% per annum) to reap the benefits of compounding as well as minimize trading costs. The Little Champs Portfolio went live on August 29, 2019. The performance so far is shown in the below table.

|

|

|

|

|

Some of the Little Champs companies not mentioned in Exhibit 3 miss out due to valid reasons as explained below:

- Aavas Financiers: The company is majority owned by Private equity investors.

- V-Mart: Is promoted by first generation entrepreneur Lalit Agarwal who himself is just 51 years of age.

- Amrutanjan: S. Shambu Prasad, then ~30 years old, joined the company as non-executive director in 2004. He took over as MD in 2005 due to the demise of his father S Radhakrishna.

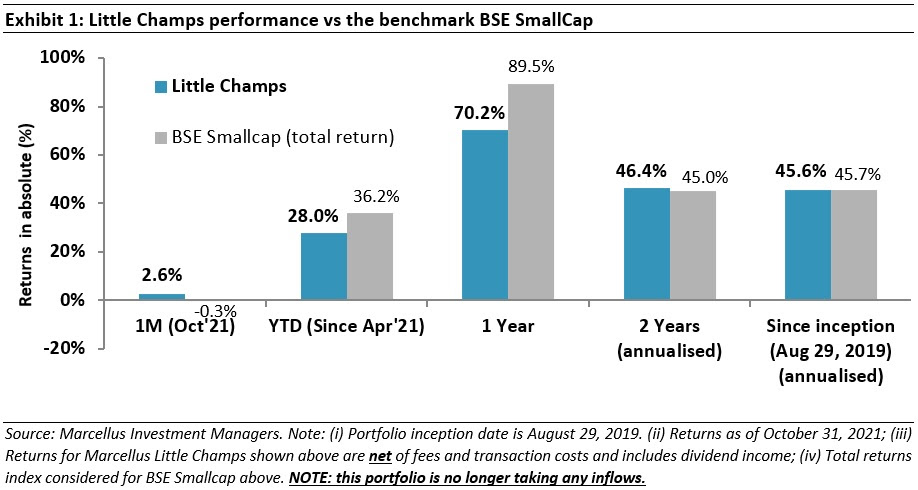

B. Professionalisation of the management team

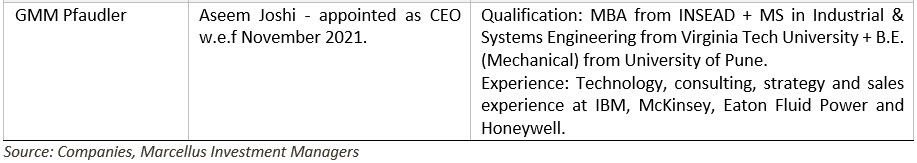

Quite impressively, Little Champs portfolio companies have in the recent years, appointed professionals as the Chief Executive Officers. In addition, in these firms, professionals are heading key functions like R&D, operations, sales, etc. In fact, most of these initiatives has been driven by the next generation leaders of the family. We illustrate some examples of Little Champs companies with professional CEOs in Exhibit 4.

- Employee ownership plans: An important tool employed increasingly by Little Champs portfolio companies in the recent years is to give the non-promoter professionals a share in the ownership of the Company. This is being achieved primarily through Employees Stock Options Plan (ESOP) or Employee Stock Appreciation Rights (ESAR)- both of which are effective tools to attract and retain scarce talent & give high potential employees an opportunity to participate in the upside in company’s value generated through their skills & efforts. As of today, nearly 50% of the Little Champs portfolio companies have an employee ownership plan in place as shown in Exhibit 5.

- Long term growth career prospects: It helps that Little Champs companies are market leaders within their niche sectors. Furthermore, these companies have been at the forefront of product & process innovations, operational excellence, etc which plays an important part in attracting talent. Our interactions with these companies’ management indicate that effective communication of the company’s long term growth strategy and thereby the employees’ career advancement and a culture of empowerment are as, if not more, effective as incentivisation.

