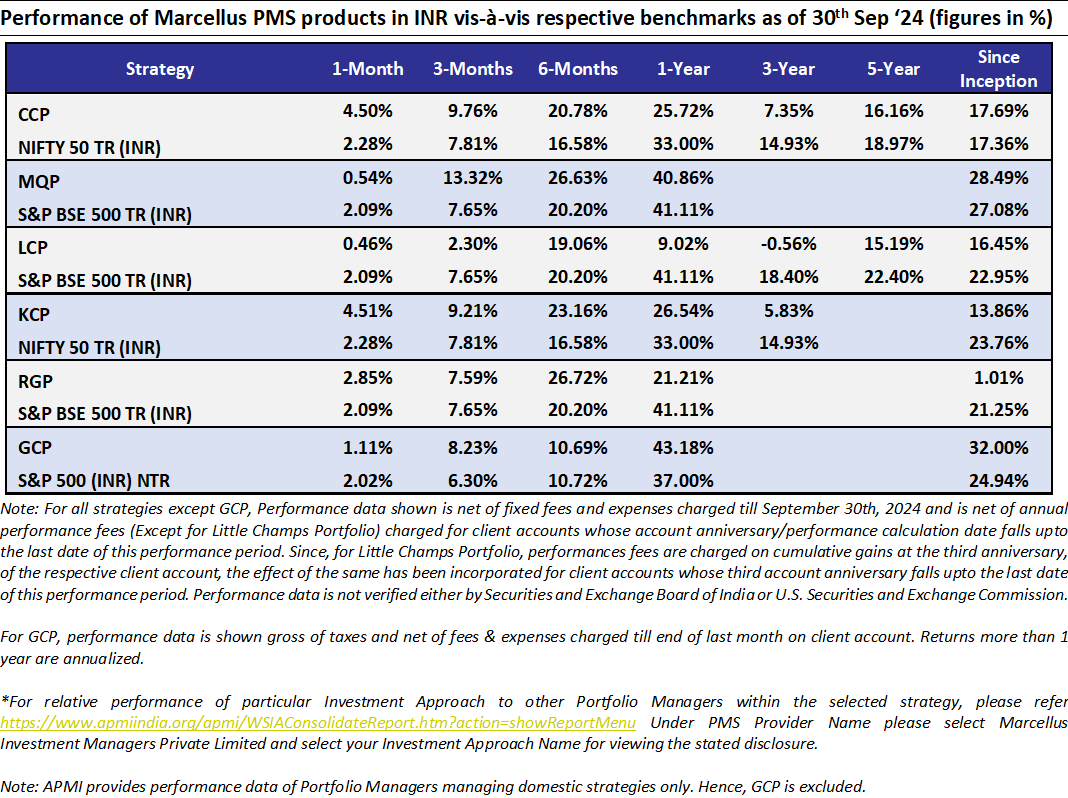

Consistent Compounders Portfolio (CCP)

Performance of Marcellus’ CCP portfolio has turned a corner in absolute returns over the last 18 months (31% CAGR) and in relative returns over the last six months (20.78% for CCP vs 16.58% for Nifty50 TRI). This is attributed to both the upgrades made to our portfolio construction approach as well as to the strong performance of the ‘quality’ universe in the broader stock market.

When it comes to a fundamental comparison, CCP portfolio companies delivered a weighted average revenue growth of 18% YoY in Q1 FY25 vs only 12% YoY growth for the top 100 stocks of BSE500. Furthermore, CCP portfolio companies delivered a EPS growth of 23% YoY vs 1% YoY for the top 100 stocks of BSE500. Govt. capex spending / narrative that drove certain segments of the stock market in FY23 and FY24 has also started to reverse. For instance, on a cumulative basis in the first five months of FY25, Govt capex is down 19% YoY and has been only 27% of the full year target (vs 39% of full year target in 5MFY24). Compared to budgeted expenditure for FY2025, railways and roads expenditure remain on target while defence expenditure and loans to states for capex remain off the targets (Source: Sell side reports).

