Longevity of free cashflow compounding is the most undervalued aspect of a high-quality stock. Besides strength of the existing business, the sources of longevity for a business include incremental reinvestment in areas which will deliver cashflows beyond the next 3-5 years, and the institutionalization of strategy and business execution. In the recent past, most CCP companies have: a) accelerated investments around technology with an aim to reinforce the sustainability of their pricing power; and b) made further progress around ‘building an institution’ through decentralization of processes and incentivization / empowerment of high quality professionals. In this newsletter, we have given examples of such initiatives taken by some of our CCP portfolio companies (like Asian Paints, Page Industries and Bajaj Finance).

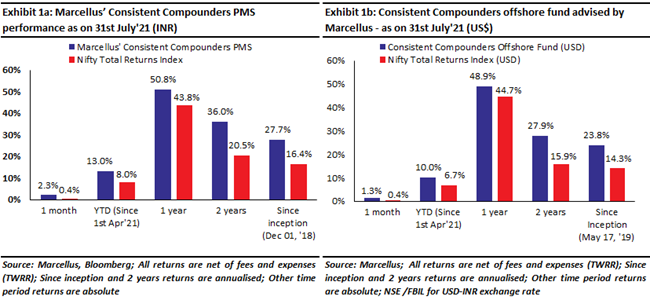

Performance update – as on 31st July 2021

We have a coverage universe of around 25 stocks, which have historically delivered a high degree of consistency in ROCE and revenue growth rates. Our research team of eleven analysts focuses on understanding the reasons why companies in our coverage universe have consistently delivered superior financial performance. Based on this understanding, we construct a concentrated portfolio of companies with an intended average holding period of stocks of 8-10 years or longer. The latest performance of our PMS and offshore fund (USD denominated) portfolios is shown in the charts below.

Some of the common themes in FY21 annual reports of CCP companies

In our January 2020 newsletter (The conventional DCF method undervalues longevity of a business) we had explained that one of the most undervalued aspects of the valuation of a great quality business is the longevity of its healthy free cashflow compounding.

Two important tools in Marcellus’ proprietary longevity assessment process include the lethargy framework (discussed in our 1 August 2020 newsletter) and the succession planning framework (discussed in our 1st September 2020 newsletter). The lethargy framework analyses capital reinvestment initiatives being adopted by the firm to deepen its existing competitive advantages over the next 3-4 years, add new revenue growth drivers to the business every 5-7 years, and radically disrupt its own industry over the next 10 years. The succession planning framework tracks softer aspects such as institutionalization of the business at different levels i.e. decentralization of decision making amongst members of the Board, CXOs, as well as ground level execution through systems and processes.

Annual Reports are one of many sources of data which contribute to our lethargy and succession planning frameworks. There have been two themes common in the FY21 annual reports of several of our portfolio companies:

- Reinvestment of surplus cashflows on tech-oriented initiatives with a focus on using tech to radically disrupt their own industry in addition to using tech to enhance operating efficiencies.

- HR related initiatives towards further incentivizing and empowering professionals and hence build an ‘institution’.

We discuss these attributes with some examples from FY21 annual reports of Asian Paints (click here for a marked-up version of the annual report) and Page Industries (click here for a marked up version).

Technology investments to incrementally strengthen competitive advantages

In our 2nd October 2020 newsletter (The Role of Technology in Consistent Compounding), we had highlighted that companies which have consistently innovated over longer periods of time have combined tech initiatives using a recipe that is heavy on intangibles and difficult to replicate. It is this recipe which enables consistent compounding over long periods of time despite several disruptions in the external as well as internal environment of a firm.

Examples from Asian Paints’ FY21 annual report (text in italics has been quoted from the annual report): Asian Paints (APNT) spent Rs 83 crores on Research & Development and invested Rs 42 crores on Information Technology in FY21. In our 1st May 2020 newsletter, we had highlighted that with labour costs contributing to more than two-thirds paint projects at a household level, Asian Paints’ attempts to offer value added labour / experience to the customer could redefine (i.e. radically disrupt) the drivers of market share in the paints industry. The firm’s latest annual reports shows that it is taken several strides forward in this regard.

One of the key focus areas for use of technology in FY21 has been the Home Décor business. This includes an omnichannel model to offer design ideas to customers through digital properties such as www.beautifulhomes.com and an expanding network of AP Homes stores. “All (AP Homes) stores are using digital technology to provide consultation to consumers and have rapidly enhanced their fulfilment capability through the paint total service and the décor execution service offered at these stores.” This channel offers state-of-the-art 3D visualisation platform with physical displays, not just for paints but for a complete décor product range that covers custom-design-to execution furniture, furnishings, lightings, customised tiles, full-modular kitchens to bath and sanitary products.

