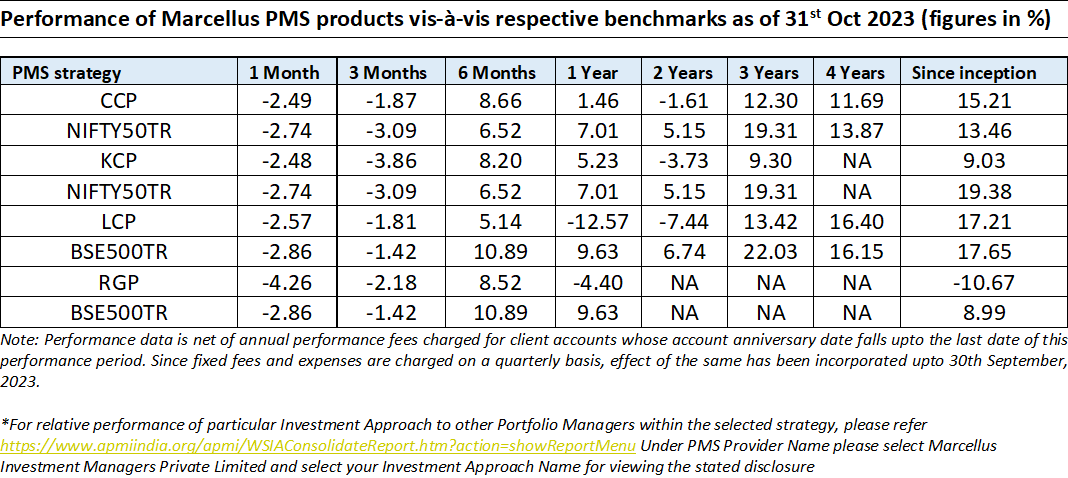

Consistent Compounders Portfolio (CCP)

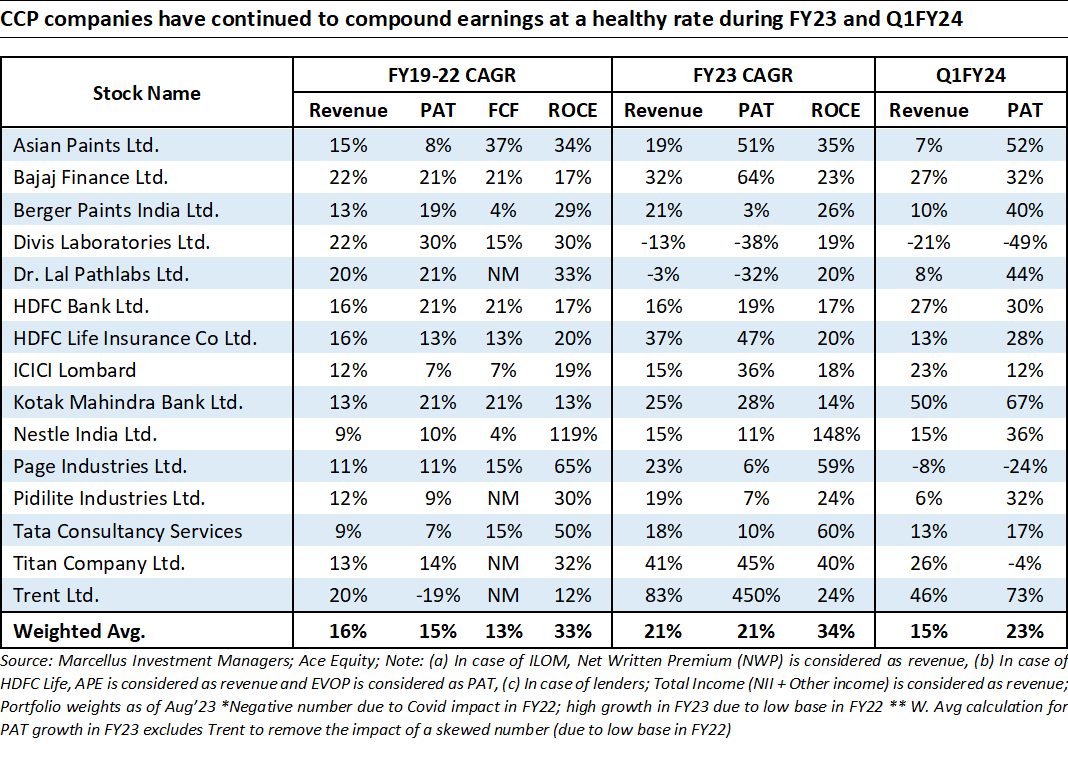

Our portfolio companies’ reported fundamentals in 2QFY24 continue to demonstrate strength and consistency – portfolio’s revenue growth was 22% YoY and EPS growth was 28% YoY in the quarter ending 30th September 2023. Several of our portfolio companies reported revenue growth rates, significantly healthier than other players in the same industry. For instance, Nestle’s 10% YoY revenue growth in 2QFY24 was one of the best across all large FMCG players, Dr. Lal Pathlab’s non-Covid revenue growth of 15% was higher than that of SRL, Metropolis, Thyrocare etc. Aberrations in EBITDA margins created over the last 18 months by volatility in input costs and global supply chains normalized considerably in 2QFY24 for several portfolio companies.