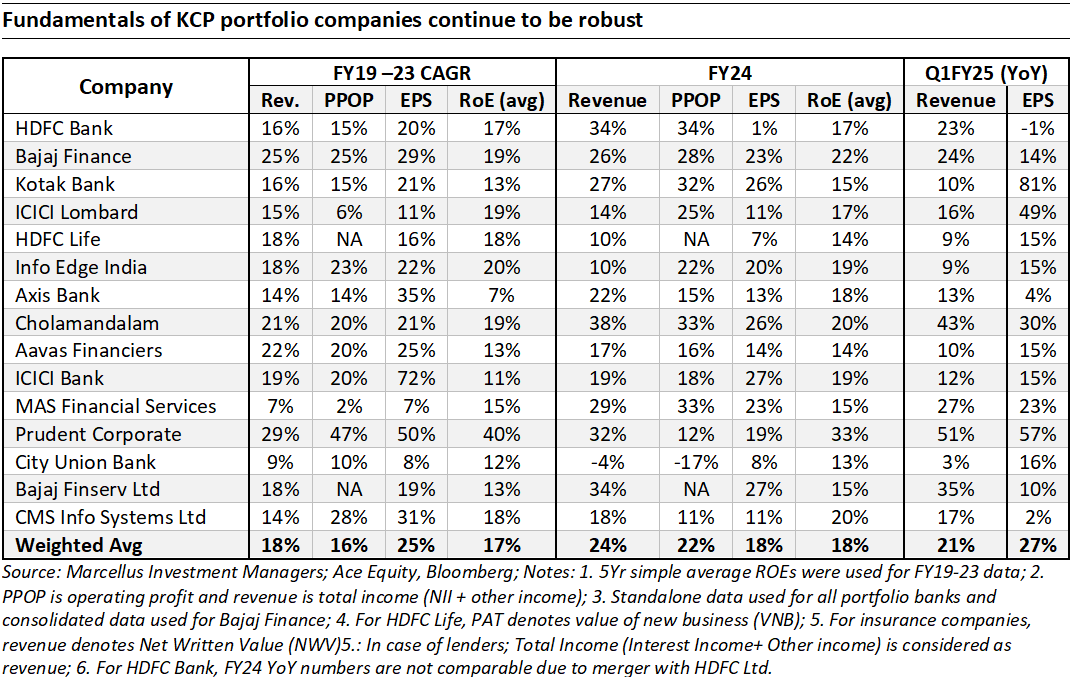

Although this macroeconomic backdrop has adverse implications for the broader economic growth, Marcellus’ CCP portfolio remains geared towards companies which are able to offset such macro headwinds through market share gains, capital allocation towards newer areas of growth, and operating efficiencies to support earnings growth. Over FY19-24, Marcellus’ CCP portfolio constituents have delivered a weighted average revenue CAGR of 18%, EPS CAGR of 26% and an average ROCE of 23%. These fundamentals compare favourably against those of Nifty50, where the index has delivered profit CAGR of 10% (FY19-23) and an ROCE of only 6% (FY19-24)(source: Bloomberg). Such superior fundamentals justify the premium valuations that Marcellus’ CCP portfolio trades at, relative to the broader stock market.

Going forward, we expect the portfolio to continue to deliver healthy and consistent performance largely backed by fundamentals of the portfolio constituents. Upgrades made to the portfolio construction approach over the last 12 months (discussed in our latest CCP webinar) should provide greater resilience to absolute and relative returns.

