If the stock prices of our portfolio companies would not have been quoting daily, as part business owners of these firms, the only way we would have judged the health of these businesses would have been by looking at their underlying fundamentals. The underlying fundamentals of Financial Services companies can be assessed by looking at their return on equity (RoE), asset quality (gross NPAs) and loan book growth. The Kings of Capital (KCP) portfolio companies demonstrate consistently healthy fundamentals on each of these metrics not only on an absolute basis but also on a relative basis vs. the Bank Nifty. In this newsletter we give a comparison of fundamental metrics of the KCP versus the Bank Nifty.

Further, we compare how fundamentals of quality Financial Services companies have behaved in previous crises relative to the post-Covid recovery.

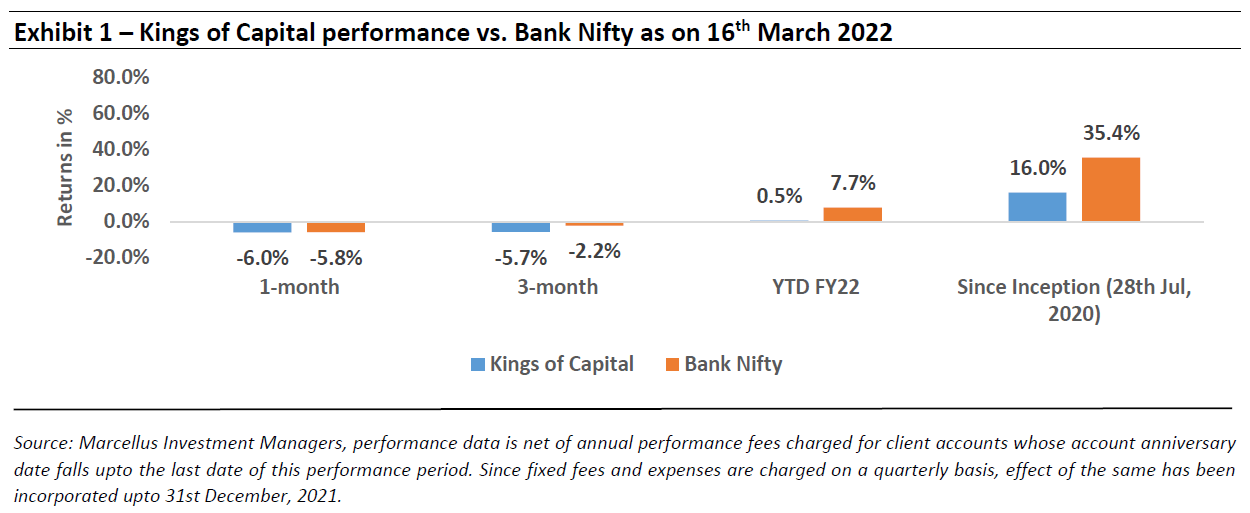

Performance update of the live fund

The key objective of our “Kings of Capital” strategy is to own a portfolio of 10 to 14 quality financial companies (banks, NBFCs, life insurers, general insurers, asset managers, brokers) that have good corporate governance, prudent capital allocation skills and high barriers to entry. By owning these quality financial companies, we intend to benefit from the consolidation in the lending sector and the financialization of household savings over the next decade. The latest performance of our PMS is shown in the chart below.

Fundamentals of KCP portfolio companies

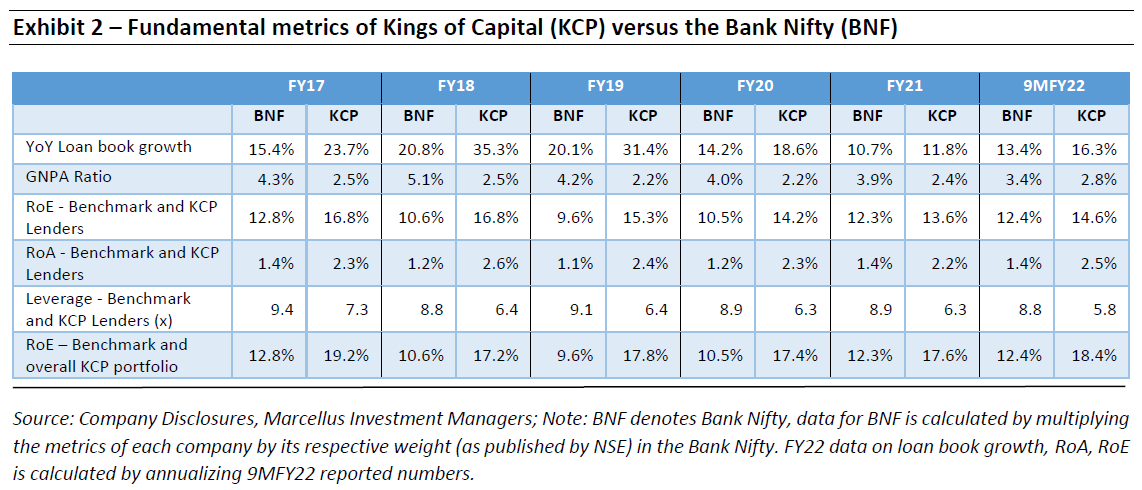

The fundamentals of KCP companies in Exhibit 2 highlight the following aspects about these companies:

