OVERVIEW

Whilst India’s net household financial savings have improved in FY25, RBI’s latest Financial Stability Report (FSR) explains why the situation continues to deteriorate when it comes to household debt. The RBI’s report points to:

- Increased leverage of households, specifically for the purpose of consumption and not creation of assets; and

- Higher write-offs and rising slippages for private banks and NBFCs respectively.

Our research suggests that these metrics are rising due to:

a) Weakening job and wage growth,

b) Rising cost of living leading to use of debt to sustain consumption, and

c) Social media creating an illusion of prosperity, thus furthering the credit boom.

“And all the roads jam up with credit

And there’s nothing you can do

It’s all just bits of paper

Flying away from you”

– The late Chris Rea in “Road to Hell – Part 2” (source: https://genius.com/Chris-rea-the-road-to-hell-part-1-and-2-lyrics)

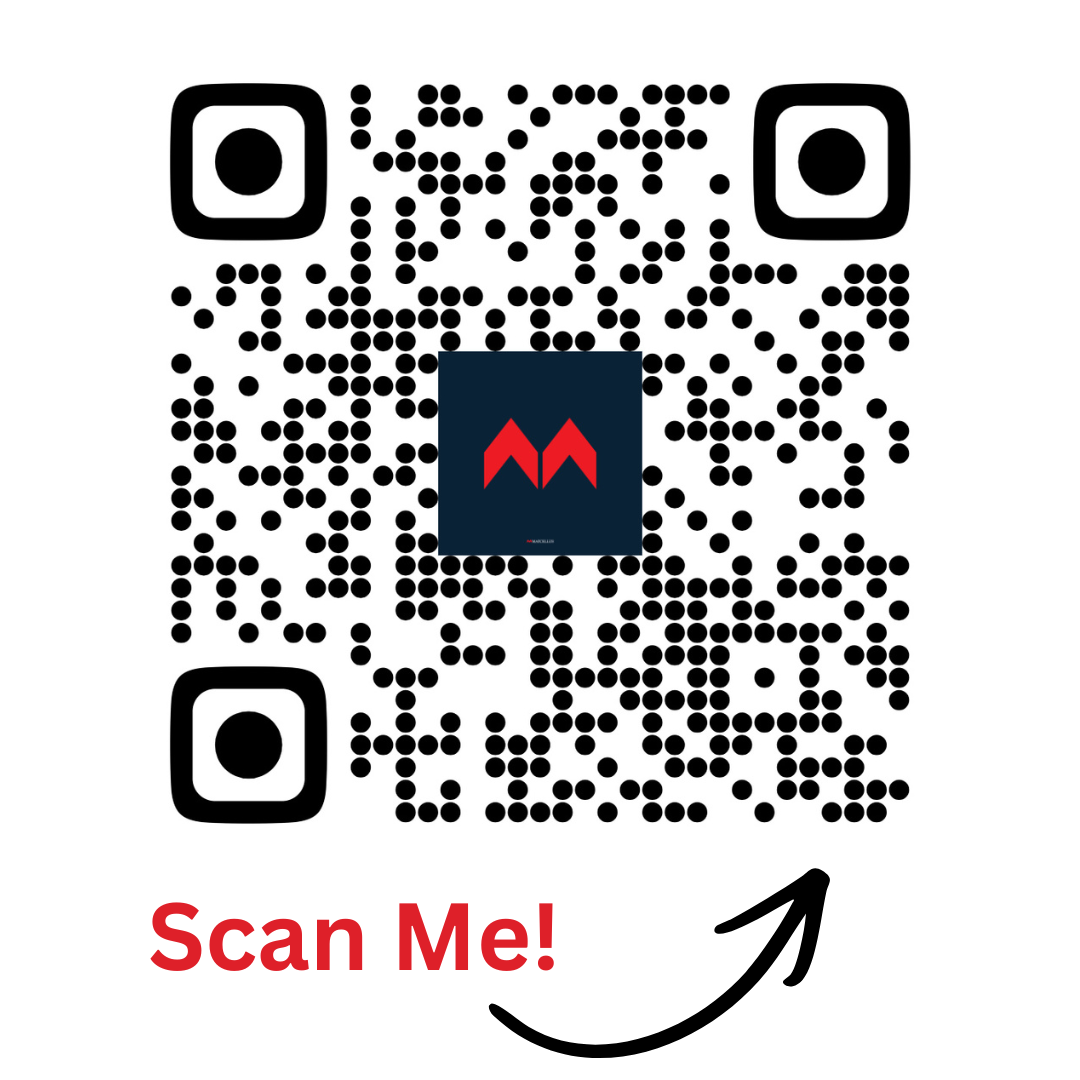

Net household savings in India has been a point of concern over the last couple of years, and for good reason. This figure, which is nothing but the gross financial assets of households less household liabilities as a percentage of GDP, had plunged to a 50-year low in FY23, largely on account of liabilities or household