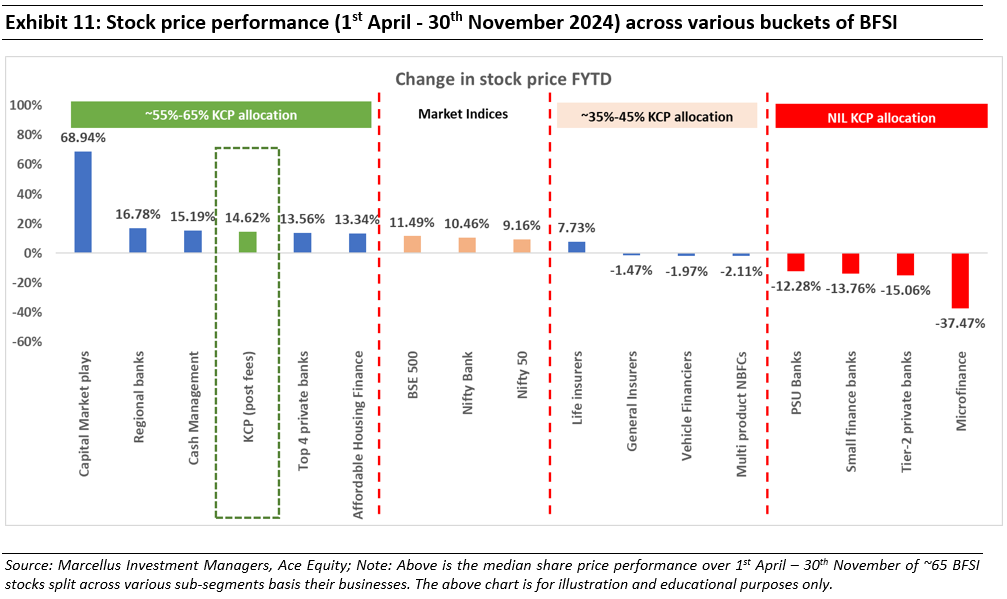

Loan growth for the banking sector has slowed down to 12% YOY from a peak of 16% and slippages for the higher risk retail lending segments are up anywhere between 2x – 6x vs FY24 levels. The increase in NPAs is a result of: (i) oversupply of credit in the post- Covid retail lending frenzy, (ii) slowdown in IT job creation; and (iii) the RBI’s increasingly unpredictable behavior around policy & regulatory enforcement. This shift in narrative from “India is a low risk, data enabled lending ecosystem post Covid” to “India has a fragile, overleveraged retail borrower base” over the past year has resulted in steep drawdowns for poor quality lenders. KCP’s zero exposure to MFIs (-37% returns FYTD), Tier-2 private banks (-15% returns FYTD), Small Finance banks (-14% returns FYTD) and PSU banks (-12% returns FYTD) combined with a healthy exposure to capital market plays (up 69% FYTD) and large private banks (up 14% FYTD) has resulted in KCP outperforming the Bank Nifty over the last couple of years. This high-risk environment is well suited to KCP. We believe the asset quality outcomes will become further polarized over the next few months.