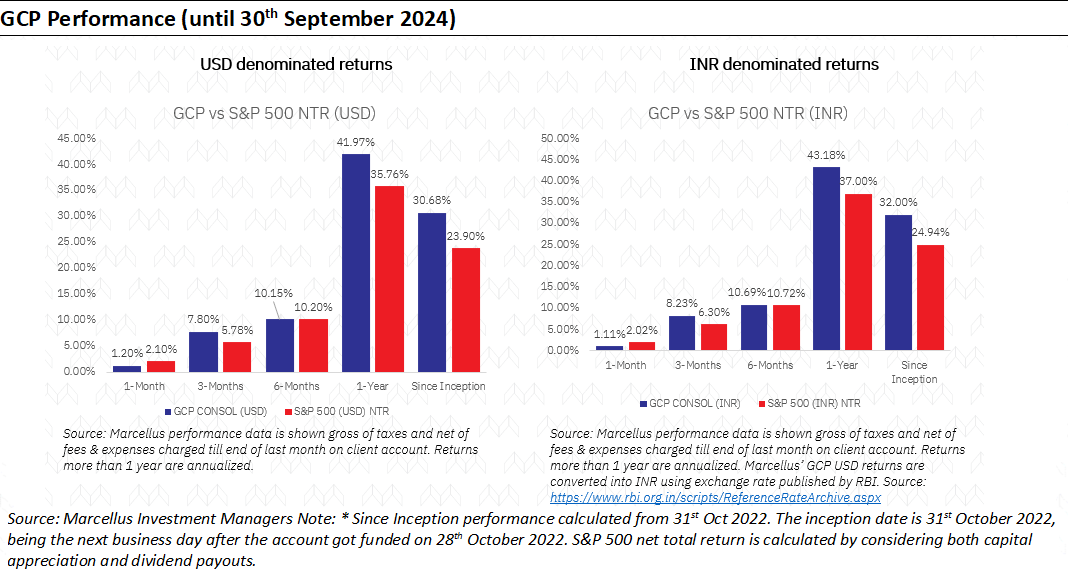

Global Compounders (GCP)

We have made no major portfolio changes since June this year. September was a bit weak, with a 90 bps underperformance versus the benchmark S&P 500. However, for the quarter, GCP outperformed the benchmark S&P500 by approximately 200 bps.

September marked the end of a particularly eventful month, with several macro and geopolitical developments. It also concluded a noteworthy quarter in which bonds (TLT) outperformed stocks (S&P 500) in an up market. Leading up to the Fed’s 50 bps rate cut on September 18th, expectations were already aligned for such a move, making the cut a “sell the event” moment, as bonds subsequently underperformed stocks. The market now expects two more 25 bps rate cuts by year-end.

The key surprise came from China and the PBoC’s measures to stabilize its struggling economy, driven by challenges in both the property and stock markets. Property wealth constitutes> 60% of Chinese household wealth, one of the highest levels globally. With property sales declining year-over-year since mid-2021, Chinese consumers have cut back on spending, increasing the risk of deflation. In response, Chinese policymakers announced the following measures:

1. A 20 bps policy rate cut and a 50 bps RRR cut.

2. A 50 bps reduction in outstanding mortgage rates and a lowered down-payment ratio (15%) for second-time homebuyers. The PBoC will cover 100% of bank loans for housing inventory purchases (up from 60%).

3. Establishment of a RMB500 billion swap facility for brokers and a RMB300 billion refinancing facility for stock buybacks.

The unexpected Politburo meeting in September, which usually takes place in April, July, and December, underscored the urgency of the situation. While these measures have been received positively by the Chinese markets, leading to a 20% rally, more substantial action may be required. For context, the U.S. TARP program after the Global Financial Crisis committed over 5% of GDP, compared to China’s <1% so far.

In terms of impact on our portfolio, consumer and luxury stocks (like Hermes) responded well. We do not have any metals and mining stocks – but that subsector did pretty well. However, oil prices remained capped due to OPEC’s production plans. We believe the second half of CY 2025 could represent a key inflection point, with growth in current market favourites slowing while sectors like consumers and traditional industrials may show renewed strength. Market will likely start pricing this beforehand. We expect to make some portfolio adjustments in October and November to position for the next three years.

Turning to company-specific updates, three of our portfolio companies reported earnings in September:

Cintas: The uniform rental leader reported strong numbers, exceeding revenue and profit expectations, and raised its FY25 guidance. The company saw 8% organic revenue growth, driven by new business wins and continued demand. There were no signs of a slowdown, and we remain confident in Cintas’ ability to deliver high-single-digit organic growth and margin expansion, fueled by technology investments and operational leverage. Our view remains that Cintas is a low-teens total return CAGR stock, a defensive play with solid fundamentals.

