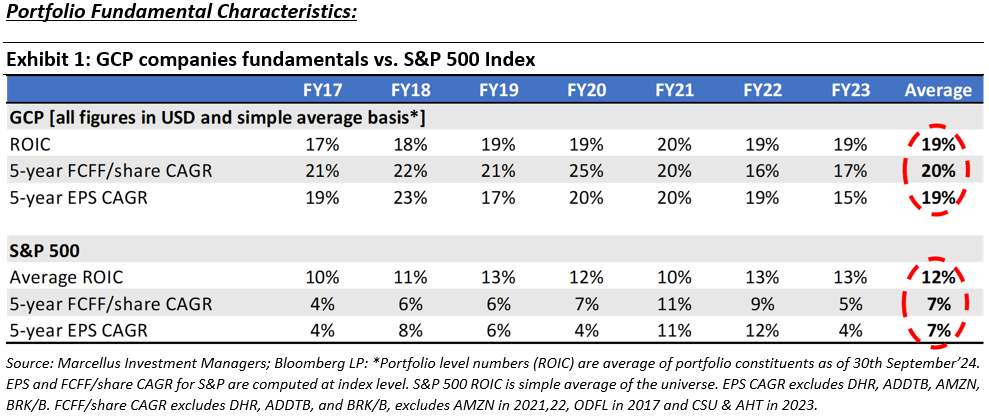

Marcellus’ Global Compounders Portfolio (GCP) strategically invests in 25-30 deeply moated global companies aligned with megatrends, fostering a consistent mid to high teens compounding of free cash flow/earnings.

Investing globally, particularly in the US, is often equated with technology companies. While the US is home to iconic tech giants, exceptional value creation has occurred across various industries. One often-overlooked theme we like is “NIMBY Investing.” In this piece, we explore what “NIMBY Investing” entails and why some of these companies are great investments

Permissible Accredited Investors* can now invests in GCP Strategy with minimum ticket size USD 25,000.

*Accredited Investors shall qualify eligible criteria as defined under IFSCA-IF-10PR/1/2023-Capital Markets dated January 25, 2024.

For non-accredited investors, Investment in Marcellus’ GCP is through Separately Managed Accounts (i.e., SMAs, just like a PMS) via GIFT City (regulated by IFSCA) with a minimum investment amount of USD 150,000.

Latest regulatory changes pertaining to Global Investment:

- For Resident Indian investors, Long Term Capital Gains (LTCG) on global equities now reduced to 12.5% (without indexation benefit) in recent budget Vs 20% (with indexation benefit) earlier

- Salaried personnel investing in GCP can now set off the TCS paid (at the time of LRS transaction) against TDS to be deducted on salaries

- Resident Indians can now open a ‘Foreign Currency Account (FCA)’ in IFSC and can use the funds for any current or capital account transactions in other foreign jurisdictions (outside IFSCs)

- IFSCA issued consultation paper on 5th August 2024 which proposed to reduce minimum investment amount in GIFT PMS to be USD 75,000.

These recent changes, which simplify and align long-term capital gains tax with domestic equities and allow resident Indians to open foreign bank accounts in GIFT City, significantly reduce friction.

For substantial wealth creation, ‘sexy’ is not necessarily the only way to go!

“I’m always on the lookout for great companies in lousy industries. A great industry that’s growing fast, such as computers or medical technology, attracts too much attention and too many competitors.” – Peter Lynch, Beating the Street

For as long as one can remember, humans have been attracted to people and things that promise to change the world radically, and for good reason. Inventions such as the electric bulb/telephone in the 19th century, internet/semiconductors in the 20th century & e-commerce/electric cars in 21st century have played a disproportionate role in the betterment of human civilization – making the inventors and businessmen like Thomas Edison, Jeff Bezos & Elon Musk extremely wealthy in the process.

Meanwhile the stakeholders in the companies catering to these innovations have not fared too shabbily either. The business (& stock market) performance of technological giants like Amazon, Apple, Alphabet and more recently Nvidia has made many stakeholders – employees/vendors/shareholders – very rich over last two decades.

However, this newsletter is NOT about such companies!

