OVERVIEW

I hadn’t heard of Brad Jacobs until Marcellus’ Global Compounders team invested in his latest NYSE-listed venture, QXO. I then learnt that Mr Jacobs has created EIGHT multi-billion dollar businesses in run-of-the-mill industries i.e. he’s not your typical tech mogul doing disruptive things.

Six of the eight companies Mr Jacobs has created are publicly traded: QXO (2024); XPO (2011) and its spin-offs, GXO Logistics (2021) and RXO (2022); United Rentals (1997); and United Waste Systems, now Waste Management (1989).

During his career he has completed over 500 M&A transactions and created tens of billions of dollars of shareholder value. Yet, this Brown University dropout maintains a low profile inspite of being worth $15bn and authoring a bestseller (aptly titled “How to Make a Few Billion Dollars?”).

So, one afternoon – while the INR continued its steady fall against the USD – I decided to watch a few interviews of Mr Jacobs. Here is what I learnt about his methods:

- Get the major long-term trend right. “If you the get big trend right, the chances are pretty high you will get a good outcome even if you get the smaller stuff wrong….A big part of my career has been M&A i.e. identifying big industries, then identifying big & basic trends in these industries such as strong growth. Then I look for fragmentation in such industries. Then I try to understand whether there are economies of scale. If there are, then I try to understand whether tech can be used by me to improve profitability. If all of these boxes are ticked, then I look for attractively valued acquisition opportunities.”

- Do what you are really, really good at. “I am good at identifying which industries which are fragmented, growing at a decent rate and have companies which are available at decent valuations. These industries which are likely to undergo consolidation. I have a toolkit which I can apply to these industries…I look for industries which are NOT on the cutting edge of tech. I look for industries which AI is NOT going to disrupt in the future. Eg. Garbage, construction, logistics. I then put together an amazing team of smart people. I then give the team tons of equity but the equity cannot be sold in the first 5 years…My main job is to buy companies at reasonable prices and then improve the companies. These are the two main things we are good at.”

- My teams disagree and argue with me and with each other. “We look at things from different angles. We use trial & error, experimentation and A/B testing to attack a new industry. We then figure out what is right. This culture of ours is super-organised and very powerful. We then improve pricing, tech, HR, procurement….everything from A to Z. We double the acquired company’s EBITDA in 3-5 years by applying the playbook….We have a team which knows how to execute on this.”

- 90% of what I think about is ‘work’. “I work 7 days a week…Being absorbed in work helps me lose track of time. I am in ‘flow’ when I am working….Mediocrity is always invisible until passion shows up and exposes it….We buy good companies and make them better by putting in good tech (which frees up staff to use their time more usefully), by incenting the sales team better, by improving product pricing, by bringing in great talent, by aligning the compensation…I prepare diligently for internal meetings and my colleagues and I use an app to share pre-read materials and we raise questions (on the app) BEFORE the meeting…the questions are usually centred on how can we deliver more shareholder value from what we are doing. We then debate the questions during the meeting. Then I send back out the takeaways (using the app) to my colleagues and we then rank the takeaways. We then action the highest ranked takeaways. We do this over 10 hours without any breaks. That’s how I run the business…This creates a space for us to be open minded, to be wrong, to be challenged.”

- Business is all about dealing with problems and solving problems. “You cannot be glum about the problems you face in your business life because solving problems is what business is about. You have to embrace problems. You to have run towards the fire. The world is not perfect and that’s what creates opportunities. We are the children of imperfection. Don’t expect things to be perfect. We need to reduce demands on ourselves and our colleagues to be perfect. Don’t fight with reality because reality always wins.”

- Multiple failures are par for the course: “Before the companies that people now associate with me, I went through several ventures in the seventies and eighties that did not work. There was a time when I was almost wiped out financially. I had to start again from a very low base and rebuild my confidence and methods step by step. That period taught me emotional detachment, the importance of looking at facts without shame and the need to make progress through small, simple actions. Many of the systems I use today were shaped in those years when things were going wrong, including my focus on preparation, checklists, and disciplined review. I also learnt that most people fail not because they lack ability but because they quit too early when a business hits a difficult stretch. Sticking with the problem is often the difference between failure and success.”

