Page’s promoters have used their experience in the Philippines to fortify Page’s moats around: a) product differentiation based on in-house manufacturing in a labour-intensive industry; b) aspirational brand recall using Caucasian models in high-impact advertising campaigns; and c) IT investments and control on the distribution channel to manage a wide spectrum of products. Whilst these moats have helped the firm deliver an exceptional track record, recent moderation in revenue growth momentum has raised investor concerns around the sustainability of healthy fundamentals in future. In this newsletter we highlight why Page’s competitive advantages are sustainable in the long run, and why we believe that the recent headwinds are unlikely to sustain.

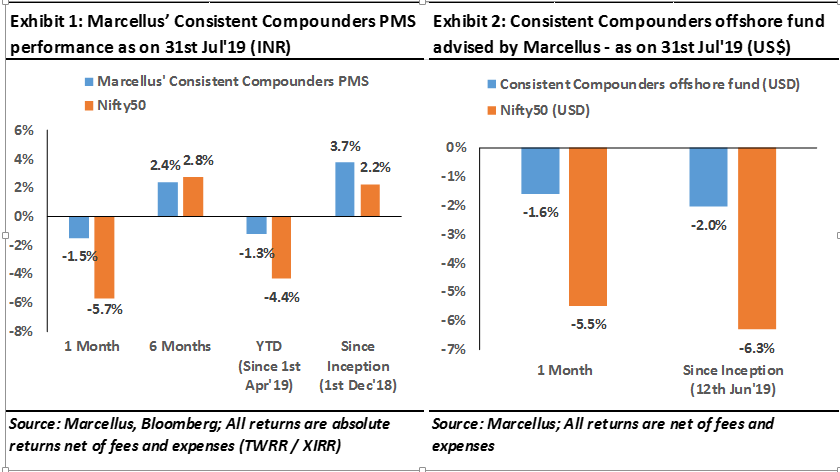

Performance update

We have a coverage universe of around 25 stocks, which have historically delivered a high degree of consistency in ROCE and revenue growth rates. Our research team of five analysts focuses on understanding the reasons why companies in our coverage universe have consistently delivered superior financial performance. Based on this understanding, we construct a concentrated portfolio of companies with an intended average holding period of stocks of 8-10 years or longer. The latest performance of our PMS and offshore fund (USD denominated) portfolios is shown in the charts below.

Page Industries is one of the larger allocations in our Consistent Compounders Portfolio (CCP). It’s share price has halved from its all-time high of Rs 36,000 per share achieved on 28th August 2018. This calendar year Page Industries has fallen by 28% and has been the weakest performing stock in our portfolio. Given this backdrop, many clients have asked us for our views on Page Industries and why we continue to hold it in our portfolio despite the ongoing weakness in its share price. In this month’s newsletter, we reiterate why we believe Page is a consistent compounder and why we have not reduced exposure to Page in our clients’ portfolios.

Innerwear industry’s product characteristics – what do consumers want?

“One would think that making innerwear isn’t rocket science. And given that innerwear is neither on display (at least not in India) when worn by users or widely spoken about in everyday conversation, the presumption would be that brand can’t possibly be that important. But think about this: comfort in innerwear is much more important than the clothes we wear above them. Innerwear also has to be strong and durable. As if all this wasn’t enough, difference in physiques, weather-related factors, consumer preferences of comfort in India are not entirely similar to those aboard. Consequently, the product design, fit and fabric composition of an undergarment stock keeping unit (SKU) has to be indigenized in order to be successful in India. This is a curse if you get it wrong and a boon if you get it right. If a consumer accepts a particular style and brand, it is highly likely that he will stick to it. Therefore, consistency of product quality and design over a period of time across geographies is critical for a brand to avoid losing a satisfied consumer. Finally, a steady stream of new products keeps distributors and retailers active and interested. Selling the same product year after year does get boring. The ‘feel good’ factor of consumer purchase in innerwear is driven by a combination of fresh introduction of designs across various sub-segments of innerwear, and fresh introduction of colours within existing styles. Very few clothing brands have got all of these factors right in India.” – from ‘The Unusual Billionaires’ by Saurabh Mukherjea (2016) (see the chapter on Page Industries).