Amongst the three stocks which had been reporting weak fundamentals over the last few quarters (Dr Lal, Divis and Page), two have already reported recovery in fundamentals – a) Dr. Lal Pathlabs has seen a recovery in its revenue growth and earnings growth momentum as contribution from Covid related tests have stopped distorting year-on-year comparables, and competitive intensity from new players has eased; and b) Divis Labs has reported sequential improvement in its revenue growth momentum with a strong guidance for future growth, after four quarters of the decline in revenues due to the end of Molnupiravir (Covid drug) contribution to its sales. Page Industries reported another weak quarter of 2QFY24 (along expected lines), affected by the high base effect of athleisure, which had a strong sales momentum till 2QFY23 due to ‘work-from-home’ practices, and channel de-stocking due to tech initiatives (Auto-Replenishment-System) around distribution and supply chain.

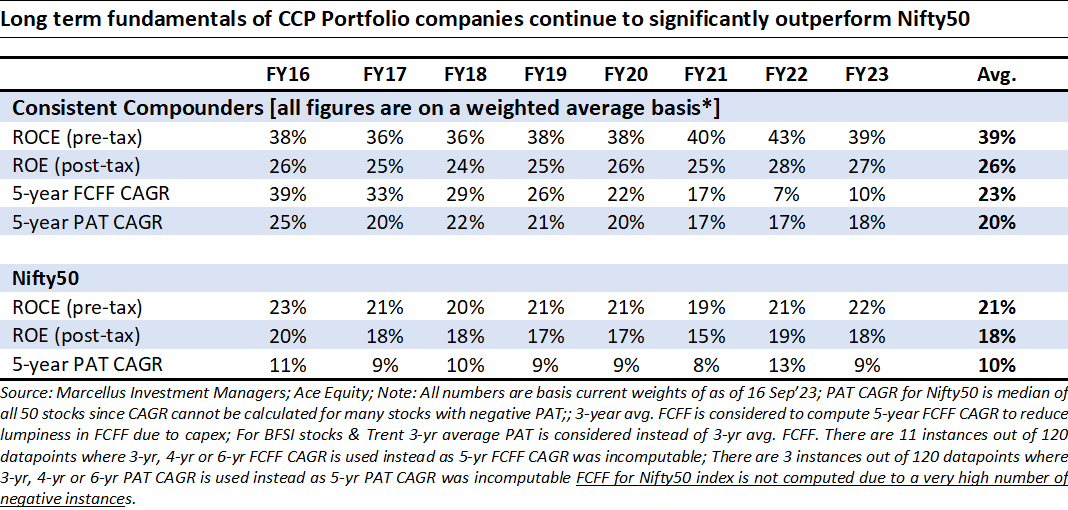

Dislocations between share prices and fundamentals continue to provide opportunities to rebalance position sizes for potential benefits in future. Consequently, we have been carrying out rebalancing exercise in CCP over the last couple of months including the addition of two new stocks to the portfolio – Trent and Astral. The portfolio remain concentrated with only 15 stocks currently, it trades at 40x P/E multiple and we expect healthy and consistent profit compounding from this portfolio over the long term future, significantly higher than the profit compounding of Nifty50 – as highlighted from historical comparisons in the exhibit below.

Kings of Capital Portfolio (KCP)

