The NIFTY 50 is an Indian stock market index that represents the float-weighted average of 50 of the largest Indian companies listed on the National Stock Exchange.

The BSE 500 index is designed to be a broad representation of the Indian market. Consisting of the top 500 companies listed at BSE Ltd., the index covers all major industries in the Indian economy.

The S&P 500 is a Free-float weighted stock market index tracking the stock performance of 500 leading companies listed on stock exchanges in the United States.

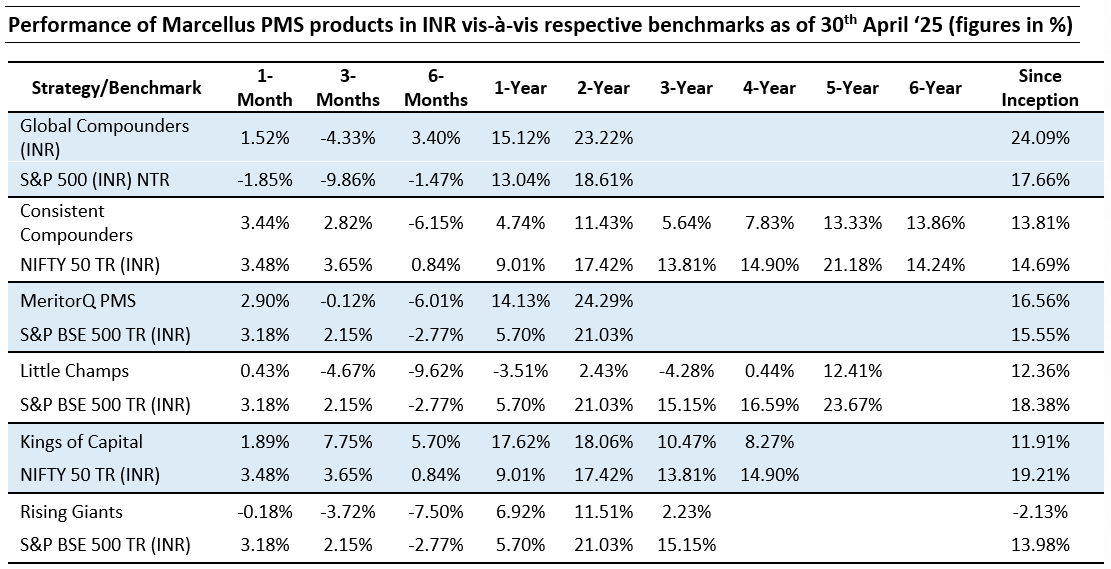

Note: For all strategies except GCP, Performance data shown is net of fixed fees and expenses charged till March 31st , 2025 and is net of annual performance fees (Except for Little Champs Portfolio) charged for client accounts whose account anniversary/performance calculation date falls up to the last date of this performance period. Since, for Little Champs Portfolio, performances fees are charged on cumulative gains at the third anniversary, of the respective client account, the effect of the same has been incorporated for client accounts whose third account anniversary falls up to the last date of this performance period. Performance data is not verified either by Securities and Exchange Board of India, IFSCA or U.S. Securities and Exchange Commission.

For GCP, performance data is shown gross of taxes and net of fees & expenses charged till end of last month on client account. Returns more than 1 year are annualized. Performance is the combined performance of our RI and NRI strategies. GCP USD returns are converted into INR using exchange rate published by RBI. Source: https://www.rbi.org.in/scripts/ReferenceRateArchive.aspx

*For relative performance of particular Investment Approach to other Portfolio Managers within the selected strategy, please refer https://www.apmiindia.org/apmi/WSIAConsolidateReport.htm?action=showReportMenu Under PMS Provider Name please select Marcellus Investment Managers Private Limited and select your Investment Approach Name for viewing the stated disclosure.

Note: APMI provides performance data of Portfolio Managers managing domestic strategies only. Hence, GCP is excluded.

Consistent Compounders Portfolio (CCP)

The macro-economic environment is going through a period of weakness. On the one hand, there is weakness in domestic macro variables such as rising household debt levels, weak growth in government capex, private capex and job creation and a moderation in consumption demand over the last 3 quarters. On the other hand, there is geopolitical uncertainty, particularly around tariff wars and hence its implication for currency, inflation and interest rates in India. Following are the three aspects of Marcellus’ CCP portfolio which should help navigate through this environment:

- Firstly in a concentrated portfolio, our largest allocations include companies whose fundamentals are relatively uncorrelated with the macro factors. For instance, we have a hospital chain in the portfolio which is expanding its capacity in hospitals outside India, and driving operating efficiency gains in its Indian hospitals. Another large portfolio allocation is that of a pharma company which has a monopolistic control on global API production for cough syrups and pain killers, and is the sole manufacturer of patented products for big pharma.