Asian Paints engaged with a start-up to create a tool to visualise the design implementation and by incorporating an algorithm, has launched the Design Visualization Tool for customers to plan their home décor architecture and design. A key differentiator in these offerings has been the flexibility offered to the consumer to make modifications and see digital customization of how her home might look.

Asian Paints also launched the Beautiful Homes Service (BHS), a ‘custom-design-to-execution’ service across eight top cities, with the aim of expanding to many more such centres. The firm partnered with multiple designers, architects, and end-delivery contractors as part of BHS to offer end-to-end services – from personalised interior design to professional execution. “This AI-driven platform would help bring in seamlessness and personalisation between the physical store and digital journeys of the Home Décor customer. Asian Paints has deployed cutting-edge digital technology on the retailing front to not just providing engaging experiences in selecting the right colours, paint, products, services, contractors, but also in ensuring authentic and genuine products are delivered by the anti-counterfeiting systems and processes”.

Supply chain efficiencies have historically been the biggest driver of competitive advantage for Asian Paints. The FY21 annual report suggests further progress was made in this domain. “We continue to treat data as a strategic asset and have deployed many projects using the power of AI/ML in analytics. A recommendation engine power of new-age algorithms has been deployed to help dealers select the right schemes/products while placing the orders on the self-service digital channels”…. “Further invested in advanced Machine Learning algorithms for demand forecasting. In a world of flux, having an agile and responsive supply chain will be key to determining which companies will be able to serve ever-changing customer needs. To fulfil this objective, our Company has embarked on the deployment of the latest solutions in areas of advanced supply chain visibility and execution by partnering with leading software vendors in this space”… “a completely automated warehouse in one location integrated with the S/4 HANA Extended Warehouse Management Systems.” … “Our logistics distribution network is designed to ensure benchmark service levels in terms of Order Fill Rates and Order Cycle Times to our dealer network. We constantly use advanced algorithms that allow us to improve our demand forecasting, inventory planning, distribution planning and transportation planning thereby making our distribution network cost efficient.”

On the manufacturing front, incremental operating efficiencies have been one of the biggest reasons for why Asian Paints hasn’t needed to take significant price hikes over the past few decades. In FY21, the firm implemented further automation in manufacturing. “We have focused on automation to improve the accuracy of our production processes and deliver consistency throughout our manufacturing process and reduce waste. Our plants use Industry 4.0 technology capability which allows us to operate, monitor and optimize our manufacturing processes through effective use of data gathered at each step of our manufacturing process. We introduced a robust automated data analytics system across our plants. We have analysed data flowing through our state-of-the-art Manufacturing Execution System (MES) and a Distributed Control System (DCS). Each of our machines has sensors that provide us with valuable feedback on accuracy of material additions, adherence to recipe parameters, etc, which help us optimise our manufacturing practices to best suit our cost reduction objectives and manufacturing excellence. This has resulted in real business impact in terms of machine cycle time reduction, energy cost savings, and material cost savings by improving accuracy of additions.”. Low quantum of price increases, thanks to incremental operating efficiencies, makes it difficult for Asian Paints’ competitors get much joy out of price wars or aggressive channel incentives, thereby supporting market share gains and profitability for Asian Paints.

On the Research & Development front, there is a lot of discussion on chemistry-led R&D in the FY21 annual report. Asian Paints’ focus on R&D has been increasing over last 4-5 years after the firm constituted the Technology Council in FY15 (a council consisting of experts/scientists/academia/internal people) to guide the R&D process. The R&D team consists of 200+ scientists on Asian Paints’ payroll, who have published six research papers in FY21 in national and international journals. 14 patents were granted and 20 patents were filed during FY21, including three for industrial paints and two for global operations. The cumulative patent filing count is 76 for Asian Paints of which 22 have been granted and a commercialisation percentage of 26%. Of the 76 patents filed, roughly 50% have been filed in FY20 and FY21. Some of the key benefits of Asian Paints’ R&D initiatives include: (a) substantial savings in raw materials – the R&D team works with vendors and the Joint Value Creation team to find alternate suppliers and raw materials to the make the products cost efficient; and (b) some key products developed in new product categories, including a water-based synthetic resin adhesive called TrueGrip Dynamo, DIY range of products branded as Asian Paints ezyCR8, etc.

