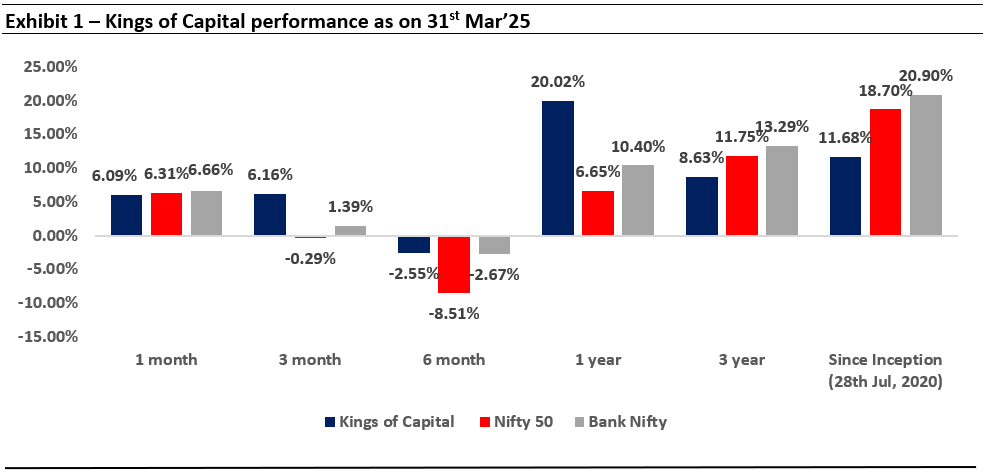

Over the last 3M/6M/1Yr/2Yrs KCP has been able to consistently outperform both Nifty and Bank Nifty. Whilst our investment approach remains long term, we believe it is prudent to analyze the drivers of this outperformance. As we look back at the performance of KCP, note that the period from ‘Nov’21-Mar-23’ was a major drag on portfolio performance as we underperformed Bank Nifty. The good news is that we have been able to recoup majority of lost ground in the past 24 months WITHOUT veering away from our philosophy of investing in clean, well run financial services companies. Prudent investing (not chasing momentum) and contrarian thinking (timely exits from small-midcaps and capital market stocks) has supported portfolio performance, whilst patience during adversity has turned out to be crucial. Simultaneously, we have broadened our universe of investable names to consciously incorporate businesses which have less correlated risk profiles vis-à-vis lenders. We remain comfortable with portfolio valuations in context of the earnings growth and believe KCP, a 100% domestic economy focused portfolio, is well positioned in an uncertain world.

Performance update of the live fund

Note: Performance Data shown is net of fixed fees and expenses charged till 31st March 2025 and is net of Performance fees charged for client accounts, whose account anniversary / performance calculation date falls up to the last date of this performance period; since inception & 3 years returns are annualized; other time period returns are absolute. The calculation or presentation of performance results in this publication has NOT been approved or reviewed by the SEC, SEBI or any other regulatory authority.

NIFTY50 TRI is the benchmark index for the investment approach as per the Disclosure Document. Nifty Bank TRI is not the benchmark for the approach and has been provided for reference purposes as the approach invests in banks and financial services sector.

*For the relative performance of particular investment Approach to other Portfolio Managers within the selected strategy, please refer. Under PMS Provider Name please select Marcellus Investment Managers Private Limited and select your Investment Approach Name for APMI (apmiindia.org) the stated disclosure.

