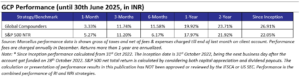

Global Compounders Portfolio (GCP):

June was a constructive month for the portfolio and the broader index. However, the portfolio underperformed the index by approximately 190 bps, as markets were led higher by a sharp rebound in a handful of large-cap semiconductor names—despite elevated valuations. In contrast, our more defensive holdings, including Waste Connections, Berkshire Hathaway, and Constellation Software, lagged. This is a familiar pattern, often driven by short-term shifts in investor preference. As we’ve long argued, maintaining valuation discipline through such phases helps deliver more consistent outcomes over time. Encouragingly, the portfolio now trades at a valuation premium lower than its historical average, providing a healthy margin of safety relative to broader benchmark.

Spotlight: Topicus

Topicus stands out as a leading European vertical market software (VMS) business, built in the image of Constellation Software. It combines a highly recurring revenue base, strong customer retention, and disciplined capital allocation—primarily through acquisitions of mission-critical software providers in regulated industries such as healthcare, education, and finance.

The company benefits from a deeply entrenched business model with high switching costs, allowing it to deliver consistent organic growth while also compounding capital through targeted acquisitions. Much like Constellation, Topicus follows a decentralised approach, empowering local teams while maintaining strict financial discipline. Its strong cash flow generation supports reinvestment into both product development and M&A, sustaining a virtuous cycle of growth.

The primary risks around the business is its ability to source similar size deals and executing the playbook around maximizing the return on investment from the deals. Additionally, organic growth trajectory of the business also remains a key watch item.

Trading at a modest valuation relative to its quality and long-term prospects, we believe Topicus is well-positioned to deliver attractive compounding for years to come—benefiting from Europe’s accelerating digital transformation and the enduring need for specialised software solutions.

The primary risks to the business include its ability to consistently source similarly sized deals and effectively execute its playbook to maximize returns on those investments. Additionally, the trajectory of organic growth remains an important area to monitor.

Key Portfolio Activity

- Cintas: We exited our position after a strong run. While we remain constructive on its long-term earnings power, the current valuation appears to price in much of that optimism.

- Mastercard: Having served as a solid defensive holding, we chose to step aside as concerns around stablecoin adoption resurfaced. While we do not view this as a material threat to the business model, such overhangs have historically impacted investor sentiment. We may revisit the name as the narrative evolves.

- Apple: We re-initiated a position in Apple after a period of underperformance and relative valuation compression. Despite near-term concerns around AI capabilities, tariffs, and regulatory risks, we believe the company remains one of the most resilient consumer-tech franchises globally, supported by its ecosystem strength, brand loyalty, and robust capital return profile.

Portfolio Outlook

We continue to tread carefully in areas where valuations appear stretched, staying disciplined in our portfolio allocation. While index levels valuation remains elevated, we’re uncovering selective opportunities in less crowded parts of the market. Our focus remains on quality businesses that can compound capital through cycles, with valuation acting as both our compass and our cushion. We are trying few things on the edges so that we can navigate Minor portfolio changes at the edges are being implemented with a view to enhance long-term resilience and return potential.

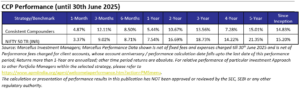

Consistent Compounders Portfolio (CCP):

Nifty50’s EPS growth moderated to 6% YOY in FY25 (from 24% CAGR over FY21-24) whilst valuations remain elevated (21x FY26 P/E for Nifty50). In stark contrast, Marcellus’ CCP portfolio’s earnings growth rate has been in the range of 17%-18% CAGR until FY24 and held firm at 14% YoY in FY25.

Spotlight: EPS Growth Contributors and Detractors in FY25 for CCP

- Key factors which compressed earnings growth in FY25 for the CCP included a weak macro demand environment for consumption in general (same store sales growth of Trent, Metro Brands) and for home building materials in particular (Asian Paints and Astral); high competitive intensity (e.g. Asian Paints and CMS Info); supply side shortages (e.g. Metro Brands) and massive commodity price inflation (e.g. Tata Consumer in Tea).

- Factors which supported EPS growth for the CCP included market share gains due to strong moats alongside gutsy capital allocation decisions taken over the past few years by our investee firms (e.g. Narayana investing in tech and in their new Cayman hospital, Chola investing in new business lines beyond vehicle financing, Divis investing in building capabilities in new categories like contrast media and peptide building blocks (e.g. GLP-1), Eicher investing in product development for both domestic as well as exports market (bikes as well as Volvo trucks), Pidilite investing in products like Roff, Jowat and Araldite); and operating efficiency gains from tech investments and process improvements (e.g. Trent, Divis, Dr. Lal, Metro Brands).

