When the economic climate is benign, the share prices of financial services companies do not adequately capture the risks of aggressive lending and governance practices. The true intrinsic value of such companies becomes apparent only when such risk actually play out. History shows that when the risk plays out, the market cap of such companies vaporise within a few days – one minute the investor is the shareholder of an outperforming stock and then, days later, he has lost 90% of his wealth. Investors in financial services companies can improve their long-term returns by investing in companies which excel at managing these non-linear risks. In this newsletter, we discuss some of these risks and their investment implication.

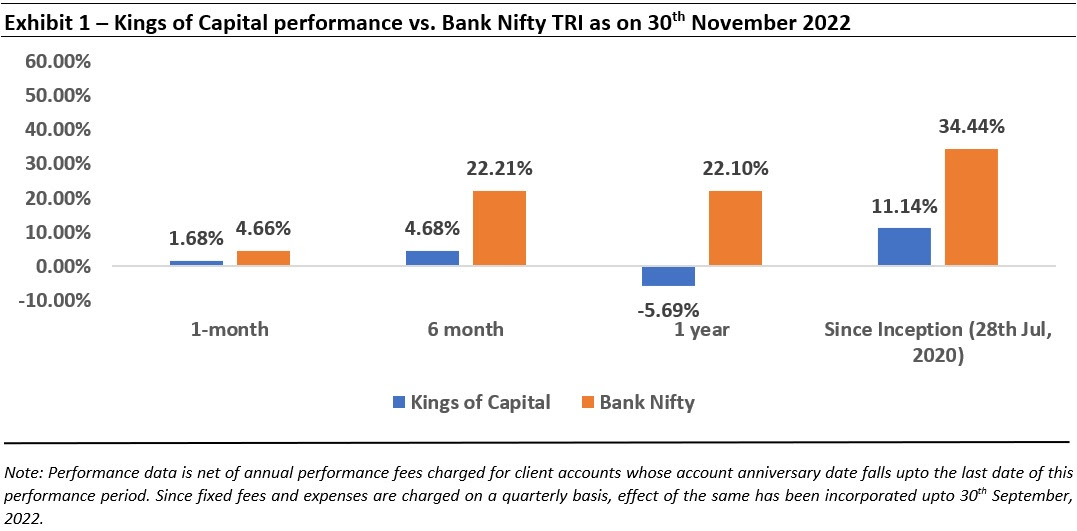

Performance update of the live fund

The key objective of our “Kings of Capital” strategy is to own a portfolio of 10 to 14 quality financial companies (banks, NBFCs, life insurers, general insurers, asset managers, brokers) that have good corporate governance, prudent capital allocation skills and high barriers to entry. By owning these quality financial companies, we intend to benefit from the consolidation in the lending sector and the financialization of household savings over the next decade. The latest performance of our PMS is shown in the chart below.

“RBI judged gross NPAs at Rs 8,373.8 crore for Yes Bank for 2016-17 against the declared gross NPAs at Rs 2,018 crore. Thus, there was a divergence of Rs 6,355 crore or three times the reported amount” – Business Today, February 2019

Financial services are characterized by non-linear risks which play out over the long term

Given that crises tend to afflict financial services firms every few years, just by doing the basic things right over the long term, financial services companies can outperform their peers. However, this sort of risk aware behaviour tends to be unfashionable during benign phases when every other lender is reporting record breaking numbers – something that we are witnessing currently.

