OVERVIEW

With the number of Indians earning more than Rs 1 crore per annum up 6x in the past decade and with the nation accounting for more than 10% of the world’s billionaires (3x the country’s share of world GDP), we are the midst of a boom in ultra-luxury spending in India. The companies benefiting from the luxury spending boom in India are listed mainly in Paris and Milan. By joining us in our Global Compounding journey you too could benefit from the rise of the Indian super-rich.

A decade ago, around 50K Indians were earning in excess of Rs 1 crore per annum (i). That number has now grown more than 6x to 324K (ii). As is well known, a significant proportion of wealthy Indians underreport their taxable income. Hence, one can safely assume that the number of Indians earning in excess of Rs 1 crore per annum is a multiple of the official figure of 324K. As their wealth & affluence burgeons, these rich Indians have become devotees of luxury consumption.

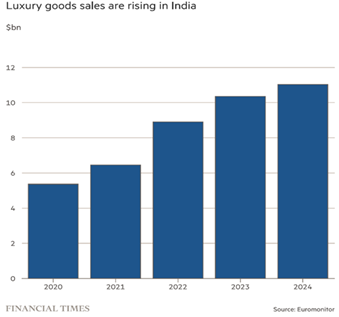

Indians are already spending $12 billion per annum of global luxury brands. This figure excludes the amount that wealthy Indians spend while shopping in Europe, Middle East and the Far East. (iii)

The Financial Times reports that “Louis Vuitton, luxury’s biggest brand…” already has three boutiques in India. Estee Lauder’s CEO Stephane de La Faverie says that India can “become the biggest contributor to the growth algorithm of the company”. Upmarket French department store Galeries Lafayette opened its first India outlet in October 2025. (iv)

Underpinning this luxury boom is a new generation of Indian billionaires. India is already home to 10% of the world’s 3000 billionaires (v) (vi) This 10% share is more than 3x India’s share of global GDP and underscores the country’s rise as a new source of growth for the world’s greatest luxury brands.

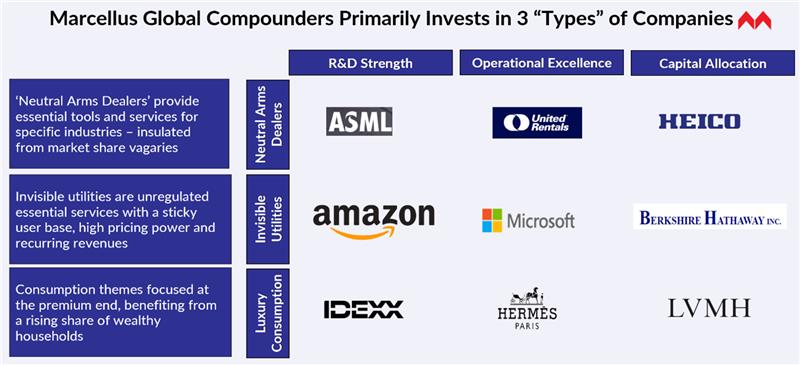

So, how can you as an investor profit from the growing boom in luxury spending in India? Unfortunately, the local stockmarket in India does not have large-listed luxury plays. When it comes to luxury, the stockmarkets to focus on are Paris and Milan because the French and the Italians remain the world leaders in creating desirable & fashionable products coveted by the super-rich.

For example, you could consider investing in LVMH , the Paris-listed conglomerate run by the legendary capital allocator Bernard Arnault. Arguably, the company most closely associated with global luxury spending, LVMH was formed by a merger between Louis Vuitton and Moet Henessey in 1987. Today, this firm controls 75 brands are across various consumer goods – leather goods, wines & spirits, watches and jewellery, perfumes and cosmetics and selective retailing. LVMH’s brands include Christian Dior, Fendi, Givenchy, Rimowa, Moët & Chandon, Hennessy, Dom Pérignon, Krug, Veuve Clicquot, TAG Heuer, Bulgari, Tiffany & Co., Hublot, Guerlain, Fenty Beauty, Sephora and many more. Unsurprisingly, LVMH has compounded shareholders’ wealth 5.3x in Euros over the past decade.

Click here to listen to our podcast on LVMH.

You could also consider investing in the world’s most valuable ultra-luxury brand, Hermes. Listed in Paris and run by the Dumas family for over 180 years, Hermes makes the world’s most exclusive leather handbags for women. With volume growth of these much sought after Birkin and Kelly bags deliberately restricted to 6-7% (whilst demand is growing much faster than that), Hermes is able to:

a) Price these handmade bags at ~10x their production cost which is around a few thousand dollars; and

b) Grow profits at 15% (in $ terms) decade after decade.

Hermes’ bags themselves are traded in a secondary market where the value of these bags tends to compound at 5-10% (in $ terms) depending on inflation. With no other company being able to come close to Hermes in the market for ultra-exclusive leather handbags for the world’s richest women, the company’s able to power through economic cycles has stood the test of time. Hermes has compounded shareholders’ wealth 7.4x in Euros over the past decade.

Click here to listen to our podcast on Hermes.

Investment implications for you

If your day job preoccupies you and does not give you enough time to research global luxury plays, you could consider joining us in our Global Compounders Portfolio.

