OVERVIEW

Whilst the US stockmarket has been a mega wealth-creator for the past 15 years, until 2 years ago it was out of our reach as a range of legal & tax issues made it impractical for Indians to invest a big chunk of their networth abroad. However, 4 blockbuster reforms changed all of that. Investing globally sitting in India has now become cost-efficient and tax-efficient thereby creating powerful diversification for the intelligent Indian investor.

In my Dec ’25 blog I highlighted how in any given 10-year cycle the INR gives up around 40% of its value to the US$ (click here for the blog). As a result of this after paying direct and indirect taxes, a typical Indian family is left with just 30 cents for every $ the family earns. With these 30 cents the family must finance its day-to-day lifestyle and its long-term goals such as children’s university education abroad and retirement.

While sitting at home during Covid, I realised that this was an unsustainable state of affairs. However, in 2020, to my shock & horror I realised that being an Indian resident there wasn’t much that I could do. As an Indian resident I faced Long Terms Capital Gains Tax on overseas investing of 20% (2x the then prevalent domestic rate). Secondly, I could only invest upto $250K abroad in a given financial year. And thirdly, when I redeemed these investments, I was obliged to bring those monies back to India.

As investors like me fretted about this state of affairs, the powers that be in India swung into action and expedited 4 blockbuster reforms which radically altered our investment horizons:

REFORM #1: The creation of GIFT City: Located next to Ahmedabad, Gujarat International Finance Tec-City (aka GIFT City) has become a world-class cost-efficient and tax-efficient global investing venue for local asset management firms such as Marcellus. Whilst the foundations of GIFT City were laid 15-20 years ago, GIFT became a serious investment venue in 2020 when the Government of India notified an Act of Parliament called the International Financial Services Centres Authority Act, 2019. Under the aegis of this act, over the next four years, GIFT City allowed firms such as ours to create and manage 100% global portfolios for our Indian clients, an investment construct which until that point had never been allowed in India.

REFORM #2: The lowering of Long-Term CGT (LTCGT) on global investments: On 1 July 2024, the Government of India lowered the Long-Term Capital Gains Tax rate on global stocks from 20% to 12.5%. Thus, Indian and global stocks now had the same LTCGT rate thereby removing a key deterrent to tax-efficient global compounding.

REFORM #3: The easing of restrictions on LRS: For a decade or so, the RBI’s Liberalised Remittance Service (LRS) allows Indians to invest upto $250K each year. Hot on the heels of the CGT relief, in July 2024, the RBI eased LRS rules very meaningfully. “…effective 10 July 2024, resident individuals were permitted to send funds under Liberalised Remittance Scheme (LRS) to International Financial Services Centres (IFSCs) for any permissible current or capital account transaction. Individuals were also allowed to use funds held in their IFSC-based foreign currency accounts to make transactions in other foreign jurisdictions.

Previously, LRS remittances to IFSCs were only allowed for investment in securities. This was expanded on June 22, 2023, to include payments of education fees to foreign universities operating in IFSCs.

To reduce compliance burden, the RBI also discontinued the requirement for monthly LRS return filings by banks from September 6, 2024.” (Source: https://www.cnbctv18.com/economy/rbi-annual-report-fy25-lrs-rules-eased-remittance-access-liberalised-scheme-19612372.htm)

In practical terms this meant that you & I can have foreign currency bank accounts in GIFT City and use that to a) invest abroad, b) spend money abroad, and c) move money – in foreign currency – between our investment and spending needs as we think fit without having to pay forex fees.

REFORM #4: The creation of the Overseas Portfolio Investment: On 22nd August 2022, the RBI announced that any Indian body corporate was allowed to invest upto 50% of its networth on foreign financial asset WITHOUT needing to permission from the RBI. (source: https://www.dhruvaadvisors.com/wp-content/uploads/2023/08/Dhruva-Alert-New-Regime-on-Overseas-Investments-24-August-2022.pdf)

How does all of this change your life?

