OVERVIEW

“He taught us that in order to find the best investment opportunities, you must open your mind to all possibilities around the world.” – Mark Mobius on his mentor, Sir John Templeton

Sir John Templeton (Source: John Templeton Foundation)

Our brain’s craving for dopamine makes diversification really hard. If you have made money on an investment – say, buying a flat in Mumbai which has doubled in value over the past decade – your brain wants to enjoy the pleasure of buying another flat (and then watching its price go up) again. Perhaps, you will be able to persuade yourself to buy a flat in some other Indian city such as Bangalore or Gurgaon. But, unless you are a highly trained investor, you will find it hard to invest in an asset which has low correlation with original asset on which you made a killing. The brain does NOT get an instinctive thrill from investing in low correlation assets (also called ‘diversification’). Even the great Warren Buffett primarily invested in a single asset class (equities) in a single country (America).

The human tendency to ‘rinse & repeat’ the same investment again and again with minor variations has been given pride of place by some investment gurus who call it “sticking to your circle of competence.” When retail investors do this it is called “home country” bias.

This rich body of thought that you should stick to investing in a single asset class in a single country (eg. Indian equities), led me to ask myself, “Who was the first investor to break the mould and invest in equities across the world?”

My research suggests that the first investor to investor globally on a serious scale was the legendary American investor Sir John Templeton (1912-2008) who was as renowned in his heyday as Warren Buffett is today, for his success in reading the world’s stock markets (2).

Born in 1912 in the small Tennessee town of Winchester, near Chattanooga, Templeton’s upbringing and formative years played an important role in shaping the principles which defined his very successful investing career. By the time he retired at the end of the 20th century, Sir John has become a billionaire “by pioneering the use of globally diversified mutual funds. His Templeton Growth Fund, Ltd., established in 1954, was among the first American firms to invest in Japan starting in the mid-1960s…” (3)

Here is a summary of the great man’s remarkable career as described by The Guardian:

“His father Harvey, a committed Presbyterian, was the town lawyer who also sold real estate. His office was within earshot of the courthouse, where auctions of bankrupt farms were held, so he was well placed to step in when they failed to make their price.

Templeton was the first from his town to go to college. He chose Yale, after teaching himself and his classmates the maths that his school was unable to provide. But a year in, his father, battered by the Depression, could no longer pay the fees. He worked his way through, partly with his winnings at poker. It was at Yale that he first rubbed shoulders with wealthy investors.

After a Rhodes scholarship at Oxford he spent seven formative months and £90 travelling the world with a friend before moving to New York in 1937 as an investment adviser. “I couldn’t find any counsellor who specialised in helping people invest outside America. So I saw a wide-open opportunity.”

His first coup was to borrow $10,000 when Hitler invaded Poland in 1939 and invest $100 on each of the 104 stocks on the New York Stock Exchange, valued at under $1 a share. All but four made a profit. Templeton had banked on war driving up profits. In 1940 he opened his own fund management company.

Success was based on his appreciation of the global market. He expressed surprise that none of the boys from wealthy families he had met at Yale invested outside the US. “I thought that was just not sensible.” After the war he was one of the first to invest in Japan, later calling Buffett “small-sighted” while judging that “if he had spent more time in foreign nations, he would be better off”.

The results were spectacular. In 1954 he started the Templeton growth fund, to which thousands entrusted their money. It was estimated that $10,000 invested at the start would be worth $7m today. He sold the growth funds in 1992 to Franklin Resources for $913m, of which $440m went to himself. He continued to invest, and his contrarian views continued to serve him as he liquidated his own and his clients’ technology stocks before the dotcom bubble burst.” (4)

Basis the books & blogs that I read the five critical principles which seem to have defined Sir John’s investing career were:

1. Diversify across equity markets globally

12 years before Harry Markowitz wrote his Nobel Prize winning paper on the “free lunch” arising from diversification, Sir John began diversifying globally. Courtesy his travels across the world BEFORE he began investing, Sir John figured out that if you invested in countries which have low correlation with each other then you get a more stable, lower risk portfolio WITHOUT sacrificing returns. “Templeton was one of the earliest American investors to devote substantial focus to investment opportunities in then-overlooked foreign markets such as Asia and Eastern Europe. He was such an early investor in Japan during the 1950s that he had difficulty finding bi-lingual stockbrokers in either Japan or the United States to handle his firm’s trades. Always on the lookout for bargain-priced stocks and hoping to avoid expensive stocks, he rotated out of Japanese stocks as they became more fashionable in the 1970s and turned to US stocks when they were at historic lows. Templeton’s flagship fund outperformed a global stock index by an average of three percent a year for his entire career.” (5)

2. Be a contrarian, buy at the time of maximum pessimism

Sir John’s success lay in patiently waiting for prices to reach “points of maximum pessimism. (6) Contrarian investing, which Templeton mastered, means deliberately going against prevailing market trends. Following this contrarian investing philosophy, he bought shares of European companies during the darkest days of World War II, when most investors thought Europe would never recover. In fact, according to Sir John, he called his broker the day World War II began and instructed him to make the purchases (7).