- We are born with a schema, a prism through which we see life. “If you have colleagues who have a negative schema which keeps telling you that ‘I am no good at this…I am faking it, I am doing a bad job, people don’t respect me….’ then – as a leader – you need to first validate that schema and then dispute it. Tell the colleague that this negative self-talk is a complete waste of time. Tell them that ‘You have a big job. It is a tough job and hence you are not getting everything right but that’s par for the course. Don’t catastrophise about yourself. Get on with solving the problems because that’s what business is about.’”

- Life in general is about building context, seeing things relative to other things. “Go backwards and forwards in time in your mind and you will realise that you are insignificant. At the same time, you will realise that you are a part of a bigger reality. Use this mental model to stay centred. One of life’s missions is to find that centre and stay in the centre. If negativity creeps into your life, use meditation and mental simulations (going backwards and forwards in time) to get back to the centre.”

- Don’t expect everyone to like you and respect you. “Don’t expect your stock price to go up all the time. That’s not reality. If people say bad stuff about you then it is possible that there is room for you to improve and it is also possible that other people are imposing their reality on you. If it is the latter then other people’s point of view does not matter unless we decide to magnify it and catastrophise about it.”

- Our exit strategy is death. “I want to do deals until I die. The best professionals don’t work for money. The work because they love their work. You want people in your team who share that passion, that love for work….I am always interacting with my CHRO and making sure that people are happy and motivated. Most of my time is spent on looking after our people and dealing with people issues…it is all about the people. You cannot achieve excellence in anything without top quality, happy people….I want all ‘A-players’ around me. My team and I spend a lot of time with each other and it is important that we like each other. It is all about the people….I want to work with people who are smarter than me. I want people for whom work is a big part of their life. I want people who are unbalanced with regards to their desire to work.”