- Secondly if we go by history, during periods when Nifty50’s earnings growth is weak, companies with high quality of moats and capital allocation prudence outshine vs the broader market. This is because when the economy is booming, moats and capital allocation are not really needed to help gun out strong earnings per share (EPS) growth – this was the case for the last three years i.e. from Fiscal Year 22-25 ending March 31st , when Nifty50 delivered 24% EPS CAGR over three years. But ‘when the going gets tough, the tough get going’ by using their superior competitive advantages to gain market shares, and by using their superior capital allocation to find new growth avenues. This is what we expect the broader quality universe to do over the next couple of years – which is a sweet spot for our CCP portfolio.

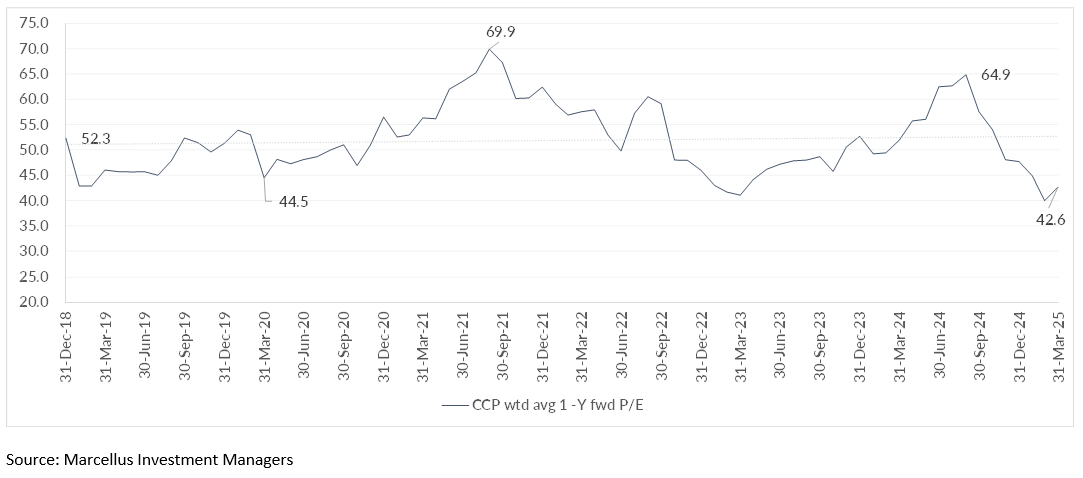

- Finally, when it comes to valuations, our portfolio’s forward P/E multiple today is at a 25%-30% discount to its last six year average (see chart below), thanks to the changes we made to the portfolio constituents in 2024. The 1 year forward P/E multiple of our portfolio is at its lowest point since inception of CCP thanks to these changes.

Global Compounders (GCP)

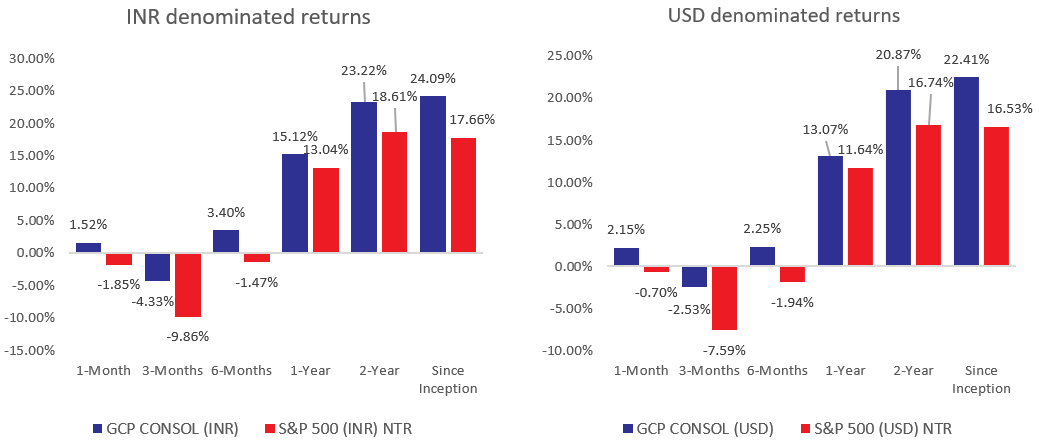

Often, the first and last chapters of a book reveal little about the actual plot—and the same could be said about the month of April. On the surface, April ended broadly flat, with the market down slightly. But that calm finish belied a volatile ride: early in the month, markets fell over 10% following the U.S. President’s announcement of new tariff plans. What followed was a period dominated by speculation over trade negotiations, especially with China. By month-end, a U.S.-UK trade agreement helped restore some optimism.

