PORTFOLIO UPDATE:

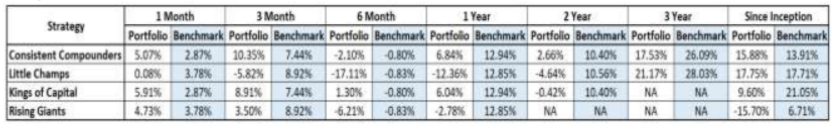

Performance data is net of annual performance fees (Except for Little Champs Portfolio) charged for client accounts whose account anniversary date falls up to the last date of this performance period. Since fixed fees and expenses are charged on a quarterly basis, effect of the same has been incorporated up to 30th April 2023. For Little Champs portfolio, since performance fees are charged on cumulative gains at the third anniversary of the respective client account, the effect of the same has not been incorporated in the performance data. (The returns are as on 31st May, 2023)

For relative performance of particular Investment Approach to other Portfolio Managers within the selected strategy, please refer https://www.apmiindia.org/apmi/WSIAConsolidateReport.htm?action=showReportMenu. Under PMS Provider Name please select Marcellus Investment Managers Private Limited and select your Investment Approach Name for viewing the stated disclosure.

Inception Date & Benchmark:

Consistent Compounders Portfolio: Inception: 1st Dec,2018 Benchmark: Nifty 50 TRI

Little Champs Portfolio: Inception:28th Aug,2019 Benchmark: BSE 500 TRI

Kings of Capital Portfolio: Inception:28th July ,2020 Benchmark: Nifty 50 TRI

Rising Giants Portfolio: Inception:27th Dec ,2021 Benchmark: BSE 500 TRI

The last 15 months were tough, globally, for our style of quality/growth-oriented portfolios, driven by –

- High commodity prices owing to the Russia-Ukraine conflict denting operating margins

- Global supply chain disruptions due to China lockdown impacting inventory (and thereby working capital) cycles

- An unprecedented 450bp rate hike by the US Fed triggering a shift from ‘long equity’ to ‘long bond’ (and a preference for value over growth) causing large FII outflows and a significant correction in valuations

However, a shift in these macro trends over the last few months – interest rates peaking, commodity prices and inflation stabilising etc. – has resulted in a meaningful pick up in our portfolio performance – CCP is up ~12% while RGP is up ~10.3% since 1st April (vs 7.09% Nifty and 8.53% BSE500). The fact that this has coincided with a ~USD8bn FII inflow should come as no surprise.

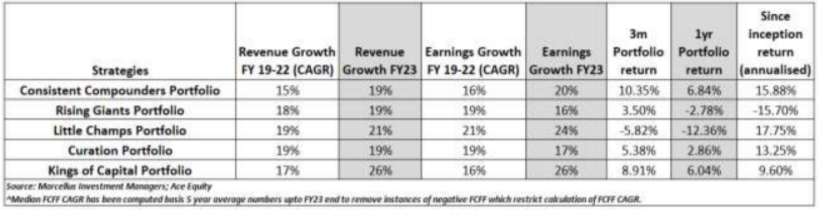

Do note, however, that any reversal in stock price performance needs to be backed by strong fundamentals. Our portfolio companies have continued to exhibit robust fundamentals during this period but a sharp correction in their stock prices has widened the valuation mispricing, which has perhaps caught the attention of FIIs. Regardless, it has helped us tactically rebalance our portfolio towards stocks where the margin of safety has expanded significantly. Please see below the screenshot showcasing the strong fundamentals of our portfolios.

Knowing what’s important amidst NOISE:

An unwavering focus on fundamentals is the backbone of our investing philosophy. Amidst all the noise over the last 15 months, we believe we have done reasonably well to not deviate from our framework or get swayed by short term factors and to focus on what is truly important – assessing the underlying strength of our portfolio companies’ businesses and their long term potential.

In a recent blog, Morgan Housel has beautifully summarised this aspect (read here – https://collabfund.com/blog/paying attention/) –

“There are two types of knowledge: Expiring and permanent.

Expiring knowledge is things like quarterly earnings, election polls, market information, and politics. It catches more attention than it should, for two reasons. One, there’s a lot of it, eager to capture our short attention spans. Two, we chase it down, anxious to squeeze out insight before it loses relevance.

Permanent knowledge tends to be principles and frameworks that help you make sense of expiring information.” “Asking how long you’ll care about the information you read pushes you to focus on permanent things and care little about temporary things – a great mindset for long-term thinking.”

On that note, our assessment of the Q4FY23 earnings (in the context of the full year FY23) reinforced our conviction on the fundamental progression of our portfolio companies’ businesses.