borrowings surging in the country. The good news in the RBI’s latest data release on household financial savings is that net household savings have risen as a percentage of GDP in FY25, which has largely been on the back of reduced pace of rise in household financial liabilities (see chart below), a fact also echoed by the largest banks in the country who say that their loan book growth had slowed significantly in FY25.

Whilst the good news on net savings is welcome, the RBI also publishes another important and insightful report twice a year called the Financial Stability Report (FSR). This document highlights not only the headline numbers on household savings but also more details on the financial assets and more specifically liabilities of households.

In this context, RBI’s Dec 2025 Financial Stability Report or FSR is an eye opener. This is so because RBI’s December FSR shows that there are largely two sets of metrics which have deteriorated over the past year:

1. Household’s non-housing retail credit is still booming:

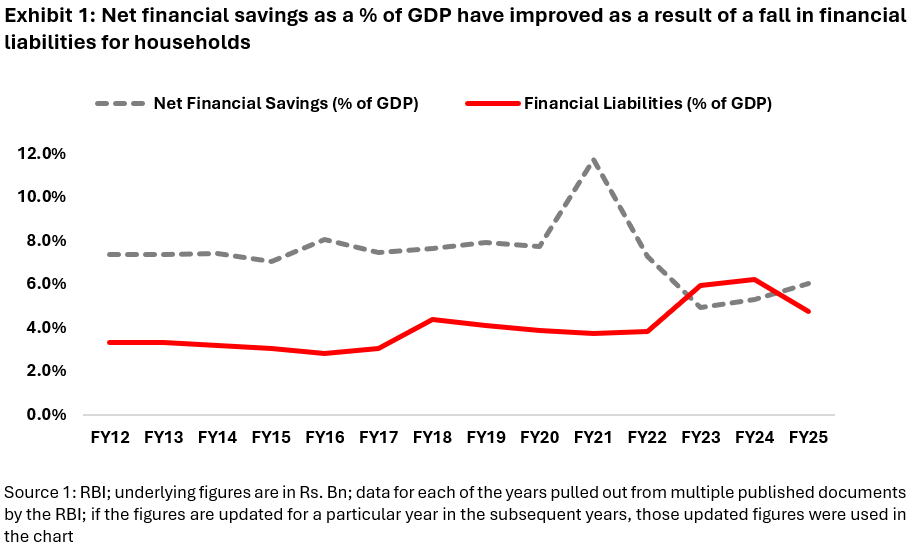

According to RBI’s FSR, retail credit ex mortgage has surged, and has trebled since March 2019, with an increasing share of such loans being used to finance consumption as opposed to financing productive assets (see charts below).

