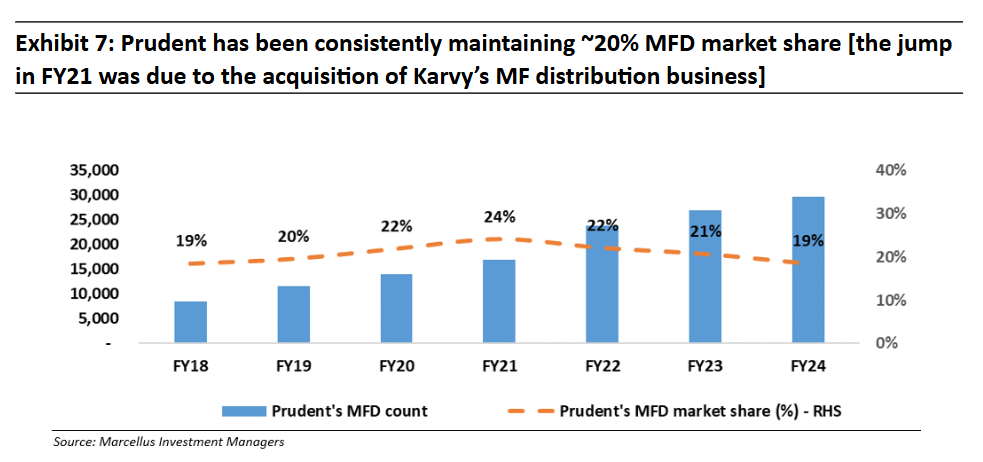

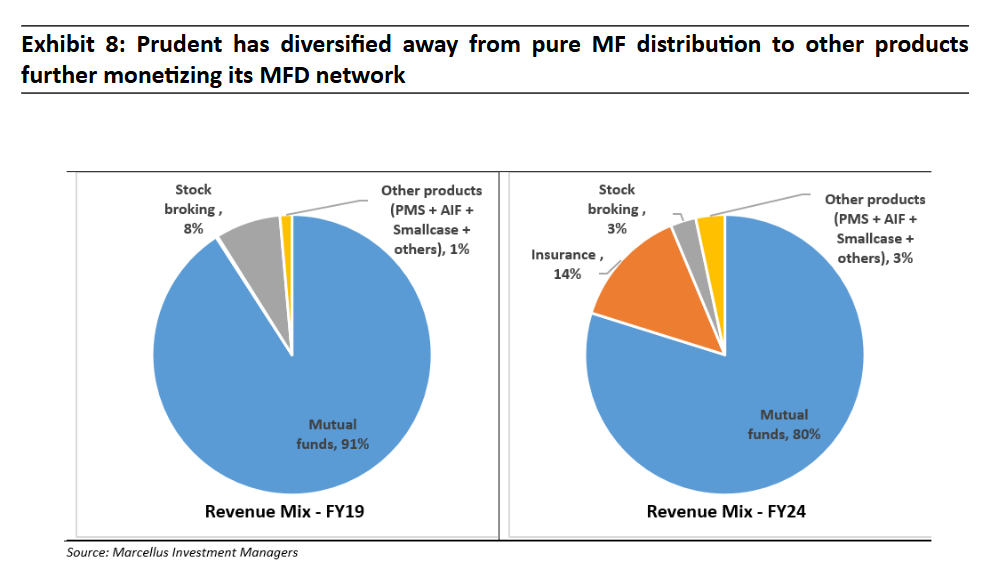

Prudent Corporate, India’s third-largest mutual fund distributor, has grown revenues and EPS by 29% and 46% respectively over FY19-24. During this period, Prudent has risen from being the 7th largest distributor to being the 3rd largest in FY24, surpassing giants such as HDFC Bank and ICICI Bank in terms of mutual fund commissions earned. Prudent’s success can be largely attributed to its strong execution capability of building a network of ~30k mutual fund distributors (MFDs) which account for ~20% of India’s total MFDs and provide it access to 1.7Mn investors. Over the years, Prudent has been able to further monetize this MFD network by expanding into life insurance, health insurance and alternatives (AIF, PMS) distribution. As this network matures, Prudent is expected to gain even greater access to Indian households’ financial savings, enhancing