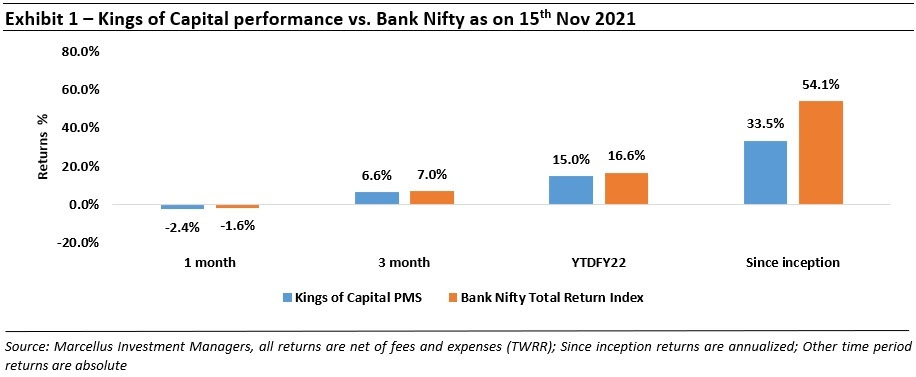

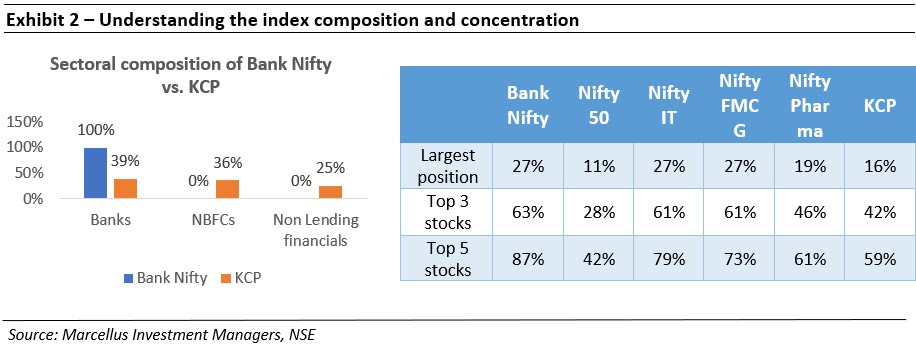

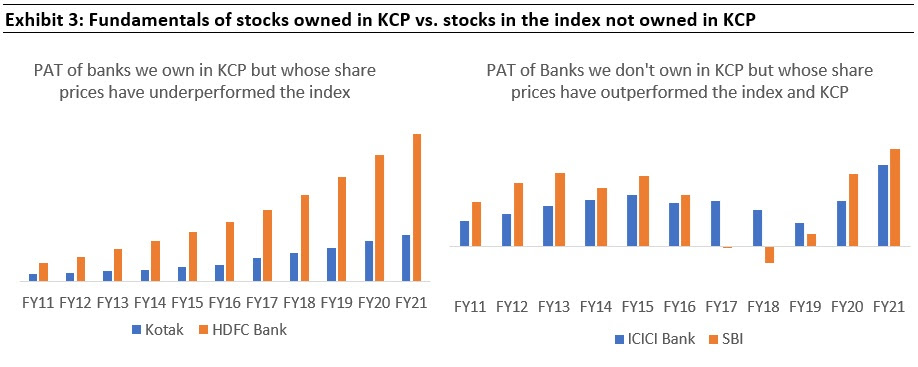

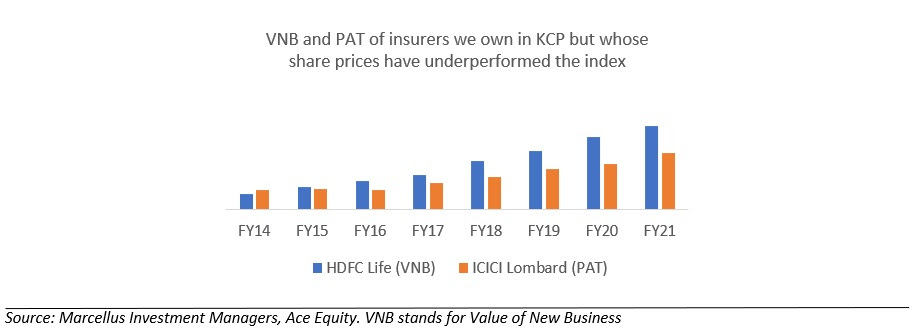

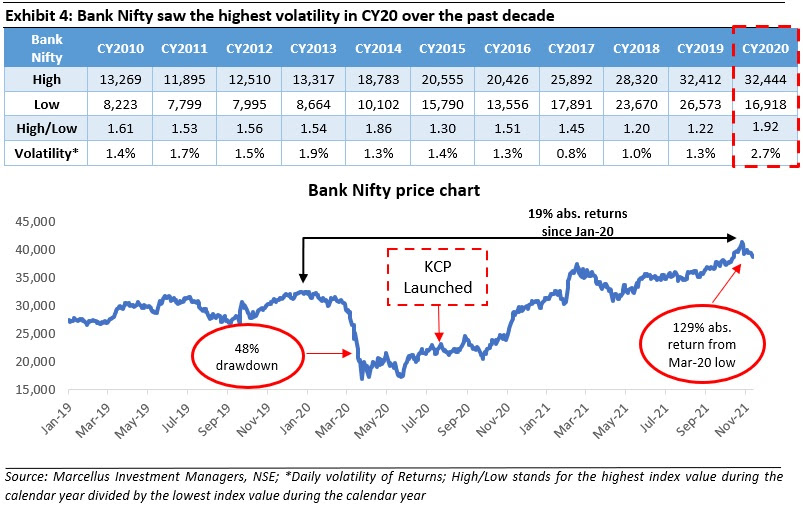

Since its inception about fifteen months ago, the Kings of Capital Portfolio (KCP) has delivered annualized returns of 34% vs. 54% for the Bank Nifty. The underperformance of the KCP portfolio is a factor of: (i) fund composition vs. that of the index – Bank Nifty consists of only banks vs. KCP has an allocation of only ~40% to banks; (ii) stock selection i.e. we have avoided turnaround stories; and (iii) the decade high volatility during the past year which saw a 48% drawdown for the Bank Nifty and then a recovery to the original highs all within a period of 12 months. In this newsletter we cover these three aspects and the fundamentals of the largest detractors of relative share price performance of the KCP portfolio (i.e. HDFC Bank, Kotak Bank, HDFC life and ICICI Lombard).

Performance update of the live fund

The key objective of our “Kings of Capital” strategy is to own a portfolio of 10 to 14 high quality financial companies (banks, NBFCs, life insurers, general insurers, asset managers, brokers) that have good corporate governance, prudent capital allocation skills and high barriers to entry. By owning these high-quality financial companies, we intend to benefit from the consolidation in the lending sector and the financialization of household savings over the next decade. The latest performance of our PMS is shown in the chart below.

|