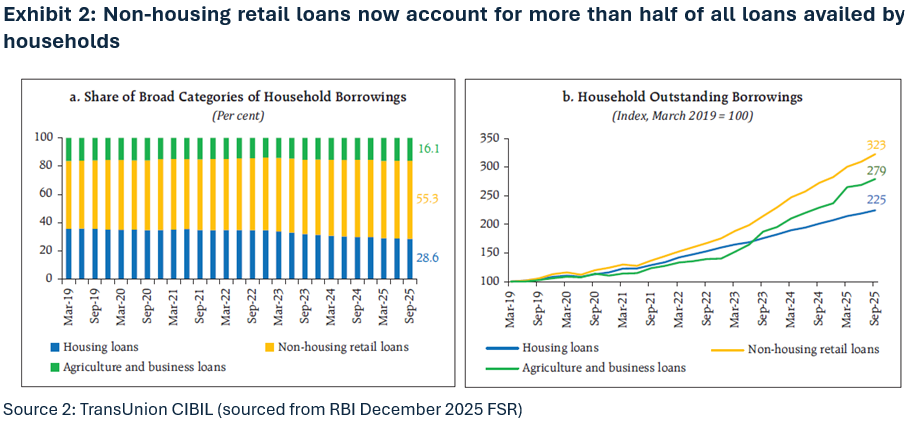

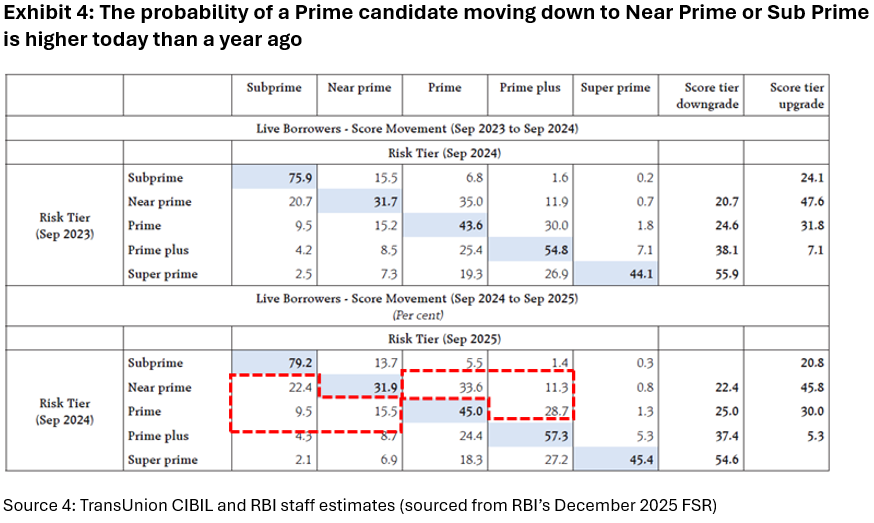

This trend, which has continued into FY26, has a further wrinkle in it. The percentage of near prime or subprime borrowers by number in total borrowers is 44%. The RBI has also included a transition matrix for different classes of borrowers (i.e., the probability of a prime customer going to near prime, subprime, or going to prime plus and super prime). What this shows is that the probability of a down-shift in credit scores is high and rising i.e., year on year, the probability of credit scores deteriorating is rising – see Exhibit 4 to understand this wrinkle.

2. Financial Services sector-level stress indicators are flashing Amber:

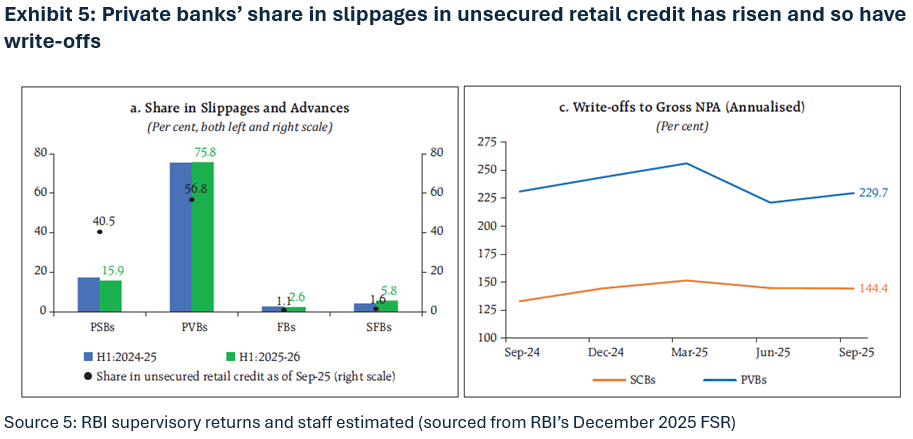

Whilst currently India’s banks and non-bank lenders (NBFCs) have good asset quality, the banking sector and specifically private banks have seen a rising share of slippages in the overall figure from March 2025 to September 2025. Furthermore, for private banks, the percentage of loan write offs to gross non-performing assets (GNPAs) has started to rise (see charts below).

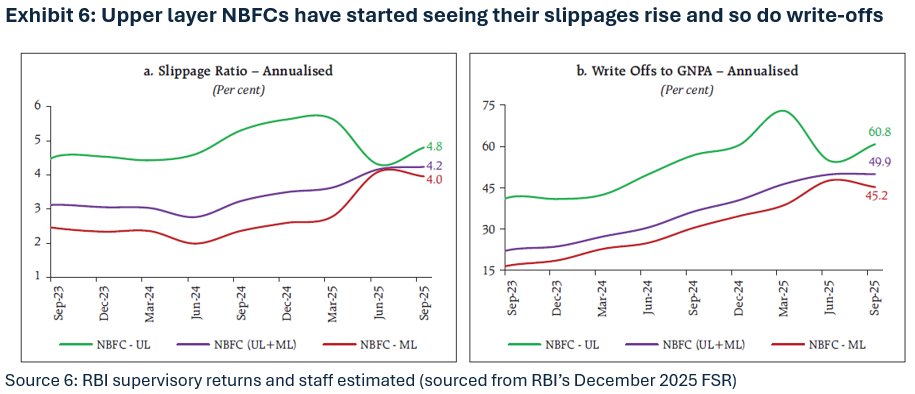

The same trend can also be seen amongst the NBFCs i.e., rising slippages as well as a rising ratio of write-offs to GNPA, indicating stress levels rising for the sector and even for the upper layer NBFCs.

