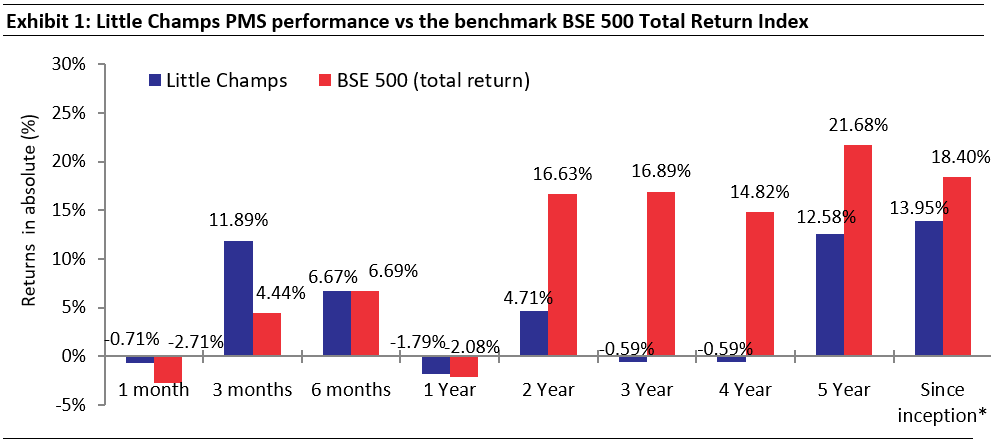

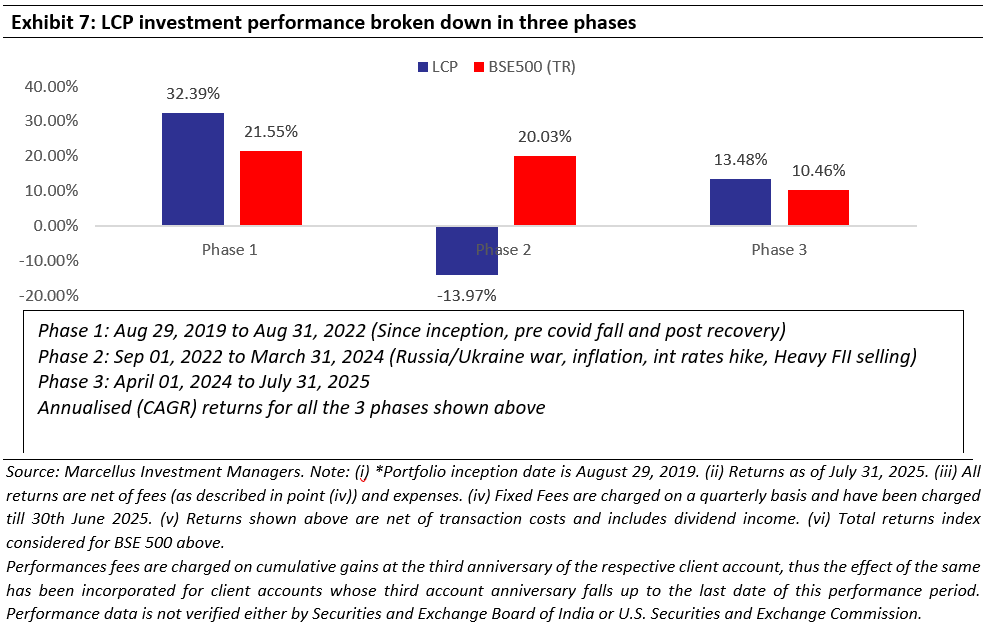

After enjoying a splendid run in the first three years of its inception, Little Champs portfolio’s (LCP) returns and earnings growth deteriorated from September 2022 – March 2024. On LCP’s 6th anniversary we focus on what went wrong during this period, the lessons learnt and the course correction we undertook around 18 months ago. The steady improvement in portfolio earnings and returns in recent quarters suggests that we are on the right track now. The current portfolio is well placed to address our concerns around weak earnings growth and high valuations for broader small-midcaps in general.

Source: Marcellus Investment Managers. Note: (i) *Portfolio inception date is August 29, 2019. (ii) Returns as of July 31, 2025. (iii) All returns are net of fees (as described in point (iv)) and expenses. (iv) Fixed Fees are charged on a quarterly basis and have been charged till 30th June 2025. (v) Returns shown above are net of transaction costs and includes dividend income. (vi) Total returns index considered for BSE 500 above.

