In this month’s newsletter, we delve deeper into Eureka Forbes Limited (EFL) one of the new additions to the portfolio. We see several earnings growth levers for EFL over the next 5 years: (a) Increase in the water purifiers (WP) category penetration backed by improved tap water supply, and initiatives taken by the WP companies to make the product affordable (rental model, financing, etc); (b) Competitive advantages around brand, established sales distribution channel and shaking off the lethargy of the past by focussing on product innovation should enable EFL to maintain its market leadership & market share in WPs henceforth; (c) Greater focus on the high margin Annual Maintenance Contract (AMC) revenues through lowering the entry points for AMC, taking initiatives to plug grey market proliferation and increasing the modern trade share; and (d) Scope for margin expansion through improving AMC mix, better vendor pricing from higher volumes, focus on reducing overheads and the tailing off of ESOP costs. EFL also enjoys a negative working capital cycle thanks to AMC payments received in advance resulting in FCF > PAT. Attrition in senior level management represents key risks to the above investment thesis

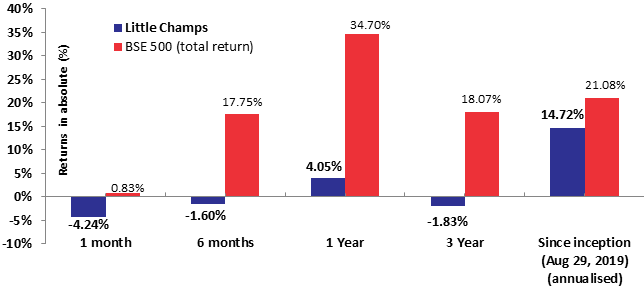

Performance update for the Little Champs Portfolio

The Little Champs Portfolio went live on August 29, 2019. The performance so far is shown in the below table.

Exhibit 1: Little Champs performance vs the benchmark BSE 500 Total Return Index

Source: Marcellus Investment Managers. Note: (i) Portfolio inception date is August 29, 2019. (ii) Returns as of May 31, 2024. (iii) All returns are net of fees (as described in point (iv)) and expenses. (iv) Fixed Fees are charged on a quarterly basis and have been charged till 31st March 2024. Performances fees are charged on cumulative gains at the third anniversary of the respective client account, thus the effect of the same has been incorporated for client accounts whose third account anniversary falls upto the last date of this performance period. Performance data is not verified either by Securities and Exchange Board of India or U.S. Securities and Exchange Commission. (v) Returns shown above are net of transaction costs and includes dividend income. (vi) Total returns index considered for BSE 500 above.

*For relative performance of particular Investment Approach to other Portfolio Managers within the selected strategy, please refer https://www.apmiindia.org/apmi/WSIAConsolidateReport.htm?action=showReportMenu Under PMS Provider Name please select Marcellus Investment Managers Private Limited and select your Investment Approach Name for viewing the stated disclosure

Significant new additions to the Little Champs portfolio in the last twelve months

Since July 2023, we have added 15 new stocks to the Little Champs portfolio (till May 31, 2024). These stocks are: (i) Rainbow Children’s Medicare; (ii) RHI Magnesita India; (iii) PDS; (iv) Cera Sanitaryware; (v) Tega Industries; (vi) Control Print; (vii) Everest industries; (viii) Ami Organics; (ix) Shanthi Gears; (x) City Union Bank; (xi) Carysil; (xii) Godrej Agrovet; (xiii) Eureka Forbes; (xiv) RACL Geartech; and (xv) Ahluwalia Contacts. On the other hand, during the same time period we have exited from V-Mart Retail, Paushak, Home First Finance, Galaxy Surfactants, Vijaya Diagnostics and Metropolis Healthcare. The brief rationales for all the above additions and deletions have been shared with you in the monthly portfolio updates.

In this LCP newsletter, we delve deeper into reasons for adding Eureka Forbes in the portfolio.

Why we invested in Eureka Forbes?

Company Background:

Eureka Forbes Limited (or EFL) began operations in 1982 as a JV between Forbes and Campbell (a Tata Group company) and Electrolux (Sweden) by introducing a range of vacuum cleaners (EuroClean). However, it’s now famous and most significant introduction came in the space of water purifiers (WP) in 1984 in the name of Aquaguard, making them the first ever WP player in the country.

