Modern Retail in India has a huge opportunity to modernize and consolidate this millenniums old sector. However, building and growing a pan-India retail network of stores with high ROCE consistently has been difficult for most retailers. Challenges range from understanding consumer preferences, optimizing store location / size / format, optimizing merchandise selection / procurement / pricing / display, and building a supply chain infrastructure to deliver high store level inventory turns and efficient working capital management across the retail network. Such challenges offer great opportunities for businesses to build strong and sustainable competitive advantages. In this newsletter, we highlight three such retailers which Marcellus has invested in its portfolios – Titan, Dr. Lal Pathlabs and V-Mart.

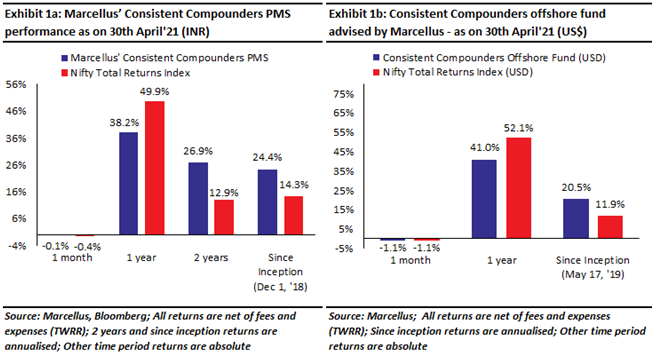

Performance update – as on 30th April 2021

We have a coverage universe of around 25 stocks, which have historically delivered a high degree of consistency in ROCE and revenue growth rates. Our research team of eleven analysts focuses on understanding the reasons why companies in our coverage universe have consistently delivered superior financial performance. Based on this understanding, we construct a concentrated portfolio of companies with an intended average holding period of stocks of 8-10 years or longer. The latest performance of our PMS and offshore fund (USD denominated) portfolios is shown in the charts below.

The slow pace of modernisation and weak cash generation of India’s retail industry

India’s retail industry is more than US$700bn in size. However, less than 20% of the industry is organized, even though it has been more than two decades since large-store pan-India retail formats (like departmental stores and supermarkets) started expanding, and more than three decades since small-store pan-India retail formats (like Bata) have existed in the country. The balance 80% of the industry continues to be traditional mom-and-pop shop formats.

Furthermore, over the past 10 years, only a small fraction of the organized retail industry in India has managed to deliver returns on capital (ROCE) more than cost of capital whilst also growing the retail network at a healthy pace.

So what are the challenges faced by pan-India retail chains which makes it difficult for them to deliver consistent growth in cash flows over the long term?

There are multiple layers of challenges faced by retailers in India. Whilst the solutions to these challenges are obvious – higher footfalls, higher inventory turns and optimization of various other aspects of retail execution – each of these solutions brings with it several more challenges, making it incredibly hard to scale up the retail network with high cash generation.

At a store level, the challenge starts with the high cost of commercial real estate and hence the need to drive high footfalls per unit of store space. However, this requires the retailer to have gone through a steep learning curve of optimising aspects such as:

· Store size (e.g. is 1,000 sqft good enough, or should it be 1,500 sqft? Should 10% of the store space be allocated towards inventory warehousing, or 5%?);

· Store location (e.g. shopping mall or high-street? Corner of the high-street or centre of the high street?);

· Look and feel of the store (e.g. height of the ceiling, shape and size of the racks, number of pillars in a large format store, lighting, etc);

· Hiring, training and retention (in an industry characterized by very high attrition rates) of an optimized number of sales personnel on the shopfloor who understand the merchandise and can convince a customer to buy it.

Another challenge at a store level is around optimising various aspects of the merchandise itself, like:

· Pricing, design and type of merchandise that will be most in demand for the kind of footfall that the store expects to attract;

· Merchandise positioning across the floor (e.g. the amount of space between two racks, which type of products should be next to entrance and which ones should be next to the billing counters?);

· Mix of private label products vs third-party products.

Once store level challenges have been addressed, a large part of the cash generated from a store needs to be reinvested towards opening of new stores to grow the retail network across the country. However, expansion of a retailer’s store network brings with it several more challenges, some of which are unique to India, like:

· Merchandise preferences change substantially across geographies, across demographics within a specific geography and over time within a specific demographic;

· Inventory management for demand hubs across India that are often thousands of kilometres apart from each other. For instance, a retail format catering largely to say metro cities will need to manage inventory transit across Delhi, Mumbai and Bangalore.

· Merchandise procurement must deal with challenges such as absence of ‘farm to fork’ supply chains in perishable food, regulatory intervention in procurement of commodities like gold, lack of uniformity in merchandise quality of footwear and apparel, etc.

Poor efficiencies around the factors highlighted above leads to issues like: a) poor customer experience due to stock-outs of SKUs at some stores, and b) too much unsold inventory of SKUs at other stores and hence weak cash generation for the overall retail network. Furthermore, evolution of newer forms of retailing like ecommerce and omni-channel also calls for re-engineering of a retailer over time in order to stay relevant to its customers and to sustain competitive advantages to keep winning market share.

