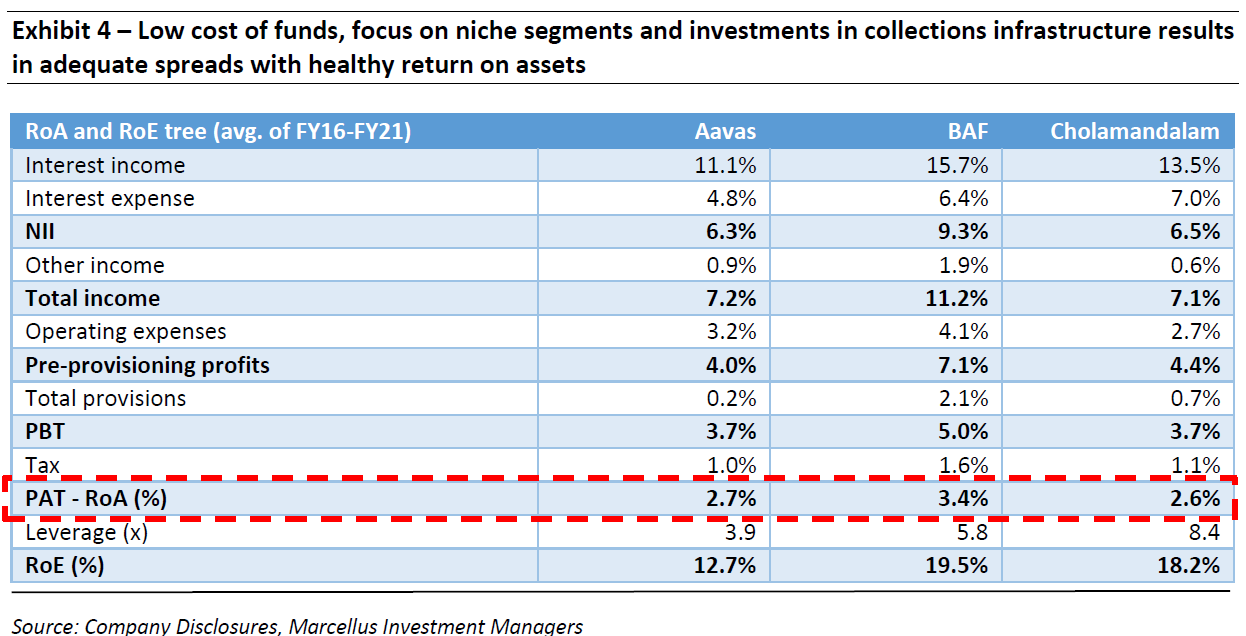

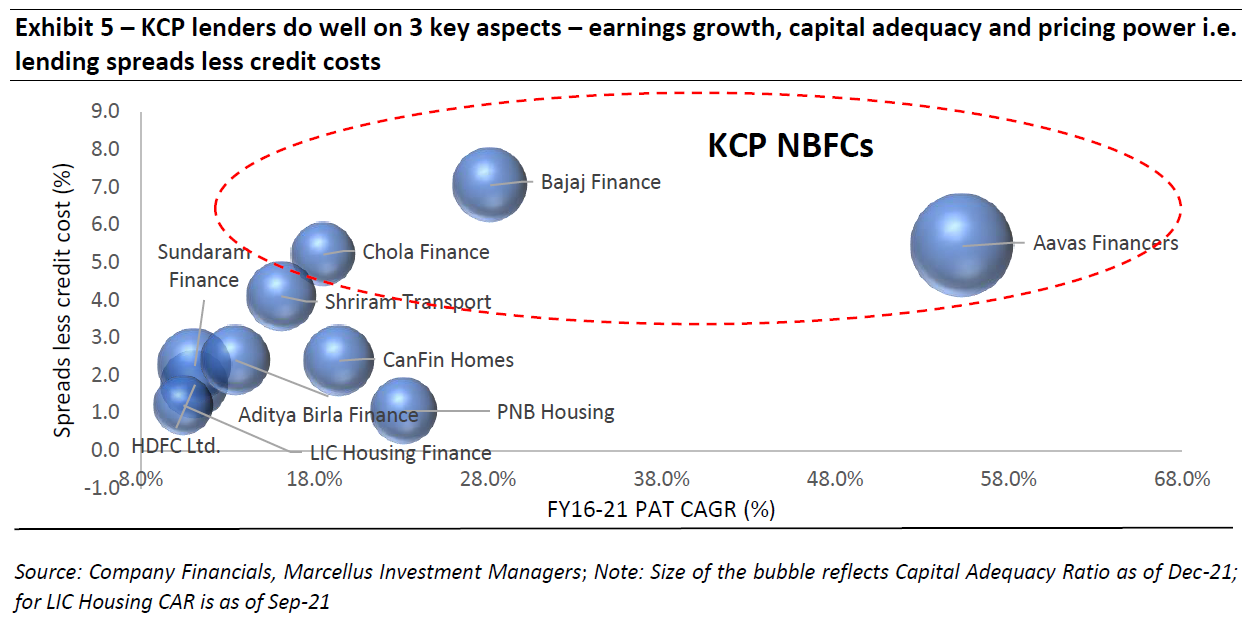

While the ILFS crisis highlighted the risks associated with India’s shadow lenders, there are a few NBFCs which have not only been able to effectively compete against banks but have also been able to generate superior ROE and earnings growth. The three NBFCs in the Kings of Capital portfolio – Bajaj Finance, Aavas Financiers and Cholamandalam Investment – have been able to grow earnings at 20%+ over the past five years by: (i) building expertise in niche segments where it is difficult for banks to compete; (ii) raising capital at competitive rates due to their parentage & track record; and (iii) focusing on niche retail and SME segments where they enjoy pricing power. These