Q4FY23 – Financials:

System loan growth remained healthy in Q4 and stood at 15% YoY. However, all our investee lenders posted YoY loan book growth in excess of industry growth – suggesting continuation of steady market share gains. Margins have likely peaked for the sector and we expect them to moderate from Q1/Q2FY24 onwards. While this may put pressure on RoAs for all lenders, most of them have invested massively in manpower, distribution and technology in last 2,3 years which should see some operating leverage benefits flow through.

Q4FY23 – Non-financials:

Amongst non-financial stocks, there was significant improvement in operating margins due to cost pressures abating – in most cases, margins are back to normalised levels or in some cases higher than even pre-covid levels (eg. Asian Paints). In our flagship CCP portfolio, FY23 top-line growth of 19% yoy signifies that underlying demand continues to be strong, as also corroborated by the recently released Q4FY23 GDP data that showed a 6.1% yoy growth (7.2% yoy for FY23). CCP earnings growth of 20% yoy on a high/normalised base is a reflection of the resilience of our portfolio companies, particularly during a year with significant pricing pressures.

Please find below links to our latest newsletters and presentations:

**For product/sales related queries please write to sales@marcellus.in**

Operations Update-

I. Minimum Top up & SIP investment amount – The minimum Top up and SIP investment amount is now 50,000/- for all products. This will enable many more clients to channel monthly savings into investmentsin an automated way (much like MF SIP). This can also be a great way to minimize portfolio churn due to rebalancing your portfolio or settlement of any due expenses.

*Note- This deployment of cash is at the discretion of the Portfolio Manager. The amount as small as 50,000/- may remain undeployed for few weeks as it will be just 0.5% in a 1 crore portfolio and would not be substantial for preparing a buy order.To set up SIP refer to the template provided in this link https://marcellus.helpscoutdocs.com/article/100-systematic-investment-plan-sip-faqs, client can either send this filled template to us or login to their Mobile App to send us a request.

II. Bank Account Registration for funding from unregistered bank account- It is important to register a bank account for the purpose of funding or redeeming in a particular PMS account. In case a bank account is not registered and still funds are transferred by the clients, the funds will be not mapped to the portfolio. In order to register a bank account please request clients to write to clientsupport@marcellus.in along with the cheque copy to register the bank details. In case of joint bank account where the joint holder is not a PMS account holder, we would require his/her PAN details or PAN copy to conduct due diligence.

III. DP Closure for full redemption/full switch- It is mandatory to send hardcopies of demat closure forms in case of full redemption as well as full switch to our office address. For initiating the request, you can share an executed scan copy. However, the hard copies should be received at our office within 4-5 days of initiating the request.

IV. Fee Recovery Process- Earlier our invoice communication emails requested clients to let us know their choice if they want us to recover the invoice amount by liquidating securities or if they would top up the portfolio with equivalent amount. From now on, we will just send clients their invoice copy. If clients wish to top up, they can transfer funds within 14 days of the receipt of the invoice. If clients do not wish, then they don’t have to take any action. We will check the account after 14 days, and if no sufficient cash available to recover fee, we will liquidate few securities and settle the expense.

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this material/email in any shape or form. Marcellus Investment Managers Private Limited (“Marcellus”) is regulated by the Securities and Exchange Board of India (“SEBI”) as a provider of Portfolio Management Services. Marcellus is also a US Securities & Exchange Commission (“US SEC”) registered Investment Advisor. No content of this publication including the performance related information is verified by SEBI or US SEC. If any recipient or reader of this material is based outside India and USA, please note that Marcellus may not be regulated in such jurisdiction and this material is not a solicitation to use Marcellus’s services. This communication is confidential and privileged and is directed to and for the use of the addressee only. All recipients of this material must before dealing and or transacting in any of the products referred to in this material must make their own investigation, seek appropriate professional advice and carefully read the Private Placement Memorandum/Disclosure Document, Form ADV, Form CRS and any other documents or disclosures provided to them by Marcellus, as applicable. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. No liability whatsoever is assumed by Marcellus as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus may be unable to exercise control or ensure or guarantee the integrity of the text of the material/email message and the text is not warranted as to its completeness and accuracy. The material, names and branding of the investment style do not provide any impression or a claim that these products/strategies achieve the respective objectives. Further, past performance is not indicative of future results. Marcellus and/or its associates, the authors of this material (including their relatives) may have financial interest by way of investments in the companies covered in this material. Marcellus does not receive compensation from the companies for their coverage in this material. Marcellus does not provide any market making service to any company covered in this material. In the past 12 months, Marcellus and its associates have never i) managed or co-managed any public offering of securities; ii) have not offered investment banking or merchant banking or brokerage services; or iii) have received any compensation or other benefits from the company or third party in connection with this coverage. Authors of this material have never served the companies in a capacity of a director, officer or an employee.

This material may contain confidential or proprietary information and user shall take prior written consent from Marcellus before any reproduction in any form.