EFL was part of the Shapoorji Pallonji Group until February 2022 when EFL was carved out from its parent, listed on the stock exchange, and whose majority stock (72.56%) was bought by Advent International, a private equity firm (out of this 72.56%, Advent recently offloaded a 10% stake in the open market). The intent was to turnaround the company given its strong positioning in the WP space by bringing in professionals and streamlining operations. Its current CEO, Mr. Pratik Pota was formerly CEO of Jubilant FoodWorks and since his appointment in August 2022, Mr Pota has built a team of professionals.

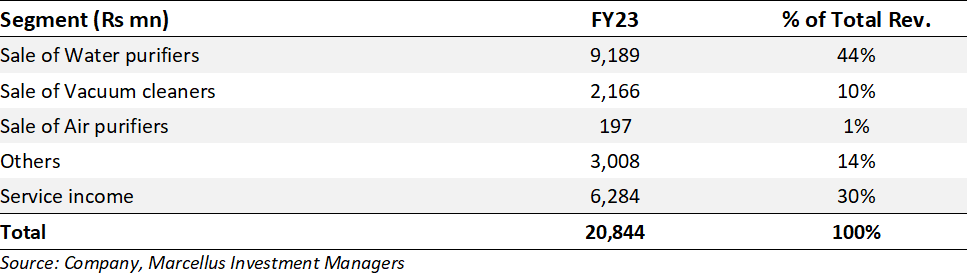

Apart from a range of products in WP (under the Aquaguard brand), air purifiers (Aeroguard brand) and cleaning segments (EuroClean), EFL also derives steady stream of revenue from the service segment (after-sales service & maintenance) and spare parts.

Exhibit 3: While products form the backbone, services contribute significantly to Revenues/Profits

How do different types of water filters work?

WPs generally work on two major principles of purification – Reverse Osmosis (RO) and Ultraviolet (UV) filtration.

Of these, UV is the easiest to make and standardised. This is useful for areas where potable water availability is not an issue and there is no instance of the water being laden with hard minerals and metals (example Mumbai – TDS level is between 50-300 ppm). UV filtration will just pass a light through the water to kill any germs or bacteria or viruses in the water and pass it through a filter to give you clean water.

RO uses a slightly advanced technology where the water is treated to remove hard metals and minerals that may be dissolved in the water. This type of filtration is more robust and is suitable for areas with relatively bad water quality (example Delhi NCR – TDS level is generally greater than 300 ppm). Usually, purchasing an RO filter in areas where good quality water is available is not recommended as it can ‘over purify’ the water and remove essential minerals from the water.

There is a third kind where filters come with RO and UV both functionalities, where the UV part is activated if the input water is of good quality. Else RO part is activated.

Key Investment thesis:

i. Scope for category expansion/creation – Household WP penetration of just 6%, considerably lower than other consumer durable categories

The current household penetration of WPs in Indian households is ~5-6%. This has significantly lagged the penetration level of other consumer durable categories such as TVs (65%), Refrigerators (33%), Washing machines (14%) and ACs (13%) as well as the WP penetration in other countries like Thailand (20%), China (21%) and South Korea (60%).

The key reasons which inhibited the penetration of WPs in India have been:

· Lack of awareness around the benefit of WP. Traditional methods like boiling, using cloth and other rudimentary filters have historically been considered as panacea to treating impurities in water. In addition, the incumbents have also not been able to effectively communicate the utility/benefits of WPs to the population at large.

· Lack of access to tap water and electricity which are perquisites for WPs.

· High costs attached to the product as well as service (explained in detail in subsequent sections).

We believe that adoption of WPs is likely to improve going forward due to the following reasons:

a. Strong use case for the product:

In India today roughly 200 districts and 400 mn people are exposed to life-threatening pollutants like fluoride and arsenic (source: Kotak Institutional Equities initiating coverage report, Dec 2023). Further, water borne diseases impact roughly 37.7 mn people in India annually, and roughly 0.83 mn people die due to water borne diseases like cholera, typhoid, dysentery, etc each year in India. Traditional solutions like using clothes are ineffective and even boiling water (which also involves costs towards heating) just kills the germs but doesn’t rid the water of the germs and other impurities. Hence, there is no like-to-like alternative which provide similar effective solutions as water purifiers.

b. Improved tap water access:

In the recent years under the Jal Jeevan mission of the Government of India. To that end, incrementally ~113 mn households since 2019 have been given access to tap water and around 97% of Indian households are now connected to the electricity grid.

c. Increased product awareness:

Our checks also suggest an increased awareness of importance of water purification in general and WPs in particular in the recent years driven by:

Increased consciousness around health/hygiene post Covid-19.