its leverage with asset management companies (AMCs) and insurers. Further, Prudent’s track record of doing acquisitions at reasonable valuations will prove to be useful as it generates free cash flow of ~Rs. 200Cr annually which can be deployed in a downturn. In this newsletter, we discuss how Prudent Corporate is well positioned for capitalizing on the rising SIP culture. Our Kings of Capital Portfolio invested in Prudent Corporate in Nov, 2022 and continues to be invested in the business.

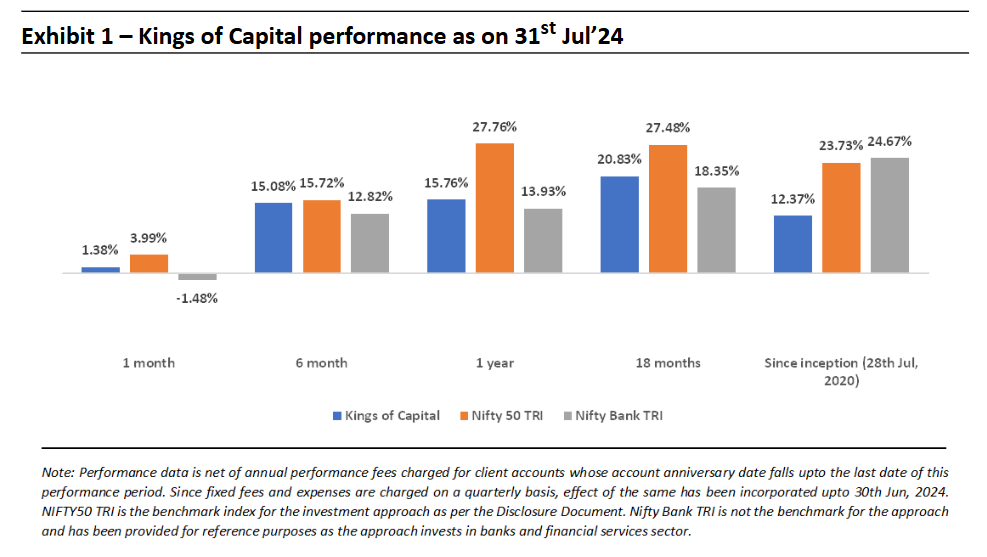

Performance update of the live fund

*For relative performance of particular Investment Approach to other Portfolio Managers within the selected strategy, please refer https://www.apmiindia.org/apmi/welcomeiaperformance.htm?action=PMSmenu Under PMS Provider Name please select Marcellus Investment Managers Private Limited and select your Investment Approach Name for viewing the stated disclosure