Finally, even if a retailer successfully surmounts all of the challenges discussed above, she then faces the conundrum of how to successfully re-deploy her free cashflows in a country where very few Modern Retail categories are truly mass market, high demand categories. The penetration and frequency of consumption of many categories significantly drops as one moves away from Tier 1 cities and metros, towards Tier 3 / 4 and rural cities. This lack of enough depth of consumption in India across various categories limits the number of stores that even a successful and dominant retail format can successfully open in the country at a given point of time. These limits then result in retailers deploying free cash flows from successful existing formats into new retail formats, which do not necessarily achieve success. For instance, Shoppers Stop’s launch of HyperCity, Jubilant Foodwork’s (Domino’s) launch of Dunkin Donuts, Trent’s (Westside) launch of Landmark Bookstores / Star Bazaar, etc have not delivered high ROCEs.

How can investors choose retailers which can deliver value for shareholders in a healthy and consistent manner over the long term?

“All happy companies are different: each one earns a monopoly by solving a unique problem. All failed companies are the same: they failed to escape competition” – Peter Thiel in ‘Zero to One ‘, (2014)

There are a few structural factors which reduce the intensity of the challenge highlighted above for a retailer. For instance:

· A small-store retail format (say 500 to 5,000 sq ft per store) gives more agility to the retailer to shorten the learning curve and revamp / shut down unviable stores, compared to a large-store retail format (say more than 30,000 sq ft. per store).

· A retail format selling merchandise which is utility oriented (rather than luxury oriented) might have a longer runway for growth before it reaches the limit of store-count across the country.

· Merchandise with longer shelf life (like packaged foods vs fresh foods, or long-lasting apparel trends vs fast fashion) can help reduce wastage / shrinkage of unsold inventory at a store level.

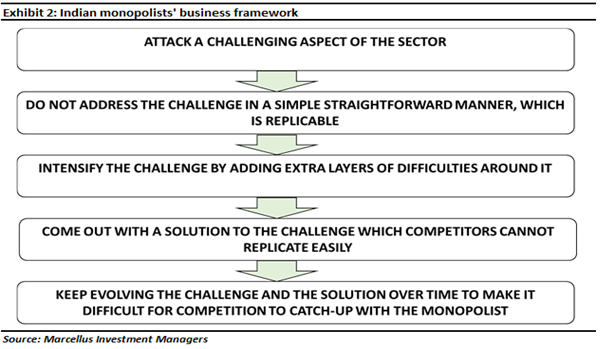

However, relief through these structural factors is available to the competitors of the said retailer as well. As we had highlighted in our 16th June 2020 blog titled ‘Inside the Mind of the Indian Monopolist’ (click here), addressing the challenging aspect of a sector in a simple straightforward manner is not a sustainable way to build deep-rooted competitive advantages. Instead, as highlighted in exhibit 2 below, a solution which cannot be replicated easily by competitors is a far more sustainable way to consistently compound fundamentals.

Here are examples of three retailers which are part of various Marcellus portfolios:

Titan Company

The biggest challenge that Titan has addressed in jewellery retailing (Tanishq) is around the customer’s trust regarding the purity of the gold sold by the retailer. Mom and pop retailers in jewellery have dominated the industry (~70% market share) through the relationship of being a customer’s ‘family jeweller”. However, since most of these mom-and-pop retailers derive their profit margins based on commodity prices, they have sold impure gold to the customer compared to the purity for which they have priced the product (e.g. selling 19 ct gold at the price of 22 ct). Titan has addressed this challenge by offering: a) transparency on gold purity through karatometers in their stores; b) ‘trust’ oriented brand recall of being a Tata group company; and c) selling jewellery to a customer based on superior product designs and shopping experience rather than as a commodity. When it comes to designs of its products, unlike most of its competitors, Titan’s design team has complete control on the karigars and the manufacturing processes.

The next big challenge that Titan has addressed is around neutralizing the exposure of its profit margins to fluctuation in commodity prices by procuring raw materials through ‘gold on lease’, ‘gold exchange’ and hedging instruments.

Another big challenge faced by pan-India Jewellery retailers is that with wedding jewellery controlling almost 70% of the total jewellery sales, customer preferences of designs of wedding jewellery merchandise are highly localized and change substantially from one state to another. This then causes a massive adverse impact on inventory management and the working capital cycle of pan-India jewellers. Over the past 3 years, Titan has started to overcome this challenge by leveraging on its scale of operations within a locality and significantly improving its understanding of wedding jewellery merchandise preferences of local customers to an extent that almost a quarter of total jewellery sales for Tanishq are now derived from this jewellery segment, up from less than 5% until few years ago.

One of the biggest threats looming ahead for gold and weddings oriented jewellers in India is a shift in customers to studded jewellery or low caratage gold jewellery. An additional, and related, challenge is the ongoing rise of ecommerce as a way to access jewellery merchandise. On this front, Titan’s May’16 acquisition of a majority stake in Caratlane, an online jewellery franchise – which is expanding rapidly, successfully and profitably across ecommerce, omni-channel and brick and mortar formats – has been an unequivocal success.