Copart: The world’s largest salvage auction company reported over 7% topline growth, impressive in the weak used car pricing environment. Copart continues to gain market share, a key metric for us. While profitability was impacted by one-time costs, we see these as temporary. Encouragingly, the company is expanding beyond its core insurance business. One long-term risk is autonomous driving, which could reduce the number of accidents, but for now, we expect Copart to deliver mid-teens total return growth.

Ashtead: Results were in line, but Ashtead has lagged in market share gains compared to its peer United Rentals. The announcement of CFO Michael Pratt’s retirement in September 2025 and his replacement by Alex Pease may catalyze a move toward a U.S. listing. However, we remain concerned about the company’s pace of market share growth.

Finally, GCP will mark its two-year anniversary this month. It has been an incredible journey of learning and growth, and we sincerely appreciate your continued trust in us!

Kings of Capital Portfolio (KCP)

September turned out to be a good month for the Kings of Capital portfolio as it delivered a 4.51% return and outperformed the Bank Nifty and Nifty indices. Over the past 6, 12, 18 and 24 months, the Kings of Capital portfolio has outperformed the Bank Nifty Index as the euphoria and investor interest in public sector banks has subsided over the past couple of quarters.

The rebound in portfolio performance has not been led by any significant changes to the portfolio or portfolio construction approach. Our name churn at the portfolio level since inception has been ~10% per annum which implies a genuinely long-term approach to investing and this approach hasn’t changed over the past 18 months. The performance rebound has largely been a result of stocks prices catching up with earnings growth rather than any change in approach.