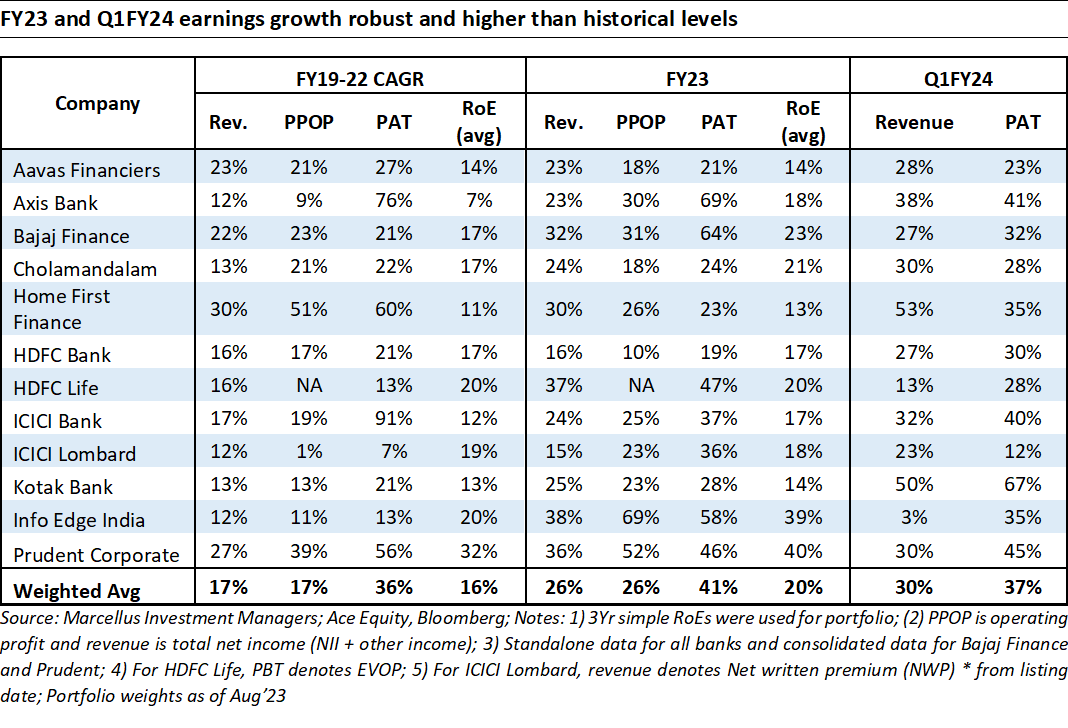

Kings of Capital portfolio companies have reported robust revenue and profit growth for Q2FY24 (for results announced thus far) with weighted average Q2FY24 revenue growth of 38% and weighted average PAT growth of 29% for the portfolio. These numbers suggest strong market share gains for KCP companies as they reported better than industry growth across lending and insurance businesses.

In what was quite an eventful month for KCP companies, below are some relevant insights and data points from the Q2FY24 results and recent events for KCP investors:

- Successful equity fund raises by Bajaj and Chola: Bajaj Finance raised Rs. 10,000 Crores i.e. ~15% of their networth with ~2% dilution to shareholders. This is ~10% Book Value per share accretive and will help Bajaj Finance further reduce leverage to less than 5x and accelerate growth. Cholamandalam also raised Rs. 4,000 Cr with Rs. 2,000Cr in the form of equity and Rs. 2,000Cr in the form of convertible debentures which also is ~10% BVPS accretive with only 2% dilution to shareholders. Even after the equity raises, Bajaj and Chola will continue delivering 20% RoEs with reduced leverage.

- New MD&CEO at Kotak: The successor of Uday Kotak was announced during the past month with an external candidate – Ashok Vaswani becoming the next CEO. This came as a surprise to us and most investors given an internal candidate was expected to be the next CEO, however we believe Uday Kotak’s position on the board and 26% shareholding will continue to mean that the stewardship of the bank will be no different than what it has been in the past. Ashok Vaswani also comes with quite a credible background – his profile can be accessed here and click here to his listen to his views on technology and banking.

- HDFC Bank reports first set of numbers post mega merger: After a disappointing Q1FY24 on deposit garnering, HDFC Bank reported solid incremental deposit addition of Rs. 1.1 trillion in Q2FY24. We continue to believe that if HDFC Bank is able to continue this over the next couple of quarters, it will be able to put to rest the biggest uncertainty of the merger and focus on extracting synergies out of the merger. Markets were however disappointed with the marginally lower than expected net interest margins reported during the quarter. While HDFC Bank has been consistently reporting stellar numbers and market share gains, margins have remained a sticky point for investors. Given that the merger is behind us, we believe HDFC Bank is now on a trajectory of upward slope on margins along with the continuation of rapid market share gains.

- ICICI Lombard posts marked improvement in profitability: The general insurance industry has grown at a healthy 15% for the first half of the financial year while ICICI Lombard has grown at 18% during the period. In addition to market share gains, the biggest takeaway from the recent most quarter was a sharp improvement for ICICI Lombard in its motor insurance segment. Over the past couple of years, ICICI Lombard has been cautious in growing its motor insurance business because of irrational pricing, however if the trends of the recent most quarter continues it could mean both – improved RoEs and higher growth for ICICI Lombard. We remain watchful of trends on combined ratio which were stated to reach 102% by FY25 as per management’s earlier guidance but Q2FY24 suggests that the combined ratio improvement can happen much sooner than expected.