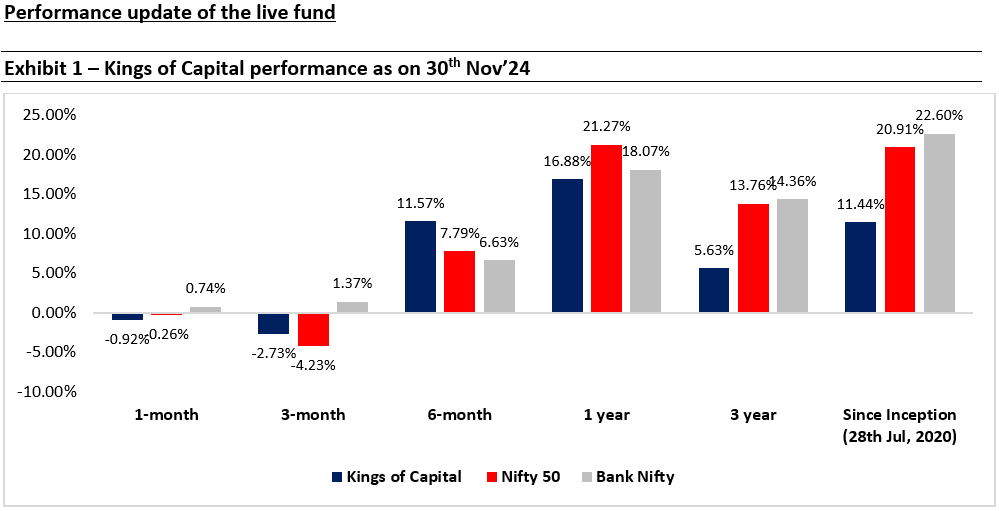

Note: Performance Data shown is net of fixed fees and expenses charged till 30th September 2024 and is net of Performance fees charged for client accounts, whose account anniversary / performance calculation date falls up to the last date of this performance period; since inception & 3 years returns are annualized; other time period returns are absolute. The calculation or presentation of performance results in this publication has NOT been approved or reviewed by the SEC, SEBI or any other regulatory authority.

NIFTY50 TRI is the benchmark index for the investment approach as per the Disclosure Document. Nifty Bank TRI is not the benchmark for the approach and has been provided for reference purposes as the approach invests in banks and financial services sector.

*For the relative performance of particular investment Approach to other Portfolio Managers within the selected strategy, please refer. Under PMS Provider Name please select Marcellus Investment Managers Private Limited and select your Investment Approach Name for APMI (apmiindia.org) the stated disclosure.

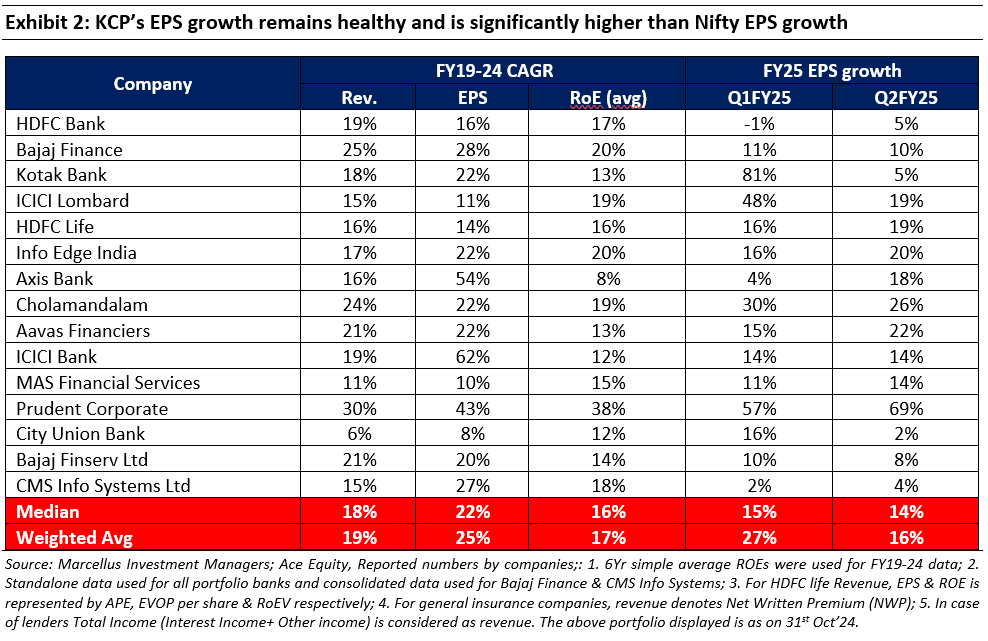

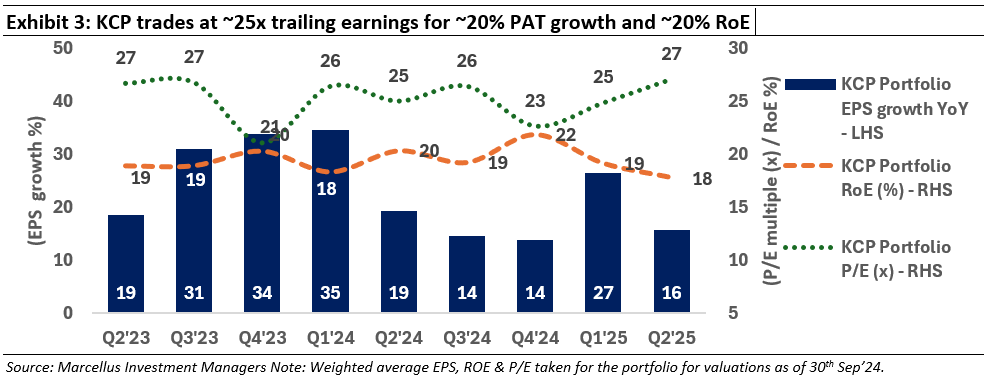

Portfolio continues to deliver robust fundamentals and trades at reasonable valuations