Performances fees are charged on cumulative gains at the third anniversary of the respective client account, thus the effect of the same has been incorporated for client accounts whose third account anniversary falls up to the last date of this performance period. Performance data is not verified either by Securities and Exchange Board of India or U.S. Securities and Exchange Commission.

*For relative performance of particular Investment Approach to other Portfolio Managers within the selected strategy, please refer the following link https://w ww.apmiindia.org/apmi/welcomeiaperformance.htm?action=PMSmenu. Under PMS Provider Name please select Marcellus Investment Managers Private Limited & select your Investment Approach Name for viewing the stated disclosure.

Reflections on the eve of Little Champs’ 6th anniversary

Today i.e 29th August 2025, Little Champs Portfolio (LCP) completes 6th year of its existence. Three years ago, we published a newsletter (https://tinyurl.com/Marcellus-LCP) reflecting on LCP’s splendid three years of compounding returns and earnings. However, unfortunately, that upcycle came to an abrupt halt the very next month (September 2022). The next 1.5 years saw portfolio performance turn out to be opposite of the preceding three years – with deterioration in both the earnings growth and returns. In this 6th anniversary newsletter, we reflect on our actions during this painful period and the course correction we have undertaken over the past 18 months to bring the portfolio performance back on track.

Basis our internal reviews and analysis of the portfolio, the following three reasons stand out for the underperformance in returns and earnings over the Sep 2022-March 2024 period:

A. Persisting with heavy positions in some stocks despite deteriorating fundamentals & high valuations

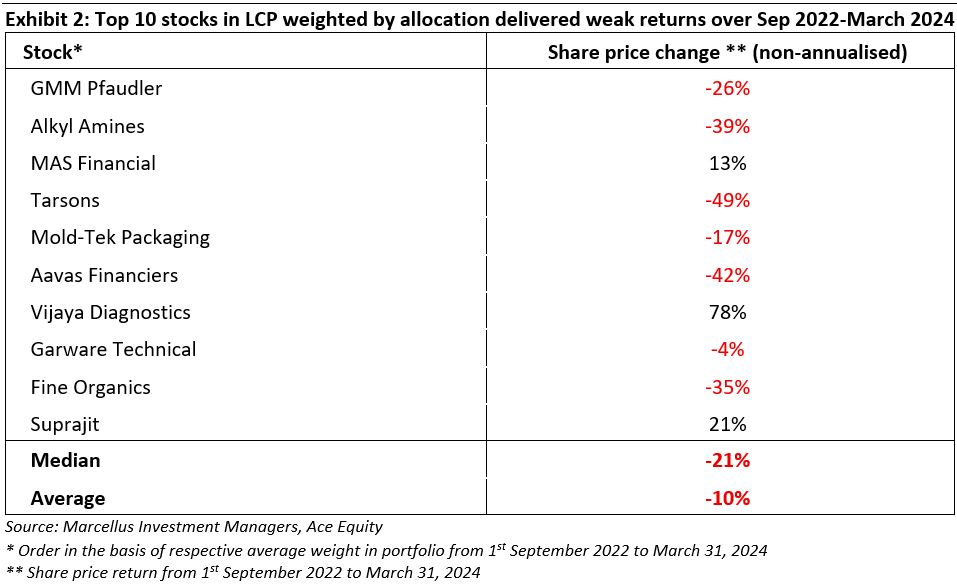

The top ten portfolio stocks, weighted by allocation, delivered a median return (non-annualized) of -21% (average -10%) over September 2022 to March 2024. This was obviously one of the biggest drags on the portfolio’s returns.

One of the biggest setbacks we faced during this period was our large allocation to the chemicals/pharma sector (as can be seen in the table above). Most of the chemical stocks underperformed in the post Covid-19 world due to weakening demand for their products as well as a significant influx of chemicals’ supply from China. This created adverse demand-supply dynamics impacting volumes of our then investee companies as well as their margins.