Page Industries has the exclusive license to manufacture and sell Jockey branded innerwear and leisurewear (sleepwear / sportswear) products in India. Manufacturing and selling products in this segment broadly has four features:

Utility oriented products:

Utility, in innerwear, gets typically defined by durable, high-quality fabric and a comfortable fit. Successful products sold in the western world cannot be replicated in India because of the difference in weather conditions, physiques and usage habits. Fashion and luxury are not the primary aspects of innerwear consumption.

Loyalty based purchase:

There exists a broad spectrum of loyalty across products of frequent consumption. Customers of personal care products (soaps, face wash, body lotions, etc) feel bored of consuming the same SKU month after month. Hence, they remain open to experimenting with new offerings. However, customers of Maggi Noodles and infant formula milk do not shop-around once they have decided on their preferred SKU. Innerwear consumption is more like Maggi Noodles. Once the customers decide on the brand, style and size which feels most comfortable to them, they stick to the same product until it is readily available and continues to meet their utility criteria.

Labour intensive manufacturing:

Textile is perhaps the most labour intensive industry in India. Moreover, if a manufacturer uses R&D to indigenise product development, the workforce needs to be skillful and trained. Such a manufacturer cannot afford to have high attrition rates and hence outsource labour workforce.

Mom-and-pop hosiery stores:

Mom-and-pop hosiery stores (multi-brand) control the biggest share of innerwear sales in India. Ready availability of a customer’s preferred SKU at these shops is critical for a manufacturer to build loyalty with the customer. Moreover, most of these shops do NOT have a trial room, which further increases the loyalty component of a customer’s purchase.

What is Page’s offering to the end consumer?

Page offers to a consumer, a combination of the following four things:

- Product differentiation around comfort and durability;

- Affordable price points which are only 20-30% higher than the inferior quality economy products, and are 20-50% cheaper than similar quality products being offered by peers like Benetton, Fruit of the Loom, Hanes etc;

- Aspirational brand recall; and

- Widespread distribution with availability across 55,000 multi-brand outlets, large format stores (like Pantaloons, Lifestyle), over 650 exclusive brand outlets and an ecommerce channel (both on aggregator platforms like amazon.in as well as their own website www.jockeyindia.com).

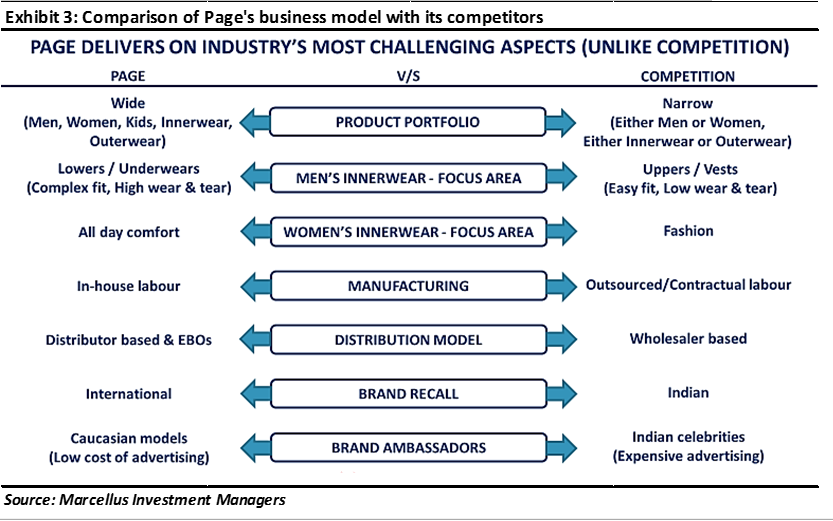

How is Page different from its competitors?

