OVERVIEW

Like the internet a generation ago, AI is triggering a massive wave of value migration from traditional style businesses to new business models. Our Global Compounders team has identified and invested in several opportunities in developed markets over the past four years, with the aim of positioning our clients to potentially benefit from this new era of value migration from old style information intermediaries to the providers of AI including the hardware & data center ecosystem.

Source for the chart: FourweekMBA (1)

“Catching the right moment to take action when successful business models begin to wane requires skilled detection work and the courage to face reality.” – Benson P. Shapiro, Adrian J. Slywotzky, and Richard S. Tedlow (2)

The first large scale information intermediary of the industrial age was the daily newspaper. Typically, such a business employed a team of journalists to collate a wide variety of information. It also employed a team editors and columnists to provide opinions/judgement basis the information collected. Finally, it built a circulation & distribution network such that by 6am every morning its customers would have access to this latest greatest package of information and opinion/judgement. So effective was this business model that throughout his career Warren Buffett loved investing in newspapers viewing them as local monopolies providing essential news and advertising. (3)

Then along came the internet and disrupted not only the newspaper (by making it easy to get information from all over the world), but also other information intermediaries like travel agents, stockbrokers and estate agents. The moat for such traditional intermediaries was often physical – for example, you were restricted to your local newspaper or your local travel agent. The internet reduced the value of this physical access by migrating the service online. You were no longer restricted to your local newspaper or your local travel agent. Suddenly, the competition for these businesses was global! While the pace of online migration varied, all these businesses saw the same core dynamic of the market moving online. At their core, these businesses did the same basic thing: 1) Collection of information, 2) Processing of information / Generation of opinion, and 3) The provision of a product or a service basis the first two legs eg. a newspaper, an airline ticket, a stock or a property.

Whilst these disrupted professions survived, they found it hard to grow. Growth migrated entirely online as value migrated from traditional to online business models. In Adrian Slywotzky’s ‘Value Migration’ framework, economic and shareholder value flowed away from obsolete business models (eg. the conventional newspaper) to new, more effectively business models (eg. online search, social media) that were better positioned to meet customer needs. These shifts in value and market cap reflected changing customer needs that were met more effectively by new companies. (4)

For example, in the case of the US newspaper market, advertising revenues and market cap migrated to Alphabet whose market cap grew from $23billion in 2004 to ~$3.8 trillion today (i.e. ~164x growth in 22 years). Warren Buffett was at the wrong end of this value migration and sold the 31 newspapers Berkshire Hathaway owned in Jan 2020 for just $140mn. (5)

What the internet did a generation ago, AI now appears poised to do to an even broader swathe of intermediaries. Potentially affected now are even skilled white-collar professionals like market research analysts, financial analysts, journalists, economists, management consultants, accountants, wealth managers, data analysts and industry gurus of all shapes and sizes. While it’s hard to predict which role will be disrupted and how quickly, the direction of change is becoming clearer given how AI capabilities continue to evolve. Basically, anyone who earns a living by collecting information and/or generating judgements/opinions may find that at least part of their value could shift toward AI‑enabled tools.

Whilst it is increasingly evident which sort of professions & companies might face challenges due to the rise of AI, the more interesting question is who might emerge as the potential beneficiaries this phase of value migration. In other words, who is the Google of this era of value migration?

The instinctive answer to this question is that the winners in this age of AI will be providers of LLMs. Whilst in our Global Compounders Portfolio we have been longstanding shareholders of Microsoft, Alphabet and Amazon, we believe that leaving aside the LLMs there are at least two other sets of companies to whom value may migrate as information intermediaries’ fortunes evolve.

The first layer of potential beneficiaries may be firms which provide the hardware on which the brave new world of parallel computing runs. This includes ASML (as described in our 30th Jan blog https://marcellus.in/blogs/do-you-own-the-worlds-most-powerful-tech-company/) and TSMC.

Established in 1987 and listed in Taiwan, TSMC (Taiwan Semiconductor Manufacturing Company) is the world’s largest dedicated independent semiconductor foundry, manufacturing chips for tech giants like Apple, Nvidia, AMD, and Qualcomm. It specializes in advanced logic chip technologies dominating 3nm and 5nm node production for AI, smartphones, and high-performance computing. (6) TSMC manufactures over 50% of the world’s chips and more than 90% of the most advanced semiconductors. (7) Over the last decade, TSMC’s share price has risen ~23x in INR terms.

The second layer of potential beneficiaries included the companies who provide the kit to run the datacentres where the Nvidia’s famous Graphics Processing Units – which do the high-speed crunching required for AI – are housed. An example of such a firm is Amphenol.