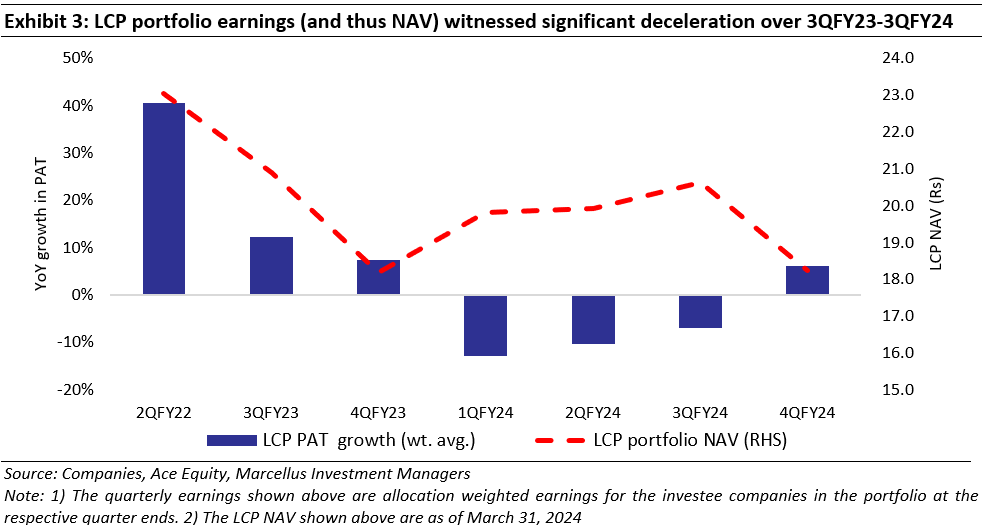

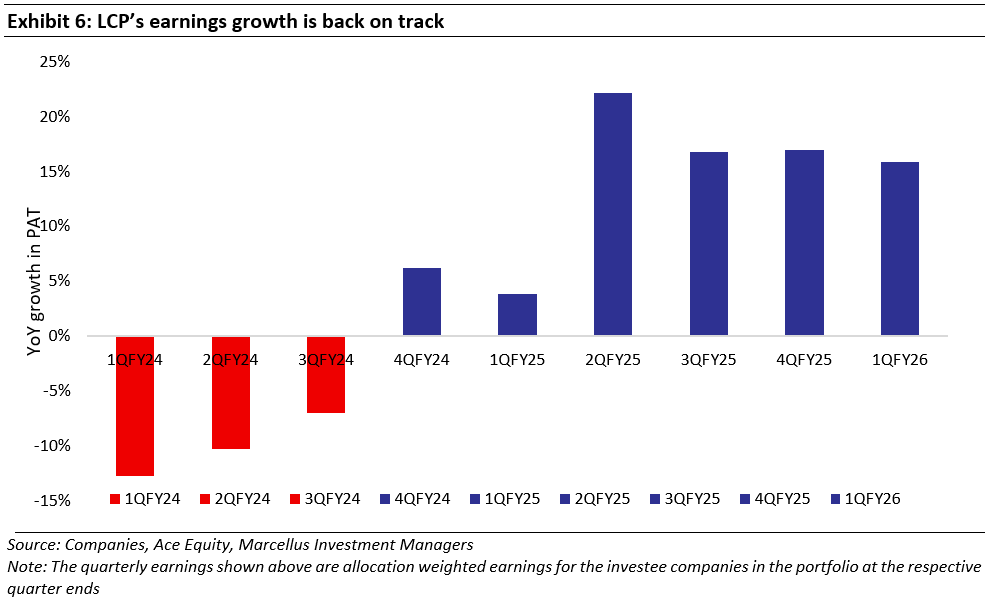

Overall, the portfolio earnings witnessed a significant deceleration starting from 3QFY23 and lasting until 3QFY24.

Why did we persist with these stocks?

- Ironically, many of these stocks were the best performing stocks in the preceding three years both in terms of returns as well as earnings. Some stocks such as Alkyl Amines, GMM and Mold-Tek Packaging had delivered healthy performance since their entry into LCP.