· Consistent RoA generation:

KCP lenders have consistently generated return on total assets (RoA) in the range of 2.2% to 2.6% vs. RoAs of 1% to 1.5% for the Bank Nifty. As highlighted in our Feb, 2022 KCP newsletter (click here to read) this is a result of the KCP lenders’ pricing power, underwriting quality and ability to raise capital at competitive rates.

· KCP lenders generate higher RoEs with lower leverage:

The higher RoAs of KCP lenders enable them to generate high RoEs with lower leverage. As illustrated in Exhibit 2, KCP lenders have a leverage of ~6x vs. ~9x for the Bank Nifty. The leverage of the overall KCP portfolio is further lowered by the non-lending businesses (life insurance, general insurance, asset management, stockbroking) in the portfolio.

· Superior loan growth for KCP lenders:

KCP lenders have demonstrated superior loan book growth and strong market share gains over the past five years. During FY21 and 9MFY22, the loan book growth of KCP lenders has slowed down due to Covid related disruptions. However, this is a temporary phenomenon and the strong sequential loan book growth of KCP lenders in Q3FY22 shows the ability of KCP lenders to accelerate growth as conditions normalize.

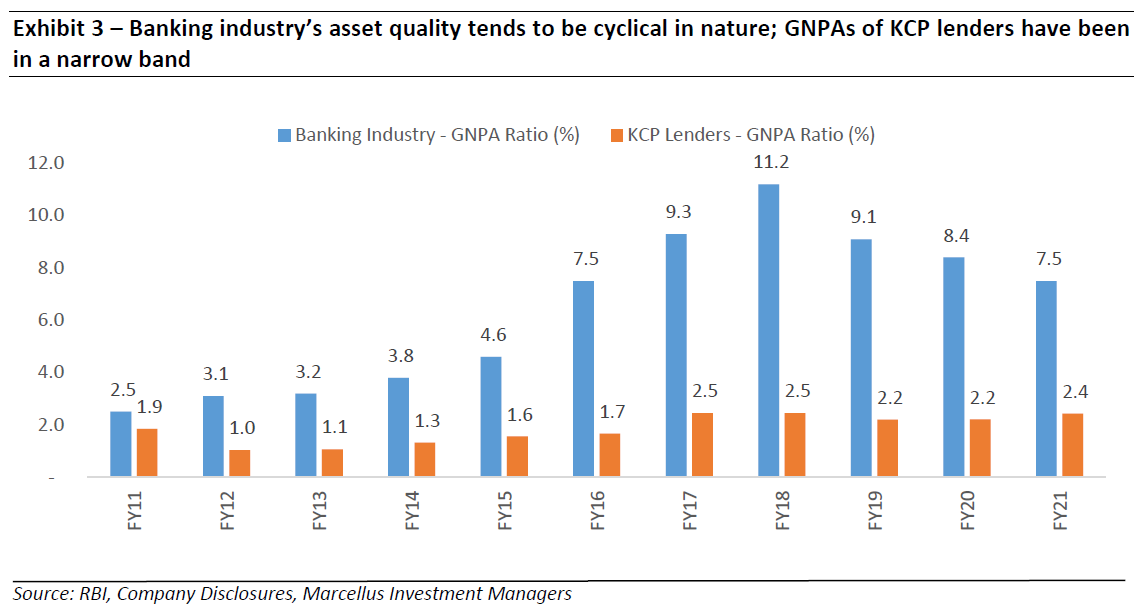

· Consistency in asset quality for KCP lenders:

Exhibit 3 below shows that while the banking industry’s asset quality is cyclical, the GNPAs of the KCP lenders have moved in a narrow band. The previous asset quality cycle lasted for more than ten years because it involved corporate loans and the banks delayed the recognition of deteriorating asset quality until they were forced to recognize these loans as NPAs as part of the Asset Quality Review during 2015-17. A large part of the banking industry has recovered from this corporate NPA cycle. However, like all financial cycles, as asset quality becomes better and lenders become more liberal in their lending practices and then we will see the beginning of the next asset quality cycle and, once again, poor quality lenders are likely to repeat the mistakes of the previous cycle.

