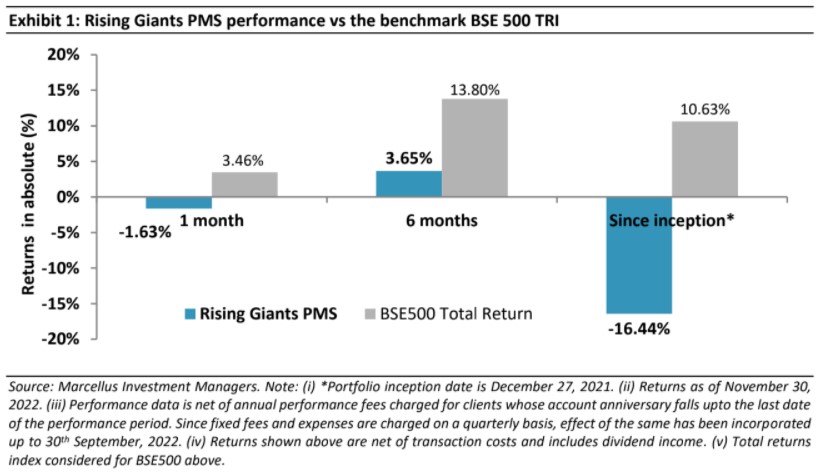

For the four quarters ending 2QFY23, the Rising Giants portfolio witnessed median revenue growth of 23% and EBITDA growth of 14%. Some portfolio companies faced headwinds around Covid-19 related revenues tapering off and higher input prices. However, as is the norm in stockmarkets, the -16.44% price correction in the portfolio (since inception) is extrapolating these near-term headwinds well into the future at a time when most of the above headwinds are abating. We note that in the past, the Rising Giants emerged stronger, not weaker, from such headwinds by strengthening their businesses through transformational capital allocation initiatives. We are confident of a similar scenario playing out this time too.

Performance update for the Rising Giants PMS

This portfolio intends to invest primarily in high quality mid-sized companies (less than Rs 75,000 crores market-capitalisation, predominantly in the Rs 7,000 crores – 75,000 crores range) with: 1) Well moated dominant franchises in niche segments; 2) A track record of prudent capital allocation with high reinvestment in the core business and continuous focus on adjacencies for growth; and 3) Clean accounts and corporate governance. From a universe of ~450 companies in this segment, a portfolio is constructed of 15-20 companies which make it past Marcellus’ proprietary forensic accounting & capital allocation filters as well as our bottom-up stock selection & position sizing frameworks.