Marketing/advertising campaigns by players like EFL (for example their ‘Nal se kapda hatega’ campaign – KAPDA PATTI TVC Hindi 30 Sec | Jab Nal Se Kapda Hatega, Tabhi Sar Ka Kapda Hatega (youtube.com) has helped in creating awareness.

The increase in Modern trade have also benefited the WP sales since consumers who come to shop say TVs, fridge etc notice WPs on display and realise its need. Indeed, our recent interaction with Croma suggest a nearly 10x increase in WP sales in Croma channels in the last 5 years.

d. Making the product more affordable:

Rental model: The company is endeavouring to bring down the initial upfront costs to drive adoption of WPs. One of the strategies popularised by Livpure has been to offer WPs on a rental model where the monthly rent starts as low as Rs. 399 a month . EFL has also started the rental model on a pilot basis in Chennai and plans to scale this up to other cities.

Launch of cheaper WPs: EFL has recently launched an Aquaguard product in the economy segment – Aquaguard Champ – at Rs. 6,499. With this product and others in the pipeline in this segment, EFL is planning to drive category creation and penetration in the water purifier segment.

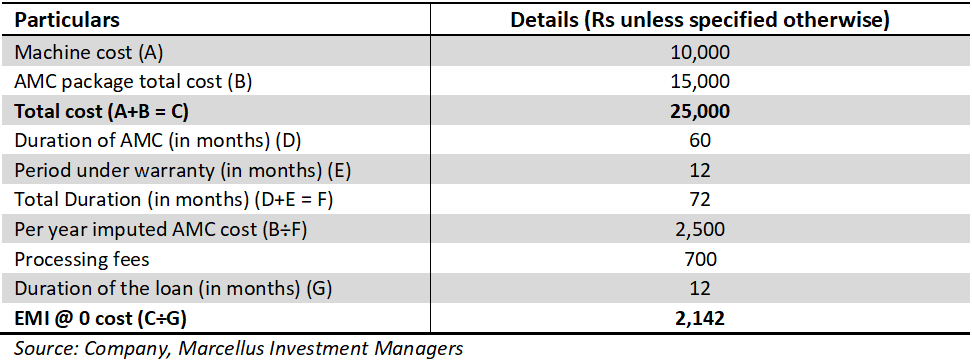

Availability of financing solutions: Given the high upfront cost involved in purchasing a WP and subsequently also the service package, a lot of people choose a Zero cost easy financing option (like for any other consumer durable purchase). For instance, if a consumer is purchasing a water purifier and a service AMC package together at a Modern Trade store, the entire package can be financed by the likes of a Bajaj Finance. According to our channel checks, roughly 60-65% people who purchase WPs in Croma, do it through financing options available.

ii. Competitive advantages around brand and established sales distribution channel – we expect EFL to maintain its market leadership (~45% market share)

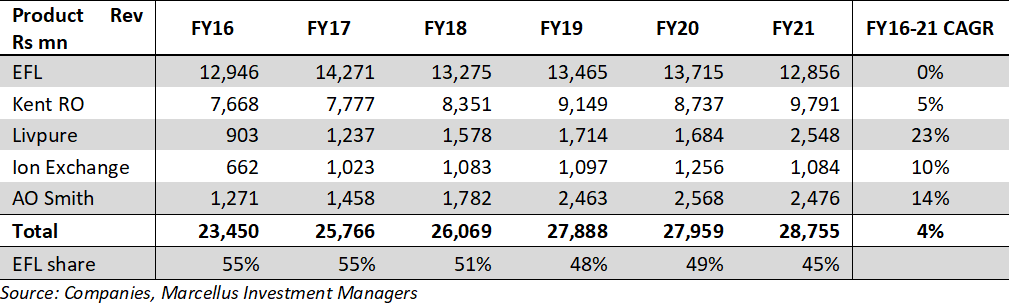

Decades ahead of any competition, Eureka Forbes was the first to introduce WPs in India in the 1980s. However, the company lost its way over the years ceding ground to peers.