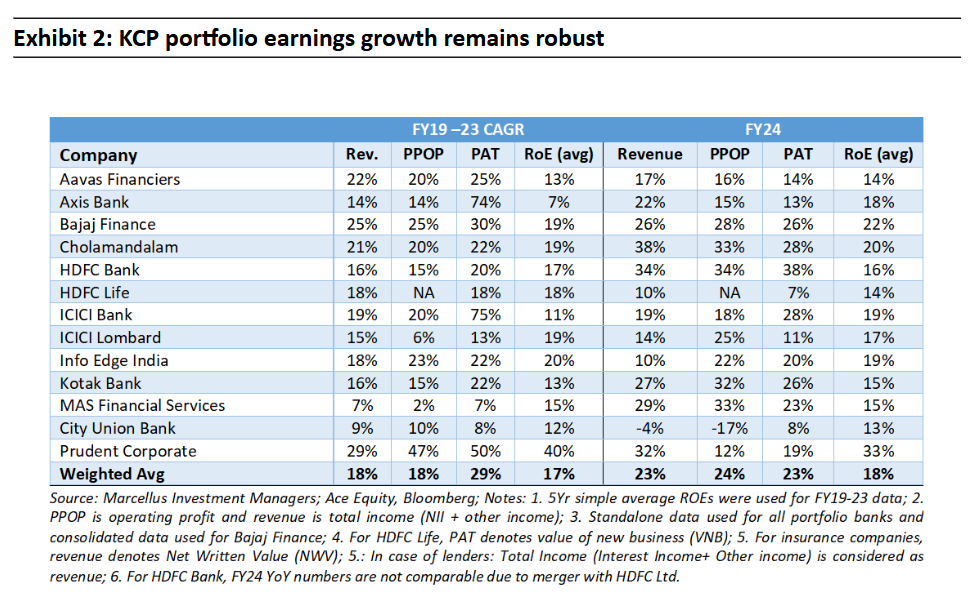

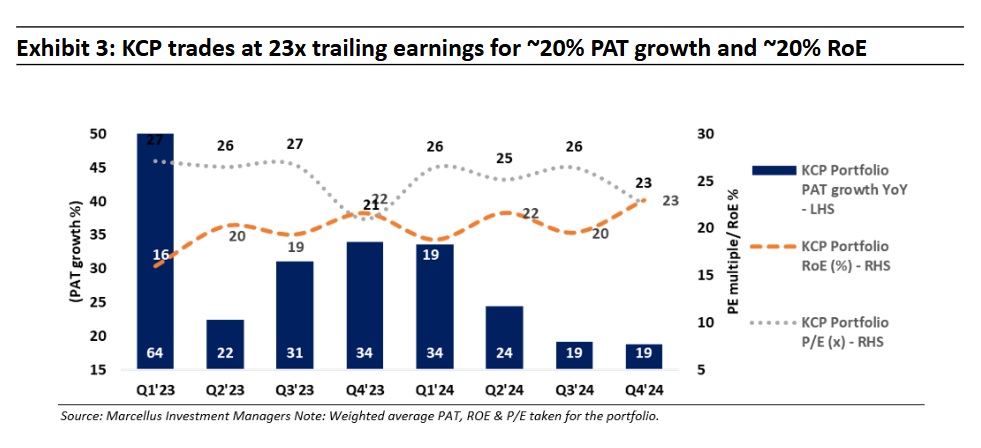

Portfolio continues to deliver robust fundamentals and trades at reasonable valuations

Understanding Prudent’s business model:

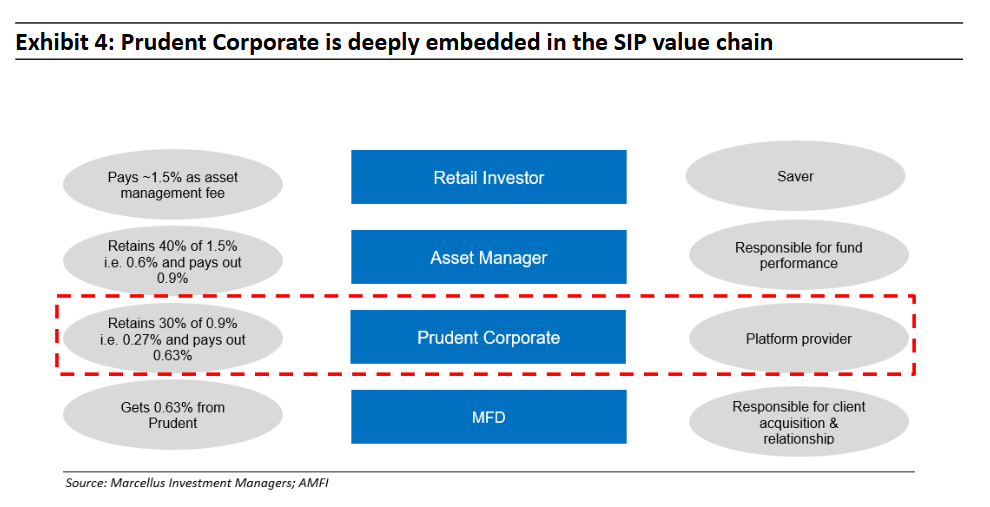

Prudent Corporate is a B2B2C business and can be viewed as a one stop shop for mutual fund distributors as well as asset management companies (AMCs). Prudent Corporate offers a win-win proposition to AMCs as well as MFDs:

- AMCs: AMCs are reluctant in adding physical infrastructure and fixed costs in smaller cities and hence the external distribution channel remains the primary channel for AMCs to reach out to the common Indian. Prudent provides a plug and play access to over thirty thousand MFDs for established AMCs as well as new entrants who want to enter the asset management space. Prudent resultantly remains a profit centre for asset managers and therefore unlike an infrastructure/ utility player has much better bargaining power.

- Mutual fund distributors: A mutual fund distributor gets a plug and play solution with access to products of 40+ AMCs and access to Prudent’s technology platform, Fundbazaar. From the perspective of MFDs, rather than negotiating commercials with giant fund houses directly, they get a plug and play solution in the form of Prudent. Prudent’s technology platform also helps MFDs and their clients complete various administrative tasks for all financial products on a single platform.

Prudent Corporate is the tollbooth capitalising on the rising SIP culture in India:

India’s soaring Systematic Investment Plan (SIP) flows exemplify the transformative impact of democratizing savings products. By making investment options more accessible, convenient, and cost-effective, a financial revolution has taken root in the country.

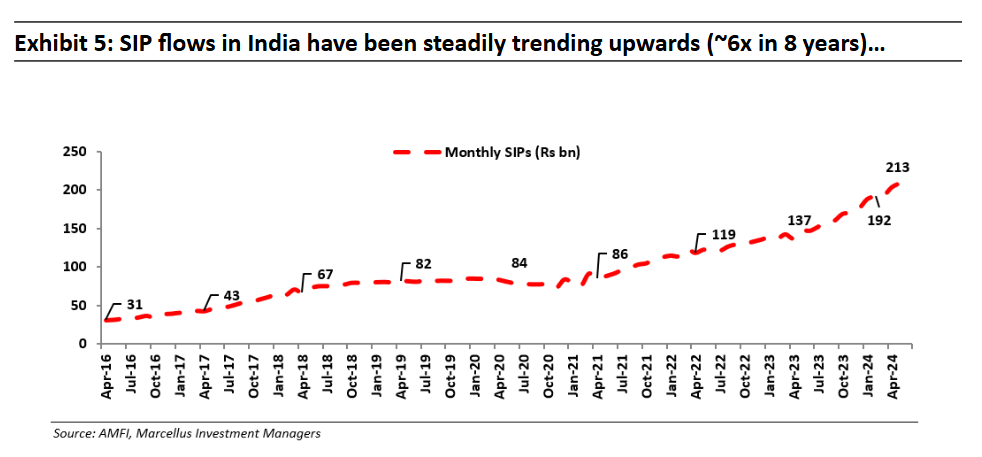

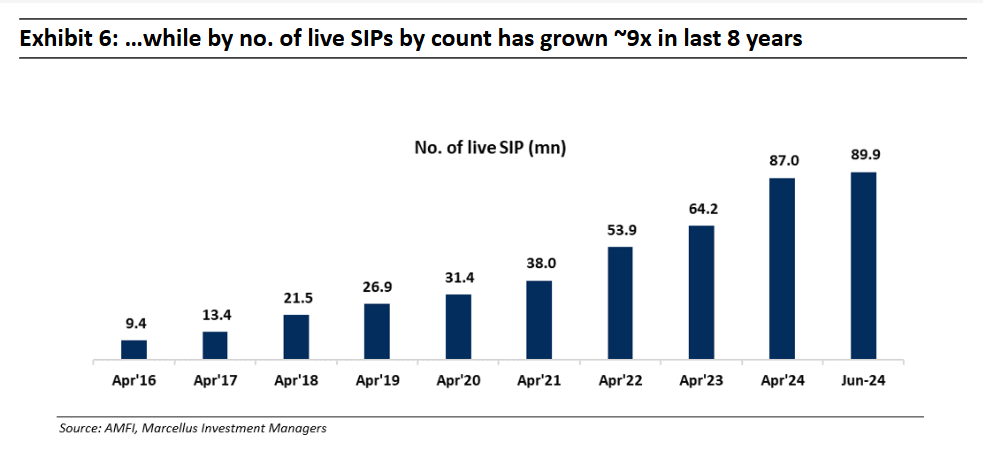

As illustrated in the exhibits below, India’s monthly SIP inflows have surged ~6x by value and ~9x by count over the past eight years. The fact that the average ticket size of SIPs is only Rs. 2,400 and average ticket size hasn’t surged over the past five years illustrates the wide accessibility and adoption of the product by middle class India. The low-ticket size also implies this category of investors requires MFDs and not wealth managers for hand holding.