So why are we see a deterioration in credit conditions?

What makes this deterioration intriguing is that it comes after a year (CY25) in which the RBI cut the repo rate by 1.25% points and flooded the system with liquidity.

We believe there are three sets of issues plaguing the household sector specifically which are beginning to reverberate across sectors now:

1. Job growth and wage growth have stagnated.

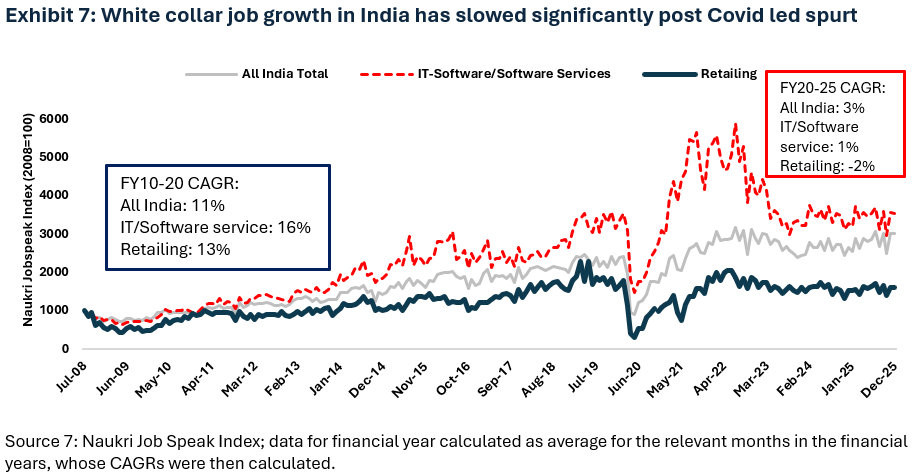

Whilst the foremost authority on labour market data in India is the Periodic Labour Force Survey (PLFS) which publishes data quarterly, we believe the most relevant metric for job growth analysis is white collar jobs. Why? Because white collar jobs concern the typical middle class Indian (who has historically been driving consumption and by extension growth in the country). A reliable source of data on such jobs is Naukri (India’s largest online classifieds business) Jobspeak index. As per the Index, whilst job growth on a pan India pan sector level was growing at 11% p.a. from FY10-20, post the pandemic from FY23 to FY25, it has slowed to a mere 3% p.a. (see chart below).

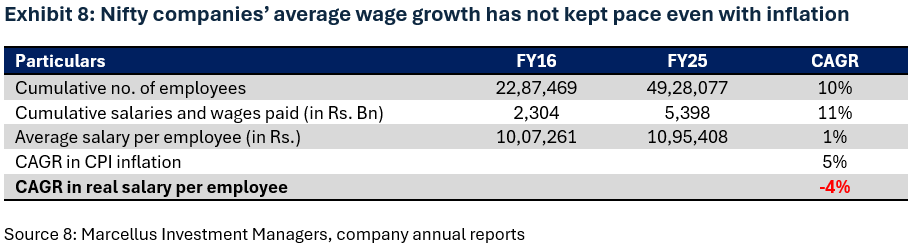

Furthermore, analysis of the average wages of Nifty companies (i.e., largest companies in India by market capitalization) shows that wages have degrown in real terms (i.e., adjusting for inflation) in the last 9 years (see table below).

2. Real cost of living is rising much faster than Consumer Price Index (or CPI).

CPI inflation is a broadly used measure to understand the pace of rise in general price level for consumers in the economy. This indicator suggests that prices have been rising at a rate of 5-6 percent in the last 10 years (and this is the indicator we have used in the table above). However, the official CPI estimation process uses a basket of goods that has little or no resemblance with the middle class’s consumption basket. For example, ~50 per cent of the CPI basket is food. Thankfully, one will be hard pressed to find a middle-class family in India that spends half of its income on food.