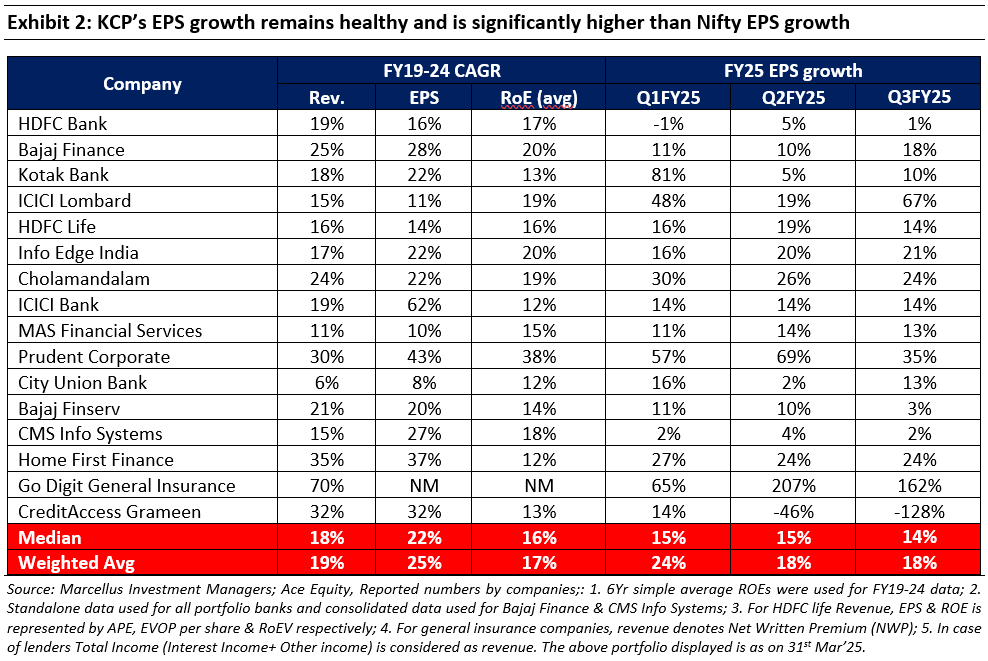

The Portfolio continues to deliver robust fundamentals and trades at reasonable valuations

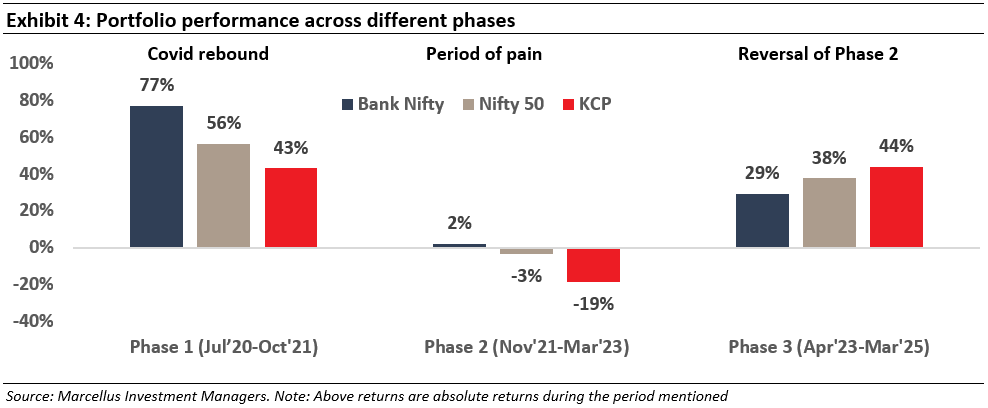

In this letter, we share our assessment of our performance since we launched this PMS strategy in July 2020. As we look back at the performance of KCP, we break down the performance into 3 time periods.

Period 1 (Jul’20 – Oct’21) was the time when country was coming out of Covid. Valuations were cheap across the board and high quality lenders were available at lowest ever valuations. At this point investing in financials looked extremely favourable especially given that the risk of mortality was lower for well managed private financials with adequate capital. While we underperformed on a relative basis, we delivered very healthy absolute returns which were more than adequate for the risks we had taken.

