OVERVIEW

The Rupee loses approximately 40% of its value every decade. As a result, after paying taxes, you have less than a third of your income left in hand to finance your daily expenses and your long-term goals (like children’s education, retirement). However, it does not have to be like this. You can compound your wealth faster AND sleep better at night by using GIFT City to diversify your investments across developed countries.

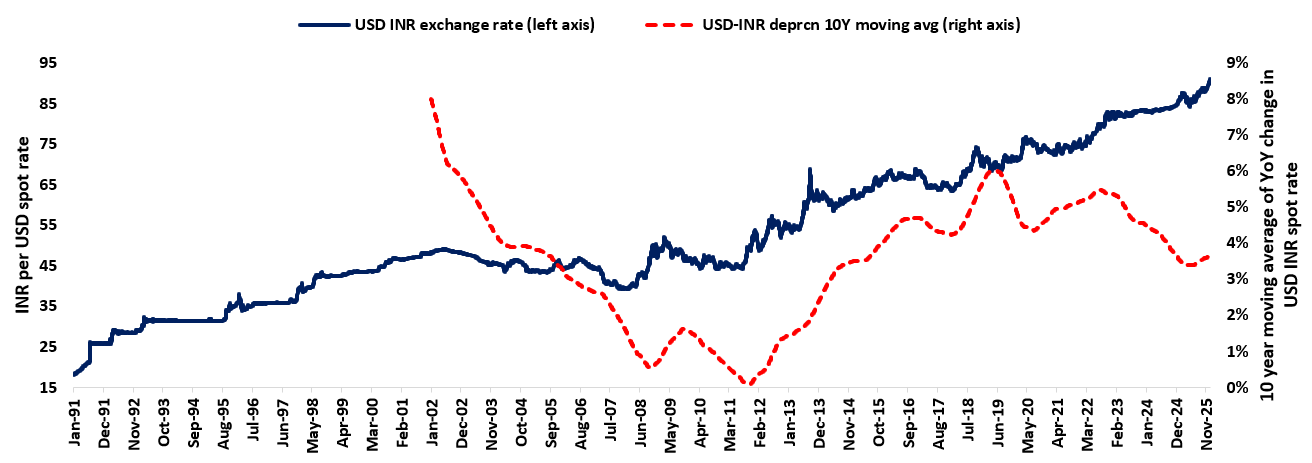

Exhibit 1: INR usually loses about 40% of its value every decade vis-à-vis the USD

One of the first things that you learn in an undergraduate economics course is that fast growing developing economies, like India, tend to have faster inflation than slower growing developed economies. As a result, the currencies of such developing countries depreciate steadily to keep the said economy’s exports competitive in the world market.

Whilst there are more complicated theorems in economics which shed light on this phenomenon e.g. the Stolper-Samuelson Theorem, the basic construct of higher inflation in India leading to faster INR depreciation has held up well since 1991 (see chart above) and is likely to hold up well in the years ahead. In any given, 10-year cycle the INR gives up around 40% of its value to the US$.

Now, given that the Government of India takes away a third of your income through income taxes and then another 15% through GST, you only have half of your income left in your hand. Out of that if a 40% goes to pay for INR depreciation then your remaining income in the currency that really matters – the US$ – is only 30 cents out of every $1 you earned. With that meagre 30 cents you have finance your daily lifestyle AND pay for long term goals like your children’s university education abroad and your retirement.

But what if you decided – like me – to say that “I don’t want to live like this. I want to save most of my post-tax income in a currency that does not give up a third of its value every decade”? IF you took such a stance, two good things would happen to you.