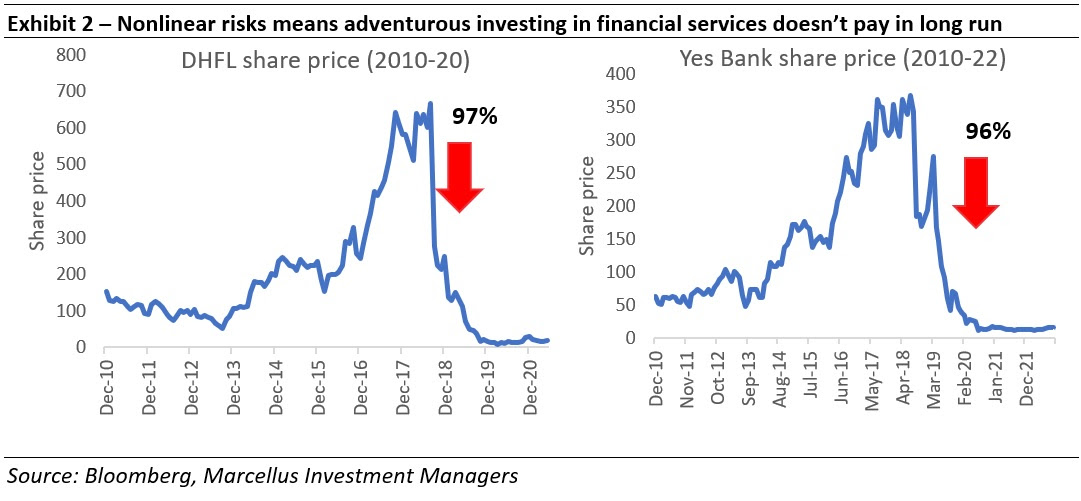

To be specific, risks related to dodgy lending and shoddy governance practices tend to become visible in clusters (eg. the RBI’s Asset Quality Review in FY15-17, the IL&FS crises in FY19) leading to a binary outcome – while the best lenders tend to benefit disproportionately when crisis strikes, naughty lenders tend to get wiped out. In other words, the stockmarket is very rarely able to price these risks properly (of ‘fairly’) on an ongoing basis until crisis strikes and then the stockmarket then rapidly realises – usually in a manner of days – who the heroes vs zeroes are. Unfortunately, for the investors in the zeroes, by then it is too late to sell as there are usually no buyers in the market for lender whose business is broken!

For eg. between 2010 and 2017, DHFL and Yes Bank stock prices went up exponentially even beating the returns of the likes of HDFC Bank until the malpractices around their lending and governance were revealed and the stocks lost all their value. It took only six more months during the IL&FS-related crisis for a CRISIL AAA rated DHFL to be downgraded to default rating. So much for efficient markets!

In this newsletter we reiterate the key tenets of our investors philosophy and explain which kind of lenders we back and which ones we stay away from.

Investment risks we avoid – Governance and Asset quality risks

The survival of any lender across an economic cycle is predicated on managing two key risks – around corporate governance and asset quality. Governance risks stem from promoters and management teams who siphon off money, indulge in unethical accounting practices for their own benefit at the cost of minority shareholders. For instance, one time market darling DHFL was involved in such malpractices which were masked over during its dream run between 2010-17.

“An initial forensic audit of DHFL’s books conducted by Grant Thorton has revealed that over Rs 17,000 crore was allegedly siphoned off between 2006 and 2019. During a raid by the Enforcement Directorate (ED) in early 2020, it was further found that DHFL had used customized software to create lakhs of fake accounts to camouflage loan defaults. DHFL had created one lakh such fictitious borrowers to route money into eighty shell companies” – Chapter 3 on ‘Spotting the Naughty Lenders’ in ‘Diamonds in the Dust’ by Saurabh Mukherjea, Rakshit Ranjan and Salil Desai

Asset quality risk on the other hand stems from risky lending practices where management teams tend to have a short-term orientation and resultantly assign a higher importance to loan growth over asset quality.