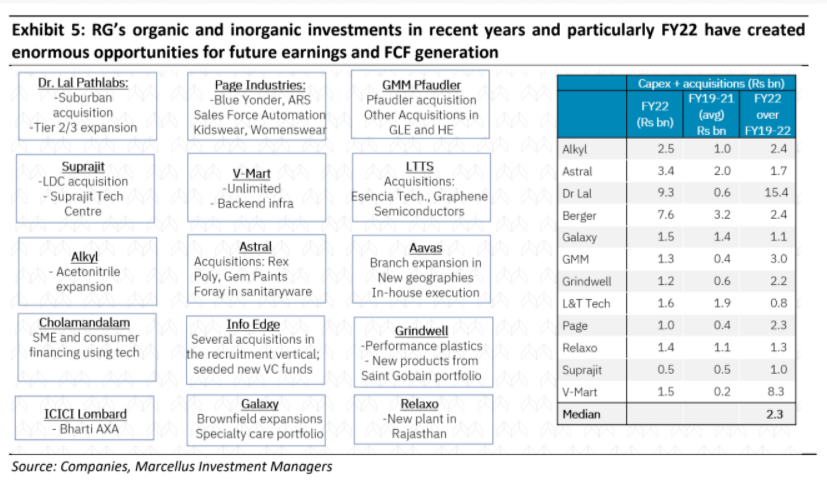

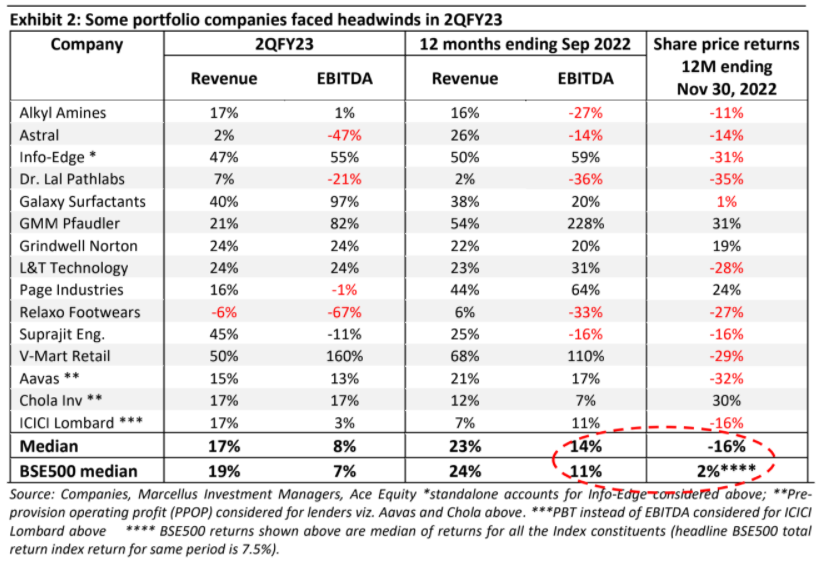

Near-term headwinds for some portfolio companies but share price correction > fundamentals As shown in Exhibit 2, most Rising Giants portfolio companies had solid 2QFY23 results with median revenue growth being 14% YoY and EBITDA growth coming in a tad lower at 8% YoY. A similar trend can be observed for the trailing 4 quarters where the portfolio median revenue growth is 23% YoY and EBITDA growth is 14%.

The most common headwinds faced by the Rising Giants over the last 12 months are:

▪ Normalization of the Covid-19 related business uptick: Some portfolio companies had benefited from a Covid-19 related revenue boost in FY21 which continued through into 1HFY22. However, as Covid-19 cases came down drastically over the last nine months, such revenues have tapered off leading to lower growth of revenues and operating profits on a YoY basis. Dr Lal Pathlabs (benefited from Covid-19 related testing) and Alkyl Amines (some supplies to anti-Covid-19 drugs) amongst our portfolio companies have been especially affected by this.

▪ Volatility in commodity prices: Since Q3FY21 there was a broad-based increase in the commodity prices including power and fuel costs which further accelerated in 2HFY22 due to geopolitical issues. This impacted the operating margins of some of the portfolio stocks such as Alkyl Amines, Suprajit, Astral and Relaxo Footwears. While most of commodity prices came off their peaks in the last 4-5 months, the benefit of the same could not be fully realised in 2QFY23 margins due to high-cost inventories that these companies carried at the beginning of the FY23.

▪ Impact on volumes due to price hikes, de-stocking: As some portfolio companies took price hikes to pass on the increase in the input prices, there has been near term impact on volumes – like in cases of Relaxo Footwears and V-Mart which cater to the lower income customers. On the other hand, the steep correction in raw material prices have led to inventory destocking at the distributors end (in anticipation of further lower cost of procurement) – such as in case of Astral.

While some of the portfolio companies did witness a YoY decline in 2QFY23 earnings and trailing last 12 months (TTM) due to the reasons mentioned above, as often the case in the stock markets, many of these companies’ share prices have witnessed steep correction as the market extrapolates this temporary weakness far into the future. Interestingly even some of the portfolio stocks which sustained their operating profits have seen their share prices decline substantially (Eg.V-Mart and Aavas) thus showing a clear divergence between the share prices and fundamentals. In fact, over the past 12 months, the portfolio’s median earnings growth is better than that of benchmark BSE500 (14% vs 11%) but median share price returns are much lower (-16% vs 2%). If one were to consider BSE500 total return of 10.63% vs. -16.44% return of the Rising Giants Portfolio (since fund inception on 27 Dec’21), the divergence is even more stark.