Prudent has laid the foundation for profitable growth:

Strong network of MFDs: Prudent Corporate has a network of 30 thousand mutual fund distributors and accounts for ~20% of MFDs being added to the industry every year.

Leveraging MFD network to distribute other financial products: Prudent Corporate has already created the network and the infrastructure which allows MFDs to sell multiple products from the same platform. This not only builds stickiness of the platform amongst MFDs, it also allows Prudent to diversify away from just 1 product/asset class. Over the past five years Prudent has added insurance and alternatives to its product suite.

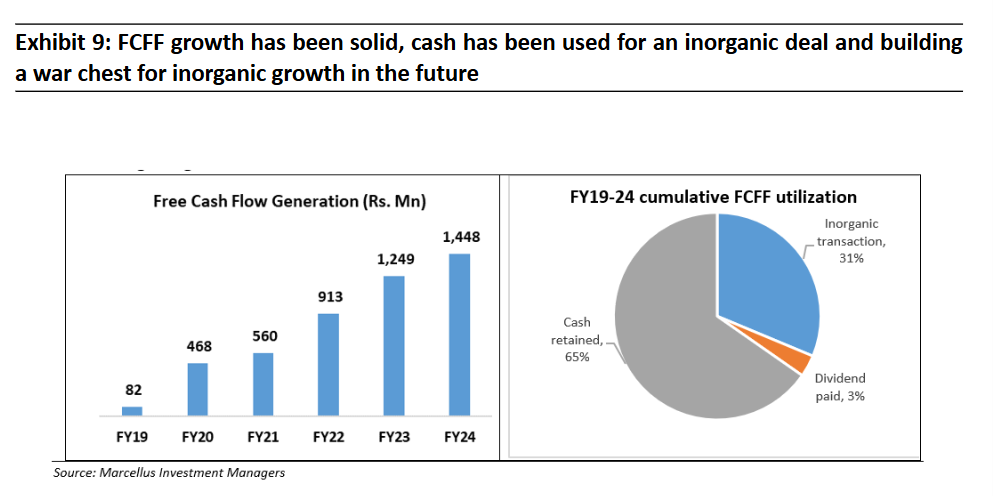

Optionality of using free cashflow for inorganic growth: Given the asset light business model, Prudent become a free cashflow machine and has built a war chest for inorganic growth during a downturn in equity markets. Given how Prudent acquired Karvy’s mutual fund distribution business in FY21 at distressed valuations, we have faith that Prudent’s management will continue to show discipline in capital allocation.

Prudent Corporate is one of those rare businesses which enjoy high incremental returns to scale:

For most businesses, size becomes an anchor to growth rather than an enabler of growth as it becomes impossible to maintain the same growth rate on a larger and larger base. However, we illustrate in Exhibits 10 to 12 below how size works in Prudent’s favour and helps it improve business economics as the business grows larger. Usually as a company scales and matures, growth will begin to slow down, both, due to internal bureaucracy kicking-in and younger competitors being attracted by the fat profit margins. In contrast, Prudent’s scaled economics shared turns size, which is normally an anchor to growth and returns, into an asset.