As highlighted in the chart below, in every aspect of its business – product range, manufacturing, distribution, branding – Page has chosen the more difficult route, which not only adds greater value to the end consumer, but also makes Page’s competitive advantages more sustainable and difficult to replicate.

For a deeper understanding of our view on Page’s secret sauce, please read the chapter on Page Industries in our book The Unusual Billionaires (2016).

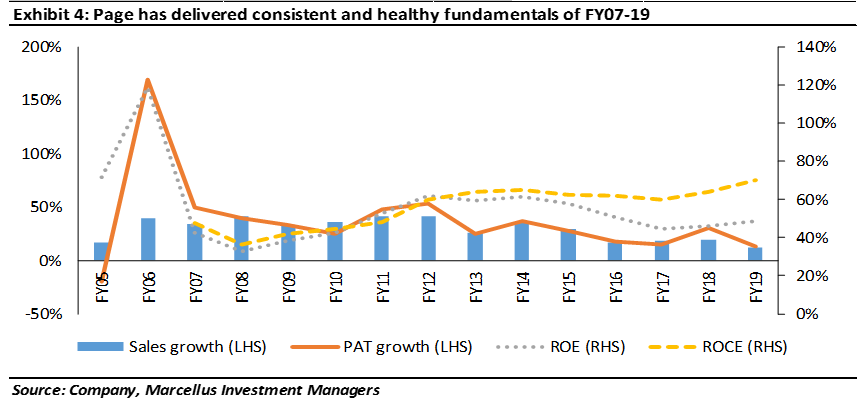

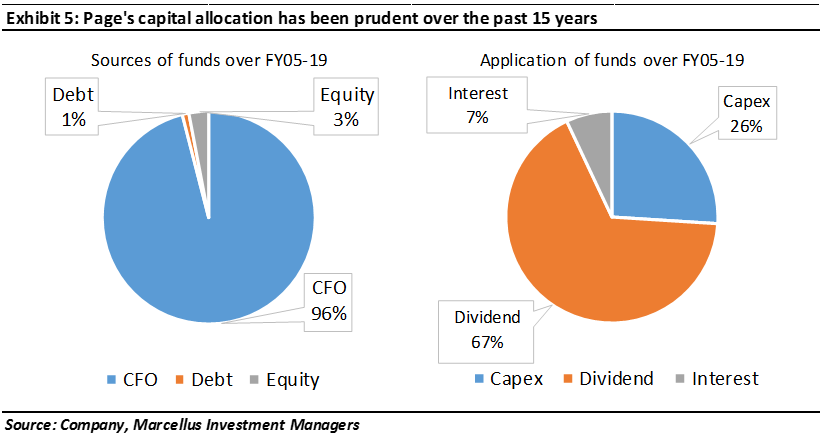

Page’s consistent historical track record

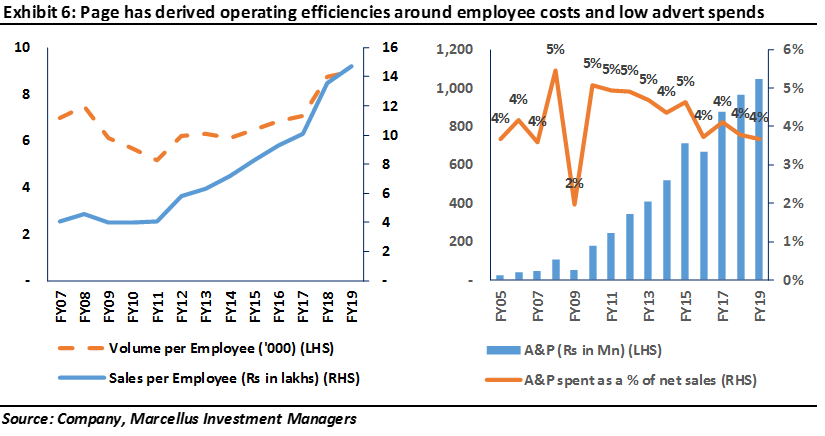

Thanks to the strength of the franchise as highlighted above, Page has delivered a very high degree of consistency in healthy fundamentals historically – see charts below. This has also been backed by high and rising efficiencies around labour management, advertising etc.

