OVERVIEW

As a bipolar world reorients itself around two superpowers – USA and China – global spending on arms, fighter jets, drones and commercial aircraft is growing annually at double digits in $ terms. Order books in Europe & America are already loaded with a decade’s worth of orders. Our Global team has made several investments over the past year to help our clients profit from this new age of Sino-American tensions.

Source for the chart: Crisp Idea

From the fall of the Berlin Wall in 1989, it has taken roughly four decades for a new bipolar world to emerge with USA and China now grappling with each other on a weekly basis just as the Americans and Soviets did in the decades after World War II . For those of us who can remember (or read up) on what happened in the 1970’s and 1980’s, there are three relatively straightforward implications:

· Pre-1989 there were numerous regional proxy-wars smouldering for decades (e.g. Afghanistan’s civil war, Namibia’s civil war, Iran vs Iraq, Ind vs Pakistan, etc). Such conflicts will once again become relatively common as America and China jostle for influence, natural resources and strategic territory.

· Countries which are NOT involved in such proxy wars will also rearm and re-equip themselves partly out of fear and partly as a show of solidarity with either their Chinese or American patrons/protectors. Just as India became a large & loyal buyer of Soviet weaponry through the 1970’s & 80’s, so Europe, Japan and, likely, India will be asked to invest serious $$ in buying US weaponry in this era of Sino-American tensions.

· Trade and defence arrangements have walked in lockstep with each other since Adam & Eve did their thing. Therefore, once again, trade, travel & globalization is likely to gradually re-orient itself around the two poles of the new world order. It seems all but inevitable that a new “Iron Curtain” or “Bamboo Curtain” of some sort will emerge in due course driven by the practical need for Free Trade Agreements and defence arrangements like the ‘Quad’ (which consists of Japan, Australia, USA and India).

All of this means that serious money is already being spent on defence and aerospace equipment. The sums involved are already mind-boggling.

