|

|

|

|

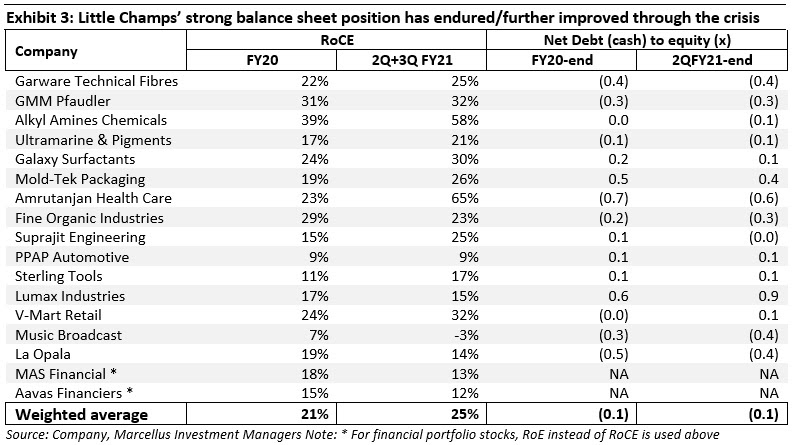

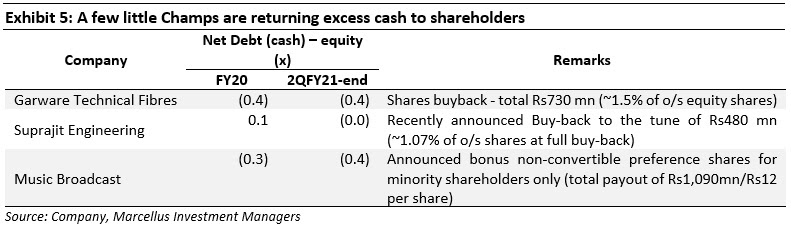

In some cases, we have also seen that some Little Champs companies which operate asset light businesses returning or planning to return excess capital to shareholders which is a positive move from corporate governance as well as capital allocation point of view. Even after returning the above amount back to shareholders, the net cash position would continue to remain healthy for these companies.

|

|