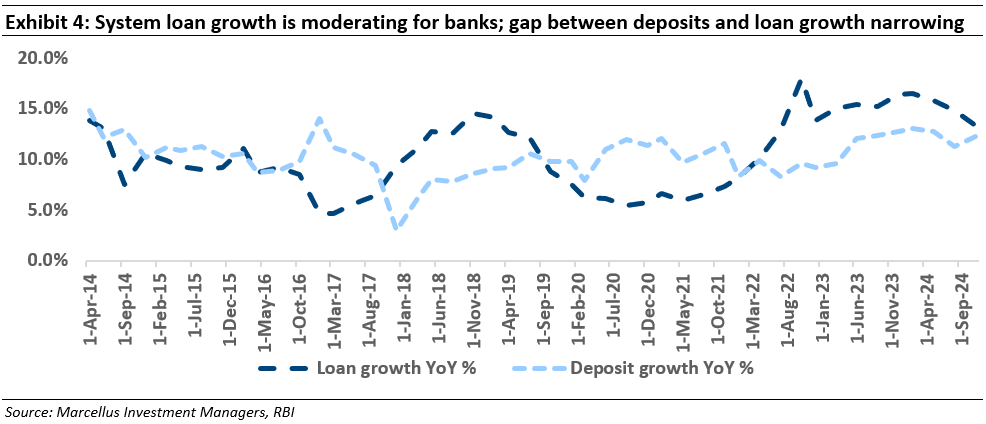

Banking system credit growth is slowing down:

Loan growth for the banking sector has moderated over the past few months to 12% YoY from a peak of 16% (in Q1’25) as the Credit to Deposit (CD) ratio for the banking system had reached all time high levels and the regulator increased risk weights of unsecured loans (Oct’23) and loans to NBFCs so as to to stem the growth of bank lending to these segments.

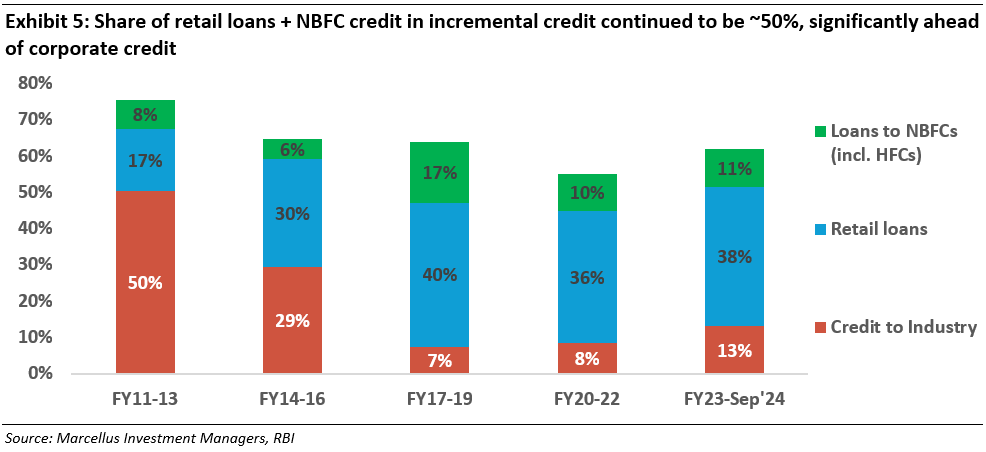

Corporate capex demand continues to be tepid and despite the slowdown in retail lending. In fact, inspite of growing evidence of pressure on household balance sheets, a majority of incremental bank lending continues to be retail in nature.

