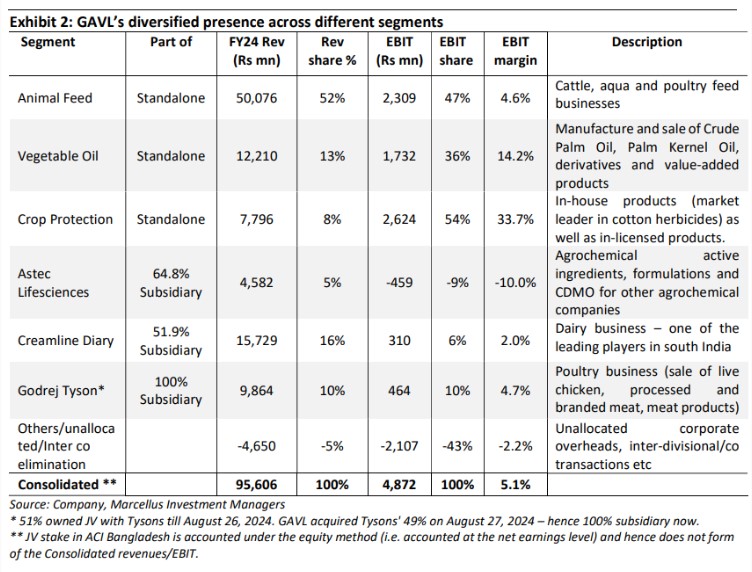

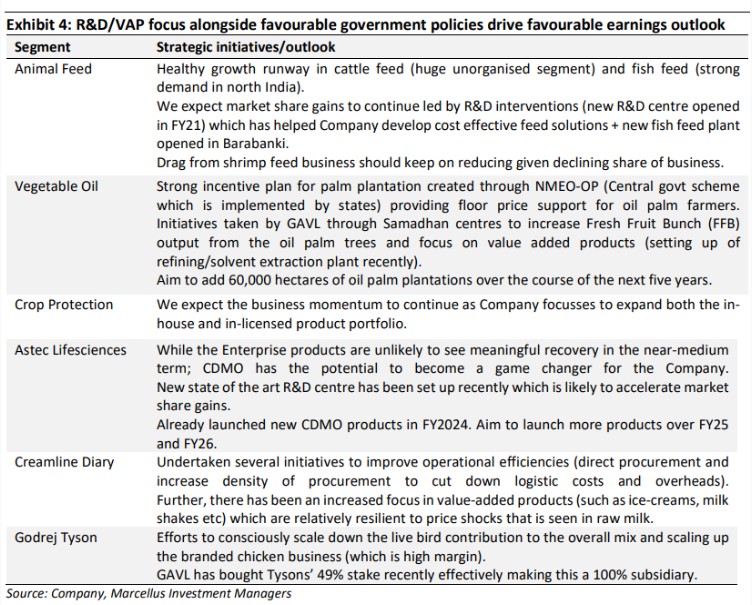

This month we delve deeper into Godrej Agrovet Limited (GAVL) which we added to the Little Champs portfolio earlier this year. GAVL is a diversified agri-focussed company present across animal feed, palm oil, crop protection, dairy and poultry businesses. The Company witnessed muted earnings growth over FY18-23 due to volatility in commodity prices (inputs as well as finished products). However, we expect much better earnings growth henceforth driven by the GAVL’s focus on building out value added portfolios across business segments and favourable government policies for farmers such as the ‘National Mission on Edibile Oils – Oil Palms’. Succession around the current Managing Director and near-term Government actions to manage commodity price volatilities are the key risks to our earnings estimates.

Performance update for the Little Champs Portfolio

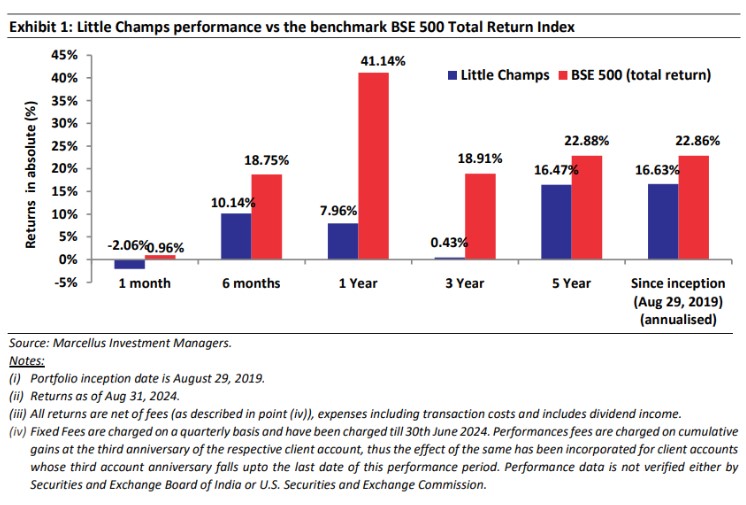

The Little Champs Portfolio went live on August 29, 2019. The performance so far is shown in the below table.

*For relative performance of particular Investment Approach to other Portfolio Managers within the selected strategy, please refer the following link https://www.apmiindia.org/apmi/welcomeiaperformance.htm?action=PMSmenu . Under PMS Provider please select Marcellus Investment Managers Private Limited & select your Investment Approach Name for viewing the stated disclosure.