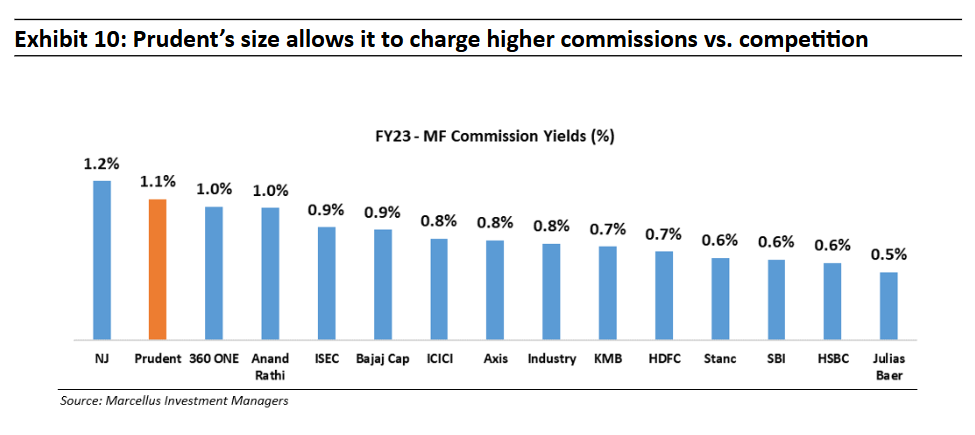

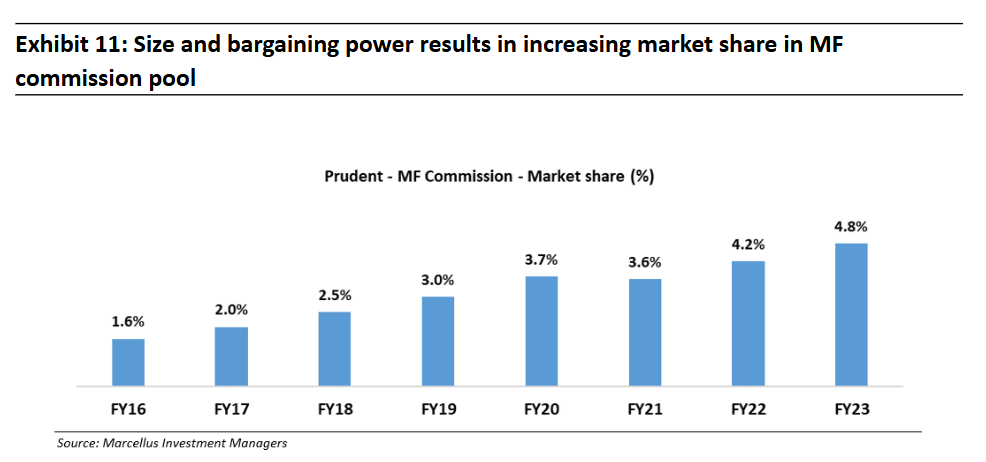

Larger the distribution network, higher the bargaining power vs AMCs:

Prudent’s large plug and play distribution network helps it bargain better with manufacturers of financial products i.e. asset management companies and insurers. This high correlation between size of distribution network and commission rates is visible in Exhibit 10 and 11 below.