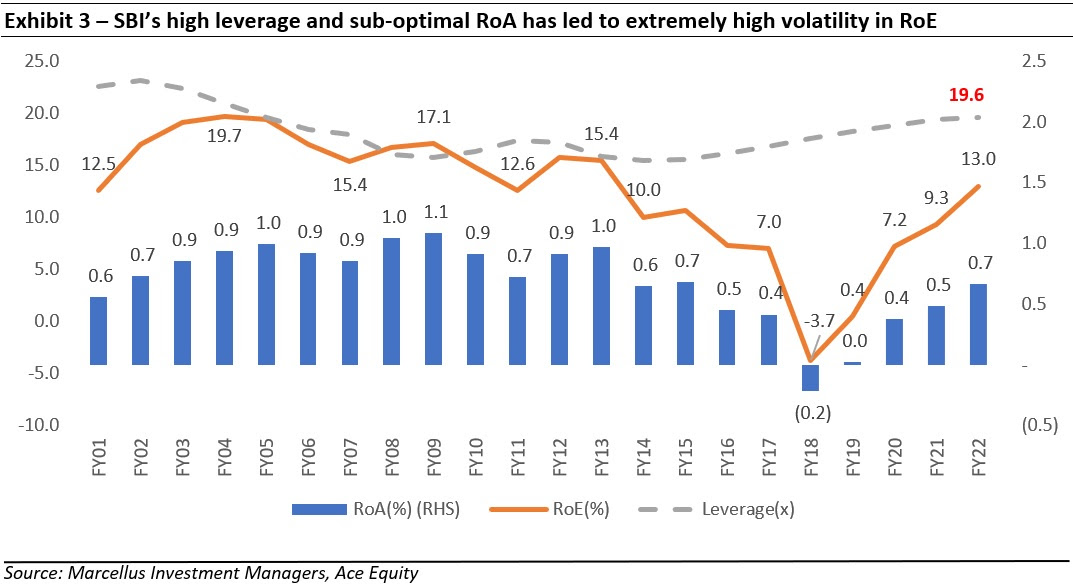

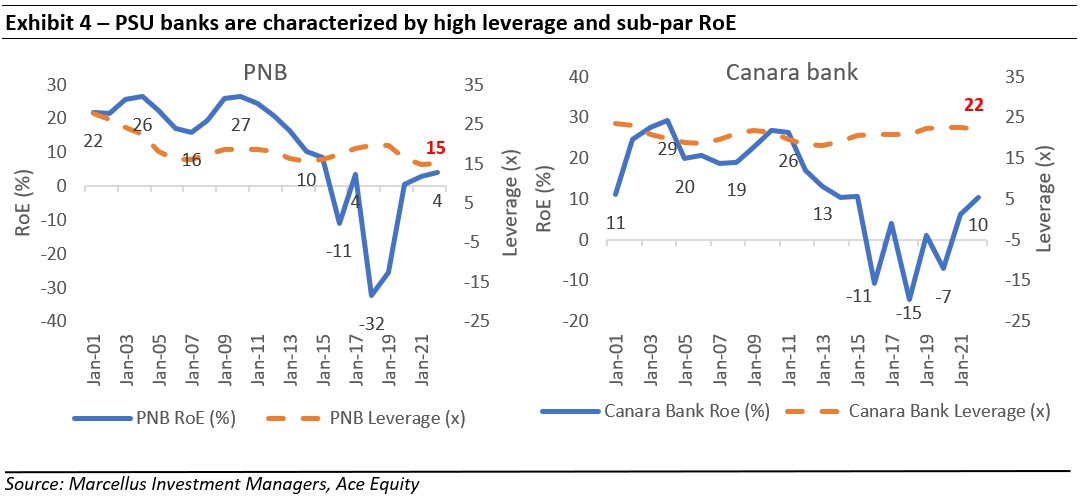

While there are examples of asset quality going awry in private sector banks as well, investing in PSU banks in general is especially tricky due to the misalignment of interests with the majority shareholders (see our Jul’22 dated newsletter). Most PSU banks operate at 15x-20x leverage (i.e. the PSU bank borrow Rs 15-20 for every Rs 1 of its own funds) and its C-Suite churns with relentless ferocity (the longest CEO tenure in a PSU bank tends to be five years). This combination of high leverage and rapid C-Suite churn is a recipe for short termism and every time the economic cycle turns south, the results of this short termism bear fruit.

