We have previously highlighted in MeritorQ: The Moneyball of Quality Investing the key reasons to rebalance in the context of MeritorQ’s investment rules. In this newsletter, we delve into how rebalancing between uncorrelated equity styles like Quality and Value, which forms the basis for selecting stocks in MeritorQ, further enhances MeritorQ’s returns. We call this the “rebalance bonus”.

For Relative performance of particular Investment Approach to other Portfolio Managers within the selected strategy, please refer this link

As we have discussed before, rebalancing MeritorQ allows investors to benefit from: (1) Mean reversion in Price to Free Cash Flow multiples, (2) Invest in the next set of undervalued stocks; and (3) Reduce concentration risk. Thus, periodic rebalancing, not only helps in improving performance but also functions as a risk-mitigation tool. Moreover, rebalancing can add further value, when combined with less correlated factors, like Value and Quality, as we do in MeritorQ’s selection step.

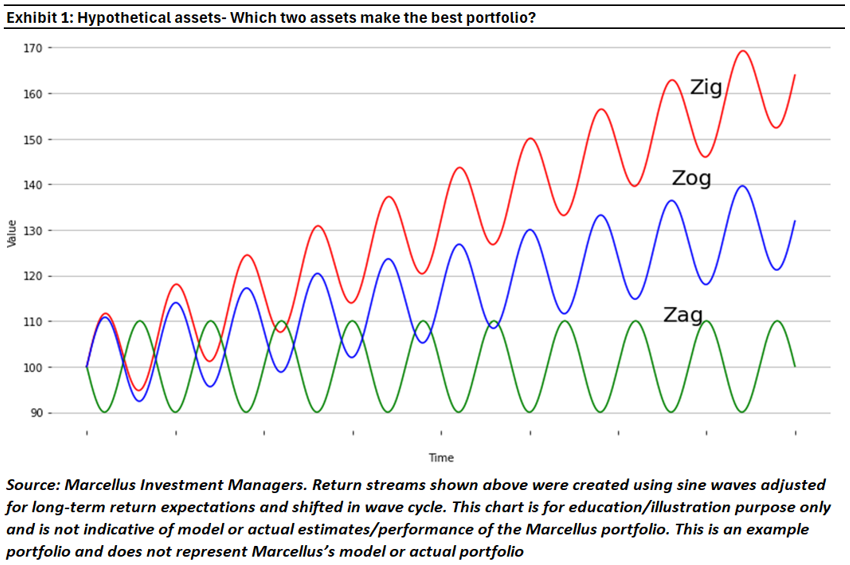

To illustrate with an example, lets assume one can buy only two assets out of a possible three choices: Zig, Zog and Zag as shown in exhibit 1.

The first two assets, Zig and Zog have the highest returns so they would seem like the obvious choices. Zag has a long run return of about zero so it seems like the least attractive option. However, there’s one wrinkle here: Zig and Zog are highly correlated with one another. They track one another and the business cycle. Both do well when markets are up and poorly when markets are down.

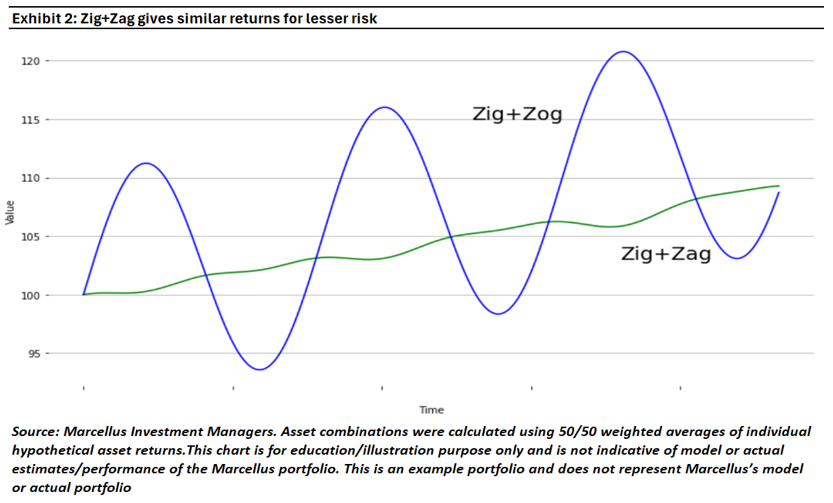

Even though Zag has an expected return of zero, it goes up in periods where Zig and Zog go down. Its most substantial gains are when the other two assets are in crisis. If you can only buy one asset, Zig is the obvious answer. It has the highest total return. However, if we can buy two assets and rebalance between them, then an equally weighted Zig+Zag portfolio can give similar returns with lower volatility and drawdowns than Zig+Zog as shown in exhibit 2. Counterintuitively therefore, we see that combining a high return asset with a low return asset boosts returns provided the two assets have low or negative correlation with each other.

This is a result of anti-correlation and rebalancing. In periods where Zig is going up and Zag is going down, some of the profits from Zig are being rebalanced into Zag. Zag has the worst returns on a standalone basis. But it provides returns at the right time to offset losses in the more offensive Zig.

