OVERVIEW

Summary: After a five-year flirtation with boosting public capex, the Government of India is now focusing on the main engine of India’s economic growth: Consumption. The last 6 months have seen the announcement of a 5-layered boost for domestic consumption including the keenly awaited GST cuts. Cumulatively, these stimuli added up to 1.8% of GDP and, in effect, they unwind the excess load imposed on the consumer since FY19. However, given the record levels of household debt and weak job creation (for white collar jobs) more rounds of stimulus are required to get consumption back on track.

Public capex surged from FY21-24

In the aftermath of the adverse economic shock delivered by Covid in FY21, the Government of India began a massive bout of public capex which climaxed in FY24 with a Rs. 10 tn outlay (FY21-24 CAGR of 34%).

Naturally, during this period, the tax burden on the Indian consumer rose. Income Tax collections from individuals rose from 2.5% of GDP in FY19 to 3.8% in FY25. GST collections as a % GDP rose from 2.5% in FY19 to 2.8% in FY25. Effectively, by FY25 Indian households were paying 1.6% of GDP more to the Exchequer each year (than they did in FY18).

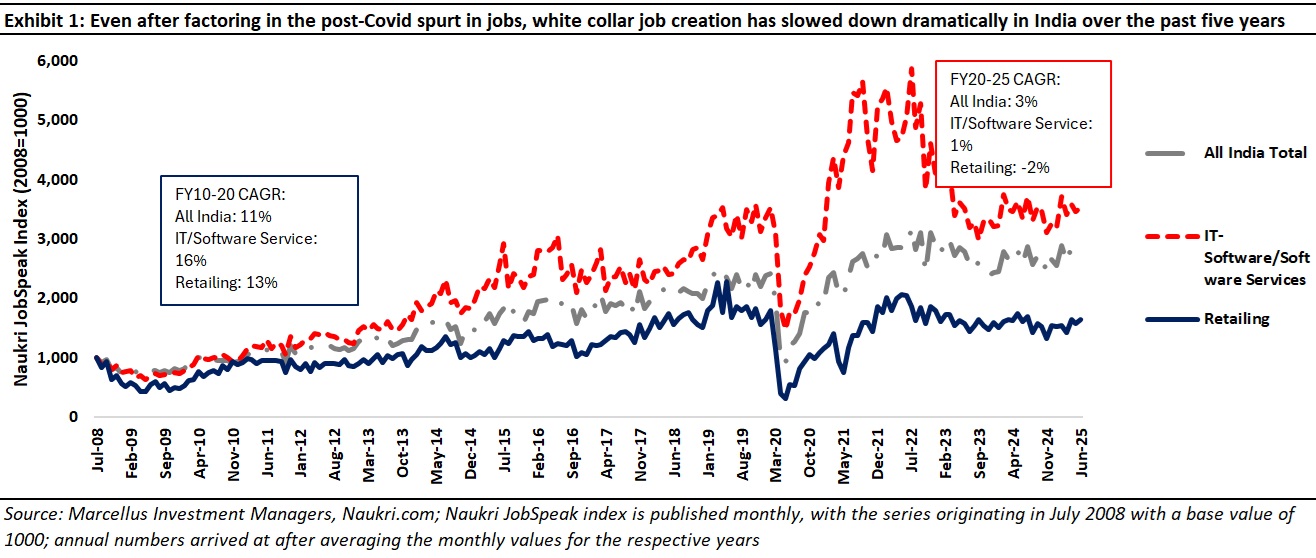

Unfortunately for the Indian consumer, this increased fiscal load that she was bearing coincided with a conk-off in white collar job creation as the unwinding of the excess hiring done during Covid started kicking-in (see chart below).

As employers’ demand for labour stagnated, wage growth too started falling. In fact, after adjusting for inflation, wages seem to have fallen in India in the post-Covid era (see our blog dated 1st August 2025, White Collar Jobs Growth and Wage Growth: Twin Drivers of India’s Slowdown).