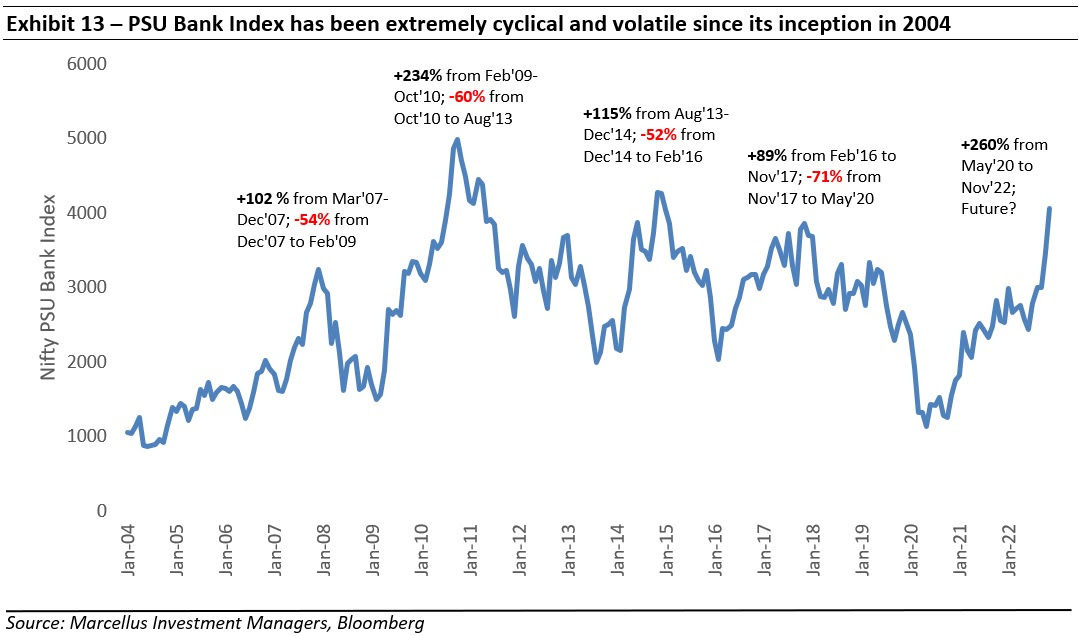

Since high leverage cuts both ways, PSU banks tend do well in an upcycle when NPAs within the system are low, but then they do poorly when the credit cycle turns for the worse.

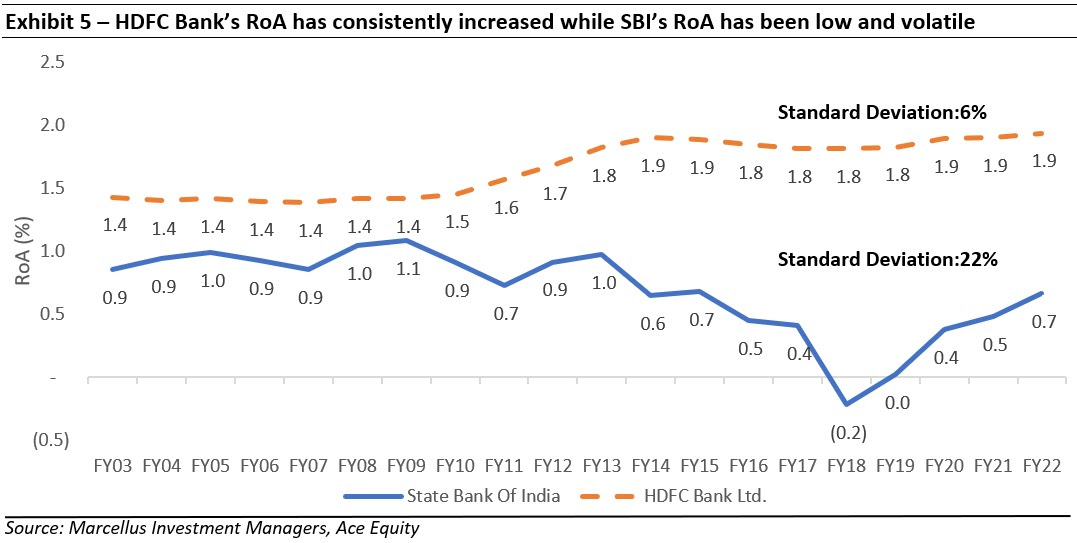

- A minor change in credit costs or opex is amplified by 15x to 20x because of high leverage. For example, between FY13-17 as RoA declined from 1% to 0.4% the RoE declined from 15.4% to 7% due to 14-15x leverage for SBI