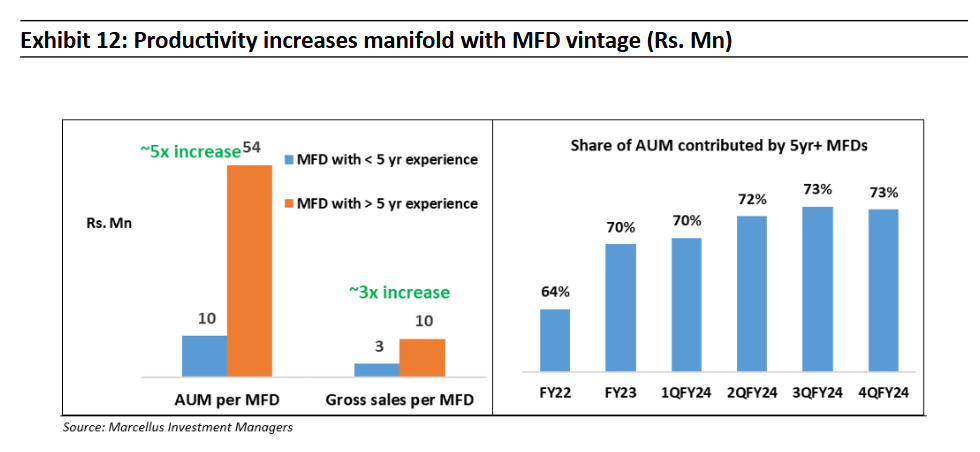

High stickiness and productivity of MFDs result in exponential returns to scale:

Prudent’s employees and MFDs see minimal churn because they earn a recurring commission income which keeps growing at the rate of equity markets i.e. 10-12% without any incremental effort. As a MFD’s vintage increases, their network of clients also increases by way of referrals and therefore flows also increase in addition to the increase in AUM due to mark to market gains.

The above factors have resulted in Prudent delivering industry leading financial metrics:

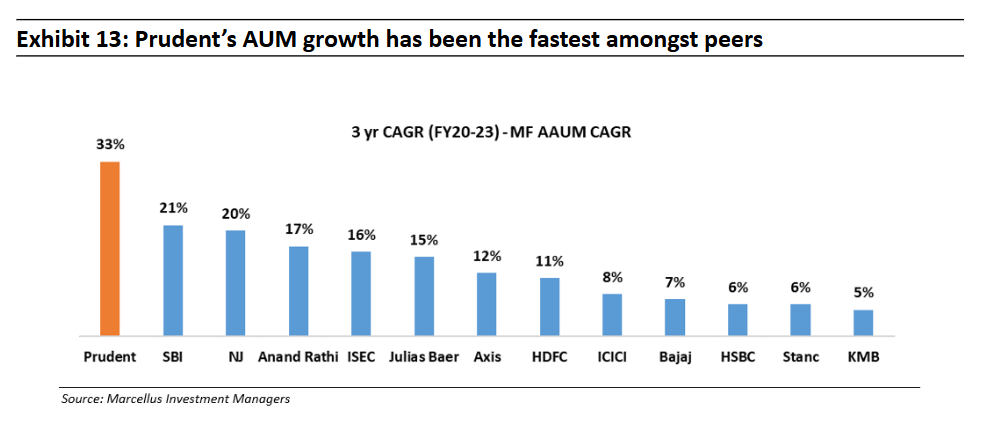

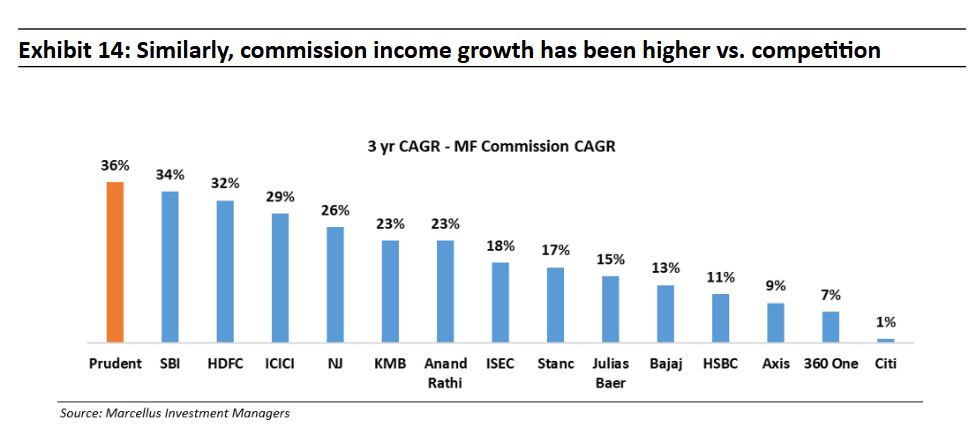

Prudent has seen the highest MF AUM growth and MF commission growth: A combination of superior execution, focus on building a large MFD network and deploying capital for the Karvy acquisition has resulted in Prudent’s AUM as well as commission growing at the fastest rate in the industry.