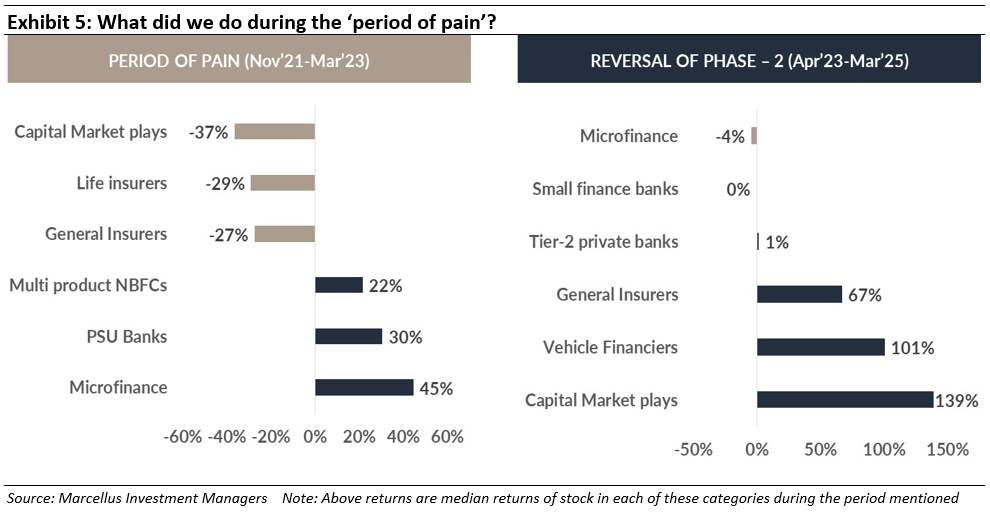

Period 2 (Nov’21 – Mar’23) was painful as this period saw KCP underperforming Bank Nifty by 21%. This period saw continuation of the post-Covid recovery with PSU banks and microfinance companies delivering the best performance. Outperformance of PSUs was led by improving balance sheets, moderating credit costs and healthy growth (partly led by deployment of excess liquidity). Strong non-core income (i.e. treasury gains and recovery from the w/off pool) also aided profitability during this period. Additionally, the valuations of PSUs were palatable between 0.5-1.0x P/BV. Meanwhile, well run banks like Kotak and HDFC despite delivering healthy fundamental performance faced de-rating as investors questioned paying a valuation premium when fundamental performance was similar to PSUs. This period also saw central banks across the world raise interest rates and substantial FPI outflows in India.

Choices we had at the end of a tough Phase 2: Buy the fad or stay true to philosophy?

Period 3 (Apr’23 – Mar’25): At the start of this period, we had a tough choice to make. Either we buy into stocks that were doing well then – MFIs, tier-2 banks and PSU Banks- thus buying into the narrative that since India’s lending market has become all retail and data oriented, underwriting ability is the same for all banks and smaller banks will gain market share on back of their ability to overpay for deposits and microfinance sector will see strong asset quality as weak borrowers have been weeded out in covid.

OR, we had the option to double down on our existing holdings, expand coverage in areas we well understand (like capital market stocks) and stay patient. We choose to do the latter and fortunately markets rewarded us handsomely with KCP delivering 15% outperformance vs. Bank Nifty over Apr ’23 – Mar ‘25.

Rational Behaviour, Contrarian Thinking and Patience

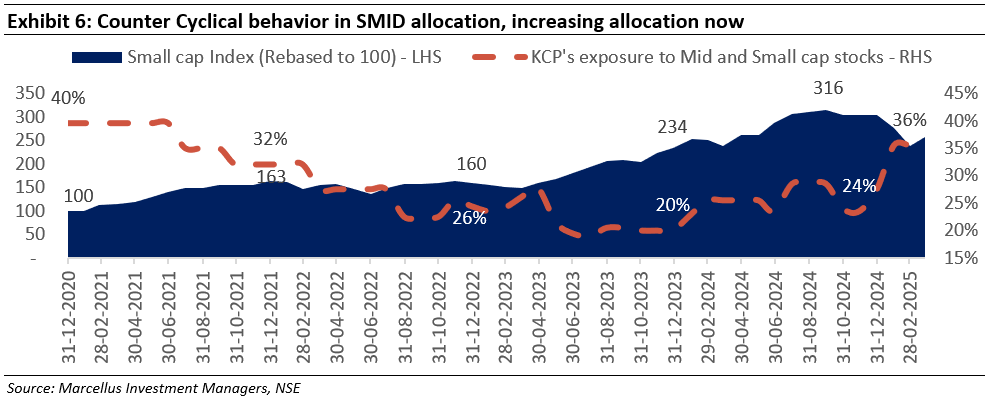

Whilst staying true to our style and choice of companies paid off, we maintained portfolio discipline, avoided chasing themes and going down the market cap just to chase returns. Through the last 12 months, whilst we continued to add stocks to our coverage universe, we added only a few stocks in the portfolio as valuations for most stocks looked stretched. The chart below explains how during the run up in mid and small cap stocks, we purposefully kept reducing our exposure – down from peak of 40% to 24%, only to increase it after a significant correction in select mid and small caps in the autumn of 2024.

