The frequency of disruptions faced by businesses has been rising over the past three decades. While most of these disruptions have been around technology, an event like Covid-19 will also be added to this list. While such events can potentially topple market leaders, Consistent Compounders use these events to disrupt their competitors. Key characteristics which allow Consistent Compounders to do so include: a) lack of complacency / lethargy; b) capital allocation to innovation; c) focus on systems & processes / tech investments; d) superior employee culture; and e) control on customers, distribution partners and manufacturing processes. Instead of speculating on who will be the leading stock/sector in this rally, we continue to follow the ‘low risk route to stupendous wealth’ with Consistent Compounders. In this newsletter, we have used one of our portfolio companies – Asian Paints – as a case study of potential disruption due to Covid-19.

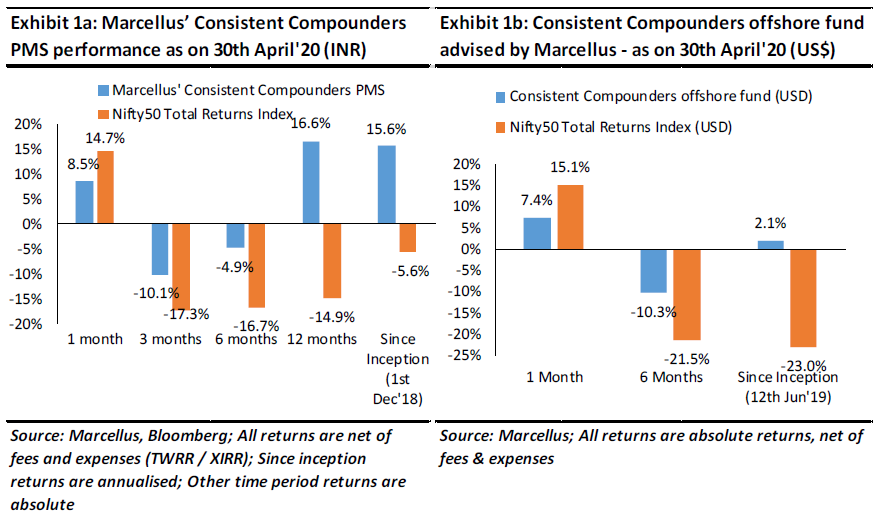

Performance update – as on 30th April 2020

We have a coverage universe of around 25 stocks, which have historically delivered a high degree of consistency in ROCE and revenue growth rates. Our research team of seven analysts focuses on understanding the reasons why companies in our coverage universe have consistently delivered superior financial performance. Based on this understanding, we construct a concentrated portfolio of companies with an intended average holding period of stocks of 8-10 years or longer. The latest performance of our PMS and offshore fund (USD denominated) portfolios is shown in the charts below.

The ongoing Covid-19 crisis and the associated lockdowns are likely to change some aspects of our lives as well as several businesses. Hence, it is logical for an investor in Marcellus’ Consistent Compounders PMS (CCP PMS) to ask the following question –

“Thanks to Covid-19, the way we lived the last 10 years might be totally different from the way we will live the next 10 years. Hence, why would companies that won the business battles of the last 10 years continue to be the companies that will win business battles in future? And hence why would the Consistent Compounders philosophy (which delivered healthy returns in the past) continue to deliver healthy returns in the future?”

Several great firms systematically slide to mediocrity…

Let us start with some data which supports the phrase ‘nothing lasts forever’. The Nifty50 Index churns by around 50% every decade. Hence, if a stock is in Nifty50 Index today, there is a 50% probability that it will NOT be in the index 10 years from now, and 75% probability that it will not be in the index 20 years from now. The tendency for large, successful companies to slide down the market cap spectrum is not confined to Nifty50. In most developed and emerging markets globally, 25-40% of the Index of large companies churns every decade. Firms like Polaroid and Xerox, once considered to be great companies, got disrupted over time.

Some of the reasons for destruction of greatness include: a) disruption of the product / service due to evolving technology or changing consumer habits; b) disruption of the distribution channel / marketing / supply chains; c) capital misallocation decisions by the company; d) change in management team or promoters of the firm; and e) drop in focus / rigor of the management team due to complacency or lethargy.