Significant new additions to the Little Champs portfolio in the last twelve months

Since October 2023, we have added 18 new stocks to the Little Champs portfolio (until August 31, 2024). The brief rationales for all the additions/deletions have been shared with you in the monthly portfolio updates. In this LCP newsletter, we delve deeper into our reasons for adding Godrej Agrovet Limited in the portfolio.

Why we invested in Godrej Agrovet?

Background: A diversified agri-focussed company

Godrej Agrovet Limited (GAVL), with a focus on building agricultural business, was incorporated in 1991. The business kickstarted with the acquisition of the animal feed and crop protection businesses (agrovet division) from Godrej Soaps Limited (later demerged into Godrej Industries Limited and Godrej Consumer Products Limited). Over the years, the Company forayed into many new businesses – prominent amongst them being:

- Palm oil (acquired again from Godrej Soaps Limited in 1997);

- Poultry (forayed in 1994 through the Real Good chicken brand and subsequent JV with Tyson in 2008);

- Dairy through the acquisition of a 26% stake in Creamline Dairy in 2005 (increased to 51.9% since 2015); and

- Acquisition of a 52.3% stake in Astec Lifesciences in 2015 (increased to 64.8% now).

By 2017, all of the above business segments were in place and the Consolidated EPS had compounded at a healthy 16% CAGR over the preceding five years (FY12-17). In October 2017, the Company went public combining a primary raise of Rs. 2,915 mn, alongside secondary sale of shares by promoters.

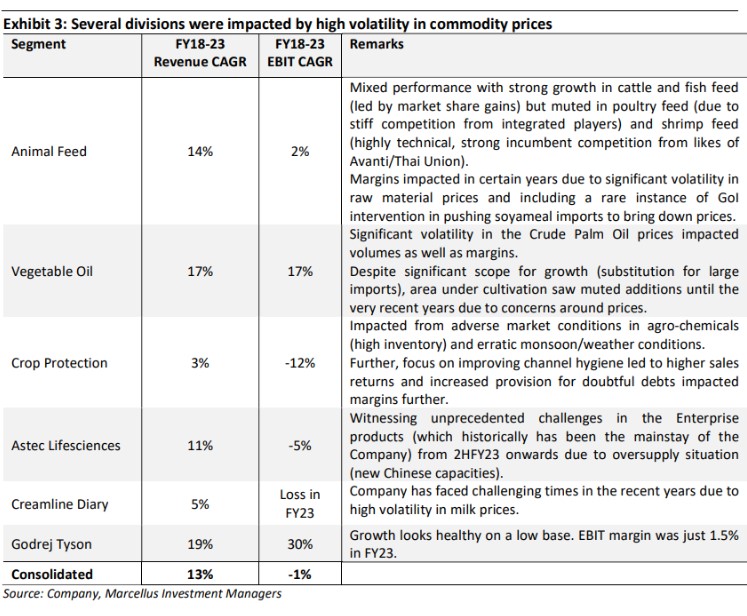

However, unlike the pre-listing era, the Company’s net earnings stagnated over FY18-23. Several of firm’s businesses witnessed cyclical issues (volatility in input/finished prices and the impact on demand/margins thereof) – explained in the below exhibit.

i. After having a weak FY23, we started seeing signs of an earnings pick from June 2023 quarter onwards. For the first three quarters of FY24, EBIT was up 27% – this was indicative of things turning around for the Company.

Similarly, driven by weak fundamentals, the Company’s share price had stagnated around Rs550 by December 2023; returning less than 3% CAGR relative to the IPO issue price (Rs. 460) about six years ago. Against this backdrop, we started researching GAVL during the early part of this calendar year. What aroused our interest in this company were:

i. After having a weak FY23, we started seeing signs of an earnings pick from June 2023 quarter onwards. For the first three quarters of FY24, EBIT was up 27% – this was indicative of things turning around for the Company.

Our research team travelled to GAVL’s various divisions/manufacturing/R&D facilities across the length and breadth of the country, interacted with the channel and primary data sources and came back convinced about the outlook for many of the key divisions for the next 3-5 years.

While Division-wise details are captured in the below table, we see this Company benefiting from the following broad trends:

- In August 2021, Government of India (GoI) relaxed rules to allow imports of upto 1.2 mn tonnes of genetically modified soyameal which led to significant inventory loss/margin impact in the animal feed division.

- In response to the volatility in the global crude oil palm prices, the GoI periodically alters the level of import duty (increase in case of weak global CPO prices; reduce in case of high prices) – this significantly impacts the domestic CPO prices and thus the fortunes of GAVL’s vegetable oil division.

Mr Balram Singh Yadav has been the Managing Director of the Company since 2007. His current term ends on April 30, 2025. It is not clear to us whether he will continue to be the Managing Director of the Company post the end of this term. While there are CEO/heads in place for all the key divisions, Mr Yadav has been associated with the Company since long (1990) playing a key role in the evolution of the Company and liasoning with the Government. Hence his continuation/succession is a key thing to watch out for.

Team Marcellus