Amidst this volatility, the GCP portfolio demonstrated notable resilience—managing to hold ground during the drawdown and participating in the subsequent rebound. For April, the portfolio rose 2.15% compared to the benchmark’s decline of 0.70%.

On the macro front, the U.S. jobs data remains a critical indicator and surprised positively in April. Despite the tariff-related headlines, earnings estimates for FY25 came down by around 2%, with a milder impact on FY26 projections. We continue to believe that GCP companies are well-positioned to deliver stronger and more stable earnings, with limited downside revisions relative to the broader market.

April was also a heavy earnings month, and our portfolio companies largely delivered strong results. Microsoft was a standout performer. Among the megacaps, Microsoft remains a top holding for us. After lagging much of the “Magnificent Seven” last year, we expect it to benefit from easing capex intensity and improving margins.

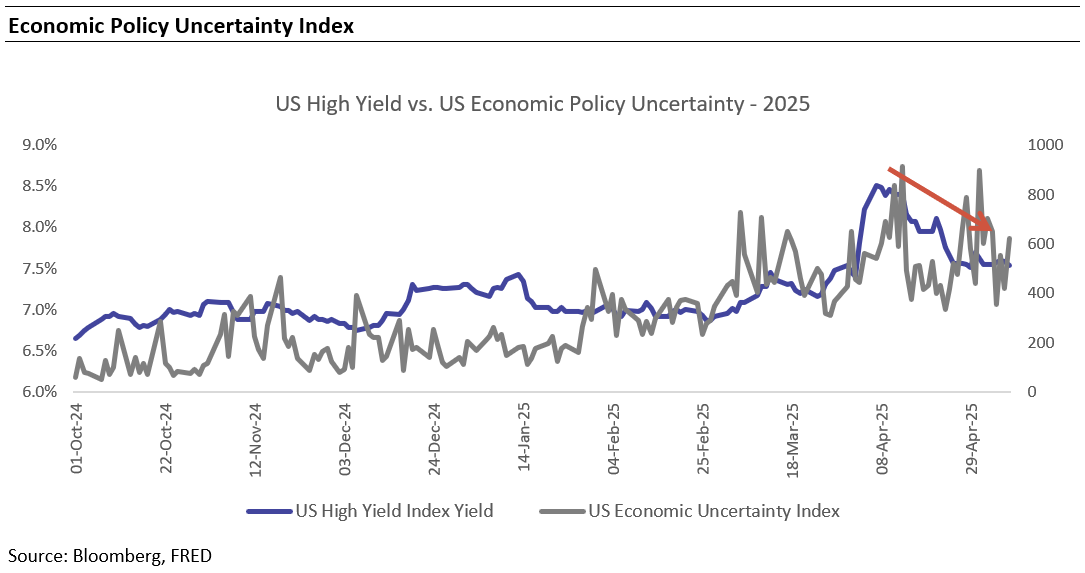

Despite ongoing policy uncertainty, the U.S. labor market continues to heal steadily. One encouraging sign is that the U.S. Economic Policy Uncertainty Index appears to have peaked, signaling potentially steadier ground ahead. However, fundamentally, the earnings revisions trajectory of broader market will likely dictate returns from here.

Portfolio Adjustments

We made minimal changes to the portfolio this month. In fact, the volatility during April broadened our list of high-quality buying opportunities.

At the same time, we’re observing pockets of the market—particularly among popular high growth names and select consumer staples—where valuations appear stretched and difficult to justify in the context of delivering returns meaningfully above the cost of capital. We are navigating these areas with caution, maintaining discipline around valuation and consciously avoiding segments where the margin of safety appears limited.

Marcellus performance data shown is gross of taxes and net of fees and expenses charged until the end of last month. Performance fees are charged annually in December. Returns for periods longer than one year are annualized. Marcellus’ GCP USD returns are converted into INR using exchange rate published by RBI. Source: https://www.rbi.org.in/scripts/ReferenceRateArchive.aspx

Since Inception’ performance calculated from 31st Oct 2022. The inception date is 31st October 2022, being the next business day after the account got funded on 28th October 2022. S&P 500 net total return is calculated by considering both capital appreciation and dividend payouts.