… while some great firms sustain greatness through evolutions and disruptions

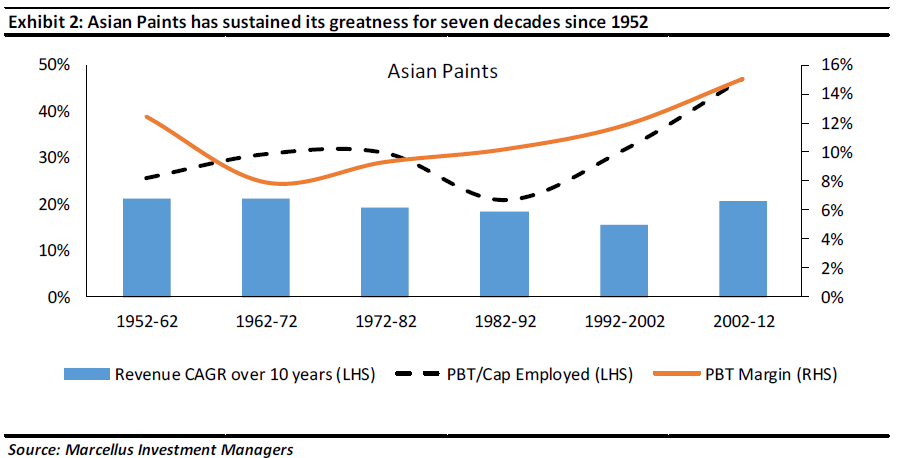

Consider the chart below – Asian Paints has sustained greatness (healthy growth and ROCE) and leadership in the paints industry for over seven decades now. These seven decades have included several events /phases of disruptions and evolutions in the external and internal environment that Asian Paints has faced – including the exit of Champaklal Choksey in 1997, one the four founders and the biggest contributor towards the DNA of Asian Paints (until that point). However, even in the post-Choksey era, Asian Paints continued to strengthen its dominance of the sector as well as its ROCE.

There are several other such companies in our portfolio – for instance, Pidilite has dominated the adhesives industry with ROCEs above 20% for more than four decades. HDFC Bank has dominated retail banking for over two decades now with 17-19% ROEs. Nestle India has dominated the infant foods and noodles space for over three decades with ROCEs higher than 40%.

Note: Our definition of greatness is not limited to dominant market share. There have been several firms in sectors such as airlines and telecom in India which have retained market leadership for 10-20 years in a row. Despite such dominance, the free cash flows (i.e. ROCE in excess of cost of capital) and earnings growth of these firms have been non-existent inspite of high market share.

A framework to pick leaders whose leadership will not be disrupted in the aftermath of Covid-19

There is a distinct possibility that Covid-19 will change many aspects of businesses & lifestyle. For instance, products and services in categories like travel & entertainment could get substituted by new ones. Customers might change the way they wish to interact with the product which could disrupt traditional ways of marketing and last-mile distribution. Similarly, supply chains, manufacturing processes, office infrastructure, etc could change in a few industries. Such disruptions / evolutions have already been impacting businesses with an increasing frequency over the past few decades, and Covid-19 could accelerate them further. We do not have the ability to foresee exactly how an industry or business or customer is likely to transition in future. Searching for companies that will disrupt an incumbent is an approach that is full of speculation and hence risk. Given our philosophy of crushing risk in our portfolio, we prefer to focus on existing leaders who are likely to disrupt / innovate in their businesses to ensure that their leadership cannot be challenged by a competitor.

The following simple framework can help filter out such likely winners from the ongoing crisis:

Focus on product categories which cannot be substituted easily:

Big ticket, discretionary and aspirational categories of consumption could be substituted more easily compared to small ticket, day-to-day essential products / services. Almost all products and services offered by Marcellus’ CCP constituents are small-ticket day to day essentials which can neither be cancelled in demand, nor can they be easily substituted by alternate products and services. There are no substitutes before or after Covid-19 for baby milk products, packaged foods, footwear, innerwear, cough syrups / pain killers / other OTC drugs, paints, adhesives, or small ticket retail lending. However, there can be disruptions which will redefine a winner in these products & services. Let us delve deeper into this point.

Focus on companies whose DNA is to disrupt rather than get disrupted:

Incumbents who are in a market leadership position before a crisis like Covid-19, are best positioned to innovate amidst disruption provided they have a combination of the following characteristics in their business:

Lack of complacency / lethargy:

“Loss of focus is what most worries Charlie (Munger) and me when we contemplate investing in businesses that in general look outstanding. All too often, we have seen value stagnate in the presence of hubris or of boredom that caused the attention of managers to wander.” – Warren Buffett’s 1996 annual letter to shareholders.