Rather, in this newsletter, we discuss the kind of companies that get overlooked amidst the widespread fascination (and even euphoria!) that takes hold when an invention becomes successful and starts gaining scale. The current rhetoric around Artificial Intelligence being one such possible example. In general, and especially during such phases, the market tends to overlook the not so sexy parts of economy – howsoever important and wealth accretive they might be!

Such businesses may not have the exponential growth curve of technological/innovation led companies but just by virtue of their ‘utility’ nature have business longevity and higher earnings predictability on their side. In our Aug’23 newsletter, we covered how such firms create substantial wealth whilst staying under the radar through astute capital allocation.

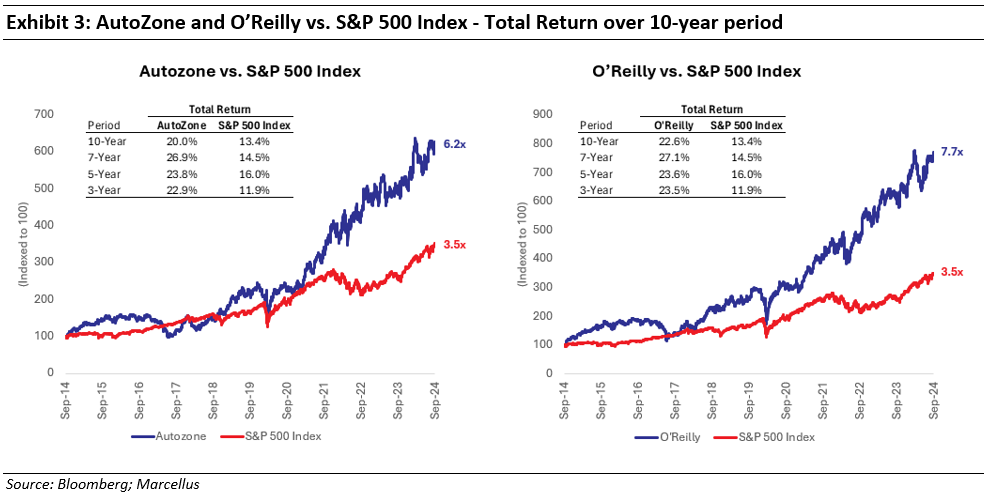

The performance of one of such firm discussed in that newsletter – AutoZone (aftermarket auto parts retailer & distributor) – and its peer O’Reilly vis-à-vis the S&P 500 index over last 10 years speaks for itself (this is the time when market’s major focus has been on the Magnificent 7!). While most investors would be happy with 2-3% points alpha over benchmark index over a ten-year period, these companies have outperformed S&P500 index by 6-9% over a decade!

To watch out webinar on NIMBY investing, click here

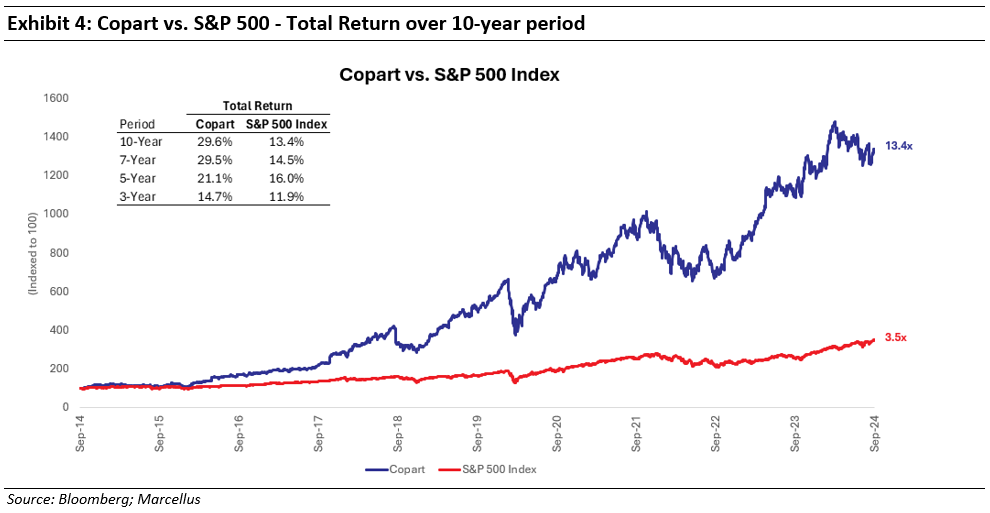

In this newsletter, we dive into Copart, that some might call rather ‘unattractive’ sector. However, as the example of two auto parts retailers above has shown, unattractive does not mean ‘un-investable’!