The calculation or presentation of performance results in this publication has NOT been approved or reviewed by the IFSCA or SEC. Performance is the combined performance of RI and NRI strategies.

The difference in performance in INR and USD is because of USD/INR currency appreciation/depreciation for the month.

Kings of Capital Portfolio (KCP)

April was a tough month for KCP as post fees NAV was up 1.89%, lower than 3.48% for Nifty 50 and 6.83% for Bank Nifty. However, over the past 12 and 24 months, the Kings of Capital portfolio has outperformed the Nifty and Bank Nifty indices as the euphoria and investor interest in public sector banks and tier-II private banks has subsided. Furthermore, KCP’s 1-year performance ranks in the top quartile when compared with mutual funds focused on the BFSI sector. Source: Value Research

Anyone who has been following the economy or the banking sector, would have probably noticed corporate earnings and economy activity slowing down in the past 6-9 months. The latest few quarters have shown that most lenders aren’t growing as fast as they were before. This isn’t really a surprise, as the overall economy has also seen some cooling, and the RBI’s data confirms that loan growth for the banking sector has come down from around 15-16% to about 10-11%.

With that context, for KCP, we’ve also seen some of that slower growth – our portfolio lenders grew by ~15% in Q4. While that’s a bit lower than before, it’s still significantly better than the overall loan growth in the market. So, we’re still outperforming the industry on growth.

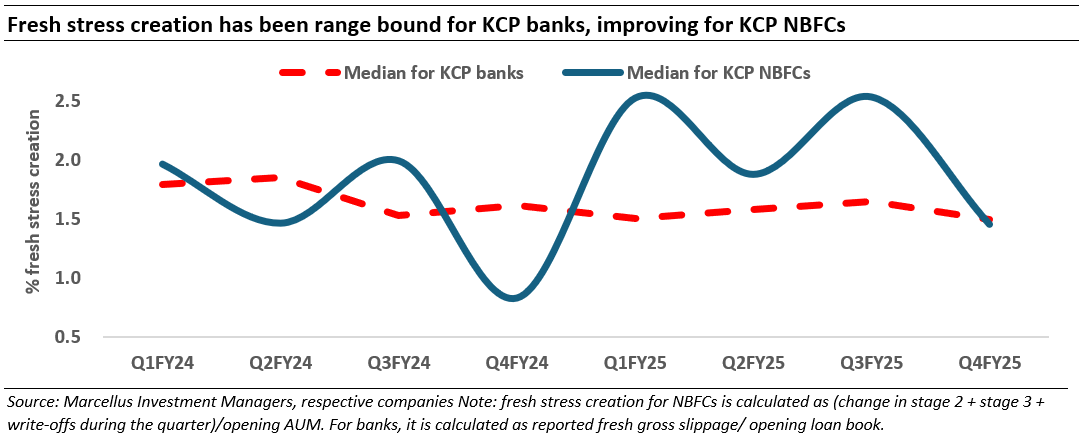

However, the good news is asset quality for the portfolio companies held up better than expectations. As we communicated earlier, large private banks (ICICI Bank, HDFC Bank) have reported strong asset quality despite the broad economic slowdown. Large Non-Banking Financial Companies (NBFCs) (Bajaj Finance and Cholamandalam Inv. saw asset quality deterioration in first half and then has improved in H2’25). Overall, asset quality issues largely remain product specific – like unsecured credit (which includes micro finance, personal loans and credit cards). Within secured credit, asset quality remains solid, other than select pockets of auto finance.

Note: ICICI Bank, HDFC Bank, Cholamandalam Inv. And Bajaj Finance are a part of Marcellus’ portfolios.