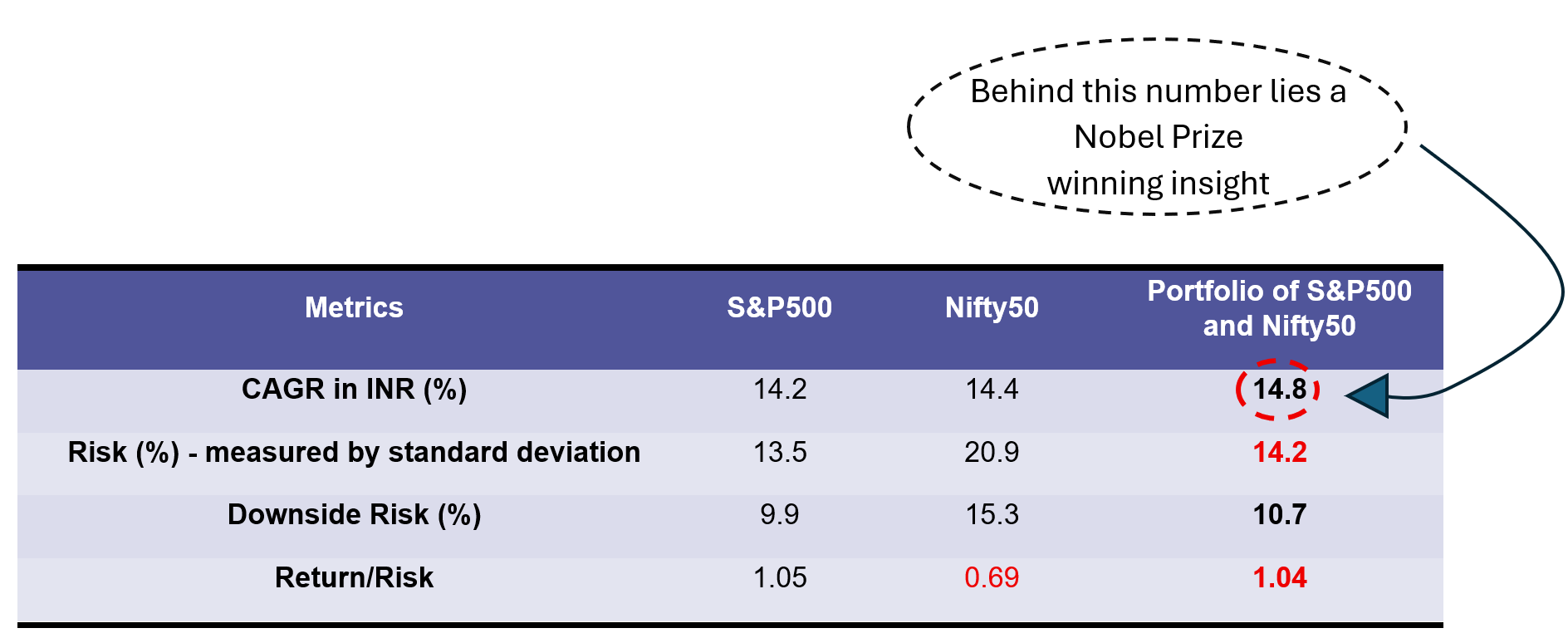

Firstly, your wealth – both in INR and in US$ – would compound much faster. As shown in the table below, an Indian investor with an equity portfolio split 50:50 between the Nifty50 & the S&P500 has historically compounded wealth much faster over the past 20 years relative to more insular Indian and American investors who have decided they will stick to their ‘home countries’ (Past performance is not a guarantee.

Exhibit 2: USA plus India delivers powerful risk adjusted performance.

An annually rebalanced 50:50 USA:India portfolio delivers superior risk-adjusted compounding.

Source: Marcellus Investment Managers, Bloomberg; note – total returns used here; metrics calculated from January 2004 to Oct 2025; equal portfolio created with annual rebalance in January every year with allocation of 50% each to S&P500 and Nifty50; all returns in INR terms; * – downside risk measured by standard deviation for negative returns for that period; CAGR, risk, and return/risk calculated over 3 year rolling period. The information is for informational/educational purposes only and is not intended to be personal financial advice.

Secondly, you are likely to sleep better at night as the volatility of your portfolio will reduce (relative to what it would have been had you just stuck to investing in India). As a result, your return – adjusted for the level risk or volatility you are taking on – would jump. This is what the late great Harry Markowitz called the “free lunch in Finance” and this is why he got the Nobel Prize in 1990. [See the bottom three rows of the table above.]

All of this good economics was very theoretical for an Indian resident until the Government of India hit the accelerator on economic reforms three years ago and: (a) cut capital gains taxes sharply on overseas investing; (b) created in GIFT City (in Gujarat) a cost-efficient venue for overseas investing; and (c) allowed Indian entities to invest up to half of their net worth abroad.