- Divergent quarter for our two affordable housing finance companies: During Q2FY24, Home First Finance reported solid 30%+ profit and loan growth with a healthy trend on disbursement growth. Home First also reported a consecutive quarter of 15%+ RoEs and is likely to sustain this from hereon. On the other hand, Aavas Financiers reported muted disbursement growth (10% YoY) albeit with better asset quality. Despite a muted quarter, we believe Aavas is likely to achieve 20%+ loan growth for the year and resume its trajectory of 20-25% growth from FY25 onwards. The lower growth during the quarter was attributed to the recent management transition and Salesforce implementation at Aavas branches.

There have been no additions/ deletions to the portfolio during YTDFY24.

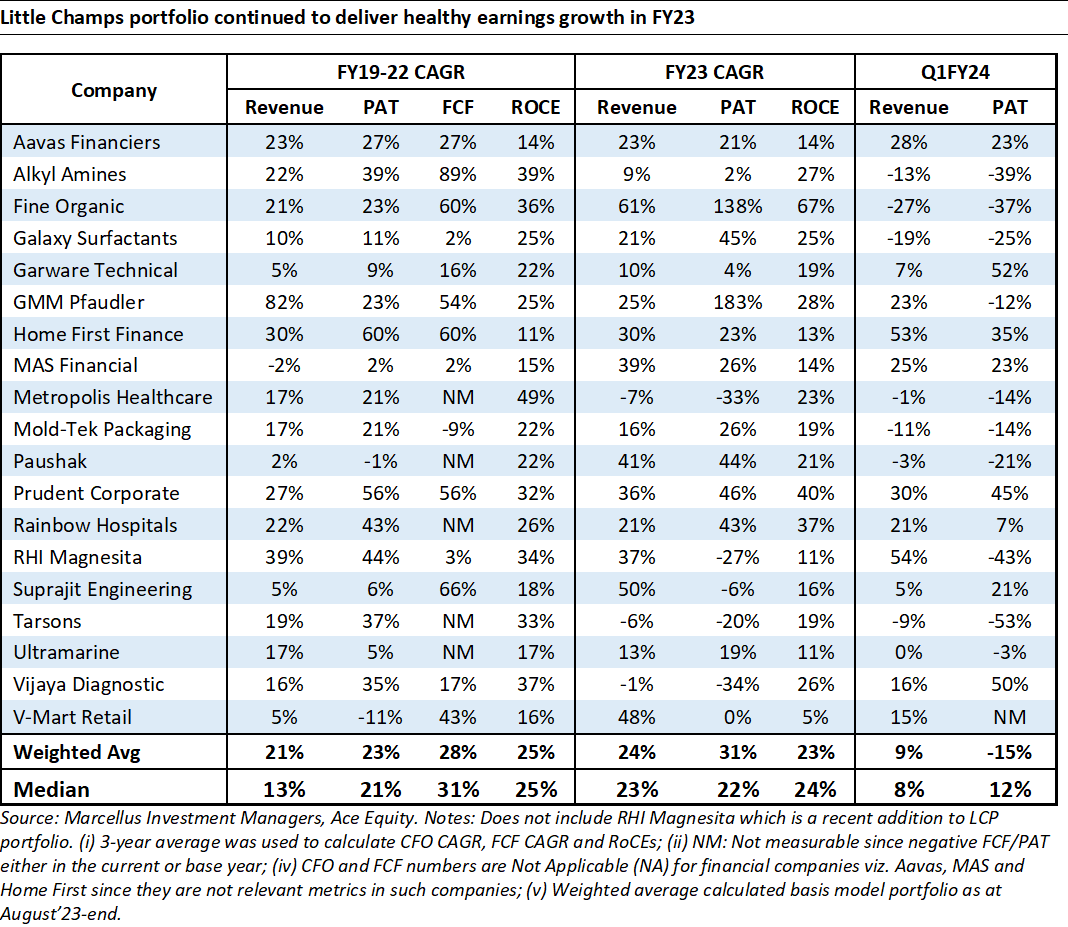

Little Champs portfolio (LCP) & Rising Giants Portfolio (RGP):

As we had expected and explained in our earlier newsletters, 2QFY24 turned out to be a challenging quarter for the Little Champs portfolio companies on the back of:

- Weakness in the chemical stocks’ (particularly Alkyl, Ultramarine and to smaller extent Galaxy Surfactants) earnings due to the current adverse demand supply equation being faced by the sector.