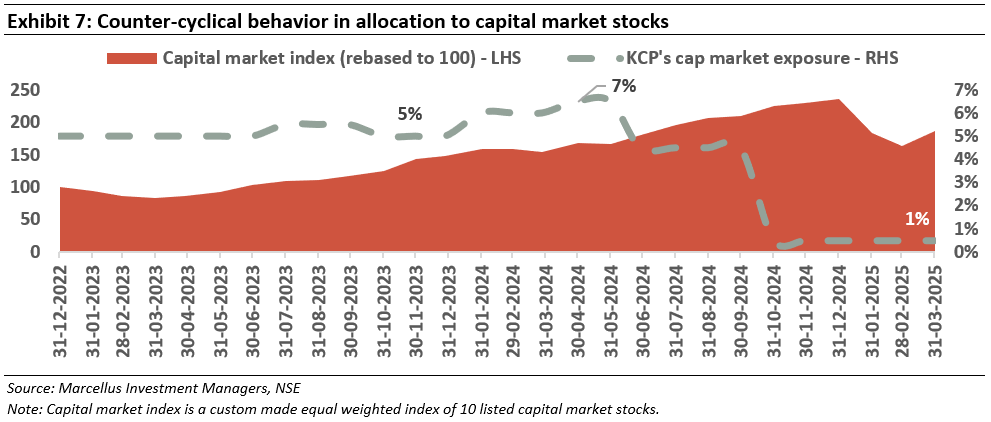

Similarly, whilst we benefited from owning capital markets stocks, by Sep-Oct’24 valuations for all capital market stocks were looking extremely stretched. Most quality capital market stocks were trading at 40-50x P/E (~2x valuations they were trading a year ago) for businesses which inherently are cyclical given the nature of capital markets. Despite the strong price momentum in these names, we decided to trim our capital market exposure, and this again has helped us as most stocks declined materially post our selling. Whilst it may be too soon to celebrate this call, we continue to watch-out for opportunities in this space, provided valuations turn more palatable.

Financial services – an interplay of many sub-segments which have different cycles

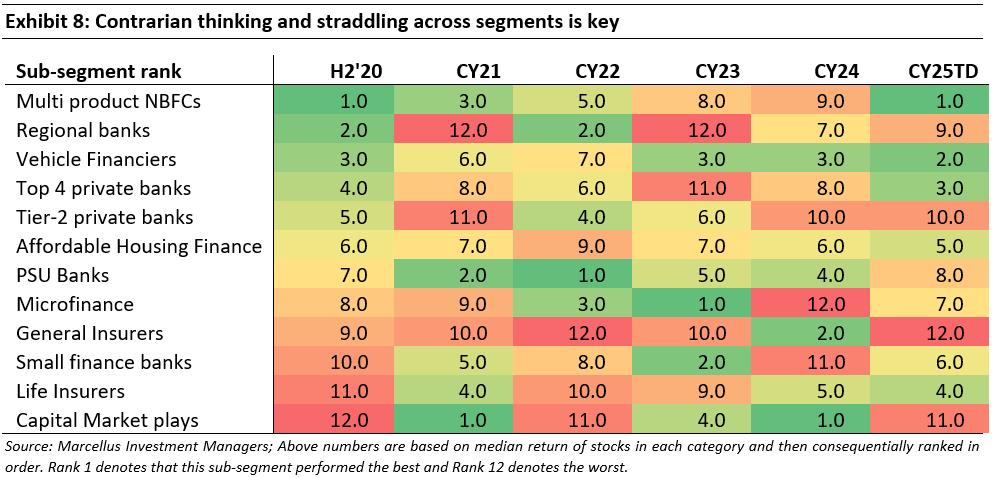

A critical insight gained over time is the strategic advantage of diversifying across sub-segments within the financial services sector. This approach introduces a dynamic character to the portfolio while mitigating overall risk. The sector’s evolving complexity has resulted in a decoupling of risk profiles among its various sub-sectors.