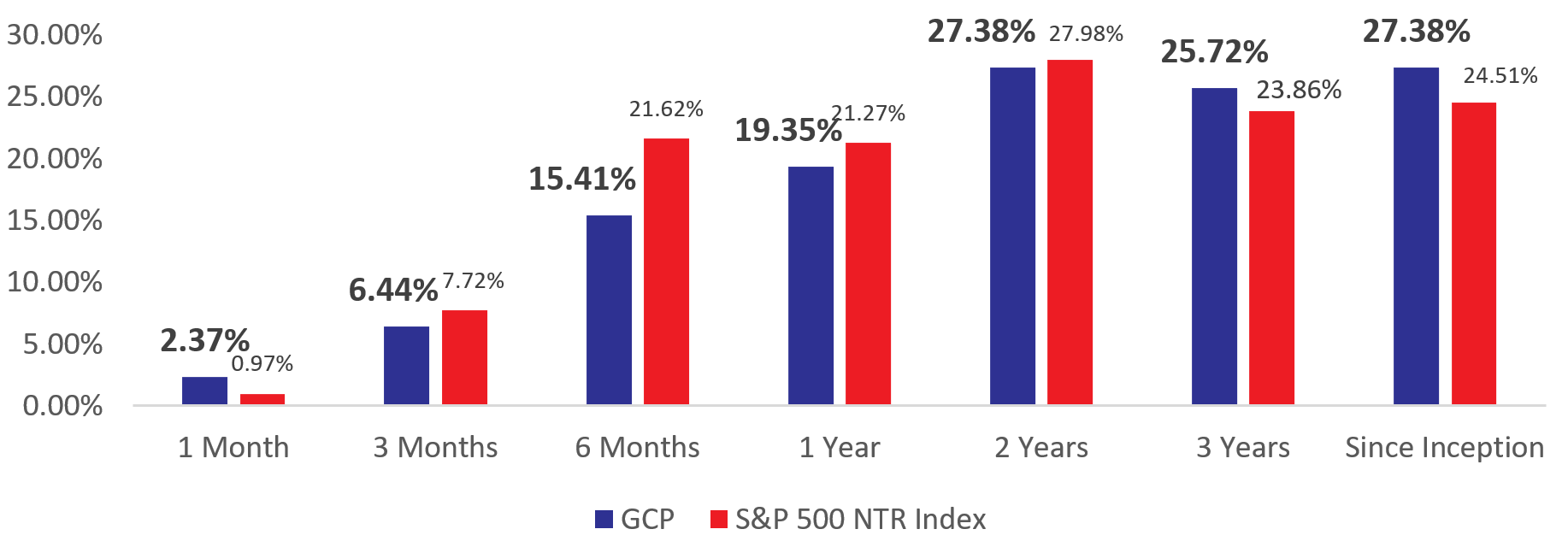

Thanks to the reforms expedited by the Government of India, we are able to diversify globally in a cost-efficient and tax-efficient manner which was NOT possible until a couple of years ago. This is life-changing and wealth-enhancing for all of us. If you would like to join us in Global Compounding, please let me know. Our track record in compounding across the world is shown below. Since inception in Oct ’22, we have compounded at 27% CAGR (net of all fees & expenses).

Exhibit 3: Marcellus GCP performance as of 30th Nov’25 in INR

Source: Marcellus performance data is shown gross of taxes and net of fees & expenses charged till 30th November 2025 on client account. Time period returns are absolute. Marcellus’ GCP USD returns are converted into INR using USD:INR exchange rate from RBI – Link for the reference

Note: * Since Inception performance calculated from 31st Oct 2022. The date of inception is 31st October 2022, being the next business day after the account got funded on 28th October 2022. S&P 500 net total return is calculated by considering both capital appreciation and dividend payouts. The calculation or presentation of performance results in this publication has NOT been approved or reviewed by the IFSCA or US SEC. Performance is the combined performance of RI and NRI strategies.

The above material is neither investment research, nor investment advice. Info Edge (Naukri), forms part of Marcellus’ Portfolios. We as Marcellus, our immediate relatives and our clients may have interest and stakes in the mentioned stock. The stock mentioned is for educational purposes only and not recommendatory. Marcellus does not seek payment for or business from this material/email in any shape or form. Marcellus Investment Managers Private Limited (“Marcellus”) is regulated by the Securities and Exchange Board of India (“SEBI”) as a provider of Portfolio Management Services. Marcellus is also a US Securities & Exchange Commission (“US SEC”) registered Investment Advisor. No content of this publication including the performance related information is verified by SEBI or US SEC. If any recipient or reader of this material is based outside India and USA, please note that Marcellus may not be regulated in such jurisdiction and this material is not a solicitation to use Marcellus’s services. All recipients of this material must before dealing and or transacting in any of the products and services referred to in this material must make their own investigation, seek appropriate professional advice. This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. No liability whatsoever is assumed by Marcellus as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus may be unable to exercise control or ensure or guarantee the integrity of the text of the material/email message and the text is not warranted as to its completeness and accuracy. The material, names and branding of the investment style do not provide any impression or a claim that these products/strategies achieve the respective objectives. Further, past performance is not indicative of future results. Marcellus and/or its associates, the authors of this material (including their relatives) may have financial interest by way of investments in the companies covered in this material. Marcellus does not receive compensation from the companies for their coverage in this material. Marcellus does not provide any market making service to any company covered in this material. In the past 12 months, Marcellus and its associates have never i) managed or co-managed any public offering of securities; ii) have not offered investment banking or merchant banking or brokerage services; or iii) have received any compensation or other benefits from the company or third party in connection with this coverage. Authors of this material have never served the companies in a capacity of a director, officer, or an employee. This material may contain confidential or proprietary information and user shall take prior written consent from Marcellus before any reproduction in any form.