- Whilst the RoAs of a lender reflect the unlevered business performance, the capital structure of the lender on the other hand reflects the risk (higher leverage implies higher risk) which in turn gets aggravated if the RoA is inconsistent.

Similar RoE and leverage profiles are evident in other PSU banks as well

The stark differential in operating performance between largest private sector bank – HDFC Bank and largest public sector bank, SBI, is evident in the chart below.

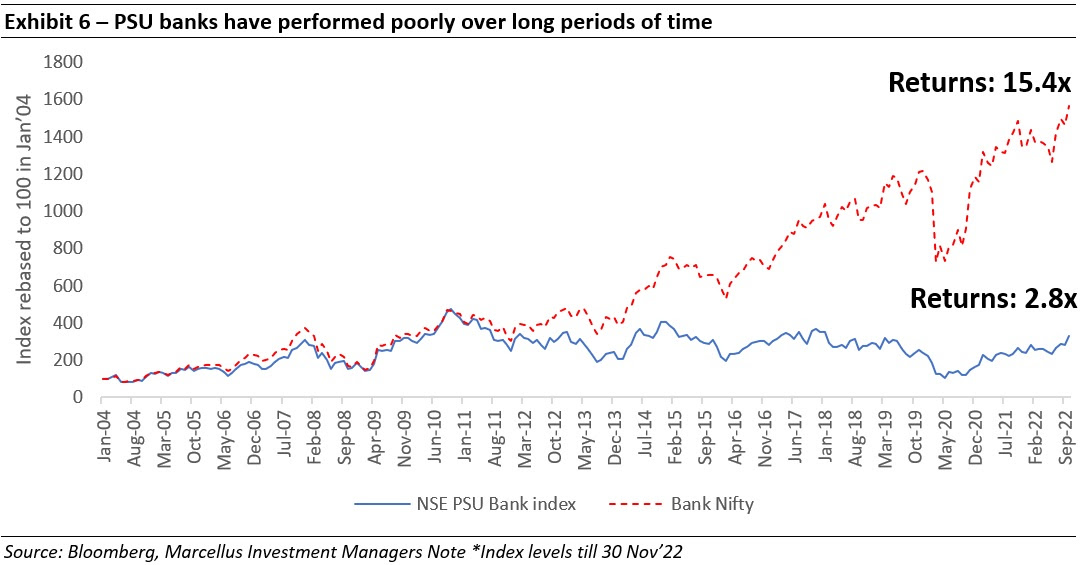

This inconsistency in operational performance for PSU banks leads to a wide differential in stock price performance, as can be seen in the performance of Bank Nifty vis-à-vis the PSU Bank index.

We mitigate the governance risks posed by lenders through our proprietary forensic framework for financials (see our webinar on the subject) and the asset quality risk through our Longevity Framework

Investment risks we are willing to take – optically high valuation multiples and conservatism

-

Paying higher valuations multiples for longevity of growth + better earnings growth + quality of management.