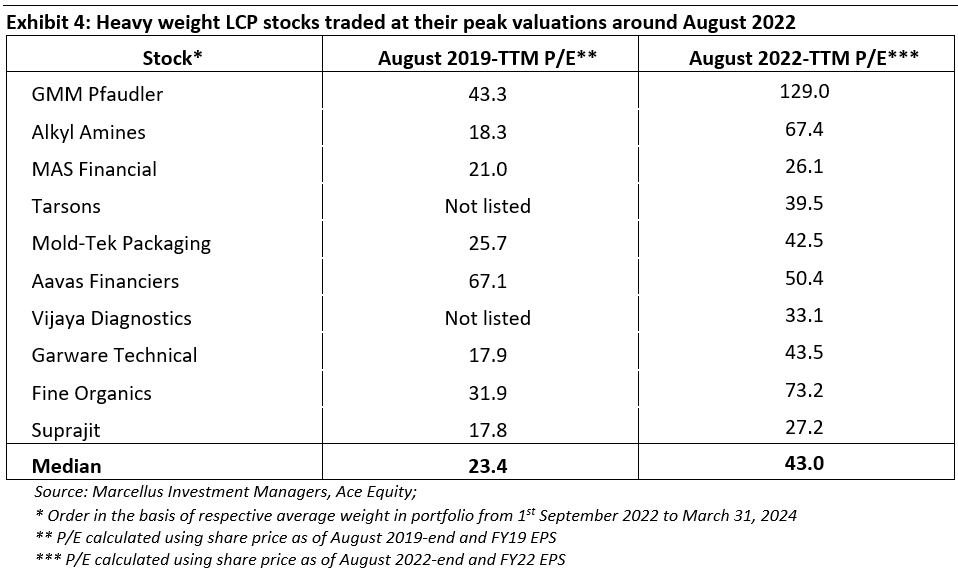

- A key call that we made in 2022 and which went wrong was to extrapolate the “transitory” superlative earnings during the Covid period as structural in nature. For instance, the broken supply chains during Covid-19 meant that larger organized players with strong balance sheets (a typical LCP portfolio company) gained market share from their weaker peers and unorganized segment. We considered these market share gains and the step-up in revenue growth/margins/RoCE as structural. While indeed this played out well initially, the market share gains reversed largely as supply chains got restored in the post Covid-19 world.

Another pitfall of the above extrapolation meant that we believed that the high valuations that these stocks commanded (significantly higher than long term average) were warranted by the “structural” uplift in earnings and RoCEs that these stocks witnessed.

As the earnings growth and “Peak” valuation unraveled, LCP’s returns suffered from Sept 2022 – March 2024.

B. Errors of omission/ inadequate coverage breadth

In contrast to the performance of the portfolio stocks, the BSE500 member stocks (as of August 2022) delivered median returns of 35% (non-annualised) between September 2022-March 2024. This indicates that even selecting a stock ‘randomly’ from the BSE500 would have had a high probability of generating healthy returns during this period.

Why did we miss the bus here?

- Our conviction surrounding the incumbent portfolio stocks (and persisting with them as described above) did away the urgency to find alternative stocks.

- Given our investment philosophy and our in-depth research process, we take time to build conviction in a company before investing. This investment process faced further challenges given the restrictions on carrying out research due to the lock-down.

C. Sizeable Impact costs

Another factor hurting LCP’s returns until March 2024 was the drag from building/exiting the positions. For most of our entry/exits the actual executed price was significantly higher/lower than the price prevailing at the time when the decision was made.

Reasons for the high impact costs?

- Some degree of impact costs is inherent in small-caps due to their illiquid nature/low trading volumes. In LCP’s case, the impact was amplified because of the large positions we held historically in the portfolio. (LCP was a <20-stock portfolio until October 2023.]

- Our view on the intrinsic value of the stocks also led us to believe that impact costs we give up initially would be more than be made up by the long term stock price appreciation.

How have we course corrected in the past 18 months?

A. Increase the number and breadth of coverage stocks

One of the important course corrections undertaken in the past 18 months is increasing the breadth of the small-mid cap stocks under our research coverage. Our research team has painstakingly worked on expanding the coverage without compromising on our investment philosophy or on the rigour of our investment process. As of today, our investment team covers ~90 stocks with market cap less than or equal to Rs. 75bn – the relevant playground for Little Champs and Rising Giants portfolios (RGP). This is nearly 3x the number of stocks in the actual portfolio.

The expansion in the coverage universe has afforded us flexibility in portfolio construction – having a higher number of stocks as well as more diverse business models/sectors in the portfolio.

B. Focus on earnings & valuation discipline

Whilst retaining the philosophy of holding stocks for the long term, the Sept ’22 – Mar ‘24 phase has made us change our approach in two critical ways:

· Given the link between earnings growth and shareholder returns for smaller companies, we now focus on earnings from a 1-3 years perspective. This also helps us identify any significant gaps in the earnings expectations between consensus and our estimates and hence take position sizing calls accordingly.