During every disruption – like demonetization, GST and the ongoing Covid-19 crisis – Tanishq benefits massively through market share gains from mom-and-pop shop jewellers whose business models struggle to deal with from the impact of these disruptive events.

Finally, Titan keeps launching new retail formats such as eyewear (Titan Eyeplus) and sarees (Taneira) thus redeploying the free cashflows arising from Tanishq. Whilst none of these formats have been as successful as Tanishq, recently the firm has started to successfully turnaround its eyewear business by making radical changes in product procurement, by launching an ecommerce interface and by revamping its brick and mortar offerings including shutting down unviable stores.

Dr. Lal Pathlabs

In an industry like diagnostic labs, there does not exist much differentiation across different diagnostic labs around accuracy of test reports. Standalone labs (mom and pop labs) might not have the entire spectrum of tests done in-house, and hence end up outsourcing some of the samples / tests to other labs. Moreover, most labs take 12-24 hours for processing a sample and generating a report, thereby not giving much differentiation in service levels either. All of this leads to the biggest challenge faced by a diagnostic labs retailer being around customer acquisition – on what basis should the retailer build loyalty with the customer and hence generate enough footfalls to generate a healthy ROCE?

The straight-forward solution to this challenge that various labs have adopted over the last 3 decades in India is incentivise the doctors for customer referrals. These incentives go up to as high as 30-35% revenue share. However, this model is neither profitable nor sustainable (because a new lab can always give some extra benefit to the doctor and take away the footfalls from an incumbent player).

Another straight-forward way to build a pan-India diagnostics lab business whilst overcoming these challenges is to setup a B2B type of retail network where samples are procured from hospitals or third-party labs / collection centres, and reports are white labelled and then delivered to hospital or third-party lab.

Dr. Lal Pathlabs has overcome the ROCE challenge in a difficult-to-copy and gradual manner. Firstly, the firm has approached the business model in a B2C manner – it controls several aspects of the franchisee’s collection centre like layout, supplying some sample collection equipment and in some cases even controlling lab technicians. This has helped standardize the experience that a customer gets across collection centres. Next, the firm has built a network of labs and collection centres in an efficient hub-and-spoke manner by first learning about the local demographics / demand potential and then opening collection centres and labs at optimized locations, size and format. This has led to only a gradual geographical expansion of the firm from Delhi NCR towards the north-east and, in the recent years, towards the eastern part of the country.

Over the past 15 years, the firm has invested significantly in systems and processes to go up the the learning curve about optimization of stores (labs and collection centres). Over the past 5-7 years, Dr. Lal has also invested heavily in technology for supply chain optimization and for upgrading the consumer interface. As a result, today the firm’s turnaround time to process test samples and deliver reports to the customers is only a fraction of what other organized pan-India diagnostic labs offer.

Given the challenges faced by customers due to Covid-19 lockdowns, there exists a massive opportunity for a diagnostics lab retailer to building an omni-channel offering. Capitalising on this opportunity, Dr. Lal has accelerated tech and physical infrastructure investment towards improving its home collection service, thereby adding to the list of differentiating factors compared to competitors, for a customer.

With regards to capital allocation, strong cash generation (ROCE of ~35% over FY17-20) has led to accumulation of Rs 933 crores of unutilized surplus cash on the balance sheet as on 31st December 2020. Unlike some of its competitors, Dr. Lal Pathlabs has NOT misallocated this surplus towards cash guzzling, large format radiology-oriented labs (like MRI, CT Scan centres, etc) which do not attract enough footfalls to generate high ROCEs. The firm has also not executed large scale M&A transactions at expensive valuations (unlike some of the pan-India players). Instead, it has reinvested some of the surplus cash towards bolt-on acquisitions (the sums paid are typically less than a million dollars for each of these bolt-ons), most of them executed at price/sales multiple of around 2x, with an objective of getting to understand new geographies before growing organically in the future.

V-Mart Retail

As highlighted in one of our October ’20 Little Champs newsletters (click here), V-Mart Retail has become the largest affordable fashion apparel retailer in tier 2, 3 and tier 4 cities of the north-eastern Hindi heartland. It commands one of the best RoCEs in Indian retail (pre-tax average RoCE of 28% over FY17-20) and has delivered net earnings CAGR of 22% over FY17-20. These robust fundamentals have been underpinned by its: (a) efficient supply chain management (automation of warehousing activities, own logistics and cluster-based expansion model); (b) merchandise selection & vendor management (investments in auto replenishment systems, vendor consolidation and extending support to vendors during a crisis); and (c) relentless focus on talent retention & training. Over the past decade, the firm has collected substantial data related to the footfalls it has received at its stores. Recently, the firm has started investing heavily in data analytics and supply chain infrastructure with an objective to further increase store level inventory turns and launch its in-house ecommerce / omni-channel offering.

These initiatives alongside V-Mart’s strong balance sheet (net debt to equity of -0.24 as of 31st Dec’20 and further strengthened by the recent ~Rs 375crores QIP) provide significant growth and market share gain opportunities for the company.

Regards

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/