Headwinds / Investor concerns faced by Page in FY19

Concerns faced by investors in Page Industries over the past 12 months have included:

- Revenue growth moderated down to 12% in FY19 (vs 24% over FY13-18). Volume growth moderated down to 6% in FY19 (vs 14% over FY13-18). Hence, earnings growth rates moderated down to 13% in FY19 (vs 25% over FY13-18).

- Van Heusen (part of ABFRL) has reported revenues of Rs 200 crores in innerwear / leisurewear segments in FY19, up from less than Rs 50 crores in FY18.

- Page stopped reporting segmental volume and revenue growth rates on a quarterly basis. Management states that as Page grows in size and across several segments, such disclosures put the firm at a competitive disadvantage when Page is the only firm in its industry reporting such granularity.

- Shamir Genomal (son of Mr. Sunder Ashok Genomal) has risen through the ranks within five years, to become the deputy-MD of the firm.

Why have we not reduced our exposure to Page?

Based on our discussions with industry participants (distributors, suppliers, competitors), we believe that the issues faced by Page Industries are related more to the external-environment rather than being Page-specific, and are non-structural in nature because of the following factors:

-

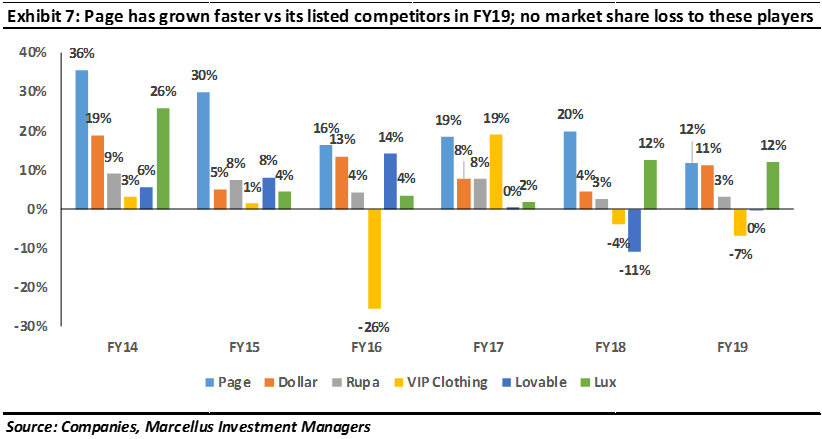

No market share loss to peers

like Rupa, VIP, Lux, Loveable, Dollar etc. Firstly, market share gains reported by new entrants like Van Heusen have been small (Van-Heusen’s incremental sales in FY19 are less than 5% of Page’s overall sales), and have been achieved on the back of unsustainable practices, such as buying significantly superior quality yarn at expensive prices and then relying on outsourced manufacturing to deliver a product priced at only 5-10% premium price point vs Jockey, offering products to distributors and dealers on a returnable basis, with higher channel margins etc. Secondly, firms like Dollar (unlike Page) have managed to grow their revenues in FY19 at the cost of a substantial increase in their receivable days (i.e. longer credit terms with distributors and wholesalers).

-

Moderation in industry’s growth rates is more a distribution-channel issue

rather than end-consumer demand issue. The textile industry’s distribution channel has been the worst affected by GST. Working capital finance available to the channel has also been constrained over the past 6-9 months.

No deterioration visible in the softer aspects of Page’s business

i.e. no issues around succession planning, complacency or talent attrition amongst senior management team. Page continues to make substantial investments in IT to manage the scale of operations and width of SKUs.

-

Corrective actions underway at Page

– changes made to the terms of trade with the distribution channel; significant thrust on EBO expansion and product portfolio expansion (kidswear, dri-fits etc); IT investments to get in touch with the end consumer.