Recovery of quality lenders post a crisis: a comparison between previous crises and Covid-19

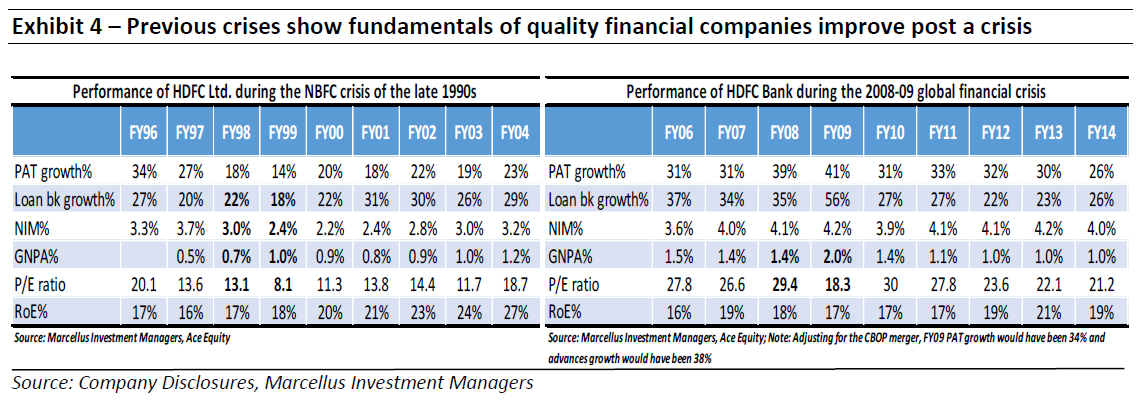

We have highlighted Exhibit 4 in our previous newsletters. Exhibit 4 shows that the impact of a crisis usually lasts a couple of years and quality lenders benefit post a crisis in the following ways:

· Better asset quality:

While the whole industry sees a rise in NPAs during a crisis, the increase in GNPAs of quality lenders during a crisis is relatively lower. Because these lenders do prudent underwriting even during good times, they tend to benefit in the form of lower NPAs during a crisis. Post the crisis, the asset quality of quality lenders further improves as they are able to operate in a less competitive environment.

· Market share gains:

Access to liquidity and capital along with better asset quality allows KCP lenders to grow rapidly post a crisis. While the absolute amount of growth is also dependent on industry credit growth, all quality lenders gain market share post a crisis.

· Better return ratios:

Better asset quality and higher growth result in better RoAs and RoEs post a crisis. Exhibit 4 shows how RoEs for HDFC Ltd. and HDFC Bank touched new highs after the NBFC crisis and global financial crisis respectively.

· Normalization of valuation multiples:

The valuation multiples of financial companies undergoes a steep correction during a crisis as there is fear of impact on asset quality and survival of financial companies. As conditions normalize and uncertainty recedes, valuation multiples of financial companies also normalize.