A decade of exuberance around retail lending is coming home to roost now

Prior to the corporate default cycle, corporate credit accounted for about 50% of incremental credit. However, poor asset quality in corporate loans pushed lenders to shift their focus to the faster-growing retail segment, which offered better risk-adjusted returns. Over the past decade, the banking sector’s credit growth has been primarily driven by personal loans and loans to NBFCs, which then on-lend to retail borrowers. Consequently, the share of corporate credit in incremental banking credit dropped from 30-50% in FY11-16 to 7-13% in FY17-FY24. This shift towards retail loans resulted in some loosening of underwriting standards in the race for growth in retail assets. Since most lenders have been wary of corporate loans (given their bruising experience in the FY09-18 era), the risk quite likely lies in the retail and MSME segments this time around.

Asset quality has started to deteriorate for the first time since Covid

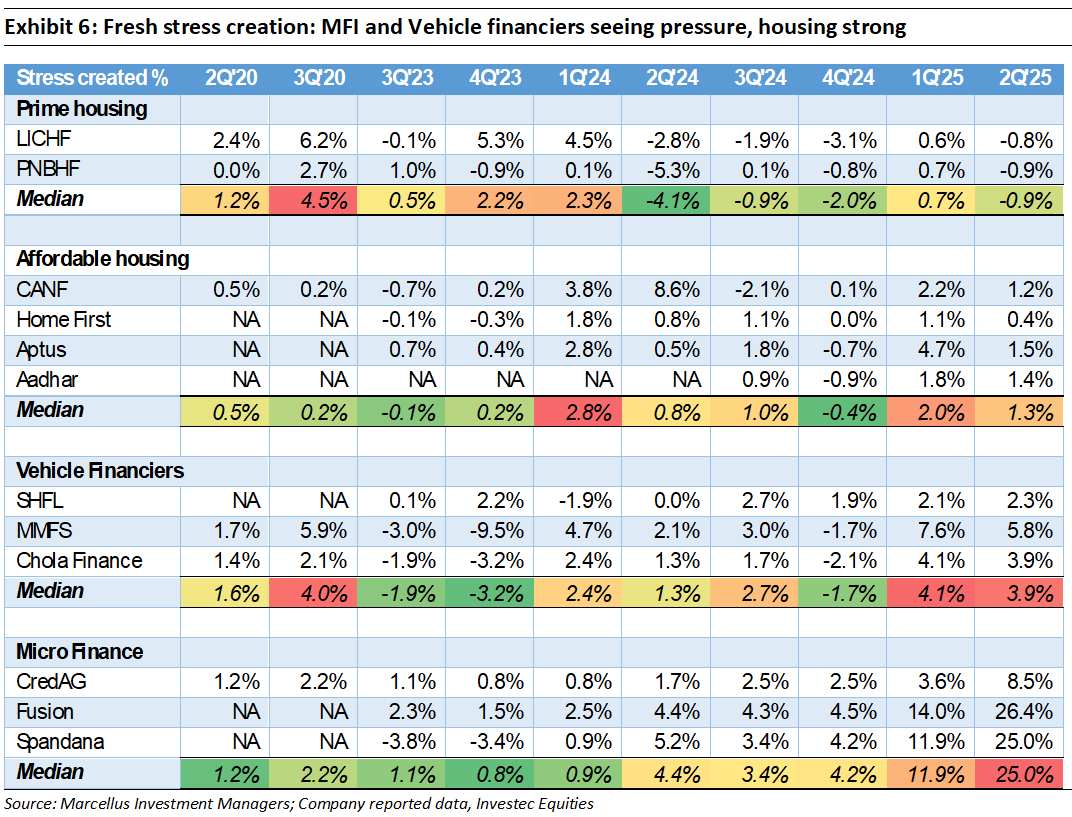

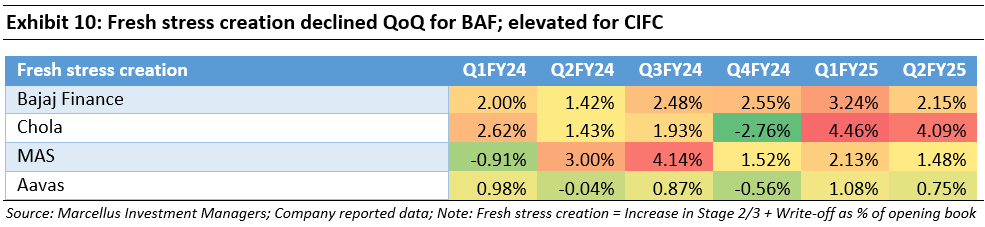

After three years of solid economic recovery and healthy credit growth, Q2FY25 results for lenders suggest that the benign asset quality environment has turned around decisively. We see clear signs of stress in certain sub-segments of lending – microfinance and low-ticket unsecured lenders have been the first casualties, whilst secured products like housing finance continue to see healthy asset quality. Our channel checks for now suggests that the risk of large-scale rise in delinquencies in MFI and unsecured loans is not – as yet – percolating down to any other small ticket secured loans. The data shown below of housing (both affordable and prime) also continues to reflect the same. However, stress is building up in not just microfinance but also in vehicle finance. [In the table below, fresh stress creation is calculated as increase in Stage 2 + Stage 3 + write-offs.]