Founded in 1932 and listed in New York, Amphenol is one of the world’s largest designers and manufacturers of electrical, electronic, and fibre optic connectors, cable systems and sensors. (8) Amphenol dominates the data centre market through a comprehensive, high-performance portfolio tailored for AI, featuring, for example, high-speed 1.6+ Terabit connectors, 48V power systems, and specialized liquid cooling solutions. The firm’s dominance is fuelled by strategic acquisitions and deeply ingrained, customized, and reliable designs (like BarKlip®) for hyperscale data centres. (9) Over the last decade, Amphenol’s share price has risen ~17x in INR terms.

Investment implications for you

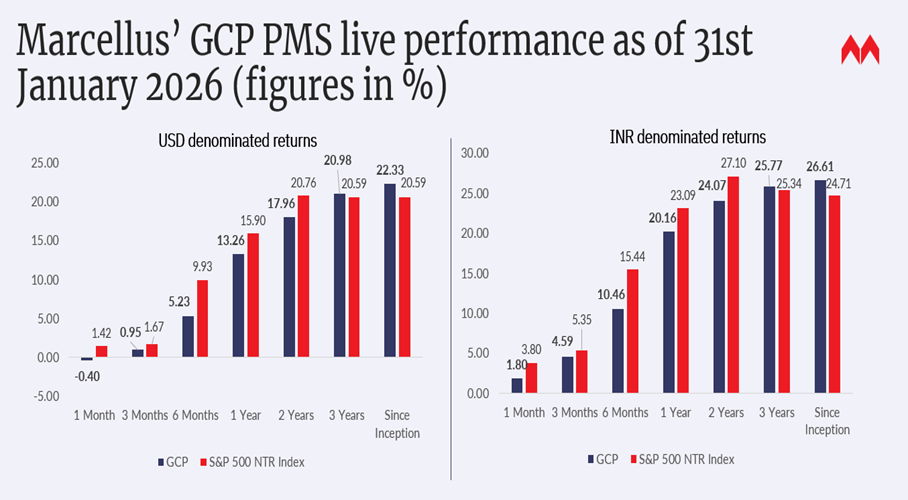

Our Global team has identified and invested in several opportunities over nearly the past four years with the aim of positioning our clients to potentially benefit from this new era of value migration from old style information intermediaries to the companies supporting AI including the hardware and datacentre ecosystem. Thanks to the reforms expedited by the Indian authorities over the past couple of years (see our 7th January ‘26 blog: https://marcellus.in/blogs/four-mega-reforms-which-opened-up-global-investing-for-indians/ ), we are now able to diversify globally in a cost-efficient and tax-efficient manner and benefit from this new age of rage. Our track record in compounding across the world is shown below. Since inception in Oct 2022, we have compounded at ~27% CAGR (net of all fees & expenses in INR).

Source: Marcellus performance data is shown gross of taxes and net of fees & expenses charged till end of last month on client account. Performance fees are charged annually in December. Returns more than 1-year are annualized. Marcellus’ GCP USD returns are converted into INR using USD: INR exchange rate from RBI – Link for the reference

Note: * Since Inception performance calculated from 31st Oct 2022. The inception date is 31st Oct 2022, being the next business day after the account got funded on 28th October 2022. S&P 500 net total return is calculated by considering both capital appreciation and dividend payouts. The calculation or presentation of performance results in this publication has NOT been approved or reviewed by the IFSCA or US SEC. Performance is the combined performance of RI and NRI strategies.

Marcellus GCP PMS is offered by Marcellus Investment Managers GIFT Branch in a segregated managed accounts format.

(1) https://fourweekmba.com/value-migration/

(2) https://www.strategy-business.com/article/9138

(3) https://www.reuters.com/article/business/warren-buffett-losing-some-mojo-on-his-economic-moats.

(4) https://www.mdpi.com/2071-1050/10/9/3113

(5) https://markets.businessinsider.com/stocks/goog-stock

https://finance.yahoo.com/news/day-market-history-google-ipo-110000083.html

https://www.forbes.com/sites/sergeiklebnikov/2020/01/29/

(6) https://en.wikipedia.org/wiki/TSMC

(7) https://www.forbes.com/sites/sergeiklebnikov/2020/01/29/warren-buffett-sells-more-than-30-local-newspapers-for-140-million/

(8) https://www.stocktitan.net/news/APH/

(9) https://www.investors.com/research/ibd-stock-of-the-day/amphenol-stock-aph-acquisitions-artificial-intelligence

The stocks Google (Alphabet), TSMC, Berkshire Hathaway, ASML, Amphenol, Microsoft, and Apple form part of the Global Compounders Strategy managed from GIFT City by Marcellus and regulated by IFSCA. Marcellus, its employees, their relatives, and clients have an interest in these stocks.

This material is for informational purposes only and does not constitute investment advice, a recommendation, or a guarantee of future results. Past performance is not indicative of future returns, and forward‑looking statements involve risks and uncertainties. All investments are subject to market, economic, and regulatory risks, including the risk of loss of principal. Investors should consult their own financial, tax, and legal advisors before making any investment decisions. This is not meant for US investors.