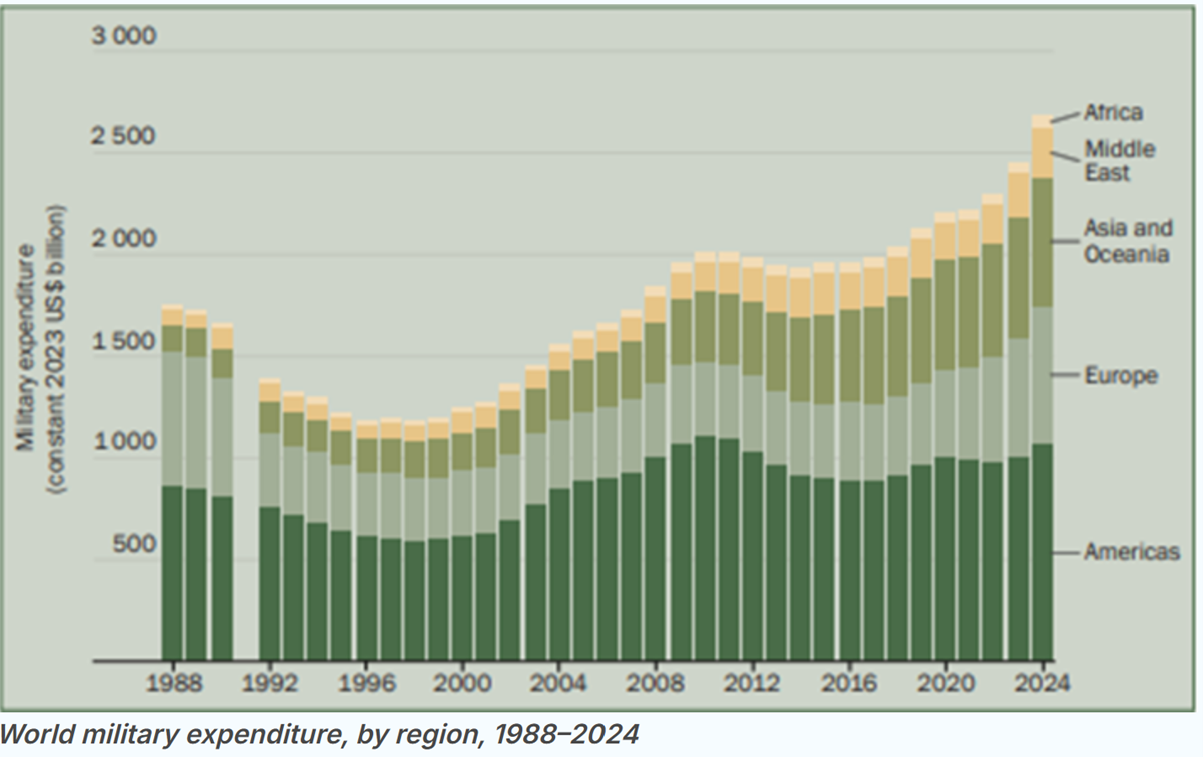

Firstly, global military spending is now running at $3 trillion per annum and growing at 10% per annum in $ terms. The fastest growth in military spending is not in America or Asia. Instead, a frightened Europe and an embattled Russia are growing defence spending at 17% in $ terms.

Secondly, distinct from military spending on arms, ammunition & defence electronics, is a boom in aerospace, drones and next-generation fighters. This segment is growing at 18% YOY in $ terms as many countries, including India, realise that they need to transition to the new era of high-tech conflict.

Thirdly, distinct from the rise in defence spending is a new boom in commercial aviation. Airlines are placing orders to modernize their fleets and meet surging travel demand, but manufacturers can’t build fast enough. The order backlog for commercial aircraft is 14,000 planes i.e. a decade’s worth of global output of aircraft.

Almost all the world class defence & aerospace centric companies are listed in America or Europe. Here are three examples.

Paris listed Airbus SE is the world’s largest manufacturer of commercial aircraft and helicopters. Airbus has benefited from, both, the post-Covid surge in global airline travel and from its biggest rival, Boeing’s quality control challenges. As of the end of 2025, Airbus’ commercial aircraft order book reached a new record high of 8,754 aircraft. This bulging order book and provides production visibility deep into the 2030’s . With no other credible competitor barring Boeing in sight, with strong demand for aircraft, with high bargaining power with the world’s largest airlines and with major factories not just in Europe but also in USA, China and India, Airbus is well placed to benefit from the new world order. Airbus’ share price has compounded 5.4x in INR terms over the past decade.

3 out of 4 commercial aircrafts in the world have engines made by GE Aerospace. As a result, this NYSE listed company is the leader in the design, production and maintenance of both commercial & military jet engines. Beyond demand for new engines, GE Aerospace has an installed base on 78,000 aircraft engines globally. Servicing these engines and supplying spare parts provides 70% of GE’s revenues. For obvious reasons, GE has no competitor when it comes to providing these services. The firm was listed as a separate business (distinct from GE) in April 2024, and its share price has doubled since then.

Safran is a major, long-term strategic partner and supplier to GE Aerospace. The two companies have a 50/50 joint venture named CFM International, which is the world’s leading supplier of commercial aircraft engines. In addition to what it does with GE, Safran also makes landing gear, braking, avionics, and cabin systems for defence & commercial aircrafts and benefits from the long-term servicing revenues & spares that following automatically . This Paris listed company has seen its share price rise by 7.6x in INR terms over the past decade.