Asset quality has started to deteriorate for the first time since Covid

After three years of solid economic recovery and healthy credit growth, Q2FY25 results for lenders suggest that the benign asset quality environment has turned around decisively. We see clear signs of stress in certain sub-segments of lending – microfinance and low-ticket unsecured lenders have been the first casualties, whilst secured products like housing finance continue to see healthy asset quality. Our channel checks for now suggests that the risk of large-scale rise in delinquencies in MFI and unsecured loans is not – as yet – percolating down to any other small ticket secured loans. The data shown below of housing (both affordable and prime) also continues to reflect the same. However, stress is building up in not just microfinance but also in vehicle finance. [In the table below, fresh stress creation is calculated as increase in Stage 2 + Stage 3 + write-offs.]

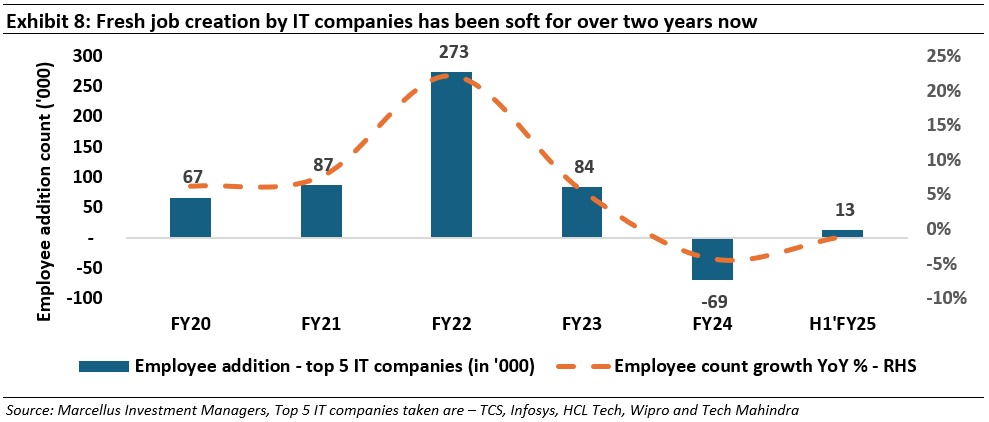

B. Slowdown in fresh job creation:

India’s largest sector for middle-class white collar employment saw tepid hiring trends over the past two years which resulted in increasing stress for household balance sheets and therefore repayment ability. In fact, the slowdown in IT jobs is part of a broader set of factors which is hurting middle class India – see our 24th Nov ’24 blog on this subject: https://marcellus.in/blogs/why-is-the-indian-middle-class-suffering/

C. Unpredictable decision making around policy and regulatory enforcement by the RBI:

Some of the RBI’s decisions have turned out to be pro-cyclical in nature while some other decisions have made the system more fragile and unpredictable vs earlier times:

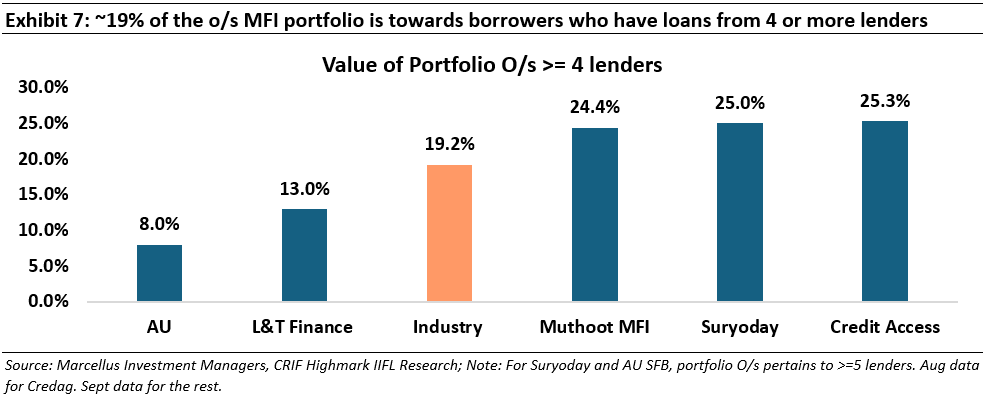

i. Pro cyclical regulations for MFI’s have resulted in the current situation:

In Mar’22 the RBI removed margin caps and restrictions on the number of lenders allowed to lend to the same borrower (for MFI loans). This change turned out to be pro-growth, allowed higher risk taking and higher profit margins for the lenders thus attracting new capital to the sector. That in turn resulted in excess supply of credit. Two years later when RBI realised this, it went to the other extreme and in ordered the temporary closure of two MFIs for overcharging.

ii. Erratic decision making on CEO tenures, CEO compensation:

India has some of the strictest regulations (when compared globally) on bank CEO tenures and compensation. The capping of CEO tenure came after the nasty episode of Yes Bank when the promoter MD and CEO put his own interest over the bank’s interest.

Similarly, bank CEO compensation is also highly regulated by the RBI. This makes attracting top talent difficult for the banking sector given as even the largest private sector Indian banks cannot compete with tech companies or even NBFCs on CEO compensation.

Additionally, RBI has been unpredictable in its decision making around extensions of MD and CEO tenures posing a risk of continuity for all stakeholders. Some such decisions are listed below:

Federal Bank: RBI approved 1-yr extensions twice for Shyam Srinivasan, ex-MD and CEO of Federal Bank vs. board approving a 3yr extension. Moreover, Mr Srinivasan wasn’t given an extension for another year even though he had only completed a total of 14 years at the bank (read more here).

ICICI Bank: The Board of ICICI Bank had appointed Mr. Sandeep Bakhshi as MD & CEO for 5 years from 4-Oct-18 to 3-Oct-23. The RBI approved only a 3-year term (read more here ).

IndusInd Bank: The Board had approved the re-appointment of Mr. Sumant Kathpalia as the MD & CEO of IndusInd Bank for a further period of 3 years. The RBI approved only a 2-year term (read more here).

iii. Extreme actions by the RBI which increase system fragility and predictability:

Whilst we are told that the RBI consults regulated entities extensively and takes actions only after repeated defaults, some of RBI’s recent actions such as the overnight shutting down of 2 MFIs and 2 NBFCs could lead to serious implications for the banking system leaving aside implications for other stakeholders including customers of these entities

How has KCP fared in this chaos around asset quality?