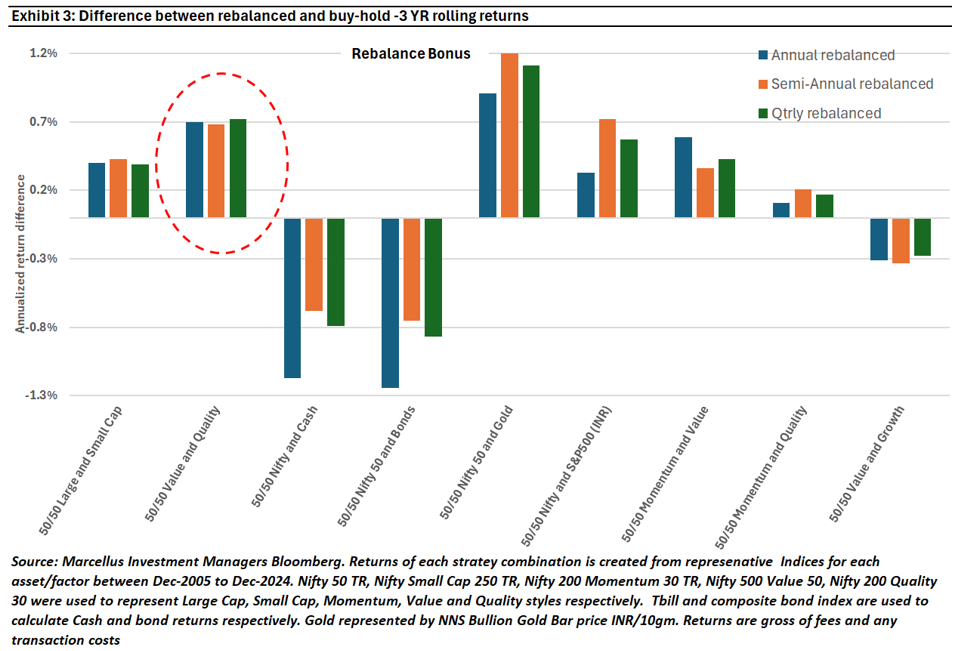

For a more real-life example, we took equal weighted combinations of popular long only equity factor indices along with other popular investable asset classes like gold, bonds and cash available to Indian investors and compared buy and hold returns of each equal weighted combination with their rebalanced counterpart. The annualized return difference between rebalanced and the buy and hold strategy is shown in exhibit 3.

As the exhibit shows, an equally weighted value and quality portfolio shows the second highest value add, of ~70 bps annualized, from rebalancing (shown within the dotted circle in Exhibit 3). The equal weighted ‘Nifty 50, Gold’ combination shows the highest value add. This extra return arising from rebalancing can be thought of as “rebalancing bonus”.

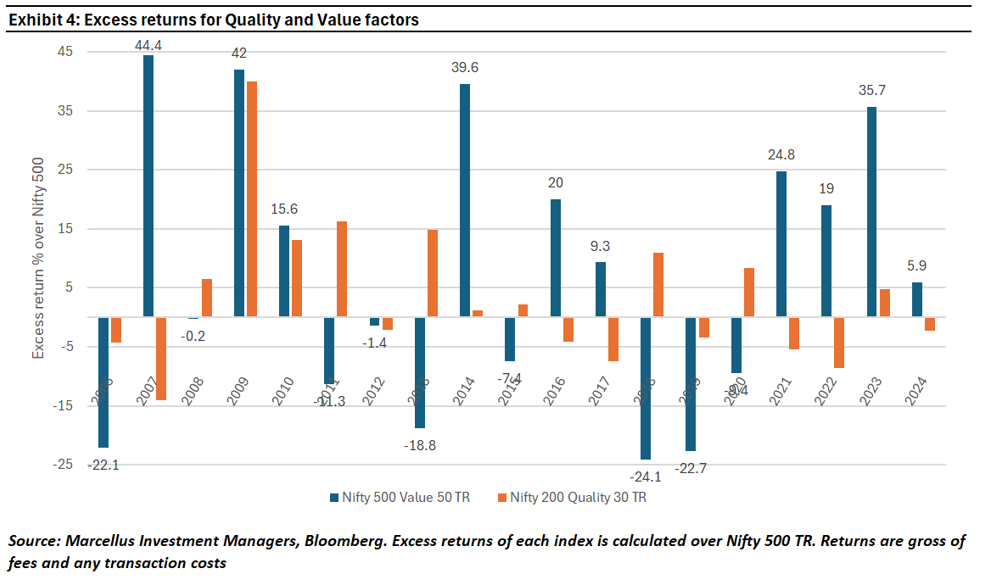

Exhibit 4 shows the yearly excess returns for Value and Quality over last 19 years. Over this period, excess returns of Value and quality have moved in opposite directions in 13 of these 19 years, attesting to the negative correlation between the two factors. This should not come as a surprise as Value and quality factors tend to drive returns in different stages of the economic cycle, with cheap value stocks outperforming during the recovery phase (refer to 2009-2010, 2021-2022) and Quality stocks outperforming during downturns (2008, 2018 and 2020) due to their stronger business fundamentals.

|

Exhibit 3 also shows that rebalancing actually drags down return for Equity (represented by Nifty 50 Index) and cash or Equity and bond combinations. This is because in both cases, growth in Equity eventually overpowers cash or bond allocation in buy and hold portfolio, which the respective rebalanced version cannot beat due to frequent reset to equal weight. Though cash and bond have lower correlation to Equity compared to say Value and Quality or even Gold and Equity, the reduction in portfolio risk due to lower correlation is not compensated by reduction in returns due to being exposed to a lower return asset class. Value and Quality are equity style factors exposed to same asset class and with similar long-term returns. Hence, the combination does not suffer from similar dilution of returns. Rebalancing can be a free lunch but not always. Assuming no transaction costs and taxes, rebalancing is well suited for Value and Quality equity styles that dance to different beats but which are likely to end up in similar positions. Regularly rebalancing a portfolio selected basis Quality and Value, as we do in MeritorQ, therefore allows the strategy to earn the rebalance bonus by reducing risk and not diluting returns. |

|

Regards, |