Copart – using second hand vehicles to generate first class shareholder value!

“Whatever made it [junkyard] look nice, we did. That way, when people walked in, it was like they were walking into a real retail store. It made it more personal. They could shop. I know that sounds crazy – shopping at a wrecking yard. But no matter what you are buying, you want it to be a good experience, and you want to find what you want easily. Up until then, people just thought of a wrecking yard as a bunch of wrecked cars in a field that you had to wander through to find what you wanted”- Willis Johnson, ‘Junk to Gold: From Salvage to the World’s Largest Online Auto Auction’

Copart literally started its business dealing with ‘junk’. Willis Johnson – the founder of Copart grew up in his father’s vehicle dismantling yard (or a junkyard) in the 1970s, essentially selling torn down car parts. Willis, however, wanted to improve the business and one of the places he took an inspiration from was a grocery store he had worked at. He especially liked the nice organization of the SKUs in retail stores which led to better customer experience.

And so, even in the ‘junkyard’, he would paint the floors white every single year and organize the rows very cleanly, organize the parts and clean them for people. Over time he realized one of the ways to increase volumes was to specialize in a particular brand (rather than offering everything under the sun) and in doing so become the go to guy for that car brand’s aftermarket parts. The volumes increased from $3500 a month to $3500 a day as a result of this specialization.

Further, in a stark example of Willis’ vision being ahead of the time, he understood the importance of volume and turnover (much like in retail) and instead of relying on fax machine to send intimations to prospective buyers to garner bids for the parts in Copart’s inventory, he invested $100,000 – a substantial amount 50 years ago – in a computer system. This allowed him to not only track the inventory much more efficiently but also build the early iteration of virtual bidding system (currently at the firm is using Virtual Bidding 3 or VB3).

Another important way in which Copart’s management differentiated themselves is by thinking decades out and not the next quarter or two was through their real estate strategy (one can see parallels with best-in-class grocery retailers like Costco here). Copart owns a ton of land – essentially a junkyard. While analysts have voiced their frustration against such ‘capital heavy’ strategy, Copart decision safeguarded them against both inflation related rental costs (the effects of which were visible post Covid) as well as having spare capacity ready whenever there was an event like hurricane that led to a large influx of towed vehicles in need of a junkyard.

From a vehicle dismantler to a highly moated vehicle auctioneer

Copart of today is essentially a two-sided network that acts as an intermediary between buyers and sellers of salvaged cars by providing an online platform for auctions. The sellers are insurance companies, banks, rental fleet operators, and dealers, while the buyers are dismantlers, rebuilders, used car dealers, and licensed repairers. Copart has customers from all over the world, including North America, Europe, Africa, the Middle East, and Asia. However, the US remains its primary market with 82% revenue share as of 2023.

The company today sells two types of vehicles – salvaged cars (80% of revenue) and used cars (20% of revenue). In the US salvaged car market, which is essentially a duopoly, Copart is the dominant player with ~65% market share much ahead of #2 player IAA which has ~30% market share. In international markets Copart competes with local/regional players. In the US used cars market Copart faces competition from established players like ADESA, Manheim, and ACV Auctions.

Before getting into the nitty gritty of how Copart makes money, lets first understand a couple of key terms critical to this industry – salvaged vehicles and total loss ratio.

Salvaged vehicles are those vehicles which have been involved in an accident and the cost to repair the vehicle is more than its pre-accident value. In such cases insurance companies prefer not to pay for repair but rather declare the vehicle as ‘total loss’ and pay their customer an amount based on pre-accident value.

After paying such claims, insurance company prefers selling the damaged car for maximum value possible (to minimize its losses). This is where Copart comes in and provides an online auction platform to sell these damaged vehicles to prospective buyers. The buyers could be repairers, rebuilders or dismantlers who would either rebuild the vehicle for reuse or take out useful parts for reselling.