Most instances of disruption arise from either the leader missing out on the evolution of the business environment around him or the leader misallocating capital as he grows the business. A single-minded focus on the company’s business and its capital allocation are core virtues possessed by leaders who deliver long-term success through several decades.

High ROCEs and hence the ability to invest surplus capital towards innovation:

To begin with, greater operating efficiencies and high ROCEs are an outcome of strong competitive advantages that a firm possesses. More importantly, high ROCEs also provide a fountain of free cash flow that is available for reinvestment. In the normal course of business, this reinvestment can either go towards expanding manufacturing capacities or paying dividends to shareholders. However, a leader with the DNA to disrupt also consistently invests some of this surplus cash flow towards initiatives which can help disrupt the competition.

Superior systems and processes / tech investments:

An event like Covid-19 will certainly favour companies with greater process automation and better tech investments in areas of raw material procurement, manufacturing, demand forecasting and supply chain management. The lower the reliance on adhoc processes and hence on labour, the greater is the resilience of such a business.

Stronger control on customers, distribution infrastructure & manufacturing infrastructure:

Within the same industry there are businesses which are structured differently relative to their competitors. In-house manufacturing with an in-house workforce is likely to be better positioned than outsourced manufacturing with a contract labour workforce especially at a time when contract laborers have migrated to their villages during the lockdown. Fully owned distribution channels are better than distribution via exclusive distributors, which in turn is better than distribution via wholesalers because distributors can be provided working capital support during the crisis whilst wholesalers might not be able to survive through the crisis given the working capital challenges they face. Tech-systems or sales teams directly collecting data on the end consumer/point of sale are better positioned than reliance on a channel partner to help understand the evolution of the end-consumer.

Superior employee culture and HR practices:

A strong employee culture helps execute operating efficiencies at the ground level consistently over time. Empowerment of professionals helps an organization scale up without size becoming an impediment against growth. Following the disruption of Covid-19, such characteristics around employee culture will help great businesses execute the transition to the new normal successfully with all stakeholders of the business – customers, marketing partners, distribution partners, manufacturing setups, vendors etc.

In our March newsletter (click here), we explained how ALL companies in our portfolio are better positioned during the Covid-19 crisis compared to their competitors due to a combination of: a) working capital support provided to their channel partners while competitors don’t have enough balance sheet strength to provide such support; b) ability to get their products in front of their customers as soon as the lockdown is lifted due to in-house manufacturing and strong control on distribution; and c) surplus capital available from FY20’s corporate tax rate cut which can be used to further suffocate competition. Let us now consider a case study on the possibility of disruption in the aftermath of the Covid-19 crisis.

Case study – Asian Paints – the DNA to disrupt rather than get disrupted

Over the past few decades, Asian Paints has disrupted the paints industry in several ways. Firstly, in the 1950s and 1960s, the firm removed channel partners like distributors and wholesalers from its distribution channel; hence today, decorative paints is the only mass market category where the manufacturer directly reaches 70,000+ points of sale (paint dealers), without any channel intermediation. Secondly, the price at which a paint dealer sells Asian Paints’ products to a painter / contractor leaves only 3-5% average margin with the dealer. Hence, in order make a healthy ROI (returns on invested capital), the paint dealer requires high inventory turns, which is the biggest area of differentiation between Asian Paints and its competitors. Asian Paints has built its strengths around demand forecasting using its technology investments, which then helps it deliver a voluminous product (paints are at least 7-10x more voluminous vs FMCG products), directly to 70,000+ dealers, 3-4 times every day. Thirdly, Asian Paints has kept product price hikes to a bare minimum – less than 3% CAGR over the past two decades! This is because Asian Paints keeps extracting incremental operating efficiencies by investing in technology and in building systems and processes (here are some examples highlighted on Cognizant’s, ABB’s and Sight Machine’s website). Without access to such operating efficiencies, several paint manufacturers have found it difficult to survive in India and this has helped Asian Paints consolidate market share very substantially.