Whilst consumption conked-off

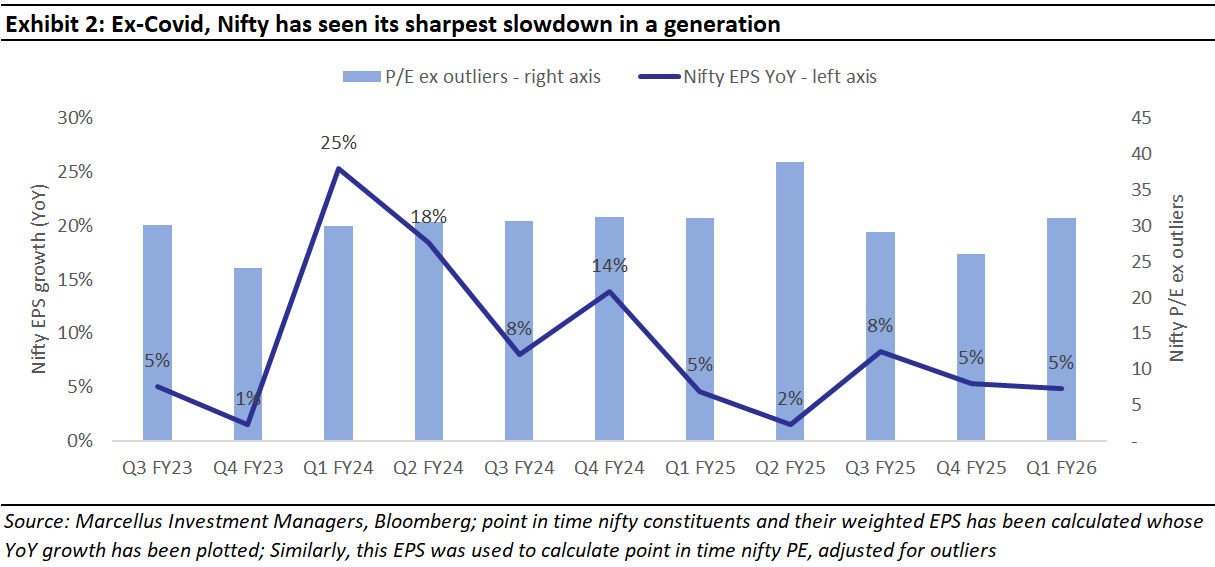

The combination of a higher fiscal load, fewer jobs, and weak wage growth combined to put the Indian consumer in a funk. As CEO after CEO spoke of a downturn in consumption, from Diwali 2023 onwards we sat and watched as earnings growth in India suffered the deepest downturn in a generation – see chart below.

Now, the consumption stimulus arrives

Over the past six months, however, the Government and the RBI have woken up to the scale of downturn in consumption and delivered multiple rounds of stimulus, namely:

· The Union Budget for FY26 said that those earning less than Rs. 12 lakhs per annum no longer have to pay Income Tax. This amounts to a Rs. 1 trillion per annum stimulus.

· The GST tax cuts set to kick-in on 22nd Sept 2025 amount to a Rs. 2 trillion per annum stimulus as per our calculations. [This Rs 2 trillion per annum figure is arrived at using FY25 GST collections of about Rs. 22 tn. With collections for all the categories that have either witnessed a tax rate reduction or rise, adjusted for impact of cess and foregone input tax credit benefit, the total cut comes to ~Rs. 2 tn, something which was also confirmed by the finance minister].

· The real money gaming ban seems likely to push another Rs 0.7 trillion back into consumption and away from gambling. [~Rs. 20K cr hit to the Exchequer , of which Rs.16.5K GST taxed at 28% rate and Rs. 3.5K TDS taxed at 30% suggests Rs. 71k cr of annual spend on gambling by participants].

· Similarly, SEBI’s newly discovered desire to curb speculative trading in the F&O market is likely to push money back into consumption. Basis the documents being made public in the SEBI vs Jane Street showdown, it appears that India’s retail F&O trader were being impoverished to the tune of Rs. 1 trillion per annum in the F&O market.

· The four repo rate cuts which the RBI has expedited so far are likely to reduce Indian households’ annual outgo on interest payments by Rs. 1.6 trillion. [~Rs. 150 trillion household debt outstanding (household debt as a % of GDP is ~42% ) multiplied by 1% cut in interest rate]

Adding up the five bullets listed above points to a consumption stimulus of around Rs. 6.3 trillion (US$ 76 bn) or nearly 1.8% of GDP from H2 FY26 onwards. Given that India’s auto, building materials, and FMCG companies have been living with volume growth of 2-3% per annum, a consumption stimulus of this magnitude should revive their fortunes and perk up our portfolios’ performance.

Note that our 1.8% of GDP estimate (of the stimuli being imparted) broadly offsets the 1.6% extra tax load that the Exchequer had imposed on the Indian consumer since FY19. So is this enough? Should the Indian authorities now sit back and wait for the economic recovery unfold?

But more stimulus is required

However, we do not see any room for complacency when it comes to reviving consumption in India. The adverse structural change in India’s white collar jobs market is profound (see our blog dated 1st August 2025, White Collar Jobs Growth & Wage Growth: Twin Drivers of India’s Slowdown for more on this] will create a multi-year disruption for the Indian economy (even without protectionist action from America on tech jobs, the latest of which is the fee hike for H-1B visas to $100K).