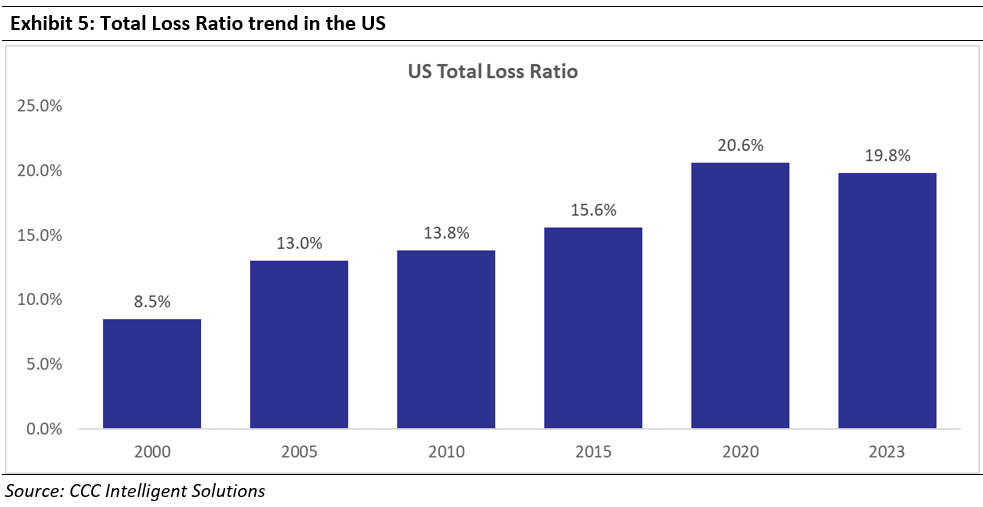

Total Loss Ratio is calculated as % of vehicle declared as total loss out of the vehicles which for which claims has been raised after accident. Total Loss Ratio in the US has increased from ~13% in 2005 to 20% 2023.

The aforementioned increase is a result of increasing cost of repair of cars – as cars have become more complex over the years (due to addition of various types of sensor and advanced features). Additionally labour cost to repair cars has also gone up as you need more skilled labor to undertake such repair. Higher cost of repair increases the chances of declaring the vehicle as total loss in case of an accident.

Under the used cars business, Copart sells cars from rental fleet operators, corporate fleet operators, used car dealers etc. It has expanded used vehicle offering to include powersports vehicles, and construction, agriculture and heavy equipment through acquisitions.

On the salvaged cars business (~80% of business) Copart currently has three revenue models:

· Percentage Incentive Program (PIP) where Copart sells vehicles and takes a percentage of the sales price as fee. Copart promotes PIP model as it aligns incentives with sellers.

· Consignment Program (Fixed Fee) where Copart sells vehicles for a fixed fee. Ancillary costs such as towing, cleaning, and storing the vehicles are charged separately.

· Purchase Program under which Copart buys vehicles directly from owners and then resells them through auctions. This model is primarily used in European markets like Germany and Spain.

Copart earns money from both sellers and buyers, but most of its revenue (~70-75%) comes from buyers. On average, Copart’s revenue is ~20-25% of the sale price of a vehicle of which ~15-20% comes from buyers and ~ 5% comes from sellers.

Copart also has other revenue streams from value added services like – membership fee, gate fee, internet convenience fee, and storage fee from buyers. It also charges extra for providing additional services like additional photographs of the car.

Over time, as its network gained scale, Copart has consistently increased fees on the buyer side, such as raising the buyer fee from 12% to 15%, increasing gate fee, and increasing internet convenience fee. Copart has also introduced membership tiers with higher fee for additional features.

For used cars (~20% of business), Copart uses the Percentage Incentive Program (PIP) model. The company holds separate auctions for used cars and charge dealers a fee of $85-100 per car, and additional 1-2% of the sale value. On the buyer side, the fee structure is the same as that for salvaged vehicles. Copart earns higher profit margins on used cars (vs salvaged cars) because there are fewer overhead costs associated with selling them.