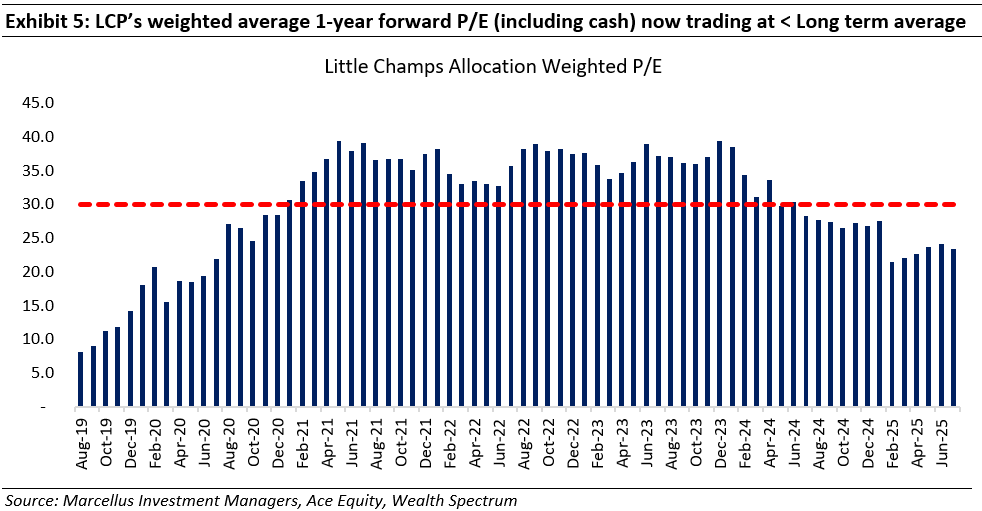

· Being conscious of the expected return of our portfolio stocks over a 5-year period by assessing not only earnings growth but also the expected change in the valuation multiples over the 5-year period. We have been relentless in trimming positions/exiting where the stock price increase is not justified by fundamentals. Thanks to this approach, we have been able to bring down the valuation levels of the portfolio significantly in the recent quarters.

C. Addressing the impact costs

· The increase in the number of stocks (and consequently the smaller positions held in the portfolio) by itself has helped bring down impact costs to a large extent; and

· Secondly, we have become more measured about buying/selling stocks until the required position is achieved.

We believe the corrective measures are yielding results:

A. Recovery in the portfolio earnings in recent quarters

LCP portfolio earnings have staged a comeback registering double-digit YoY growth since 2QFY25. This growth has been underpinned by recovery in the earnings of many incumbent stocks as well as earnings growth of new entrants. Note that in the broader smallcap market, earnings growth has deteriorated over the past 18 months.

B. Portfolio returns on the comeback trail since FY25

After a period of underperformance between Sept ’22 – Mar ‘24, LCP’s returns have also started outperforming the benchmark in the recent quarters.

Are we getting too risk averse and hence sacrificing the opportunity to generate outsized returns in the portfolio?

Diversifying the portfolio by increasing the number of stocks would mean that the average/median position per stock has come down significantly vs earlier. By forsaking concentrated position and being overtly disciplined about valuation are we giving up the opportunity to generate outsized returns from multi-baggers?

Here is our point of view on this subject:

- We remained concerned about the small-mid caps valuation in general alongside the broader deceleration in small-midcap earnings growth in India. These concerns are reflected in our cash holdings: ~30% of LCP is in cash/liquid investments today. We have written and spoken extensively about this in recent months (please find details at https://tinyurl.com/SMID-views ).

- For smallcap companies, earnings tend to be volatile with source of volatility coming from the inherent small size of business (and thus any significant capital allocation decisions weighing heavily on overall earnings), the cyclical nature of the industry, the evolution of the mindset of the promoters as the business grows from small to large. Given that there are multiple variables which can dramatically impact earnings, holding large positions in small-caps can be more counterproductive except in exceptionally compelling situations (example – when we started LCP in August 2019 when small-caps were trading at one of their lowest valuations). In addition, the impact cost associated with large positions has made us reluctant to maintain concentrated positions.

We are grateful to those who have supported us in our Little Champs journey over the past six years. We remain committed to further improving LCP’s performance in the coming years.

Regards,

Team Marcellus

If you would like to read our other published materials, please visit: https://marcellus.in/insights