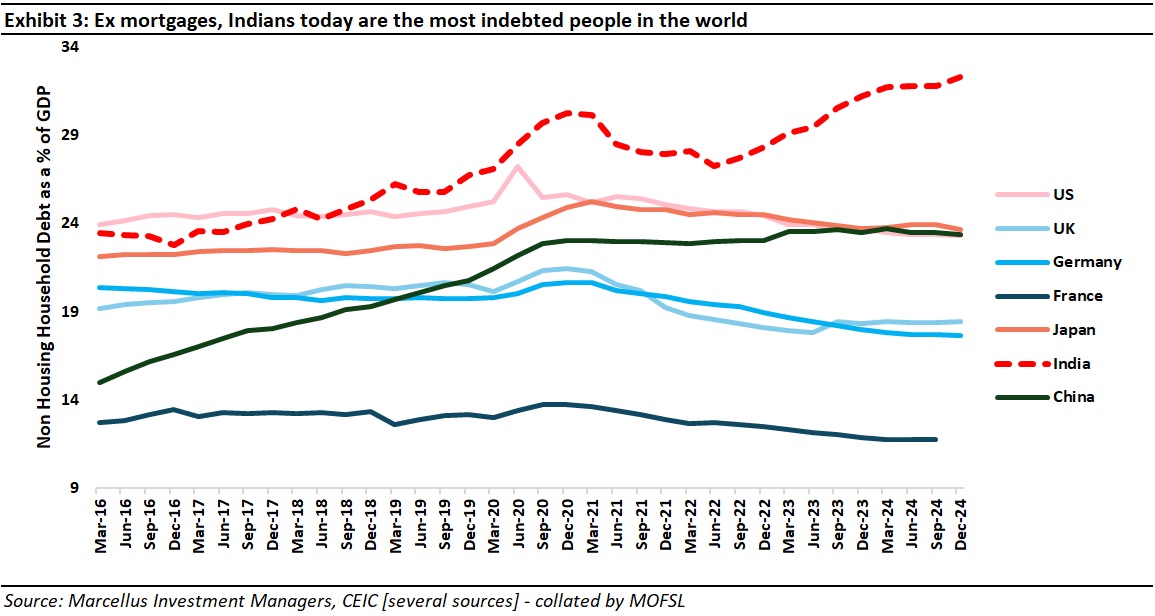

Secondly, since 2020, Indian households have taken on record levels of debt. The RBI is repeatedly highlighting in its Financial Stability Reviews that a large proportion of middle class households are struggling with their debt burden and will need multiple rounds of tax & rate cuts to keep their heads above the water.

What the Indian consumer needs is further relief on his debt burden. The simplest way to deliver that would be another round of 100bps of rate cuts from the RBI.

Nandita Rajhansa and Saurabh Mukherjea work for Marcellus Investment Managers (www.marcellus.in). The views and opinions expressed in this material are those of the writers/authors and do not necessarily reflect the official policy. This material is for informational and educational purposes only and should not be considered as financial, investment, or other professional advice.

The above material is neither investment research, nor investment advice. Info Edge (Naukri), forms part of Marcellus’ Portfolios. We as Marcellus, our immediate relatives and our clients may have interest and stakes in the mentioned stock. The stock mentioned is for educational purposes only and not recommendatory. Marcellus does not seek payment for or business from this material/email in any shape or form. Marcellus Investment Managers Private Limited (“Marcellus”) is regulated by the Securities and Exchange Board of India (“SEBI”) as a provider of Portfolio Management Services. Marcellus is also a US Securities & Exchange Commission (“US SEC”) registered Investment Advisor. No content of this publication including the performance related information is verified by SEBI or US SEC. If any recipient or reader of this material is based outside India and USA, please note that Marcellus may not be regulated in such jurisdiction and this material is not a solicitation to use Marcellus’s services. All recipients of this material must before dealing and or transacting in any of the products and services referred to in this material must make their own investigation, seek appropriate professional advice. This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. No liability whatsoever is assumed by Marcellus as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus may be unable to exercise control or ensure or guarantee the integrity of the text of the material/email message and the text is not warranted as to its completeness and accuracy. The material, names and branding of the investment style do not provide any impression or a claim that these products/strategies achieve the respective objectives. Further, past performance is not indicative of future results. Marcellus and/or its associates, the authors of this material (including their relatives) may have financial interest by way of investments in the companies covered in this material. Marcellus does not receive compensation from the companies for their coverage in this material. Marcellus does not provide any market making service to any company covered in this material. In the past 12 months, Marcellus and its associates have never i) managed or co-managed any public offering of securities; ii) have not offered investment banking or merchant banking or brokerage services; or iii) have received any compensation or other benefits from the company or third party in connection with this coverage. Authors of this material have never served the companies in a capacity of a director, officer, or an employee. This material may contain confidential or proprietary information and user shall take prior written consent from Marcellus before any reproduction in any form.