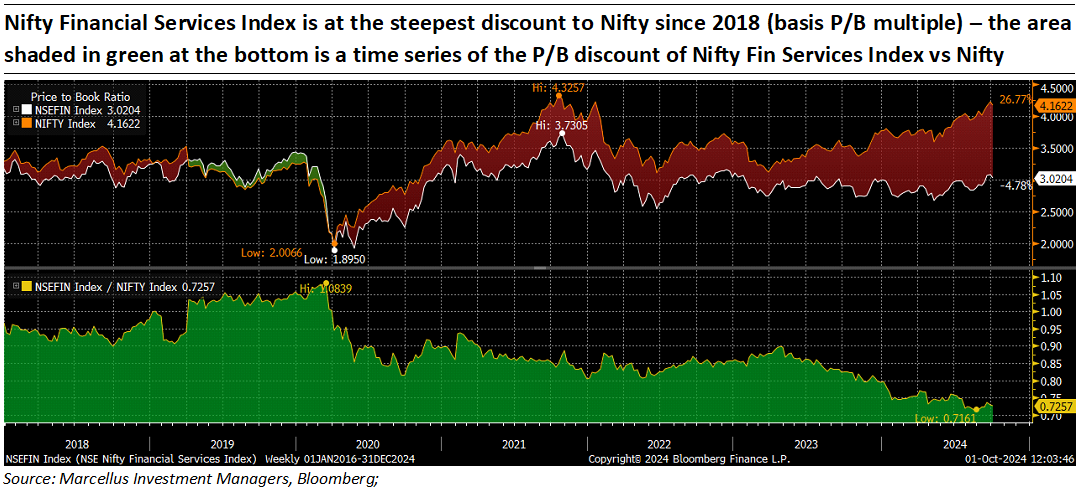

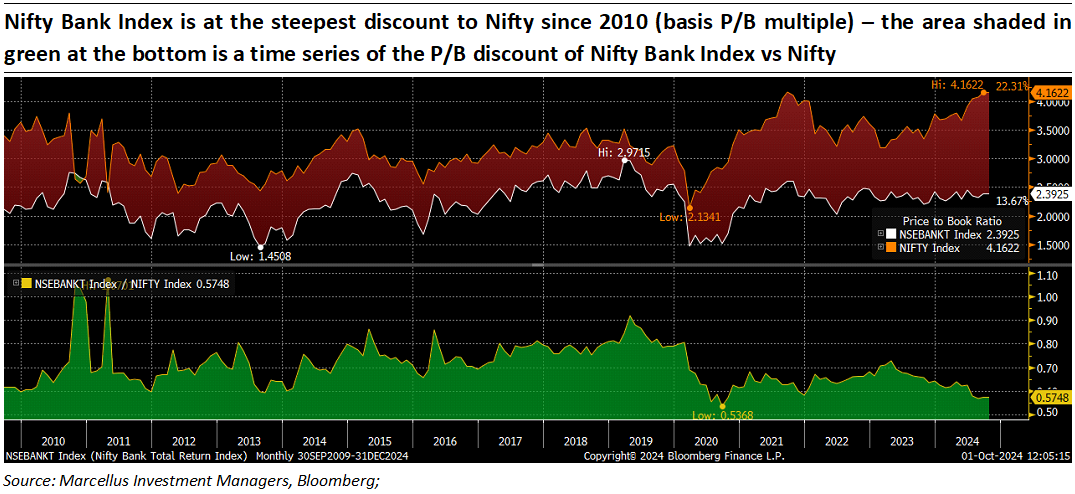

Despite our portfolio delivering ~45% returns over the past 18 months, the portfolio valuations are not expensive (while valuations are no longer cheap either) especially vis-à-vis rest of the market. As illustrated in the two screenshots from Bloomberg below, the Nifty Financial Services Index and the Nifty Bank Index are trading at their steepest discount vs the Nifty over the past five and fifteen years respectively. The sector continues to be out of favour due to regulatory risks and headwinds around deposit growth and margins. While the timing of mean reversion of multiples is difficult to predict, large well run private banks offer downside protection in a market which is full of excesses in many pockets.

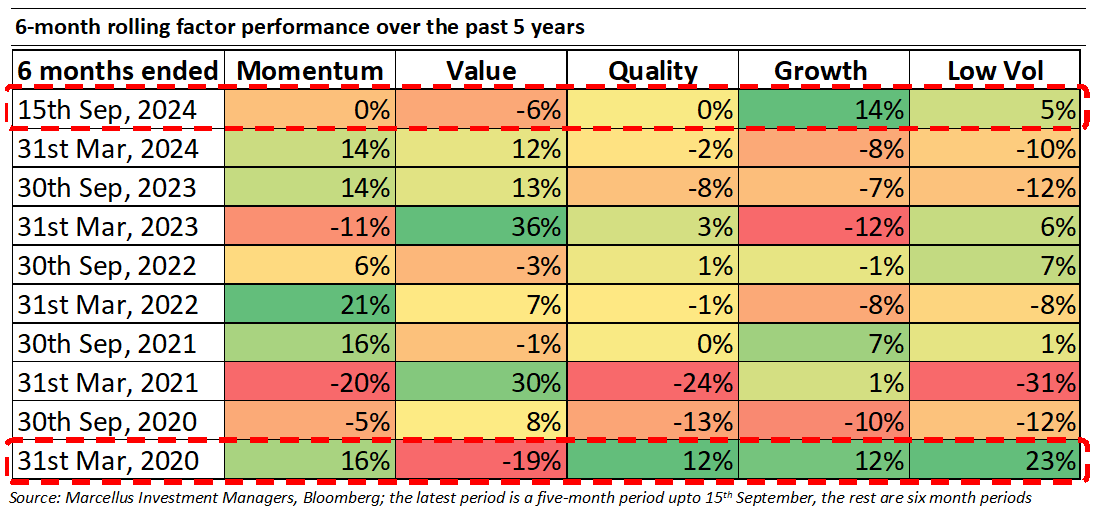

Quality, Growth and Low Volatility factors coming back in favour together for the first time since Covid:

From a top-down market perspective, we are observing quality, growth, and low-volatility factors performing well together for the first time since the Covid drawdown in March 2020, aside from a brief blip in Q3 2021. Over the past three years, starting in September 2021, the Indian markets have been led by a value-stock rally. However, in the last six months, this value rally has begun to lose momentum resulting in our strong outperformance. Given the relatively attractive valuations of high-quality stocks, there’s a higher likelihood that this trend may persist in the upcoming quarters. While it’s still early to determine if this shift will decisively favour high quality and growth stocks, our portfolio’s natural tilt towards consistent, high-growth compounders positions us well to benefit from it. Nonetheless, we remain balanced, maintaining a focus on bottom-up idea generation to invest in the highest-quality financial companies at sensible valuations.