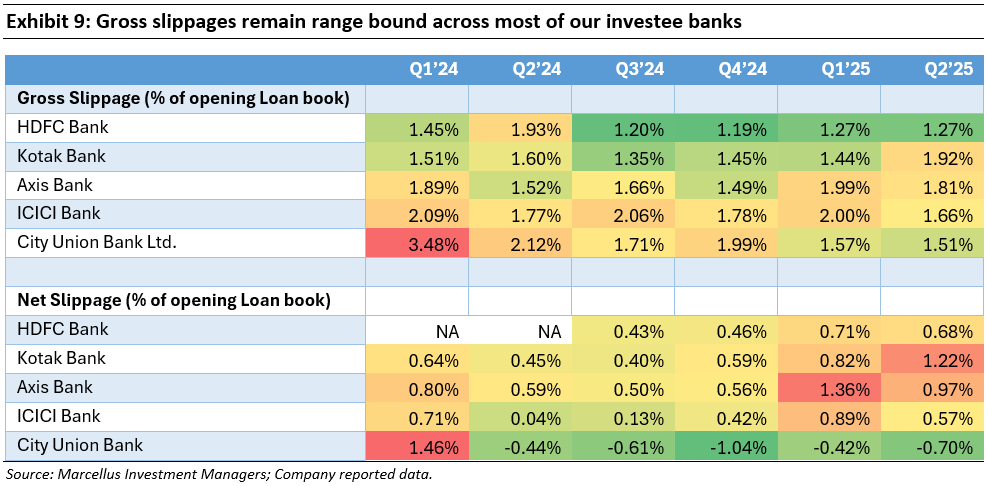

· Large private sector banks and regional banks have maintained strong asset quality, even as delinquencies normalize from cyclical lows, primarily in unsecured credit. Growth calibration in large banks is aligning with the system, and we remain confident in their ability to deliver superior asset quality outcomes compared to the sector. Notably, in Q2, the gross slippages ratio declined YoY for both HDFC Bank and ICICI Bank.

- Within NBFCs, the pain was higher than large private banks but was well contained. In an environment when unsecured loans are seeing sharp increase in delinquencies across the system, Bajaj Finance witnessed stress creation decline QoQ in Q2 . While it is too early to draw definitive conclusions, early stress indicators suggest that Bajaj Finance’s asset quality in unsecured should turn out to be head and shoulders above the rest of the industry. We will not be surprised if some of the fringe players report large holes in their unsecured book over the next 2-4 quarters.

- Also, our investments in the insurance sector are better positioned as they are insulated from the asset quality issues of the banking sector. However, the tailwinds that benefited the general insurance sector over the past 12-15 months, such as growing new motor sales and improved pricing discipline, appear to be reversing, as evidenced by declining premiums in commercial lines due to aggressive pricing. While this could pose growth challenges for the general insurance sector over the next 2 quarters, we continue to believe that high quality general insurers have a long runway of profitable growth.

- Additionally, we have reduced exposure to capital market plays given punchy valuations and a possibility of earning downgrades if equity markets continue to remain tepid.

How is KCP positioned to benefit from this downturn?

Way forward: Time and again we have witnessed that during economic slowdowns, weaker lenders experience asset quality and significant stock price declines. In such times, stronger lenders not only gain market share but also get re-rated as market starts to reward certainty over mindless growth. FY25TD has been no different, and KCP’s conservative positioning in high-risk segments (NIL presence in the portfolio) has helped the portfolio to deliver both fundamental and share price performance materially better than the benchmark (see chart below). The risks to our portfolio can further emanate from asset quality issues percolating upwards towards secured segments such as vehicle finance and affordable housing. We continue to monitor stocks which have experienced sharp price correction and hunt for suitable opportunities.

Portfolio changes over the last 3 months: Whilst we keep investors updated of the portfolio changes via our monthly updates on the portfolio (read here ), below is the summary of the 2 portfolio additions that have been done in KCP over the last 6 months.

Addition of Bajaj Finserv: We started adding Bajaj Finserv to the portfolio in July. Bajaj Finserv owns 51.3% stake in Bajaj Finance – one of the most profitable and best-managed NBFCs – and 74% stake in 2 insurance businesses – BAGIC and BALIC. BAGIC is one of the best run general insurers in the country, whilst BALIC has turned around in the last 3 years under the new management team. Bajaj Finserv’s new initiatives like Bajaj Finserv Health, FinServ Market Place & Bajaj Finserv AMC offer additional optionality. With all cylinders firing, it is a good way to take exposure to the Indian financial sector. When we started adding Bajaj Finserv, its derived holding company discount (on Bajaj Finance) was marginally lower than previous 5-year average. However, this has discount significantly narrowed over the past month post our purchase. This position was built by selling off some of our holding in Bajaj Finance. Given majority of the SoTP value of Bajaj Finserv continues to be contributed by its stake in Bajaj Finance, this addition does not result in any significant change in portfolio composition.

Addition of CMS Info Systems Limited: We started adding CMS to the portfolio in July. CMS is a business services company with leadership in cash management market, a growing presence in ATM managed services market, and now expanding into tech solutions (remote monitoring and software). On back of its scale and a strong balance sheet (net cash company with healthy return ratios), it is well placed to benefit from healthy ATM rollouts (capex heavy), increased outsourcing activity of support functions by banks and tightening regulatory compliance. Stronger growth in RMS segment and diversification into bullion-logistics and loan collections will drive revenue growth & diversification of revenues. The biggest risk is acceleration in replacement of cash by digital payment modes and hence material reduction in cash in circulation.

Regards,

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/blog/