One extreme example from the below table is capital market plays – from being the worst performing subsector in CY22 (denoted by rank 11 – refer table below), it went onto perform the best over the next couple of years. Similarly, microfinance sector was amongst the worst performing sector in H2’20/21 only to outperform massively in CY22/23. Identifying well-managed companies within each of these distinct sub-segments is likely to offer us more opportunities to benefit from as each sub-segments go through their own highs and lows on business performance and/or valuations.

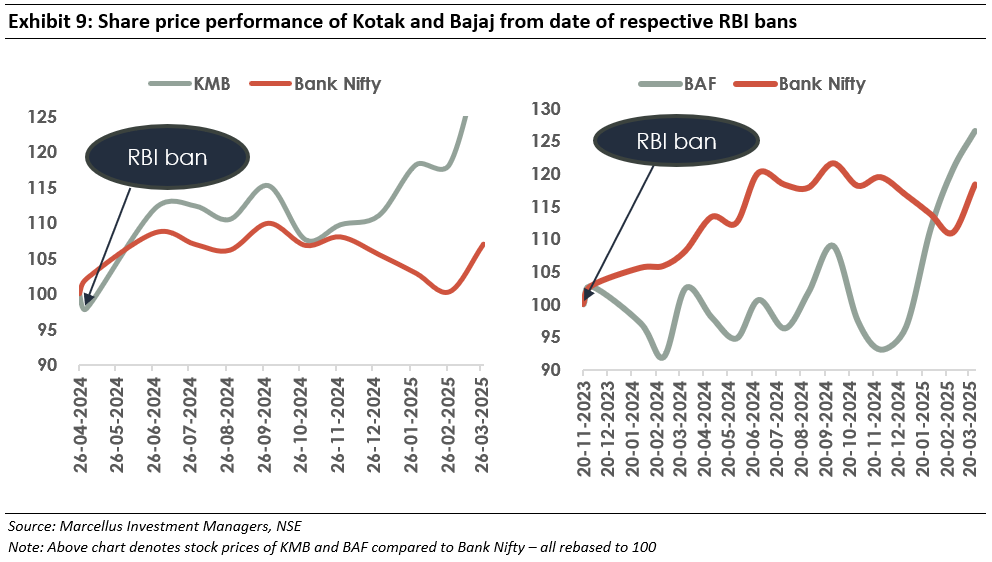

Ultimately, patience — a virtue universally acknowledged but selectively practiced during adversity—proved crucial. KCP’s resilience was rigorously tested when certain portfolio companies encountered regulatory challenges.

· Specifically, Bajaj Finance (BAF) faced a product-level ban on two key offerings, and

· Kotak Mahindra Bank (KMB) was restricted from sourcing credit cards and onboarding new online customers by the RBI.

In both instances, stock prices experienced substantial declines upon the announcements. While these bans impacted earnings, our analysis indicated that the market’s reaction significantly exceeded the projected EPS reductions.

Maintaining our conviction in the inherent strength of these franchises, we remained steadfast. With the benefit of hindsight, this decision has been validated, as both KMB and BAF have demonstrably outperformed the Bank Nifty since the imposition of the respective bans.

Where do we go from here?