3. Classical value investing

Like many other great investors of the 20th century, Sir John was a student of the “father of value investing”, Benjamin Graham. “Despite the name of his flagship fund, Templeton Growth Fund, he was more a practitioner of value investing rather than growth investing. However, his stock-selection strategies could be eclectic and often defied easy categorization other than avoiding stocks he considered expensive, defined as an estimated five-year forward price to earnings ratio higher than about 12-14x. Templeton focused on buying stocks he calculated were substantially undervalued, holding them until selling when their price rose to fair market value. His average holding period was about four years. He believed holding assets priced above fair market value in hopes they would further increase in price was speculation, not investing. However, Templeton did not buy stocks merely because they were undervalued but also took care investing in companies he determined were profitable, well-managed and with good long-term potential.” (8)

4. Maintain an elevated mood, avoid anxiety and stay disciplined

Those investors who have a stable and fulfilling life outside investing tend to crave the dopamine thrill from investing less. That in turn allows them to see investing in a more dispassionate way relative to the rest of us (for whom investing becomes an end in itself rather than being a means to an end). “From the late 1930s Templeton and his colleagues developed sophisticated quantitative finance methods that anticipated by decades common features such as the Shiller P/E, rebalancing and Tobin’s q” (9). Such signals allowed Sir John to sell off his tech stocks before the dot-com bubble burst in 2000.

5. Historical trends matter

“Templeton’s approach to investing is grounded in a belief that history often repeats itself in financial markets. He warned against the dangerous assumption that investors often make, which is to assume that current circumstances are different from past ones and that as a result, different outcomes should be expected. He believed that investors should be wary of making decisions based on the assumption that things have permanently changed and instead pay attention to historical trends.” (10)

Why Templeton’s philosophy matters for Indian investors today

The United States now generates the majority of the world’s corporate profits and dominates innovation in areas such as AI, cloud computing and semiconductors. For an Indian investor, a US-centric global portfolio is NOT a country pick. It is exposure to the world’s most consistent compounding engines. Templeton travelled widely to find the best ideas wherever they emerged. Today, many of those ideas happen to be in the United States.

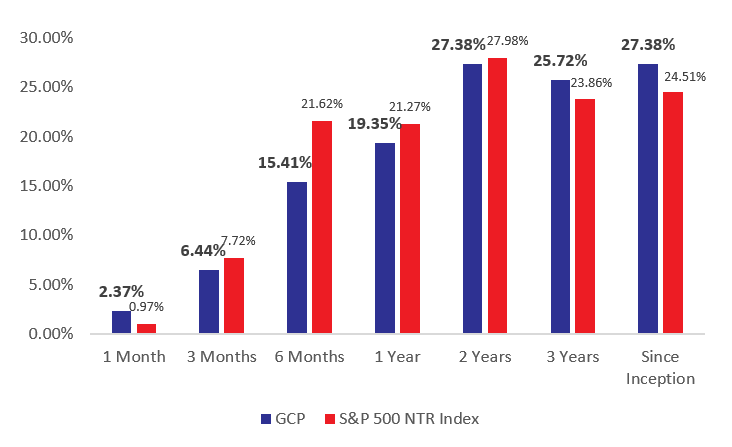

Like Sir John, we at Marcellus have learnt from lived experience that diversifying globally allows us to compound at a healthy rate whilst sleeping better at night. Our equity investments are spread across India, America, Canada, Sweden, Germany, France, Holland and Taiwan. Thanks to the reforms expedited by the Government of India, we are able to diversify globally in a cost-efficient and tax-efficient manner which was NOT possible until last year. If you would like to join us in Global Compounding, please let me know. Our track record in compounding across the world is shown below. Since inception in Oct ’22, we have compounded at 27% CAGR (net of all fees & expenses).

GCP’s Performance as of 30th Nov’25 (in INR)

Source: Marcellus performance data is shown gross of taxes and net of fees & expenses charged till 30th November 2025 on client account. Time period returns are absolute. Marcellus’ GCP USD returns are converted into INR using USD:INR exchange rate from RBI – Link for the reference

Note: * Since Inception performance calculated from 31st Oct 2022. The inception date is 31st October 2022, being the next business day after the account got funded on 28th October 2022. S&P 500 net total return is calculated by considering both capital appreciation and dividend payouts. The calculation or presentation of performance results in this publication has NOT been approved or reviewed by the IFSCA or US SEC. Performance is the combined performance of RI and NRI strategies

Thanks,

Saurabh Mukherjea

(1) Sir John Templeton | TIME

(2) Sir John Templeton | Business | The Guardian

(3) John Templeton – Wikipedia

(4) Sir John Templeton | Business | The Guardian

(5) John Templeton – Wikipedia

(6) Sir John Templeton | TIME

(7) The World’s 11 Greatest Investors

(8) John Templeton – Wikipedia

(9) John Templeton – Wikipedia

(10) Investing with legends: Sir John Templeton