- Weakness particularly in the global/export markets impacting the earnings of the portfolio companies like Suprajit, Tarsons etc

- Couple of stocks (Fine Organics, Prudent) saw earnings decline/moderation due to high base of FY23

On the positive side:

- Financials (Home First, Mas Financial) continued on their strong earnings growth trajectory.

- Improvement is seen in the diagnostic space (Vijaya Diagnostics, Metropolis Healthcare) with better YoY revenue and net earnings growth trend than the previous quarters.

Temporary headwinds notwithstanding, we remain sanguine about the long-term prospects of our portfolio firms on account of:

- Healthy reinvestment undertaken in FY22 & FY23 to further strengthen their franchises;

- Current valuations signaling market’s underappreciation of LCP’s longevity of compounding; and

- historical evidence of strong share price returns post periods of weakness.

More details on the above can be read in our recent Little Champs newsletter

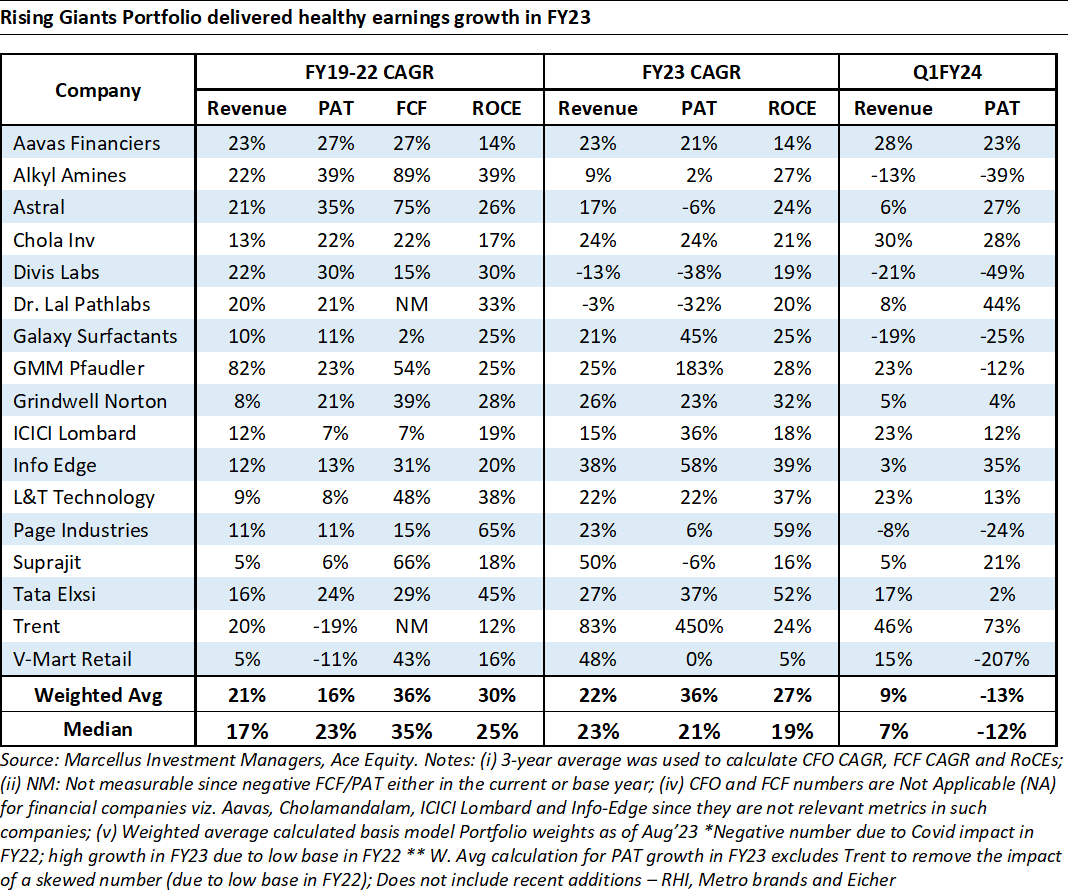

The above commentary with respect to Little Champs portfolio also applies to the Rising Giants portfolio companies with weakness in earnings for the chemical/export-oriented companies (Alkyl, Suprajit, Divis) on one hand but strong results by financial companies (Cholamandalam) and recovery in earnings for Dr Lal Pathlabs.

Changes to the Little Champs portfolio: We have added PDS Limited and Cera Sanitaryware Limited to the Little Champs. Rationale for the additions can be read in our recently published Little Champs newsletter.

Regards,

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/