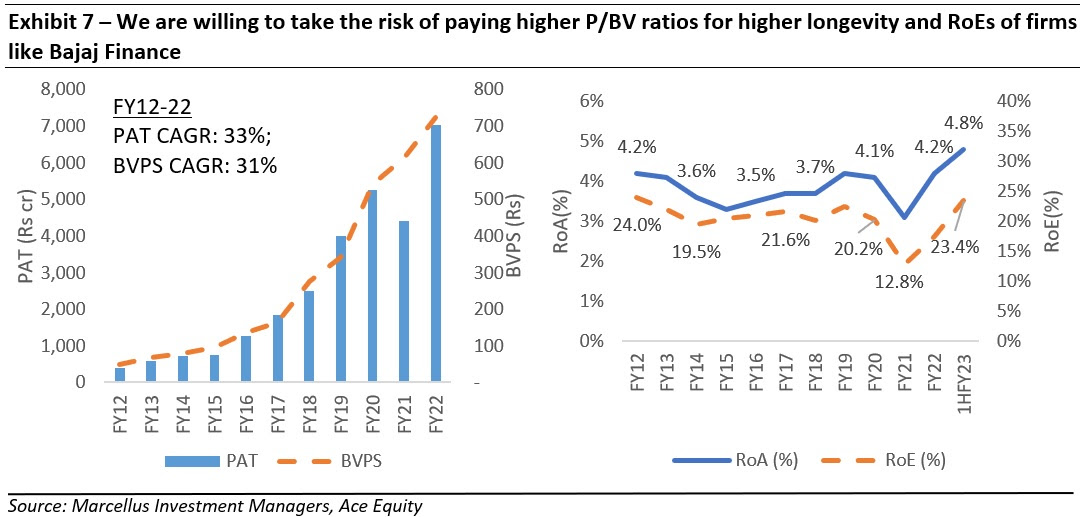

Given the paucity of listed high quality lenders which have a long track record of delivering profitable growth, we are willing to pay up a ‘high’ price for buying an equity stake and participating in their future prospects. Bajaj Finance is a great example of such a firm which has been trading at 8-9x P/B given its stellar track record of 30%+ PAT growth for more than a decade.

We are willing to take this risk because it’s not an existential risk unlike the risks related to governance or asset quality we described in the previous section. With a lender like Bajaj Finance, the main risk we see is that of lower-than-expected earnings growth rate leading to a temporary phase of subdued performance in the share price. However, what a lender like Bajaj Finance will seldom, if ever, expose us to is a permanent loss of capital.

2. Staying invested in conservative lenders which look boringly defensive in a credit upcycle

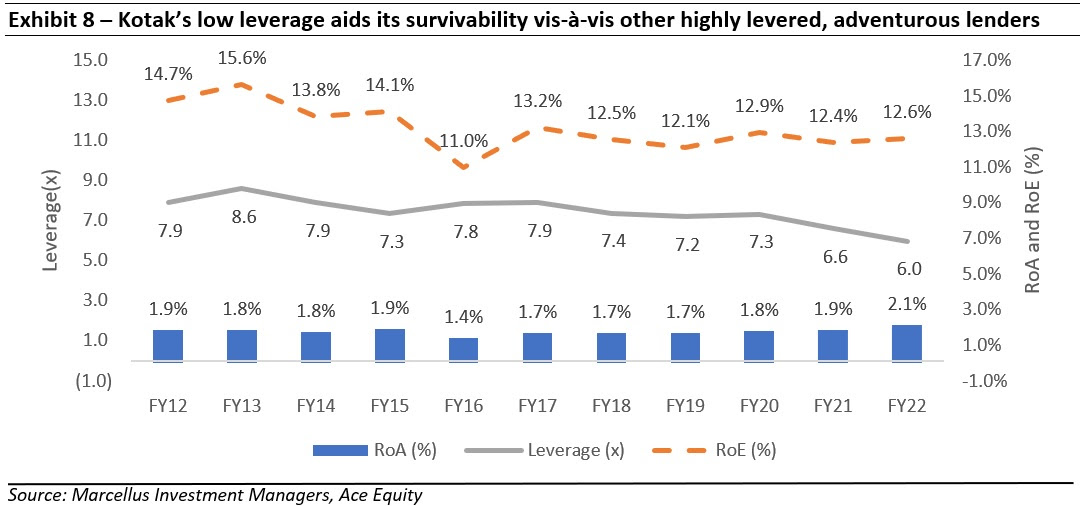

Secondly, we are willing to stay invested in conservative lenders irrespective of whether the environment is very good or very bad. Conservative lenders like Kotak appears boring, defensive or a drag on the portfolio when the credit cycle is booming but their consistency is rewarded in a downcycle when most other lenders struggle.