Our management and primary data interactions points to the following key reasons for loss of market share specially over the last decade:

a. Lack of product innovation:

The company was slow to drive innovation and new technologies in the space. One of the biggest casualties of this was the company’s inability to anticipate the market shift towards the Reverse Osmosis (RO) technology, a superior technology over the incumbent UV filtration, introduced and popularised (through strong marketing) by Kent RO Systems in India. Similarly, the Company was slow to respond to the stainless-steel water purifiers launched by LG in 2016.

b. Increase in prices to compensate for volume stagnation:

With overall market growth slow (due to slow adoption as discussed above) and due to market share loss, the Company took recourse to price hikes to maintain its revenues and profitability. A big side effect of this was making the product more and more unaffordable to the vast section of the population.

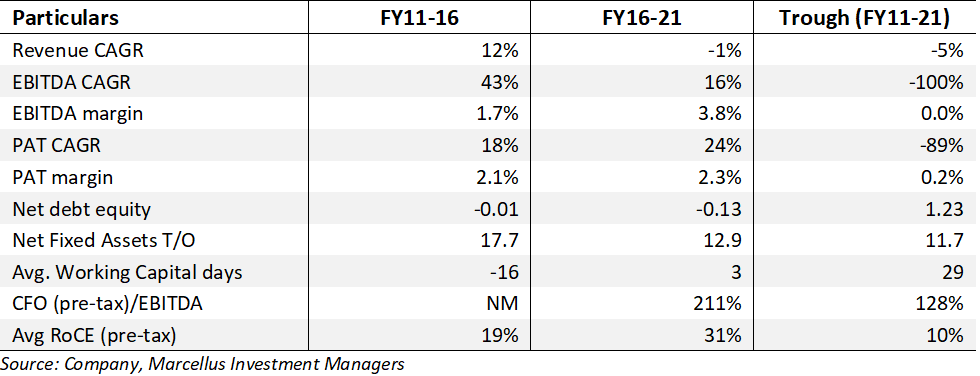

Almost all the peers of EFL are unlisted companies and hence this impedes our ability to do peer comparison to some extent. Furthermore, market share data is not readily available. Nevertheless, when we compare EFL’s total revenues (break-up between WPs, vacuum cleaners and air purifiers not available and hence we use total revenues for both EFL and peers) – we can see that historically EFL has significantly underperformed its peers between FY11-21 and more so between FY16-21 – see below exhibit.

Exhibit 4: EFL underperformed peers prior to the acquisition by Adven

iii. Greater focus on the higher margin service AMC and spares business

Service Annual Maintenance Contract (AMC) is a highly lucrative business –

a. AMC revenues through life of product significantly outpaces the revenue from one-time product sale.

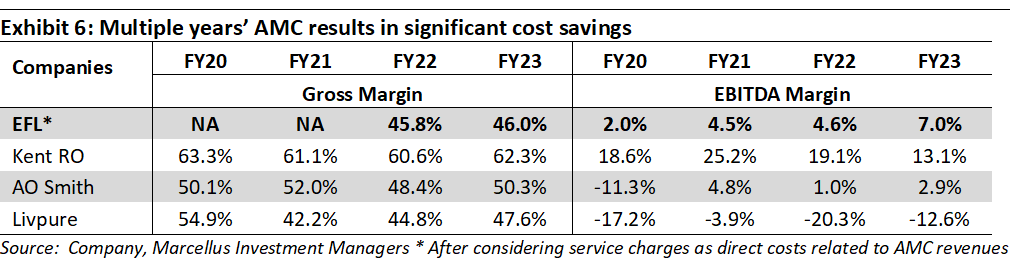

b. AMC is a higher margin business than the product.

c. The structure of a typical AMC is such that cash is received upfront, even before the service is delivered (unlike with the product side of the business) – making its working capital friendly.

However, similar to its fortunes in the product business, the Company has historically been unable to perform to its potential here due to following factors:

§ Loss of AMC customers to franchisees/other cheaper alternatives. Once a customer purchases an AMC (they usually do the first time), a relationship between the service provider and client is built. Subsequently, the former will offer the customer a discounted rate of say Rs.2,000 instead of Rs.3,500 for the kit and the service and not report it to the company. If not the franchise, there are other local service providers who by offering cheaper contracts are able to wean away the customers.