three qualities have resulted in the KCP lenders having lower credit costs than most other lenders despite earning higher interest margins.

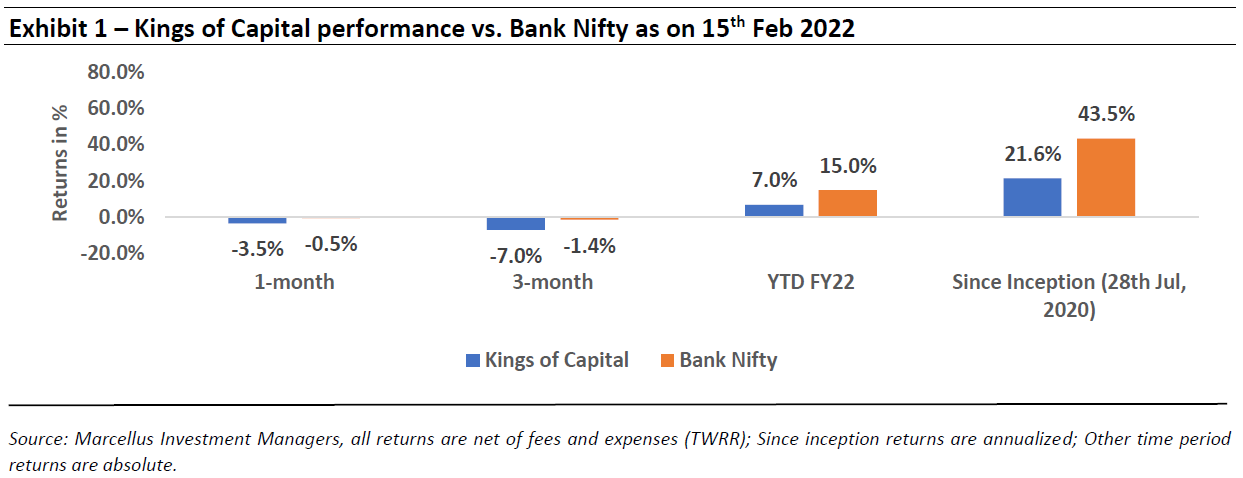

Performance update of the live fund

The key objective of our “Kings of Capital” strategy is to own a portfolio of 10 to 14 high quality financial companies (banks, NBFCs, life insurers, general insurers, asset managers, brokers) that have good corporate governance, prudent capital allocation skills and high barriers to entry. By owning these high-quality financial companies, we intend to benefit from the consolidation in the lending sector and the financialization of household savings over the next decade. The latest performance of our PMS is shown in the chart below.