Rising Giants have emerged stronger from similar headwinds in the past

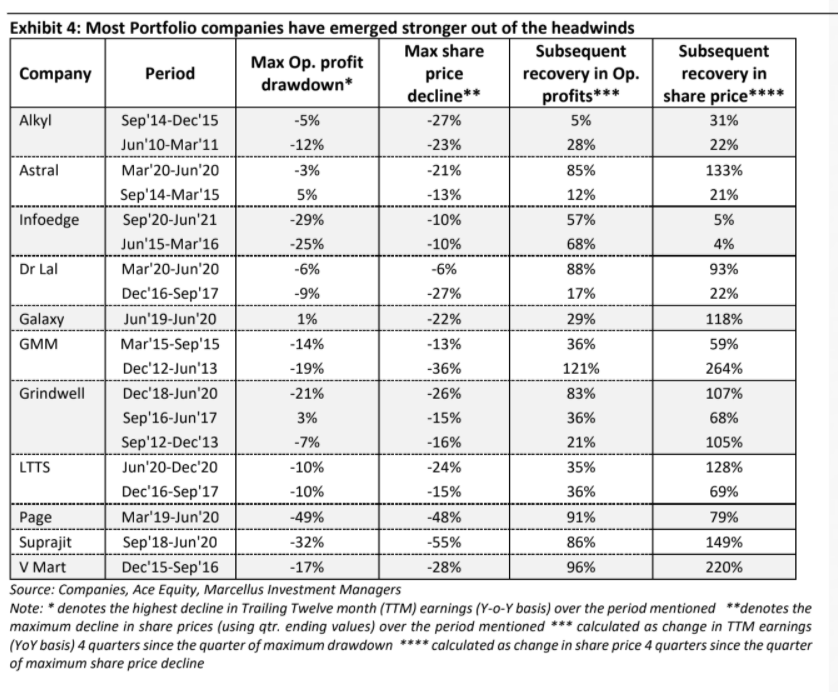

This is not the first time that the Rising Giants have witnessed a slowdown in earnings growth. For instance,during the Covid-19 first wave in March 2020, there was much sharper decline in earnings and share price returns across the corporate world. Further, before Covid-19, there have been several instances of macro slowdown and company specific issues which adversely impacted the Rising Giants. Exhibit 3 catalogues some of these episodes and it can be clearly seen that the norm in such episodes is for the share price correction to be much bigger than the drop in profits.

We discuss the reasons for the drawdown in earnings and share price (as shown in Exhibit 3) for some of the companies in detail below.

Example #1 – Alkyl Amines: Alkyl witnessed an extended period of slowdown for six quarters (YoY quarterly operating profit growth ranging from -11% to +5%) starting from 2QFY15 to 3QFY16. The key reasons were slow-down in the domestic pharma industry, increase in imports from China for specific products, momentary over-capacity in methylamines and recessionary trends in Europe which impacted export revenues of the Company (Europe contributed ~50% of Alkyl’s exports).

Despite the near-term slowdown, Alkyl continued to maintain a high level of reinvestments in FY15 and FY16 (in fact 50% higher than cumulative reinvestments made in FY13 and FY14). It reinvested close to 50% of the cumulative operating cash generated over FY15 and FY16 in the following:

▪ New green field facility in Dahej for manufacturing Methylamines;

▪ Expansion in Acetonitrile capacity at Kurkumbh; and

▪ Investments in solar power capacities to bring down the power costs.

Interestingly, the major investments during this period were into Accetonitrile and Methylamines – both products which were seeing at that time challenges around oversupply and rising imports. This indicates the long-term orientation of the management at Alkyl. Both these investments went to become major successes for the Company in the coming years.

Example #2 – V-Mart Retail: “The financial year 2015-16 was full of challenges. V-Mart successfully resisted the full brunt of the sectoral slowdown through proactive countermeasures, business model robustness and store expansion. And that made all the difference. At V-Mart we believe in turning challenges into

opportunities; the larger the challenge, the greater the growth opportunity”– Excerpt from V-Mart 2015-16 Annual report.

V-Mart witnessed a significant deceleration in earnings in the 12-month period between 3QFY16 and 2QFY17 with operating profit for the trailing 12-months down 17% YoY in the September 2016 quarter. A key challenge faced by V-Mart during this period was the hammering of rural and semi-rural incomes (which are the core markets for V-Mart) due to successive monsoon failures, Government measures to plug subsidy leaks and weak rural employment. This impacted the same store sales growth (down 1% for FY16) which had been consistently growing at 8-10% p.ac. for many years for V-Mart until then.

However, despite the above setbacks, V-Mart continued to execute on its long-term plans. Some steps taken by the Company during this period were:

▪ Continued on expansion: Opened 17 stores expanding the stores network from 108 at FY15-end to 123 at FY16-end) and forayed into new states like West Bengal and Orissa. Further the company more than doubled the warehouse space.

▪ Strengthened backend efficiencies: (i) Moderated the number of vendors from 1200 to 850 in exchange for superior value; (ii) Launched a vendor-dedicated portal to enhance vendor-centric merchandise visibility across each store helping company optimise inventory at warehouse; (iii) Implemented an advanced warehouse management system to enhance visibility of inventory – colour, fabric, style and size – across the organization with the objective to replenish shelves faster following sales.