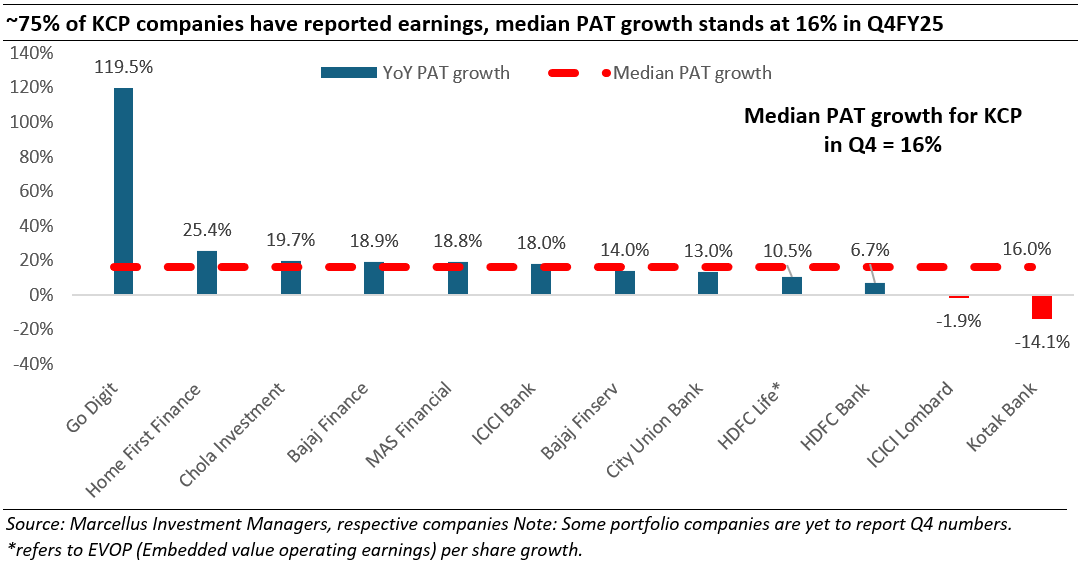

Earnings growth for KCP is also decelerating in line with trends visible in loan growth. For Q4 – about 75% of the companies have already reported Q4 earnings and we have seen median profit after tax (PAT) growth at mid-teens for the portfolio. Now, here’s where it gets interesting. When we compare this to the overall market, analysts are expecting only low single-digit profit growth for the Nifty 50 companies in Q4. That’s a significant difference and it highlights the resilience and strength within our portfolio.

In an external world which has turned volatile with the outlook cloudy given the tariff-war, we believe financials are well placed as they are 100% domestically focused. Meanwhile, a policy pivot by the regulator focused on cutting interest rates, maintaining adequate liquidity and relatively easier on regulations bodes well for financial services companies.

Consequentially, we continue to maintain a large weight to private sector banks and NBFCs but have further concentrated our holdings by reducing exposure to stocks with inconsistent growth or low RoEs. While we remain believers in the long-term story of Indian capital markets, we still don’t find value in capital market linked stocks and haven’t added back any since our exit late Sep’24. The combination of lack of opportunities within capital markets and the recent re-rating in quality lenders has meant that we hold ~10% cash in the portfolio.

Little Champs portfolio (LCP) and Rising Giants portfolio (RGP)

Most of the Little Champs and Rising Giants portfolio companies are yet to report their 4QFY25 (Fiscal year ending March 31st) results.

Our views and portfolio strategy remain the same as communicated in the earlier newsletters:

- We remain concerned about the broader corporate earnings (significant deceleration witnessed in the earnings growth of BSE500 in recent quarters – with average YoY PAT growth for BSE500 companies moderating to single digits from 1QFY25) and more particularly the smaller companies (slowdown in earnings growth has been much sharper for the smaller cap stocks within BSE 500 – with average double digit YoY PAT declines in 251st to 500th ranked market cap companies within BSE500 for 3QFY25).

- This together with uncertainties around the global trade and geopolitical situation increases the risk of corporate earnings slowdown cycle persisting for some time as well as likely downgrades in the FY26 consensus earnings growth expectations.

- In view of the above, our portfolio strategy for LCP and RGP has been to focus on companies which can demonstrate relatively resilient earnings performance, maintain a strong discipline around the valuations and increase the allocation towards cash (including liquid funds). All of these have been discussed in detail in our latest webinar (https://www.youtube.com/watch?v=7oBIhB1pCw0)

- Past precedents show that good quality stocks do fall during periods of market slowdown – hence cash will give some mitigation against these falls. Secondly, we will also get an opportunity to nibble into good quality stocks which can stage a strong comeback once the dust settles. This could be both increasing the position in the existing stocks which see unwarranted correction + getting into coverage stocks but which we had not invested earlier due to want of better entry price. We are keeping a close watch on the developments on a continous basis to see if we need to adjust the cash positions.

We have added Abbott India and Indegene to the Little Champs portfolio in the recent months. On the other hand, we have exited from Home First Finance, Everest Industries and Credit Access Grameen.

We have added Control Print and Indegene to the Rising Giants PMS portfolio in the recent months. On the other hand, we have exited from Home First Finance, Credit Access Grameen, Astral, Tube Investments and Poly Medicure

Regards,

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/insights?filter

Please refer to the following link for our Responsible Investing Policy, our ESG Integration Framework and results of ESG scoring: https://marcellus.in/responsible-investing