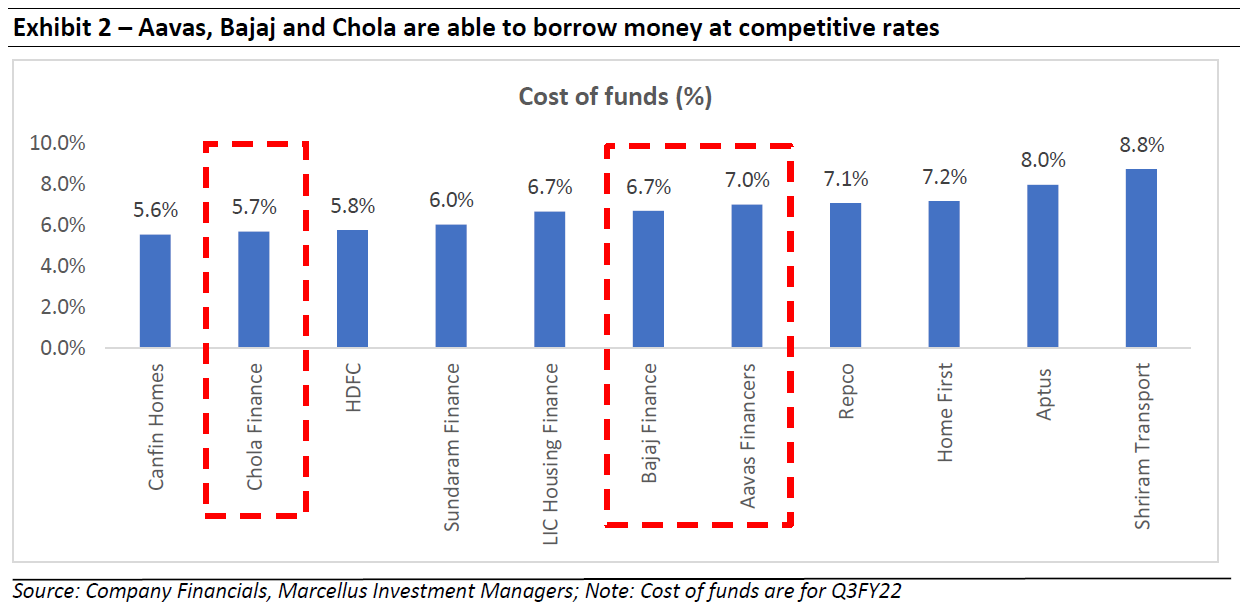

The ability of KCP NBFCs to borrow at competitive rates

The ability to borrow funds at attractive rates is one of the biggest advantages in a lending business as lenders with higher cost of funds are forced to lend to riskier borrowers. Lower cost of funds not only allows lenders to earn higher margins, but it also allows lenders to pick and choose segments/products/geographies they want to lend to. Below are the key reasons why KCP NBFCs are able to borrow money at competitive rates:

- Aavas Financiers:

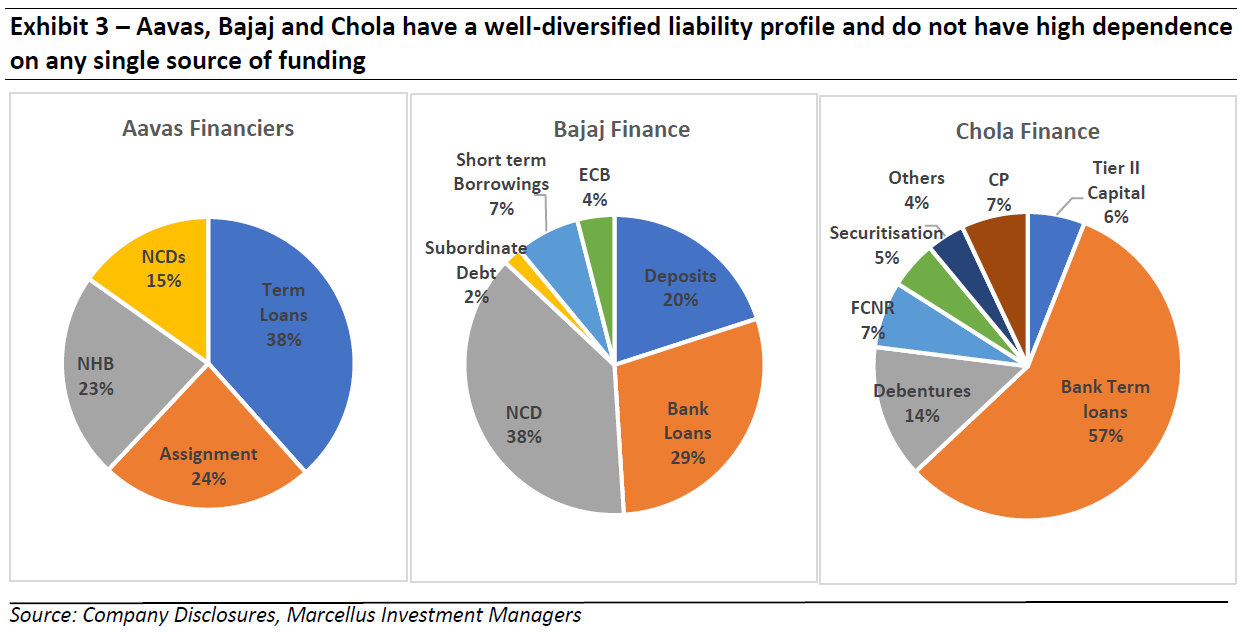

Aavas’ cost of funds (7%) is superior to its comparable affordable housing finance peers by a margin of 20-100 bps owing to its long track record of stable asset quality, better product mix (high share of housing loans) and strong capital adequacy. Unlike many housing financiers which have in the past raised money through commercial papers and used it to give long term loans, Aavas’ conservative philosophy of not raising any money through CPs provides further comfort to its lenders. Given the nature of Aavas’ loan book, it is classified as priority sector lending (PSL) for banks. There is high demand from banks for a good quality PSL book and this enables Aavas to enter into “assignment transactions” wherein Aavas downsells its loans to the banks and de-risks its balance sheet. Aavas’ affordable housing loan book has also garnered interest from Development Financial Institutions enabling Aavas to raise over Rs. 500 crores of long-term liabilities from the likes of IFC and the Asian Development Bank. Further, Aavas’s long term credit rating was upgraded to AA- by ICRA with a positive outlook in Dec, 2021.

- Bajaj Finance:

Bajaj Finance is able to borrow at competitive rates given the parentage of the Bajaj Group. The company is one of the few large NBFCs to have built a large deposit book (dominated by retail deposits) which supports BAF’s large balance sheet. Unlike many other lenders, BAF runs a negative ALM (i.e. it borrows long term money and gives short term loans) as the company judiciously maintains a longer duration for liabilities than assets, and keeps an optimal mix of borrowings between banks, money markets, external commercial borrowings and deposits. Over the past couple of quarter, BAF has continued to raise longer duration liabilities at fixed rates to protect itself in a rising interest rate environment. The company has raised Rs ~5,000 crores of 10-year duration funds in the last two quarters; this is more than the cumulative amount of 10-year money BAF has raised in the past 14 years.

- Cholamandalam Finance:

Chola’s cost of funds (5.7%) is superior to its comparable peers by a margin of 30-300 bps. Chola enjoys ratings of A1+, AA+ from rating agencies across various borrowing instruments. The company has a diversified borrowing/investor profile on the debt side. Owing to its high-quality parentage (Muruguppa group), solid track record and the retail secured nature of its loan book, the company has been able to raise liabilities at competitive rates. The diversified nature of Chola’s liability franchise as illustrated in Exhibit 3 also gives it bargaining power over its lenders as no single lender accounts for a large part of its borrowings.