Based on the price inflation we can see in many of the items that the middle class purchases, we reckon that the cost of living for urban middle class families is doubling roughly eight years implying around 9 per cent per annum inflation as opposed to the 5–6 per cent per annum inflation number used so far in this chapter. For example:

- Cost of a typical vegetarian thali rose at 11 per cent per annum in the last 5 years while salaries of employees rose by just 6 per cent per annum. (i)

- Cost of an Alto (small car) rose by 8 per cent per annum from ₹2.83 lakh in FY2019 to ₹4.23 lakh in FY2025. On the other hand, the price of Hero Splendor (entry level motorcycle) rose by 7 per cent per annum from ₹56,000 in FY2019 to ₹77,000 in FY2025. (ii)

- The cost of medical treatment in private hospitals is rising at 14 per cent per annum. (iii)

- Transport and communication CPI has risen by ~5 per cent per annum over the last 6 years. (iv)

- A good proxy for the cost of secondary education is the rise in education loans outstanding as per RBI’s data. Outstanding education loans rose from ₹65.3k crore in 2020 to ₹1.29 lakh crore in 2024, registering a CAGR of nearly 19 per cent per annum. (v)

When we combine this with the fact that nominal wages have risen by 1% p.a. (see the previous point), the reduction in real wages is not 4% but a much steeper 8% p.a. implying a halving of real wages every decade.

3. Social media is increasing aspirations, beyond means to fulfill them.

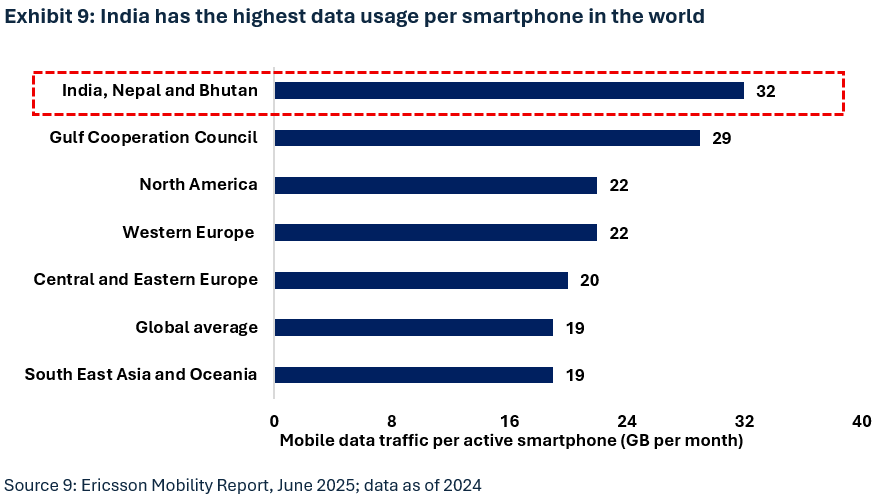

In 2016, as internet was made ubiquitously available across the country at a low cost, courtesy Jio, most Indians grabbed the opportunity to ‘upgrade’ and use a smartphone with low-cost data, gaining access to the internet and by extension the world. This fast adoption of smartphones and internet access has meant that Indians today are using more data per capita than their western counterparts.

As one would expect, in the wake of mobile data and smartphones proliferating, access to social media was democratized. Whilst a lot of people and businesses have used this to their benefit to reach larger cohorts of potential customers across the country, there is a flipside to this rise in use of social media.