For eg. a 20 bps change in SBI’s RoA will result in a 4% change in RoEs (due to 20x leverage) while a 20bps change in RoAs of a Kotak Bank will result in a 1.2% change in its RoE (due to 6x leverage). Therefore, a lender with lower leverage will deliver more consistent return ratios which will be relatively independent of the external environment and more dependent on the business’ operational performance.

-

Investing in businesses which are built for structurally higher RoEs but current low RoEs are only because of the capital structure

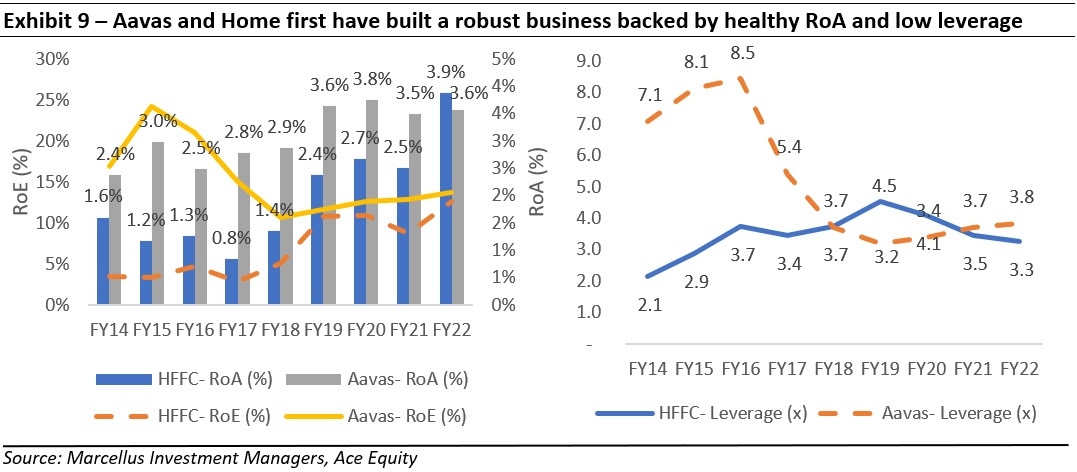

On similar lines, we are also willing to back lenders like Aavas and Home First who generate lower RoEs just because of their capital structure. Excess capital acts as a backstop for such lenders in case they make inadvertent mistakes in lending alongside providing consistency to return ratios. Read more on the affordable housing financiers here.