So, what is the future of India’s decorative paints industry and within that, what is the future of Asian Paints’ leadership in the aftermath of the Covid-19 crisis? To begin with, paints demand cannot be easily substituted by other products (Asian Paints is already amongst the leading wallpaper manufacturers with their brand Nilaya). 80-85% of decorative paints demand in India is repainting of households where each household has a certain repainting cycle. Demand for interior paints are at the risk of being deferred as, given the Covid-19 crisis, consumers might take a few months before they feel comfortable about inviting labour into their homes. If a household was scheduled to get their interior walls painted during the summer of 2020, it is likely that they will delay this paint project by few months. However, it is unlikely that they will get their walls painted at the end of the next cycle i.e. 7-8 years later. Also, those households which were scheduled to get their walls painted in 2021, will perhaps not defer their paint projects. Hence, during a 12-18 months period after the lockdown, we are likely to see pent-up demand from lockdown-affected households along with normal demand from the 2021-scheduled households, and hence a deferment (instead of a cancellation) of demand due to the lockdown.

Whilst we cannot foresee exactly how the sector will evolve / get disrupted over the next 3-5 years, there are some very interesting observations which could guide towards an answer to this question. As highlighted in this article (click here), Asian Paints has been providing direct cash transfer into the bank accounts of over 40,000 contractors across the country (in fact, a press article on Berger (click here) gives some indication on the quantum of these cash transfers). During our recent channel checks, we were told by some dealers that for the first time in history, Asian Paints has relaxed credit terms for payment to the company. They have given extra credit of 45 days to the dealers with a 2% discount available on the payment if made within these extra 45 days. The firm is also providing a comprehensive Covid-19 insurance coverage to people working inside a dealer’s shop and to contractors / painters attached to some of these dealers. Once the lockdown has been lifted, Asian Paints will provide free sanitization of dealers’ shops. Competitors like Akzo Nobel, Kansai Nerolac and smaller organized or unorganized players are either not providing such support to the channel partners or are providing some of this support on a chargeable basis. Also, Asian Paints’ dealers have also been informed that the firm has finalized (but not yet disclosed) on ‘many areas of new products and painting services’ which will benefit the consumer. Now, let’s delve deeper into this.

The paints sector in India has undergone a transition over the past few decades. As mentioned above, Asian Paints has limited product price hikes to less than 3% CAGR. In a typical paint project at a household level, a customer pays for two things – the paint material and labor. While the paint material cost has gone up at a CAGR of less than 3%, labour cost has increase at a much higher rate of 8-10% CAGR. This in turn has meant that today on average, 65% of a paint project cost in India is labour, up from ~20% two decades ago. This transition calls for a possibility to drive market share in the industry by offering a value-added labor experience to a household in exchange for a labour-intensive composition of the current project cost. In order to use this transition as a source of disruption, Asian Paints has spent more than a decade in establishing value-added labour-oriented offerings like Asian Paints Home solutions, Water Proofing solutions, Color consultancies, etc. Moreover, the firm has indigenized mechanized solutions (express-painting solutions) which are used by labor workforce to execute these paint projects in less than half the time it otherwise takes painters via manual painting processes. There might also be a possibility that Asian Paints could offer such mechanized solutions in a DIY format to customers directly.

Asian Paints has already spent more than a decade to get greater control on offering value-adds via the applicator (i.e. the painter or contractor) involved in the paint project. With Covid-19 being a disruption which will increase the focus of a household on the applicator’s hygiene and on the time it takes to get a house painted, Asian Paints could yet again be the best positioned paint company to disrupt the paints industry and deepen its competitive advantages further in the aftermath of this crisis. We don’t yet see the Indian decorative paints industry being disrupted in a manner which will change the leadership of this industry. It appears to us that the leader – Asian Paints – has prepared for a long time for the disruption we are seeing today.

Investment implications

There are two ways to invest in companies which win by disrupting an industry – a) invest in a newcomer who will disrupt; or b) invest in an incumbent leader who will disrupt (and will hence maintain leadership by not allowing a newcomer to enter). Whilst many industries will see the former type of disruption, we prefer to stick to the latter because of the low risk involved in adopting this approach. For instance, if blockchain is a future disruption, rather than speculating on which new technology firm will create the blockchain disruption, we would prefer to invest in Asian Paints and HDFC Bank if these are two of the companies which will use the blockchain technology to disrupt their competition. Similarly, instead of investing in a new set of companies in the aftermath of Covid-19 crisis, we would rather invest with Consistent Compounders who are likely to retain their leadership in the post-Covid world by disrupting their competitors.

Regards

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this email in any shape or form. Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.