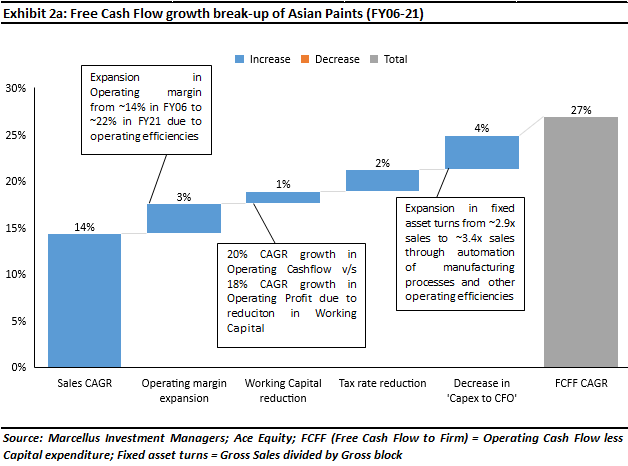

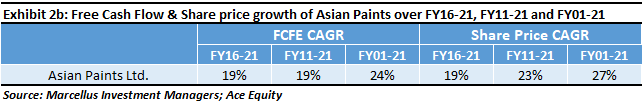

There is also plenty of focus in the Annual Report on Free Cashflow generation through working capital compression and asset turns expansion. “Efficient debtors and inventory management measures have consistently driven strong cash flow generation over the years. The approach is to generate adequate demand in the market so that dealers can rotate their inventory faster and thus operate on a lower credit period with Asian Paints and to increase the credit granted by creditors. The latter is done by leveraging our long-term relationships with vendors and suppliers built on a solid foundation of trust through timely repayment of dues. On the inventory management front, we focused on reducing generation of dead, damaged and defective materials”. Strong focus on generating growth in free cashflows is the key reason why Asian Paints has delivered 24% FCFE CAGR over the past 20 years, including healthy 19% FCFE CAGR over FY16-21, a five year period adversely affected by several macro disruptions like demonetization, GST introduction, the Covid crisis and hence an overall weak economic growth.

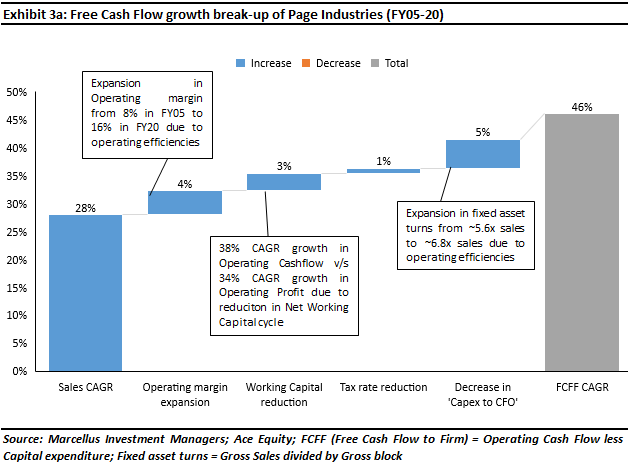

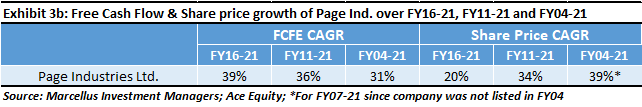

Examples from Page Industries’ FY21 annual report (text in italics has been quoted from the annual report): Given the varied sizes and styles of innerwear and outerwear apparel across mens, womens and kids offerings, Page manufactures and sells a wide range of SKUs across the country. In this context, investments in technology are key to scaling up the business without compromising on its free cashflow generation. Over the past three years, Page has transformed its IT infrastructure and its systems and processes across all its functions. For example, our channel checks suggest that Page has provided handheld devices to the sales team of its distributors and has enabled auto-replenishment systems for restocking of inventory. The FY21 annual report suggests further steps have been taken towards technology adoption.

In FY21, Page setup a smart distribution center for finished goods. “The Company has also embarked on its journey with 3PL Warehouse Outsourcing model with one of the trusted partner – DHL at Attibele- Anekal MCS facility. It is catering to both our E-commerce & Channel Distribution business requirements. Spread across 2 Lakh Sft., the warehouses are built with best-in-class infrastructure at par with global industry standards. This is (i) Company’s first mechatronic warehouse for Channel Distribution with minimal human intervention through seamless integration of processes & technology implementation; and (ii) Best in class E-com warehousing model to cater seamless order processing with focus on service quality and speed to market along with improved inventory accuracy and productivity.”

As part of its progress through digitization, Page is upgrading its enterprise planning tool to ‘BlueYonder’ (formerly known as JDA). “With this, our agility and nimbleness in various areas of demand forecasting, customer responsiveness, improved fulfillment, productivity improvement, cost improvement and inventory optimization shall be a reality.”

On the manufacturing front, Page has successfully completed piloting the digital factory initiative in its Hassan facility. “With this initiative we can have real time data, interventions and multi-tier reports on key manufacturing activities like skill deployment, WIP management, efficiency tracking, online inventory management, skill inventory initiatives, down time tracking and reduction.” Separately, the firm has continued upgrading and modernizing the machines used in its manufacturing plants in areas such as: a) kids socks manufacturing machines with auto toe-link technology for a seamless toe line; b) best in class auto-cutter etc.

|

|