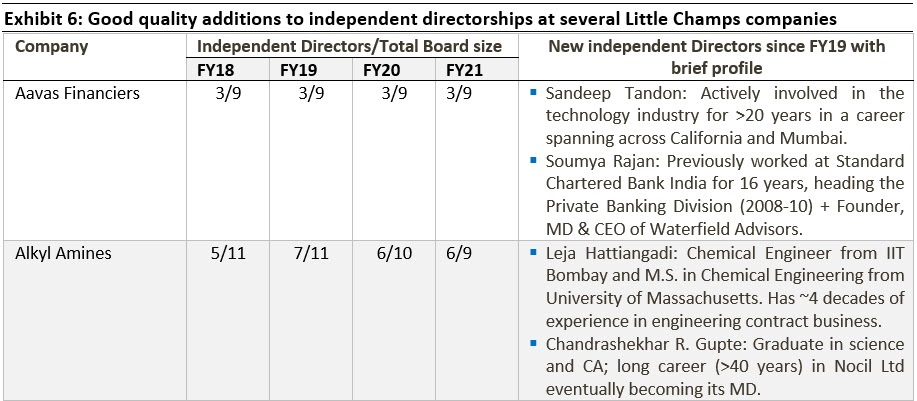

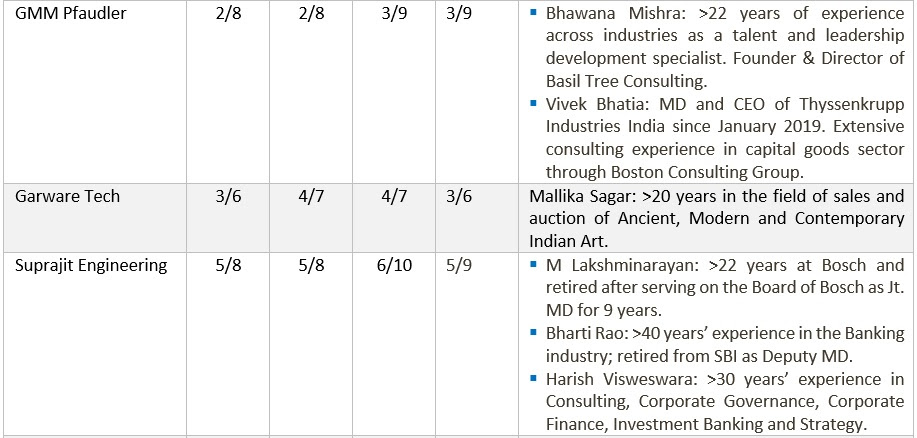

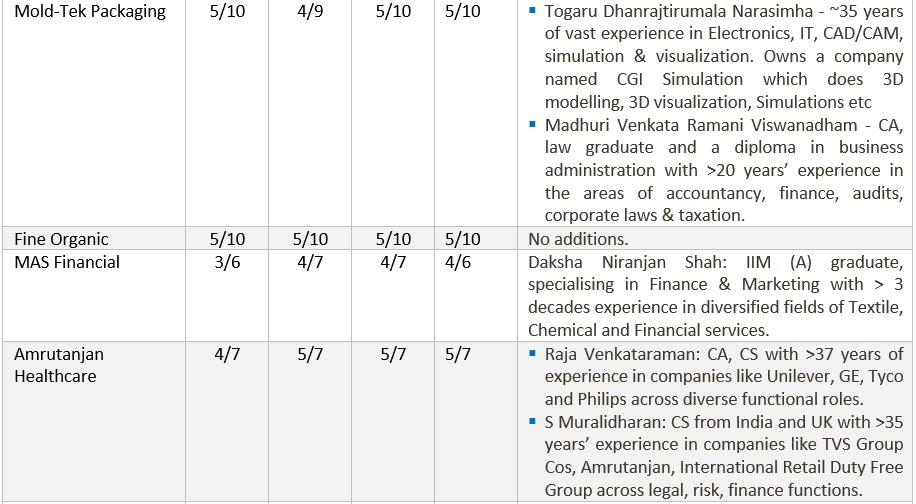

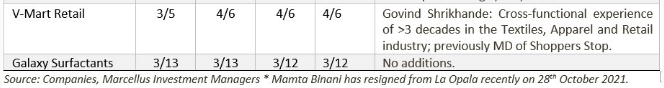

C. Significant improvement in the Independent Board quality in the recent years

Another positive development in the Little Champs portfolio companies is a significant improvement in the quality (relevance, diverse set of expertise, etc) of the independent Board Directors over the last 2-3 years. A high-quality Board plays an important role in positively influencing the key strategic including capital allocations decisions. It can in fact play a central role in guiding the succession planning exercise within the organisation.

|

|