Portfolio Outlook

We expect the gap between the ‘boys’ in the Nifty vs the ‘men’ in CCP to widen going forward, similar to how the historical experience has been (Over the last 20 years, Nifty200 Quality 30 TR Index has delivered 18.2% CAGR vs 14.6% CAGR for both Nifty50 TR Index and for Nifty 200 TR Index). As earnings growth for the broader markets moderates in the absence of strong macro-tailwinds, we expect CCP to benefit from: a) focus on deeply moated companies with better quality management teams reallocating cash generated from better ROCEs towards driving market share gains, better profit margins, lower working capital cycles and better asset turns; b) potential for earnings upgrades for our investee firms; and c) an approach towards valuations looking to find underappreciated elements of quality (which provide low entry valuations).

Key risks to our expectations include significant incremental deterioration in the macro demand environment and a broad-based economic growth recovery, akin to the FY21-24 period.

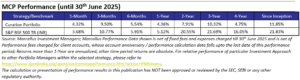

Marcellus Curation Portfolio (MCP):

Against the backdrop of a broader corporate earnings slowdown, the MCP portfolio delivered 13% weighted average EPS growth during FY25, while the median EPS growth for BSE500 companies was 12%. With FY26 consensus EPS estimates for the BSE500 index revised down to 7%—and a real possibility of mid-single digit growth—the market environment remains challenging.

Spotlight: Early signals from pre-quarter updates

About a quarter of the portfolio (in terms of weights) has reported a pre-quarter update for the quarter ending June. Below is our take on these earning updates.

The hits:

· Bajaj Finance reported 25% YoY loan growth vs 9% YoY growth for the banking industry as per RBI’s latest data. The market share gains for Bajaj Finance continue unabated. This is especially praiseworthy in a quarter when consumer durable sales and the unsecured loan segment have seen a slowdown.

· HDFC Bank reported 16% YoY deposit growth and 8% loan growth as it continues to repair its balance sheet. HDFC Bank even at this scale continues to grow deposits 5-6% higher than the industry growth rate.

The misses:

· Trent reported 20% YoY revenue growth, while strong in absolute terms, this marked the fourth consecutive quarter of deceleration in revenue growth for Trent. This is lower than our and consensus expectations as 20% growth implies a decline in revenue per store for the quarter. However, we believe that the strengths of Trent’s business incubation engine, focus on operating leverage and execution strength across retail formats will show through as the end consumption demand improves.

· Info Edge reported 11% YoY billings growth. Within this, the recruitment vertical reported +9% YoY and 99acres reported +16.5% YoY while Jeevansathi and Shiksha reported +19% YoY. Billings typically convert into revenue over the following four quarters, making FY25 billings a lead indicator for FY26 revenue. The 11% billing growth was lower than the seasonally strong 19% growth reported in Q4FY25 and was also lower than consensus expectations. We believe Info Edge enjoys a great competitive position in the recruitment industry and the slower growth is temporary in nature rather than being reflective of market share losses. Also, Info Edge’s investments in AI will help it improve operating leverage over time.

Portfolio Outlook

We remain committed to our style of investing in quality, growth-oriented companies. The portfolio’s premium valuation is supported by RoCE and earnings growth that are higher than the index. Our forward-looking strategy is centred on active management: we continuously monitor valuations, seek to upgrade portfolio quality when attractive opportunities arise, and proactively trim or exit positions where valuations become excessive.

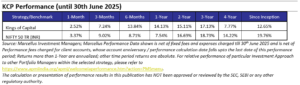

Kings of Capital Portfolio (KCP):

June continued to see recovery in broader markets, KCP NAV returned 2.52% in June vs. 3.37% for Nifty 50. However, over the last 1 year, KCP has performed better than the benchmark supported by higher earnings growth of our portfolio companies, which delivered a weighted average EPS growth of 17% YoY in FY25, compared to just 6% for the Nifty50.

Spotlight: Ground-Level Perspectives: What We’re Hearing

We spent a couple of days on Bangalore to gain insights into ground level activities across segments. We met experts across gold loan, auto finance, micro finance, small ticket MSME loans and loan origination agents. We also met with the management teams of some listed players.

Key takeaways are as follows:

Competitive intensity remains high in gold loans, but market has expanded, recent entrants being Bajaj Finance and Chola Finance. Muthoot is regarded the best owing to its strong loan processes, low employee turnover, strong and safe brand image and customer centricity.

CV demand is subdued and issues in asset quality are likely to persist in H1’26 too. Disbursement of funds from government entities to contractors is delayed. Expert opined barriers to entry are high in Chola’s LCV business, many have tried but it is a tough to replicate Chola’s success.