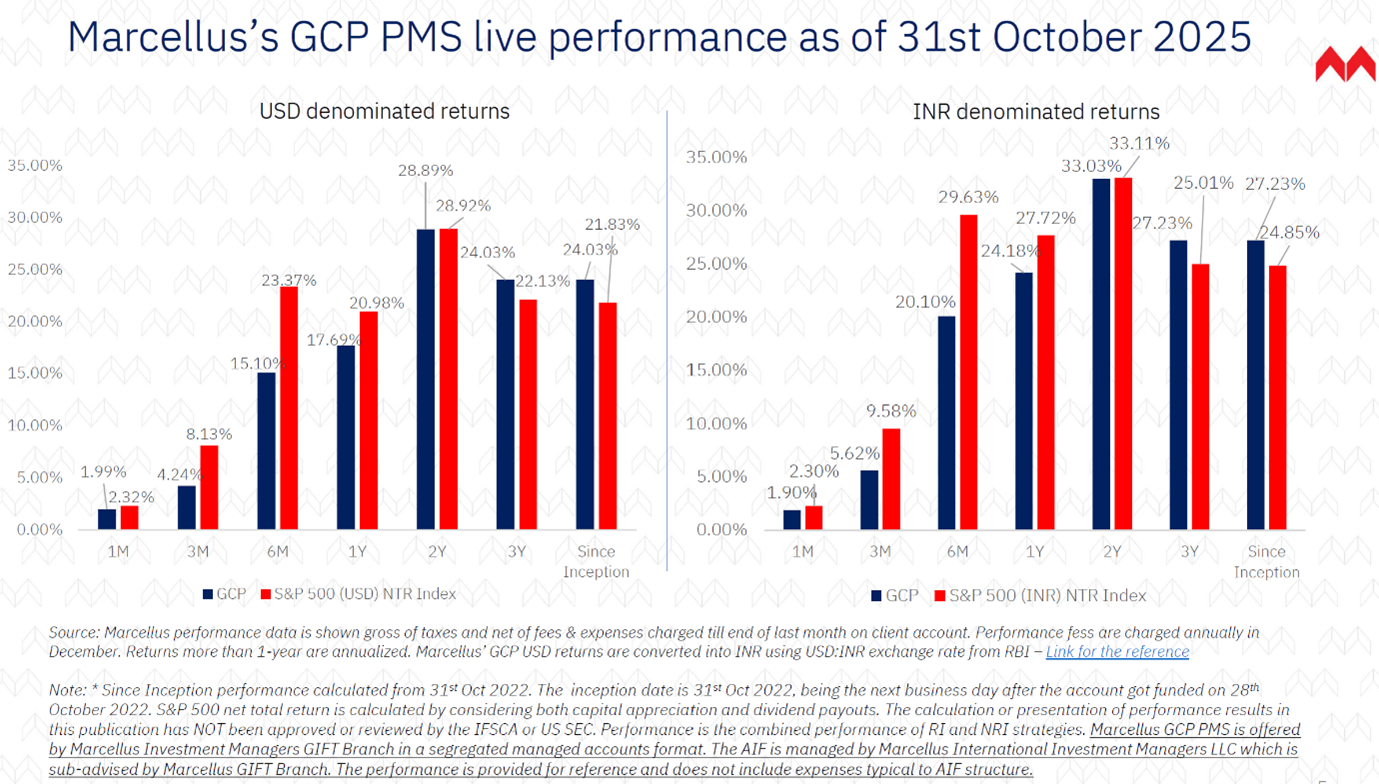

In case you would like to join us in investing in the world’s most powerful compounding machines in USA, Canada, Sweden, Holland, France and Taiwan, please let us know. Since inception in Oct ’22, we have compounded at 27% CAGR (net of all fees and costs). More details on our performance are given in the chart below.

Thanks

Saurabh Mukherjea

Sources:

Founders podcasts with David Senra: Brad Jacobs, QXO, XPO, United Rentals & United Waste | David Senra;

Goldman Sachs podcast: XPO Executive Chairman Brad Jacobs on building billion-dollar companies | Goldman Sachs;

Shane Parrish podcast: https://fs.blog/knowledge-project-podcast/brad-jacobs/;

Becky Quick Interview: https://www.youtube.com/watch?v=1bYNCE3sn9I;

Economic Club of New York interview: https://www.youtube.com/watch?v=1bYNCE3sn9I

The above material is neither investment research, nor investment advice. Info Edge (Naukri), forms part of Marcellus’ Portfolios. We as Marcellus, our immediate relatives and our clients may have interest and stakes in the mentioned stock. The stock mentioned is for educational purposes only and not recommendatory. Marcellus does not seek payment for or business from this material/email in any shape or form. Marcellus Investment Managers Private Limited (“Marcellus”) is regulated by the Securities and Exchange Board of India (“SEBI”) as a provider of Portfolio Management Services. Marcellus is also a US Securities & Exchange Commission (“US SEC”) registered Investment Advisor. No content of this publication including the performance related information is verified by SEBI or US SEC. If any recipient or reader of this material is based outside India and USA, please note that Marcellus may not be regulated in such jurisdiction and this material is not a solicitation to use Marcellus’s services. All recipients of this material must before dealing and or transacting in any of the products and services referred to in this material must make their own investigation, seek appropriate professional advice. This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. No liability whatsoever is assumed by Marcellus as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus may be unable to exercise control or ensure or guarantee the integrity of the text of the material/email message and the text is not warranted as to its completeness and accuracy. The material, names and branding of the investment style do not provide any impression or a claim that these products/strategies achieve the respective objectives. Further, past performance is not indicative of future results. Marcellus and/or its associates, the authors of this material (including their relatives) may have financial interest by way of investments in the companies covered in this material. Marcellus does not receive compensation from the companies for their coverage in this material. Marcellus does not provide any market making service to any company covered in this material. In the past 12 months, Marcellus and its associates have never i) managed or co-managed any public offering of securities; ii) have not offered investment banking or merchant banking or brokerage services; or iii) have received any compensation or other benefits from the company or third party in connection with this coverage. Authors of this material have never served the companies in a capacity of a director, officer, or an employee. This material may contain confidential or proprietary information and user shall take prior written consent from Marcellus before any reproduction in any form.