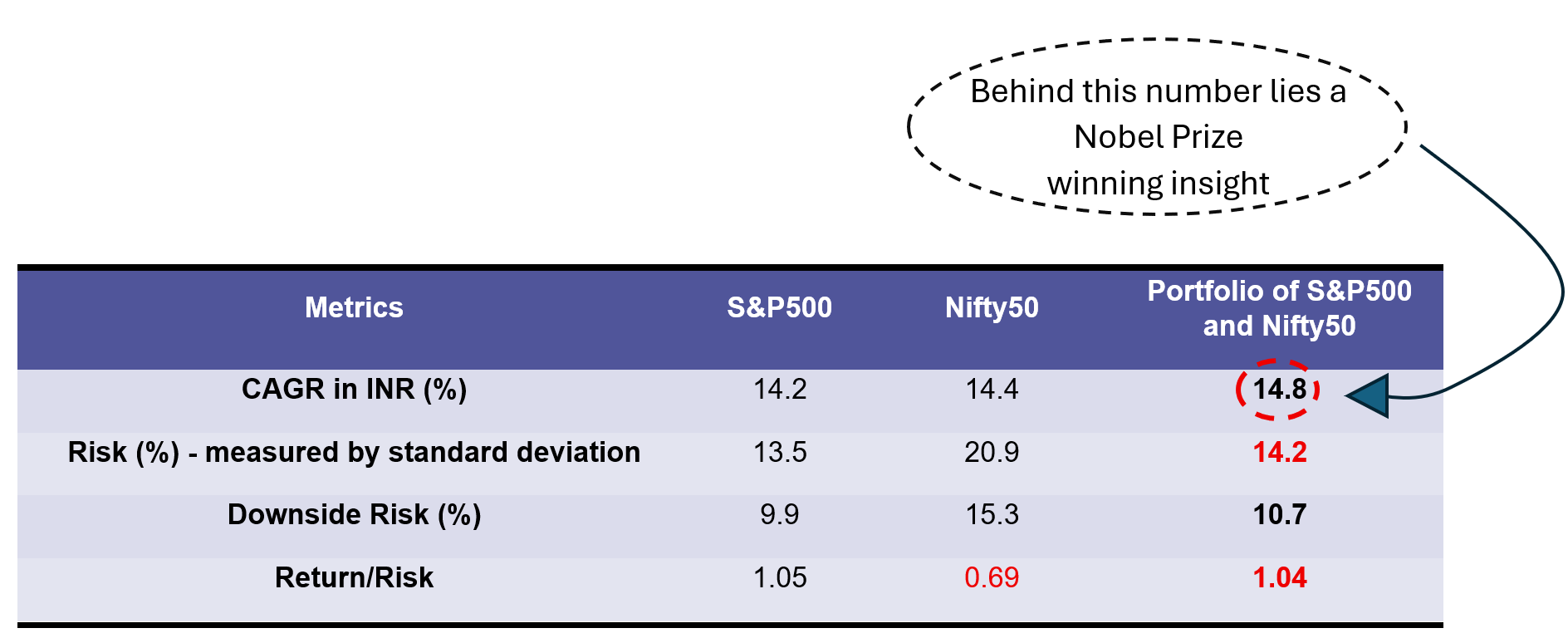

Thanks to the reforms expedited by the Indian authorities, your wealth – both in INR terms and in US$ terms – should compound much faster now if you diversify globally. As shown in the table below, an Indian investor with an equity portfolio split 50:50 between the Nifty50 & the S&P500 has historically compounded wealth much faster over the past 20 years relative to more insular Indian and American investors who have decided they will stick to their ‘home countries’. (Note: Past performance is not a guarantee.)

More practically for us as at Marcellus, the reforms expedited by the Government of India has allowed us to compound wealth globally through our Global Compounder family of products. If you would like to join us in Global Compounding, please let me know. Our track record in compounding across the world is shown below. Since inception in Oct ’22, we have compounded at 26.70% CAGR (net of all fees & expenses in INR).

Source: Marcellus performance data is shown gross of taxes and net of fees & expenses charged till end of last month on client account. Performance fees are charged annually in December. Returns more than 1-year are annualized. Marcellus’ GCP USD returns are converted into INR using USD:INR exchange rate from RBI – Link for the reference

Note: * Since Inception performance calculated from 31st Oct 2022. The inception date is 31st Oct 2022, being the next business day after the account got funded on 28th October 2022. S&P 500 net total return is calculated by considering both capital appreciation and dividend payouts. The calculation or presentation of performance results in this publication has NOT been approved or reviewed by the IFSCA or US SEC. Performance is the combined performance of RI and NRI strategies. Marcellus GCP PMS is offered by Marcellus Investment Managers GIFT Branch in a segregated managed accounts format. The AIF is managed by Marcellus International Investment Managers LLC which is sub-advised by Marcellus GIFT Branch. The performance is provided for reference and does not include expenses typical to AIF structure.