Demand for home loans is down 20% in Bangalore, driven by stagnant salary growth and reduced hiring. Personal loans growth impacted by supply side reasons – lenders have tightened filters. Asset quality NOT a concern here in large banks/NBFCs. HDFC and ICICI Bank remain the preferred choice for DSAs in Bangalore. SBI’s TAT in home loans is still 1 month vs. 7 days for HDFCB. Processes are quick and improving for HDFCB. ICICI stable and good.

Micro finance is seeing a perfect capital cycle playing out, industry has shrunk 20-25% in last 18 months, exit of fringe and inefficient players has already taken place. Management teams of some prominent south based NBFCs sounded confident of recovery and should be back to 4%+ RoAs in the MFI business from H2.

Experts opined, other than large banks only Bajaj Finance and IDFC First are 2 players who understand unsecured credit really well. One should expect a lot of recalibration from small banks/NBFCs in unsecured credit and should reorient business models towards secured products.

Our Approach

Focus on Market Share Gainers: In a slow-growth market, our priority is to identify quality lenders that can prudently grow faster than the system.

Active Position Management: We are continuously adjusting our position sizing based on the evolving regulatory and economic environment.

Valuation Discipline: With valuations in the sector no longer cheap, our current cash levels are higher than normal as we remain disciplined in deploying capital.

Portfolio Outlook

Looking ahead, we believe our selective approach is key to driving returns. While the broader sector may see muted growth, significant opportunities exist in well-run companies poised to gain market share.

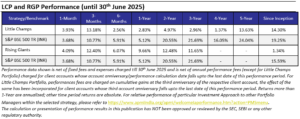

Little Champs (LCP) & Rising Giants (RGP):

Both the Little Champs (LCP) and Rising Giants (RGP) portfolios demonstrated resilient earnings growth in 4QFY25. The LCP portfolio recorded allocation-weighted earnings growth of 17% YoY, marking a sustained double-digit recovery since the second quarter. Similarly, the RGP’s earnings growth held up strongly in double digits at 15% YoY.

Spotlight: Key Growth Drivers

The consistent earnings performance in the LCP portfolio has been primarily driven by two key themes:

- Export-Oriented Companies: The majority of these firms recorded robust, double-digit earnings growth.

- Rural-Oriented Stocks: Companies like Dodla Dairy and Godrej Agrovet demonstrated notable resilience in their earnings.

Our Approach

The small-mid cap (SMID) stocks continued to do well in the month of June 2025 with 251st to 500th stocks (ranked by market capitalisation) within the BSE500 rising by 2.3% on a median basis. Similarly, BSE Small Cap also continued to recover (since the start of the financial years) rising 4.3% in the month of June 2025.

We remain cautious about both the fundamentals as well as the valuations in SMID space as reiterated in the previous months’ newsletters. As the case witnessed in the recent quarters, we expected a muted 1QFY26 earnings print for most of the companies in this space.

Given the above view, we continue to strategise the portfolio construction as follows:

- Highest allocation to stocks where we have visibility on the earnings or valuations are reasonable. This set of stocks given their earnings resilience or valuation comfort have historically outperformed during periods of market drawdowns.

- Increase the cash position in both the Little Champs and the Rising Giants portfolios – with the model portfolio cash allocation reaching 30% each by June 2025-end. As stated earlier, we see this as a tactical move to both mitigate the impact of likely drawdowns as well as provide us the dry powder to get into new stocks or increase the allocation to existing portfolio stocks in case, we see corrections not in sync with the that warranted by the fundamental performance.

Portfolio Outlook

Whilst we remain concerned of the outlook for the broader SMID space as described above, LCP and RGP portfolios are relatively well-placed given our focus on earnings, valuation and the increase in the cash position detailed above.

Little Champs portfolio (LCP) and Rising Giants portfolio (RGP)

For 4QFY25, the Little Champs PMS portfolio recorded allocation weighted earnings growth of 17% YoY. The portfolio has witnessed double-digit recovery in earnings since 2QFY25. Similarly, the RGP’s allocation weighted earnings growth is holding up in double digits (15% YoY in 4QFY25).

The key drivers of the double-digit earnings growth in the LCP portfolio in the recent quarters continue to be:

- Most Exports oriented companies in the LCP portfolio recorded double-digit earnings growth in 3QFY25; and

- Rural oriented stocks (such as Dodla Dairy, Godrej Agrovet) exhibiting resilience in earnings growth.

Furthermore, as highlighted in the previous newsletters, the valuation multiples for both LCP and RGP portfolios have come down sharply from the highs of the previous periods as visible in the exhibits below. This has been through both being disciplined about the valuations and increase in cash allocation in the portfolios.

Regards,

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/

Please refer to the following link for our Responsible Investing Policy, our ESG Integration Framework and Results of ESG scoring: https://marcellus.in/responsible-investing. We have updated our ESG policy to also include metrics around Sustainability Outcomes adopted by our investee companies. The policy on our website reflects these changes.