Hence, we believe that the end consumer demand for Page’s products has moderated by a smaller extent compared to the revenue growth moderation reported by Page Industries over the past 12 months. The channel related issues faced by the textile industry seem likely to be resolved over the next 12 months, and as long as Indian middle-class household consumption growth continues, Page Industries is one of the better positioned players to capitalize on it.

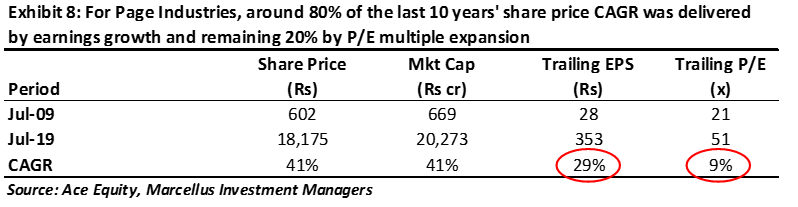

What about valuations when it still trades at 51x FY19 (trailing) P/E?

This is a valid question from a short term (less than 2 years of investment horizon) perspective. From a longer term (more than five years) perspective, as highlighted in our previous blogs and newsletters (Valuing longevity of healthy fundamentals; Value Investing-The Indian Challenge), the only relevant question to ask is “Will the earnings growth momentum sustain at a healthy level (let’s say more than 20% CAGR) consistently for the next decade or longer?”. If the answer to this question is “NO”, then such a stock is expensive even at half of its current P/E. On the other hand, if the answer to this question is “YES, earnings growth can sustain at 20% CAGR”, then P/E inflation or deflation will be an insignificant contributor towards delivering satisfactory shareholder returns, if invested at the current levels.

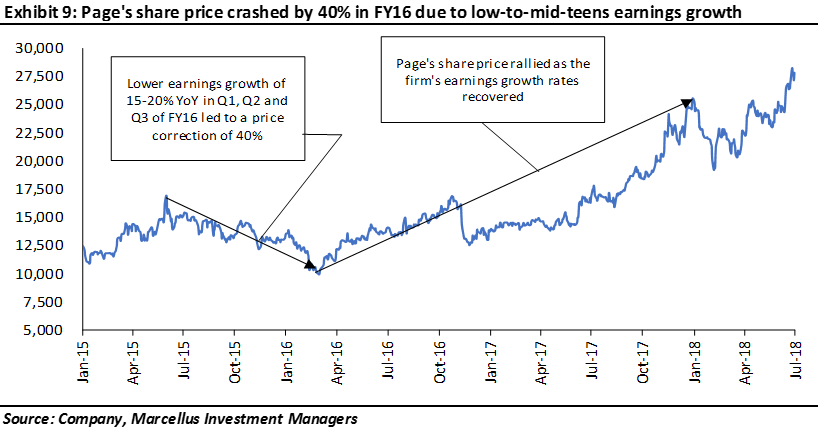

In the short term, any moderation in earnings growth rate of high-growth stocks like Page Industries tends to result in a significant volatility in its share price trajectory. For instance, the chart below shows the 40% drop in its share price witnessed in FY16 after the firm reported only 15%, 21%, 16%, earnings growth YoY in Q1, Q2, Q3 of FY16 (v/s 26%, 22%,29% reported in corresponding period in previous year) which was also followed by a reduction in the promoter’s shareholding to below 50%.

In the short term, any moderation in earnings growth rate of high-growth stocks like Page Industries tends to result in a significant volatility in its share price trajectory. For instance, the chart below shows the 40% drop in its share price witnessed in FY16 after the firm reported only 15%, 21%, 16%, earnings growth YoY in Q1, Q2, Q3 of FY16 (v/s 26%, 22%,29% reported in corresponding period in previous year) which was also followed by a reduction in the promoter’s shareholding to below 50%.

Regards

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/blog/

Note: the above material is neither investment research, nor investment advice. Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

Copyright © 2018 Marcellus Investment Managers Pvt Ltd, All rights reserved.