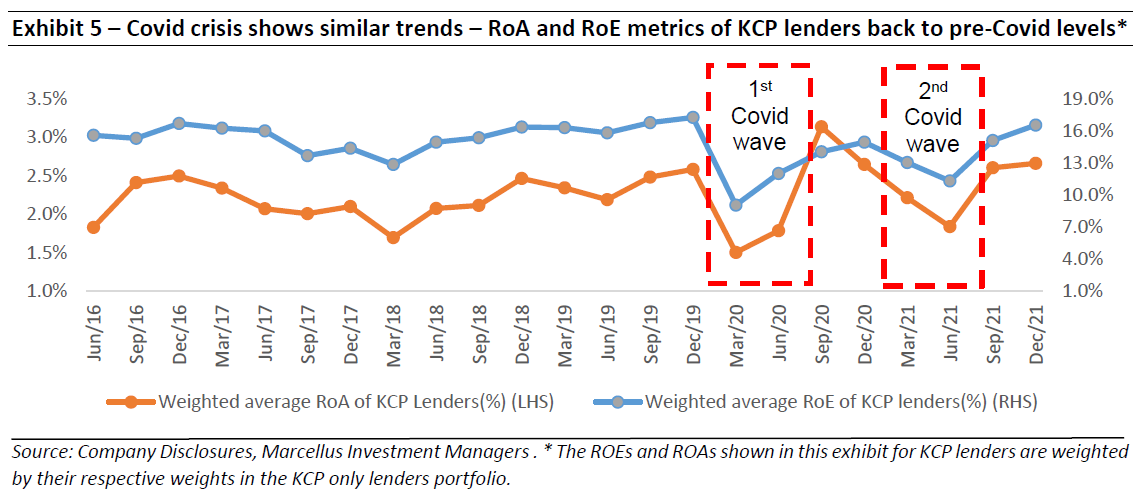

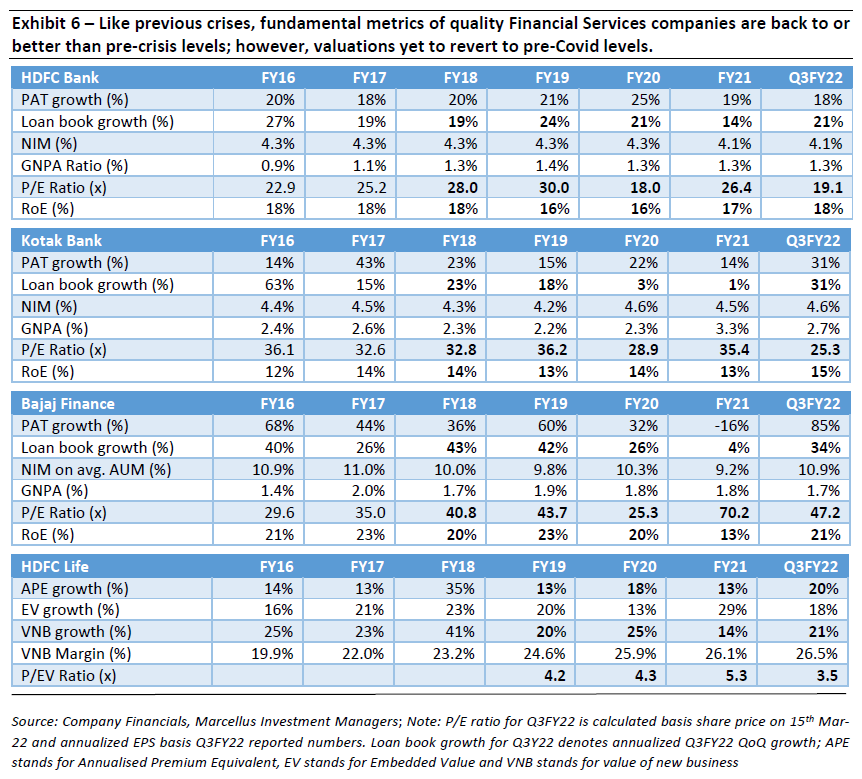

While we are in the relatively early stages of a recovery from the Covid pandemic, Exhibit 5 illustrates how the return ratios of KCP companies have normalized in the latest quarter. The return ratios in Exhibit 5, combined with the fundamentals of KCP companies in Exhibit 6 show that the recovery pattern of previous crises is being repeated this time as well.

Exhibit 6 below illustrates how the fundamentals of KCP companies – whether it be loan book growth, asset quality or return ratios, have recovered in the recent quarter only valuations are yet to revert to pre-Covid levels. As seen in previous crises, we expect this recovery in fundamentals to accelerate as the crisis related disruptions recede.

Changes to the Kings of Capital portfolio – replacing MAS Financial Services with Info Edge India

Info Edge investment thesis:

Info Edge, already the dominant player in the recruitments classifieds space, is integrating its operations by way of strategic acquisition, to not only expand its addressable market but also strengthen its competitive advantages by offering services across the recruitment value chain. They are doing the same in the real estate classified space too, which will aid their journey to leadership in what is currently a duopoly market. In order to deploy the FCF from the core business into early-stage investing, Info Edge has created a separate CAT-II AIF. The objective of making these investments through a separate vehicle is to bring in a more disciplined approach to the process, including attracting talent through a more market-friendly carry structure. In the first fund, Info Edge and Temasek have come in as LPs with a commitment of about $50m each and Smartweb, a subsidiary of Info Edge will be the GP/investment manager. On a consolidated basis, we estimate Info Edge to deliver healthy earnings growth driven by its recruitment business and unlisted investments.

Why is Info Edge a part of KCP:

We define a company as a financial services company if at least 50% of its market cap can be attributed to financial services and related businesses. An attribution analysis of Info Edge’s current market cap (~Rs. 60,000Cr), suggests that ~60% of the current market cap can be attributed to the AIF + value of stake in PB Fintech + value of stake in Zomato + on-books investments. Info Edge’s AIF (i.e. the investment vehicle which will invest in the unlisted space), investment in Policybazaar and Zomato and other legacy investments constitute its financial investments. Given that a majority of Info Edge’s value is now derived from its unlisted asset management business and other financial investments, we have added Info Edge to the Kings of Capital portfolio. Info Edge has a higher longevity score than MAS Financial resulting in the exit from MAS Financial. However, we continue to hold MAS Financial in our Little Champs strategy.

Note: HDFC Bank, Kotak Bank, Bajaj Finance, HDFC Life and Info Edge are part of many of Marcellus’ portfolios.