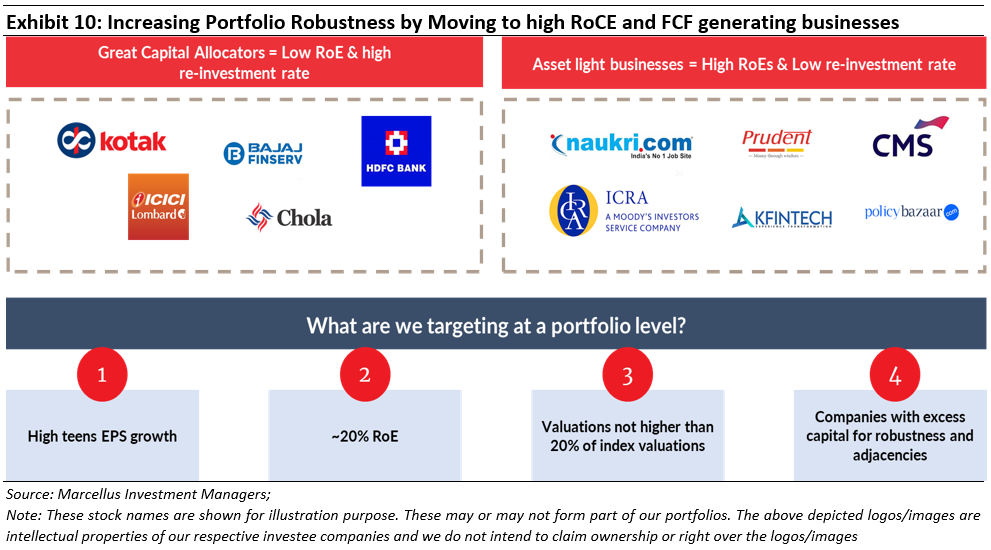

The Indian BFSI sector is undergoing rapid expansion, transcending traditional lending models. While the Bank Nifty index is heavily weighted towards banking institutions, we recognize and appreciate the significant potential of diverse non-lending business models.

Consequently, over the past 12 to 18 months, KCP has broadened its investment focus within the financial sector, incorporating numerous asset-light enterprises. These businesses typically hold leadership positions in their respective segments, operating within favorable industry structures. For instance, consider platforms such as

· Naukri, a dominant job listing portal with a majority share of online job listings

· Policybazaar, which commands a 93% market share in online insurance sales

· Additionally, we have identified duopolies, such as Kfintech, and CAMS, which together manage majority of Registrar and Transfer Agent (RTA) services for mutual funds.

· CMS, a leader in cash management services with ~50% market share in ATMs, and

· ICRA, one of the three major credit rating agencies holding a combined 75% market share.

The strategic combination of lending institutions, characterized by lower Return on Equity (RoE) but high reinvestment rates, and oligopolistic non-lending businesses, exhibiting higher RoE and lower reinvestment rates, is designed to optimize the portfolio’s performance across our four key metrics.

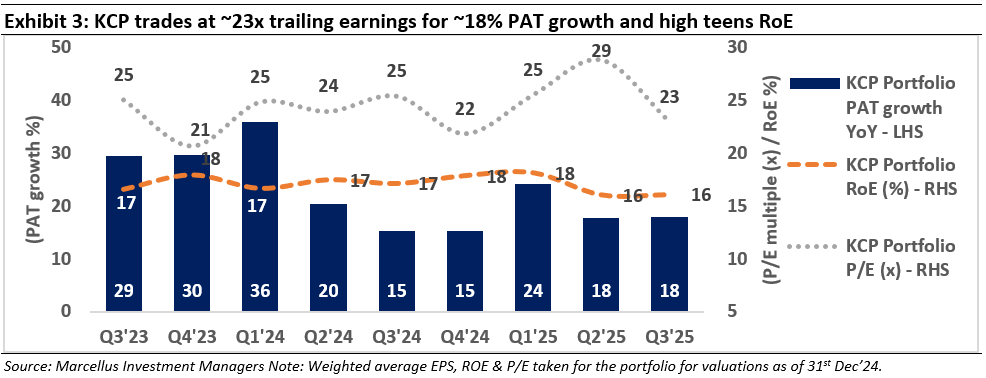

Path ahead and valuation check

Our valuation philosophy is largely relative to the market. It is well understood that the Nifty index, over the long term, delivers ~10% earnings growth and a 12% RoE. Despite superior fundamental (earnings and RoE) performance of KCP, we are committed to maintain valuation discipline, ensuring that our portfolio’s valuation premium over Nifty does not exceed by 20%. This approach is essential for preserving a consistent margin of safety within our portfolio. Given than index trades at 18-20x EPS, we would be comfortable with KCP trading at 22-25x EPS.

As of now, KCP’s valuations are within our tolerance band, hence, we remain comfortable. Additionally, since most of the portfolio companies continues to deliver healthy earnings growth, the portfolio is comfortably placed in the current scenario where growth is scarce in the market.

In an external world which has turned volatile with the outlook cloudy given the tariff-war, we believe financials are well placed as they are 100% domestically focused. Meanwhile, a policy pivot by the regulator focused on cutting interest rates, maintaining adequate liquidity and relatively easier on regulations bodes well for financial services companies

Regards,

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/blog/