Little Champs portfolio (LCP) and Rising Giants portfolio (RGP)

As has been the case with other Marcellus portfolios, LCP and RGP have seen a turnaround in the performance in the last six months (April 1, 2024 to September 30, 2024) delivering net returns of 19.06% and 26.72% respectively. This is attributable to:

- An improvement in the earnings growth witnessed by the portfolios in the recent quarters;

- Portfolio changes through additions of the stocks where we have high confidence of earnings delivery over the near-medium term; and

- Aligning the allocation to the stocks proportional to the IRRs that are expected to be delivered, taking into consideration the earnings growth prospects and possible valuation re-rating/de-rating.

Whilst there has been some concern building around the performance of small-mid cap portfolios in the recent months, we remain sanguine about the relative prospects of the LCP and RGP portfolios driven by our confidence around the earnings outlook, healthy balance sheets and management quality of our portfolio stocks which has historically helped them exhibit high degree of resilience during periods of market drawdowns.

We continue to make suitable changes in the portfolio (particularly the Little Champs portfolio) to create more diversity (increasing the mix of domestic vs the historical heavy leaning towards the export-oriented franchises; reducing the historical high concentration of chemical oriented companies in the portfolio) and bring the healthy earnings growth trajectory back in the portfolios.

Changes to the Rising Giants PMS portfolio (as of September 30, 2024)

a. Addition of Go Digit General Insurance Limited: Amongst companies which are not backed by the large Indian banks – Go Digit is the only player who has been able to make it big despite having both brand and distribution disadvantages. Overall, one thing which stands out in Digit’s numbers is its underwriting ability. Within 6-7 years of operations, it has been able to achieve a golden combination of scale + solid underwriting outcomes. Operations are leaner despite running a higher share of retail business which is opex incentive and lower scale. Digit is currently at 6% in motor insurance and its overall market share in the non-life insurance sector is low at ~2.7%. In this context for Digit to grow at 1.5-1.8x industry growth is plausible, when overall market share is just 2.7%. However, profit pools beyond motor are tough to penetrate or make money – particularly the commercial lines/health/crop insurance – which presents an opportunity as well as challenge to the Company.Source: Marcellus Investment Managers, company’s annual filings

b. Addition of Jash Engineering Limited: Jash Engineering is a manufacturer of water flow control equipment, including sluice gates, valves, screens, filters etc. These products are essential elements in water and wastewater treatment plants and together form 5-10% of the total cost of a plant. Jash has manufacturing operations in India, US and UK and sells globally. It has grown through acquisitions, JVs and technical collaborations with Indian and international players, that has helped the company to acquire competencies in new products as well as access to markets outside India. Rodney Hunt, their US acquisition, for example, is a 180-year-old company and a market leader in the US. In India too, Jash has a strong reputation and is a pre-qualified vendor in most municipalities, as well as other govt bodies, including the likes of Nuclear Power Corporation. Revenues have grown at a 34% CAGR over the last 5 years, and EPS at 33% CAGR over the same period, led by expansion of product basket and turn around in profitability of the US business.

Source: Marcellus Investment Managers, company’s annual filings

On the other hand, we have exited from RHI Magnesita India Limited, SKF India Limited and Ratnamani Metals & Tubes Limited from the portfolio.

Changes to the Little Champs PMS portfolio (as of September 30, 2024)

a. Addition of Go Digit General Insurance Limited: Please refer to rationale mentioned under the Rising Giants PMS section above

b. Addition of Jash Engineering Limited: Please refer to rationale mentioned under the Rising Giants PMS section above

On the other hand, we have exited from Prudent Corporate Advisory Services, RHI Magnesita India Limited and Tega Industries Limited from the portfolio.

Team Marcellus