Source: Marcellus Investment Managers

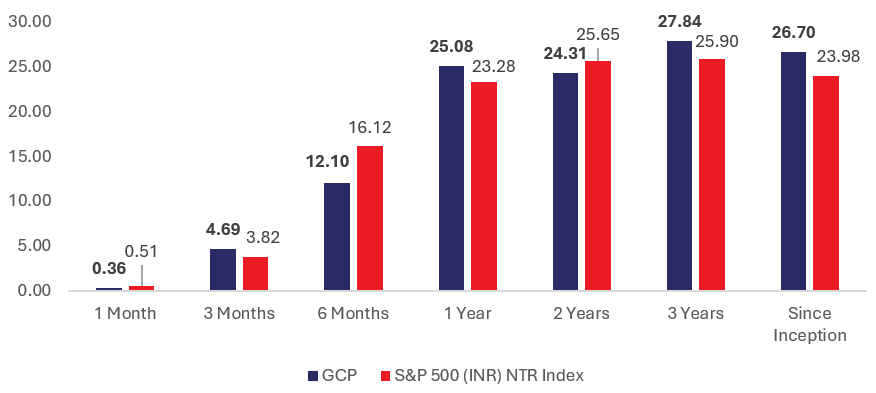

Thanks to the reforms expedited by the Indian authorities over the past couple of years (see our 7th January ‘26 blog: https://marcellus.in/blogs/four-mega-reforms-which-opened-up-global-investing-for-indians/ ), we are now able to diversify globally in a cost-efficient and tax-efficient manner. Our track record in compounding across the world is shown below. Since inception in Oct 2022, we have compounded at ~27% CAGR (net of all fees & expenses in INR).

If you would like to join us in Global Compounding, please let me know.

Global Compounders’ Performance as of 31 Dec’25 (Figures in INR and in percentage)

Source: Marcellus performance data is shown gross of taxes and net of fees & expenses charged till end of last month on client account. Performance fees are charged annually in December. Returns more than 1-year are annualized. Marcellus’ GCP USD returns are converted into INR using USD: INR exchange rate from RBI – Link for the reference

Note: * Since Inception performance calculated from 31st Oct 2022. The inception date is 31st Oct 2022, being the next business day after the account got funded on 28th October 2022. S&P 500 net total return is calculated by considering both capital appreciation and dividend payouts. The calculation or presentation of performance results in this publication has NOT been approved or reviewed by the IFSCA or US SEC. Performance is the combined performance of RI and NRI strategies.

Marcellus GCP PMS is offered by Marcellus Investment Managers GIFT Branch in a segregated managed accounts format. The AIF is managed by Marcellus International Investment Managers LLC which is sub-advised by Marcellus GIFT Branch. The performance is provided for reference and does not include expenses typical to AIF structure.

Thanks,

Saurabh Mukherjea

| Sources:

(iii) https://www.ft.com/content/1f3f3068-712b-4096-ab55-15af887ca527 (iv) https://www.ft.com/content/1f3f3068-712b-4096-ab55-15af887ca527 |

| LVMH and Hermes are a part of Marcellus’ portfolios. Hence, Marcellus, its employees and affiliates may have interest and stake in the mentioned stocks. The material shared is only for educational purposes. |

The above material is neither investment research, nor investment advice. Marcellus Investment Managers Private Limited (“Marcellus”) is regulated by the International Financial Service Centre Authority (Fund Management) Regulations, 2025 (earlier 2022) (“IFSCA”) as Fund Management Entity – Nonretail, rendering Investment Management Services. Marcellus is also registered with US Securities and Exchange Commission (“US SEC”) as an Investment Advisor. No content of this publication including the performance related information is verified by IFSCA or US SEC. If any recipient or reader of this material is based outside India or US, please note that Marcellus may not be regulated in such jurisdiction and this material is not a solicitation to use Marcellus’s services. This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. No liability whatsoever is assumed by Marcellus as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus may be unable to exercise control or ensure or guarantee the integrity of the text of the material/email message and the text is not warranted as to its completeness and accuracy. The material, names and branding of the investment style do not provide any impression or a claim that these products/strategies achieve the respective objectives. Marcellus and/or its associates, employees, the authors of this material (including their relatives) may have financial interest by way of investments in the companies covered in this material.

This material may contain confidential or proprietary information and user shall take prior written consent from Marcellus before any reproduction in any form.

Data/information used in the preparation of this material is dated and may or may not be relevant any time after the issuance of this material. Marcellus takes no responsibility of updating any data/information in this material from time to time. The recipient of this material is solely responsible for any action taken based on this material. The recipient of this material is urged to read the Disclosure Document/Form ADV, Form CRS and any other documents or disclosures provided to them by Marcellus, as applicable, and is advised to consult their own legal and tax consultants/advisors before making any investment in the portfolio.

All recipients of this material must before dealing and or transacting in any of the products referred to in this material must make their own investigation, seek appropriate professional advice and carefully read the Disclosure Document, Form ADV, Form CRS and any other documents or disclosures provided to them by Marcellus, as applicable. Actual results may differ materially from those suggested in this note due to risk or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions globally, inflation, etc. There is no assurance or guarantee that the objectives of the investment strategy/approach will be achieved.

This material may include “forward looking statements”. All forward-looking statements involve risk and uncertainty. Any forward-looking statements contained in this document speak only as of the date on which they are made. Further, past performance is not indicative of future results. Marcellus and any of its directors, officers, employees and any other persons associated with this shall not be liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this material in any manner whatsoever and shall not be liable for updating the document.