▪ Strategic initiatives: (i) Graduated the concept of evaluating profitability from corporate return on capital employed (ROCE) to store-level ROCE. This helped the Company more accurately appraise stores and then provide a customised response in terms of merchandise, space and store ambience; (ii) Defined each organisational function around a standard operating procedure thus helping reduce deviations and thus operational risks.

The result was the overall inventory stayed around the same level as the previous year. As a result, free cash flows were higher YoY despite fall in profitability and the Company remained cash surplus.

Example #3 – Grindwell Norton: Grindwell Norton’s (GNO’s) operating profits grew at just about 2% CAGR from FY12 to FY14 due to the general slowdown in industrial activity (including the auto sector) in India and due to higher costs (in the wake of higher energy prices, a depreciating INR and general inflationary conditions).

Nevertheless, GNO continued its expansional and transformational journey through these years by undertaking the following:

▪ Capacity expansion projects across businesses: Bonded abrasives expansion project at Nagpur, new non-woven plant in Bengaluru and new high-performance refractories (HPR) plant in Halol. ▪ The Company implemented a number of new ideas through “The Next Level” initiative engaging employees at all levels to make progress on several dimensions.

▪ Information Technology was enabled to provide many on-line services to GNO’s Customers. ▪ Co-Investment in Saint Gobain Research India Ltd (SGRI): SGRI was set up to invest in transversal Research & Development Centre for the Saint-Gobain Group in Chennai. GNO invested Rs 23.4mn alongwith Saint-Gobain group entities in India.

Thanks to the above investments, GNO was in good position to benefit from the industrial recovery in the coming years and also build significant traction beyond the abrasives business.

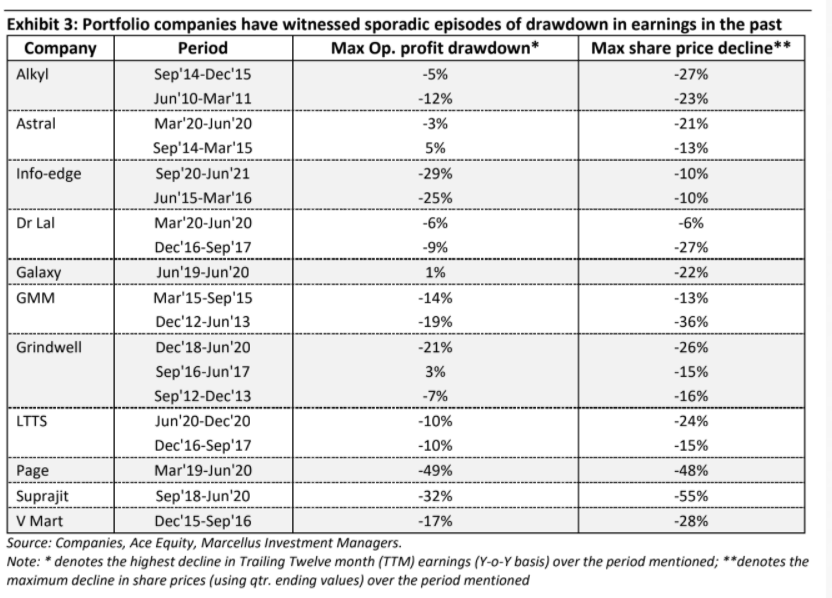

A common thread across all the above instances is the longer-term orientation of the management. While typical management responses to business challenges range from getting overwhelmed to inaction, high quality management teams continue to invest in business (often doubling down on capex and efficiency initiatives) and use the employee/management bandwidth to identify areas to further strengthen the business by bringing in operational efficiencies through tech enhancement. The result is that companies emerge from the slowdown stronger and then benefit disproportionately from the subsequent recovery as shown in Exhibit 4. Note once again that the share price recovery tends to be in excess of the profit recovery.

Conclusion: The stockmarket over-reacts to earnings corrections and we have trained ourselves to benefit from that

While headwinds are part and parcel of business life, the true strength of a company’s management comes to the fore during such periods. The Rising Giants have historically exhibited a high degree of resilience and business acumen during periods when their profits are under pressure. Over the past 12 months, we have seen the Rising Giants applying a time tested template of ramping up capex and implementing efficiency enhancers. In fact, these companies have accelerated their investments as shown in Exhibit 5 below. With commodity price and Covid-19 related headwinds abating, the Rising Giants are well place to see a recovery in earnings growth going forward.