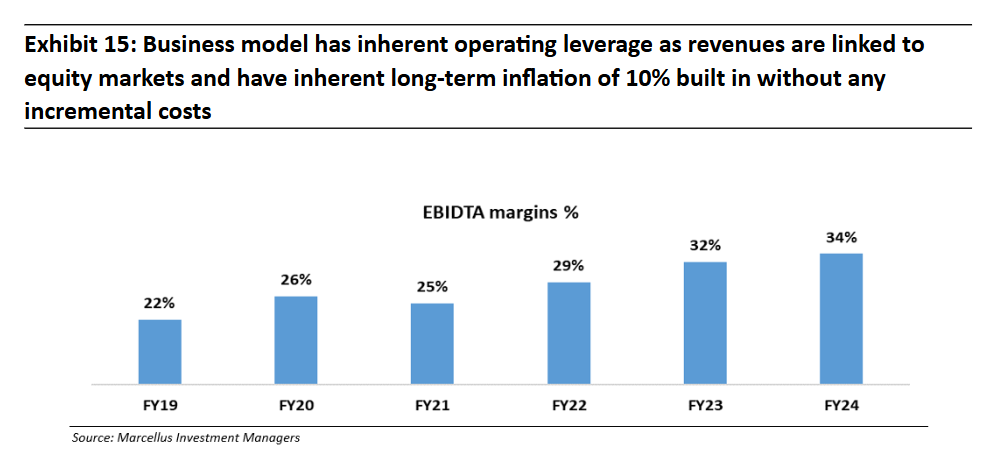

Lock in of yields and visibility of flows provides operating leverage: The yields that Prudent earns on flows are locked in until the AUM is retained by Prudent and can’t be changed retrospectively. This along with the sticky SIP book leads to high visibility of flows and revenues for Prudent.

Simple mental model to understand Prudent’s growth profile:

10% AUM growth from underlying mark to market gains of equities + 10% of AUM as net inflows in the form of SIPs => 20% AUM growth minus yield compression => 17-18% revenue growth + operating leverage + optionality of inorganic growth/ other non-MF products => ~20% EPS and free cashflow growth

Key Risks:

a. Risk of direct platforms gaining traction:

As investor awareness rises, the risk of MFDs getting disintermediated increases. Various online platforms which offer direct MF investing options have gained share in SIP flows over the last few years. As the trend of direct MF investing rises, Prudent might face growth challenges.

b. The rise of passives:

As index funds/ ETFs gain traction, the risk of active funds seeing outflows and compression in MF yields can lead to challenges for Prudent’s business model.

c. Inherent cyclicality due to underlying equity markets:

Prudent’s revenues and earnings will be cyclical because its business model is closely linked to equity markets. Both drivers of Prudent’s growth – mark to market gains and flows are closely linked to equity market performance.

Changes to the KCP portfolio:

We exited from Motilal Oswal Financial Services:

We exited from Motilal Oswal in June as we had entered the stock at ~12x FY25e operating PAT with a view that industry tailwinds should offer healthy earnings growth whilst a rebound in their AMC’s fund performance could help bridge the gap on valuations relative to its peers. Since our initial purchase, the stock had re-rated meaningfully in a short period of time. Given the relatively more attractive valuations available in other names within the portfolio, we exited from the stock during the month.

Regards,

Team Marcellus

If you would like to read our other published materials, please visit https://marcellus.in/insights