Returns align with quality on a cross cyclical basis

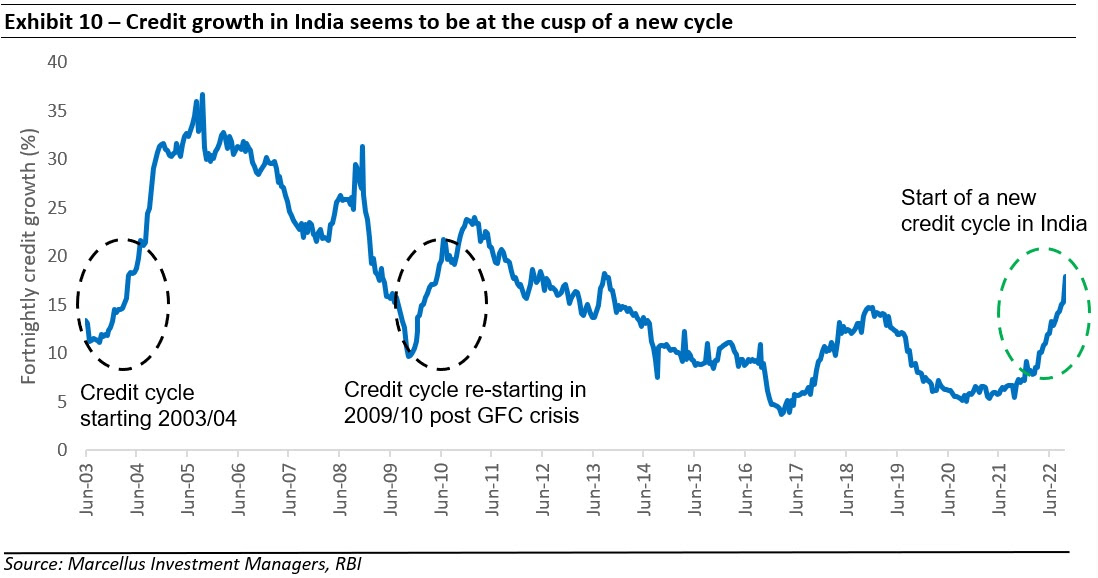

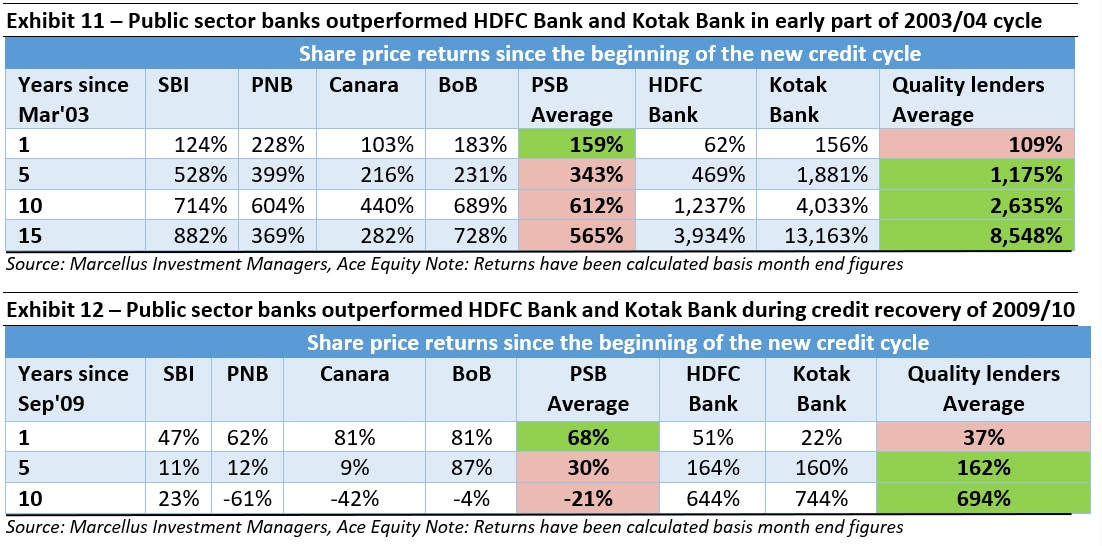

To see how markets tend to get overexcited as the narrative of a ‘new credit cycle’ takes hold and how ultimately the rewards accrue to a few high quality, conservative lenders on a cross cyclical basis, we take a look at couple of iterations of the credit cycle over the last two decades.

Over the last two decades there have been two clear instances where the revival in credit growth was strong enough for credit growth to exceed 20% thus leading to markets believing it to be a beginning of a new credit cycle. Whilst one of them which began around 2003/04 did turn out to be so, the one that began post GFC crisis in 2009/10 didn’t i.e. it was a false dawn.

As can be seen in the table below, in both these instances, high quality lenders like HDFC Bank and Kotak Bank underperformed their public sector peers at the start of such period. However, over a longer duration (exceeding 5 years), the differential in performance in favour of high quality lenders became quite stark.

Further, the reason we remain sceptical about the euphoric phase enjoyed by PSBs currently can perhaps be best captured using the Nifty PSU bank index since it began in Jan’04.

As has been the norm in the past, there will be many instances in the future as well when the kind of stocks we own will underperform their peers and our approach of holding ‘relatively expensive’ and conservative lenders will be called in to question. However, lending is a game of survival at the most basic level and we will continue to back the lenders who know how it do it the best whilst compounding shareholder wealth.