Investment implications for you

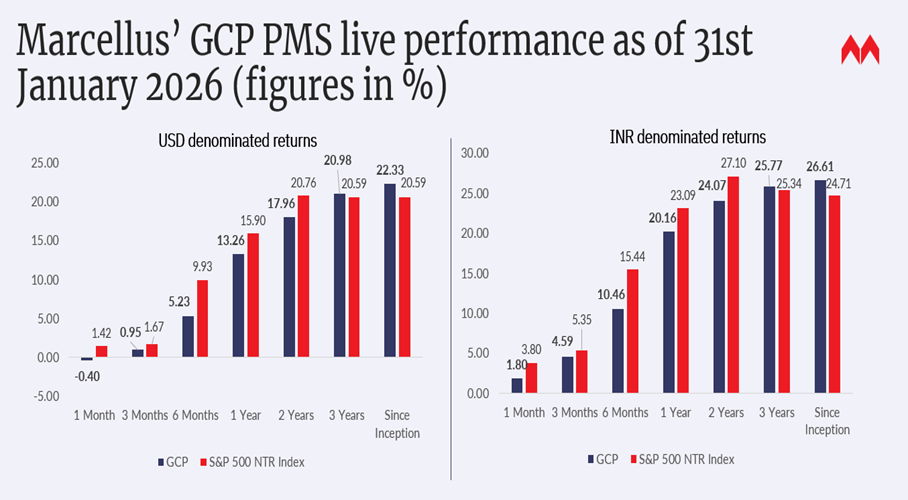

Our Global team has made several investments over the past year to help our clients profit from this new age of Sino-American tensions. Thanks to the reforms expedited by the Indian authorities over the past couple of years (see our 7th January ‘26 blog: https://marcellus.in/blogs/four-mega-reforms-which-opened-up-global-investing-for-indians/ ), we are now able to diversify globally in a cost-efficient and tax-efficient manner and benefit from this new age of rage. Our track record in compounding across the world is shown below. Since inception in Oct 2022, we have compounded at 27% CAGR (net of all fees & expenses in INR).

If you would like to join us in Global Compounding, please let us know.

Source: Marcellus performance data is shown gross of taxes and net of fees & expenses charged till end of last month on client account. Performance fees are charged annually in December. Returns more than 1-year are annualized. Marcellus’ GCP USD returns are converted into INR using USD: INR exchange rate from RBI – Link for the reference

Note: * Since Inception performance calculated from 31st Oct 2022. The inception date is 31st Oct 2022, being the next business day after the account got funded on 28th October 2022. S&P 500 net total return is calculated by considering both capital appreciation and dividend payouts. The calculation or presentation of performance results in this publication has NOT been approved or reviewed by the IFSCA or US SEC. Performance is the combined performance of RI and NRI strategies.

Marcellus GCP PMS is offered by Marcellus Investment Managers GIFT Branch in a segregated managed accounts format. The AIF is managed by Marcellus International Investment Managers LLC which is sub-advised by Marcellus GIFT Branch. The performance is provided for reference and does not include expenses typical to AIF structure.

The above material is neither investment research, nor investment advice. Marcellus Investment Managers Private Limited (“Marcellus”) is regulated by the International Financial Service Centre Authority (Fund Management) Regulations, 2025 (earlier 2022) (“IFSCA”) as Fund Management Entity – Nonretail, rendering Investment Management Services. Marcellus is also registered with US Securities and Exchange Commission (“US SEC”) as an Investment Advisor. No content of this publication including the performance related information is verified by IFSCA or US SEC. If any recipient or reader of this material is based outside India or US, please note that Marcellus may not be regulated in such jurisdiction and this material is not a solicitation to use Marcellus’s services. This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. No liability whatsoever is assumed by Marcellus as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus may be unable to exercise control or ensure or guarantee the integrity of the text of the material/email message and the text is not warranted as to its completeness and accuracy. The material, names and branding of the investment style do not provide any impression or a claim that these products/strategies achieve the respective objectives. Marcellus and/or its associates, employees, the authors of this material (including their relatives) may have financial interest by way of investments in the companies covered in this material.

This material may contain confidential or proprietary information and user shall take prior written consent from Marcellus before any reproduction in any form.

Data/information used in the preparation of this material is dated and may or may not be relevant any time after the issuance of this material. Marcellus takes no responsibility of updating any data/information in this material from time to time. The recipient of this material is solely responsible for any action taken based on this material. The recipient of this material is urged to read the Disclosure Document/Form ADV, Form CRS and any other documents or disclosures provided to them by Marcellus, as applicable, and is advised to consult their own legal and tax consultants/advisors before making any investment in the portfolio.

All recipients of this material must before dealing and or transacting in any of the products referred to in this material must make their own investigation, seek appropriate professional advice and carefully read the Disclosure Document, Form ADV, Form CRS and any other documents or disclosures provided to them by Marcellus, as applicable. Actual results may differ materially from those suggested in this note due to risk or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions globally, inflation, etc. There is no assurance or guarantee that the objectives of the investment strategy/approach will be achieved.

This material may include “forward looking statements”. All forward-looking statements involve risk and uncertainty. Any forward-looking statements contained in this document speak only as of the date on which they are made. Further, past performance is not indicative of future results. Marcellus and any of its directors, officers, employees and any other persons associated with this shall not be liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this material in any manner whatsoever and shall not be liable for updating the document.