Focus on niche customer segments

- Aavas Financiers:

Aavas has focused on the affordable housing finance segment in semi-urban and rural India. As compared to other housing finance companies, Aavas has focused on penetrating deeper into select states rather than expanding rapidly across multiple states. Aavas enters two new states in a block of every five years while continuing to go deeper in its existing states. As the company focuses on the self-employed segment which has informal income sources, a substantial part of credit risk evaluation includes collation/analysis of local market intelligence, local laws (which may vary from state to state) and physical verification which is difficult for banks to execute at scale. Aavas has been disciplined in its approach of lending to only self-constructed properties and not doing any builder/developer finance.

- Bajaj Finance:

Bajaj Finance (BAF) is India’s largest consumer durable financier and finances more than 70% of all consumer durables financed in India. BAF’s mainstay is no cost EMIs where a consumer who buys a TV, AC or a fridge is offered a 0% EMI with no/minimal processing fees, the no cost EMIs product work as a customer acquisition tool while being massively profitable. The company then cross sells other products (pre-approved unsecured loans, mortgages, etc.) to these customers. Banks have not been able to effectively compete with BAF in this segment given its strong technology led execution as explained in our July, 2021 newsletter (click here to read).

- Cholamandalam Finance:

Chola has built a vehicle finance book focused on high-yielding customers (majority of them are in the “middle of the pyramid” i.e. neither large fleet owners who have access to bank funding nor high risk borrowers such as first time users or users with 1-2 vehicles) that have limited access to bank funding. Given the secured nature of the business and the touch and feel required to do vehicle financing, this is also a business which is difficult for any of the new fintech players to disrupt.

KCP NBFCs enjoy high pricing power

The three KCP NBFCs derive pricing power from a combination of being able to borrow at competitive rates, a focus on niche customer segments and a well built out collections infrastructure. As illustrated below, the KCP companies do well on three key aspects that we look for – earnings growth, pricing power and capital adequacy.

- Aavas Financiers:

Aavas derives high pricing power by lending to customers who have a limited credit history and have income levels of less than Rs 50k per month; its average ticket size is Rs ~0.9 mn. For a 15-year affordable housing loan the monthly EMI is ~Rs. 12 to 15 thousand. As a result, the absolute EMI amount does not change materially even if some other lender offers a lower rate. This has resulted in Aavas seeing one of the lowest balance transfers out i.e. its customers are not being poached by banks or other lenders despite the fact that they are performing well and paying their EMIs on time. Aavas’ deep understanding of the geographical market in which it lends, its ‘close to customer’ proximity model, its in house sourcing and servicing capabilities are key strengths which are difficult for competition to replicate.

- Bajaj Finance:

While BAF was not the first player to venture into consumer durable financing, it has been the first player to scale the business successfully. Given its dominance in the segment and the utility of the zero cost EMI product, Bajaj Finance is able to earn healthy IRRs of 22-24% even though it might be lending to salaried customers and the tenure of the loan is only 6 months. Owing to its large presence of 100k+ touchpoints and 3,000+ branches combined with its ability to turnaround loans at much faster rates, BAF has become the consumer financier of choice for most manufacturers and dealers. BAF is able to further sweat its pricing power by using the data of customers acquired through consumer durable financing to cross sell other products.

- Cholamandalam Finance:

With more than 80% of branches in rural areas, towns and semi urban areas and target customer base of single/ small fleet operators (vs. banks targeting large fleet operators) the company charges higher yields vs. banks. Moreover, since livelihood of customers is dependent on the asset financed and the secured lending nature of the product, credit costs have been manageable in this business. Chola’s vehicle portfolio is well diversified across products and geographies which allows it to manage yields better vs. single product focused companies. For instance, Chola has been able to historically straddle across new CVs, used CVs, passenger vehicles, construction equipment, tractors and its non-vehicle financing loan book. This has helped it maintain consistent growth and better asset quality versus peers.

Note: Bajaj Finance, Aavas Financiers and Cholamandalam Investment & Finance Co. are part of many of Marcellus’ portfolios.