§ Similar to the preceding point, lack of advanced technology especially for basic purifiers, has led to the proliferation of a large grey market (catering to >50% of total requirements) and consequent loss of revenues to EFL.

§ Ultimately, the key motivation for the customers to look for cheaper alternatives (or not take AMCs at all in significant number of cases) boils down to the price points.

The result of all of the above is that we estimate that historically EFL has been able to service only about 25% of its installed machine base.

To increase this penetration of AMCs in the existing installed base, the Company is undertaking a slew of measures:

§ Lowering the entry points for AMC: Earlier a typical water purifier machine worth Rs. 10k would demand servicing at least once a year, that cost ~Rs. 3k (33% of the cost of the machine) per year. A lot of people found this price to be high and resorted to unauthorized service providers. Now the Company has just unbundled this package worth Rs. 3k into a service visit only one at Rs. 600-700, where the technician just visits and checks the WP. Any subsequent filter/candle change is chargeable. This gives the customers a chance to experience Eureka’s authorized service offering, at a low upfront cost. This does not mean that they are reducing the amount that they charge customers per se but unbundling the service deal.

§ With respect to addressing the large grey market (>50%) – the company has introduced QR code embedded filters, where the customer can themselves verify the authenticity of the filter by scanning it – these also fit older machines. To increase awareness of this, they are running a campaign which says – ‘nakli filter asli bimari de sakta hai’. EFL has also increased their presence of their app and promote its use it to get genuine service and products.

§ Furthermore, most Modern Trade (MT) stores (like Croma, Vijay Sales, etc.) today have a tie up with the Company where they coordinate between the customer and the Company in terms of service provision after the warranty period ends. Hence the rise of MT in overall sales augurs well for service revenues of WP players like EFL. These stores also give the customers an option to purchase multiple years’ worth of AMC during the initial product purchase (which results in a reduced per year cost – see the math for this below), and a lot of people do purchase that due to the availability of easy no cost EMI option (roughly 60-65% who purchase product + AMC bundle do it this way in Croma).

Exhibit 5: Multiple years’ AMC results in significant cost savings

iv. Scope for EBITDA margin expansion

EFL’s gross margin lag that of its peers despite much higher share of service revenues vs peers. There is also a significant gap between EFL’s and Kent’s operating margins.

We see several levers available to EFL to improve its operating margin:

Gross margin improvement:

While pricing the WPs competitively to push penetration will keep the margin under check, we see several positive levers such:

- Rising share of premium products with value added features.

- Higher volumes to drive much better pricing.

- Higher margin in the AMC business as majority of their call centre functionalities are shifted to their app; and

- Faster growth of the higher gross margin AMC mix within the overall revenues

Reduction in overheads:

Management has indicated strong focus towards reducing the overhead costs such as:

- IT costs – 2.5% of revenues in FY23

- Legal & professional fees – 2.3% of revenues in FY23; and

- Freight, forwarding, logistics –3.6% of revenues in FY23

We also expect the current ESOP charges (current average of Rs100 mn per quarter (~2% of revenues) to come down over the next 3-5 years.

The management has already walked the talk on margin improvement with operating margin rising from 7.0% in FY23 to 9.1% in FY24 (excluding ESOP related charges like to like FY24 EBITDA margin at 10.6%).

Key Risks:

- Management change: Attrition at the senior management level can result in derailing of the turnaround journey or atleast a massive derating in the stock valuation. A mitigating factor is the high % of ESOPs issued (9% of outstanding shares) to the management. We are trying to ascertain the vesting period to build comfort on ESOP as a factor for retention.

- Mass scale water purification employed by municipal/government agencies: In the US specifically, the Environmental Protection Agency (EPA) is responsible for ensuring the drinking water supplied to residential and non-residential properties through tap is of a certain quality (they have Acts and laws that mandate this). As a result, the drinking or potable water that is consumed as tap water in the country is filtered and disinfected at community or non-community centres for water filtration and is strictly regulated by the EPA. This makes a water purifier an irrelevant product in America. If a similar process (catalysed by regulations) starts in India, it could possibly make water purifiers irrelevant here as well.

Regards,

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/

Copyright © 2024 Marcellus Investment Managers Pvt Ltd, All rights reserved