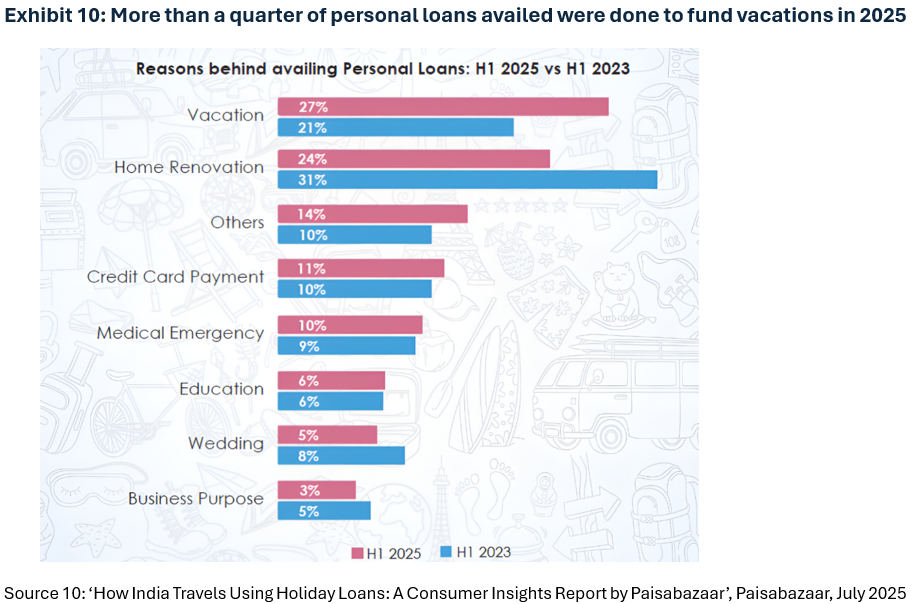

Social media has equalized the ability to aspire to something that most people could not. A decade ago, a high net worth individual vacationing in Maldives was only known to their close group of friends and acquaintances and was not public knowledge. Today, because of widely accessible social media feeds, a person working in, let’s say the underwriting department of an insurance company, can also see the HNI holidaying in the Maldives, and naturally aspires to live this life. So, even if he cannot afford such a vacation, borrowing money to finance this holiday has become default behaviour. Thus the most common use of unsecured loans today in India is “Vacationing”; more than a quarter of personal loans are being used to finance holidays.

So, what’s the way forward?

The three issues highlighted above are, we reckon, more structural than transitory. Jobs and incomes are a function of labour supply and demand in any economy. As the country keeps churning out roughly 8 million graduates per year with outdated skills, jobs become scarcer and real wages keep compressing. Furthermore, the availability of easy credit and the access to information on others living a ‘better life’ has led to an adverse behavioural change, which is often sticky and takes time to unwind.

As the country heads into a more uncertain job-market environment along with global uncertainties also persisting, we believe households need to pare down debts and save more to cope with the new realities. As with everything else in life, this is achievable if properly planned. Our colleagues at Marcellus offer our clients a free financial plan. To avail of this, please visit plan.marcellus.in OR scan the QR code shown below into your mobile phone.

The above material is neither investment research, nor investment advice. Marcellus Investment Managers Private Limited (“Marcellus”) is regulated by the International Financial Service Centre Authority (Fund Management) Regulations, 2025 (earlier 2022) (“IFSCA”) as Fund Management Entity – Nonretail, rendering Investment Management Services. Marcellus is also registered with US Securities and Exchange Commission (“US SEC”) as an Investment Advisor. No content of this publication including the performance related information is verified by IFSCA or US SEC. If any recipient or reader of this material is based outside India or US, please note that Marcellus may not be regulated in such jurisdiction and this material is not a solicitation to use Marcellus’s services. This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. No liability whatsoever is assumed by Marcellus as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus may be unable to exercise control or ensure or guarantee the integrity of the text of the material/email message and the text is not warranted as to its completeness and accuracy. The material, names and branding of the investment style do not provide any impression or a claim that these products/strategies achieve the respective objectives. Marcellus and/or its associates, employees, the authors of this material (including their relatives) may have financial interest by way of investments in the companies covered in this material.

This material may contain confidential or proprietary information and user shall take prior written consent from Marcellus before any reproduction in any form.

Data/information used in the preparation of this material is dated and may or may not be relevant any time after the issuance of this material. Marcellus takes no responsibility of updating any data/information in this material from time to time. The recipient of this material is solely responsible for any action taken based on this material. The recipient of this material is urged to read the Disclosure Document/Form ADV, Form CRS and any other documents or disclosures provided to them by Marcellus, as applicable, and is advised to consult their own legal and tax consultants/advisors before making any investment in the portfolio.

All recipients of this material must before dealing and or transacting in any of the products referred to in this material must make their own investigation, seek appropriate professional advice and carefully read the Disclosure Document, Form ADV, Form CRS and any other documents or disclosures provided to them by Marcellus, as applicable. Actual results may differ materially from those suggested in this note due to risk or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions globally, inflation, etc. There is no assurance or guarantee that the objectives of the investment strategy/approach will be achieved.

This material may include “forward looking statements”. All forward-looking statements involve risk and uncertainty. Any forward-looking statements contained in this document speak only as of the date on which they are made. Further, past performance is not indicative of future results. Marcellus and any of its directors, officers, employees and any other persons associated with this shall not be liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this material in any manner whatsoever and shall not be liable for updating the document.