Copart’s key Competitive Advantages:

A. Wide network of owned salvage yards:

· As mentioned earlier, Copart owns its salvage yards and the firm’s ownership of land eliminates risk of eviction or increased rental costs from leases.

· Much like in the case of landfills, the NIMBY phenomenon has led to difficulties in licenses for new junkyards in towns across the US – thus keeping Copart’s lead intact vs its peers.

· Having a wide network of salvage yards allows faster pick up of cars as well as lower towing cost.

· The business has a massive first mover advantage as the first mover gets best locations and makes harder for competitor to get second license. If the competitors take land parcel at far off location their towing cost increases significantly.

B. Strong Network Effect – The business has a strong two-sided network effect, much like in case of tech platforms like Amazon/Facebook (Meta)/Uber. Having large number of vehicles on the platform attracts more buyers, a greater number of buyers leads to more competitive bidding and better price realisation, this in turn lead to more sellers willing to be on Copart’s platform.

C. Integration with Insurance companies: Deep integration with processes of insurance companies and value-added services (total loss assessment, direct settlement etc.) makes switching difficult for the latter.

Breaking down Copart’s shareholder value creation

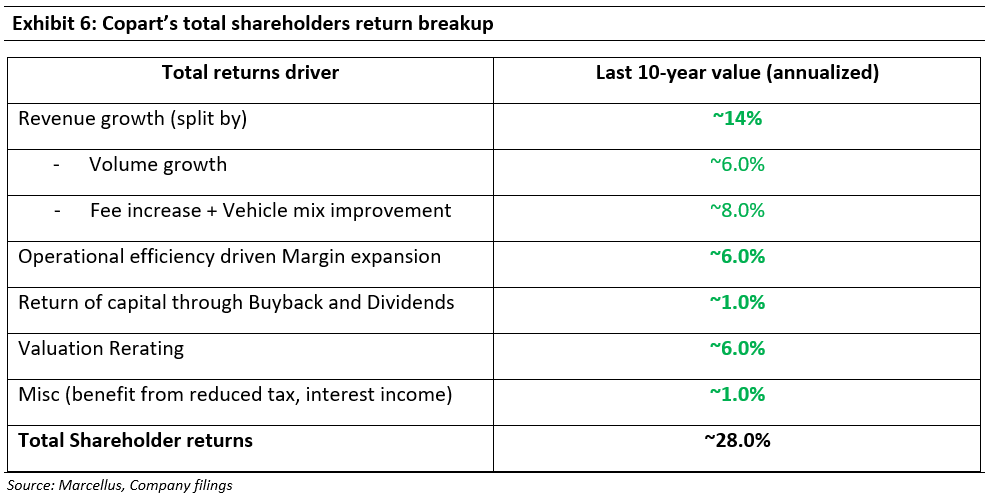

As we’d shown in exhibit 6, Copart has generated total returns of ~28% per annum over the last decade. These returns can be broken down into fundamental business components as show below:

o Over the last decade (2013-23), Copart has grown its revenue by ~14% per annum. About 80% of the firm’s revenue comes from services business (fee collected from selling salvaged/used vehicles) while the remaining 20% revenue is from vehicle sales (purchasing and re-selling vehicles salvaged/used vehicle primarily in Europe). The services revenue has grown at ~ 14% driven by both increase in salvage vehicle volume and increase in fee charged. Salvage vehicle volume in-turn has grown due to increase in total-loss ratio in the US as discussed earlier. Vehicles sales revenue has grown at ~13% mainly from entry into European markets and market share gains.

o During this period, the company has also increased its operating margin from 27% to 38.4% or by 11.4% mainly from operating leverage as more of their junkyards have matured and handle larger number of vehicles.

The example discussed above highlights how strong network effects led moats can be built even in non-tech, relatively cumbersome, capital-intensive industries like the one Copart operates in. At the end of the day no matter which sector a business operates in, long term wealth compounding is an outcome of business ingenuity of the operators, a truly long-term outlook and prudent capital allocation.

Source: All information shared on Copart is based on company’s filings, investor presentations, call transcripts and “Junk to Gold” book authored by founder Willis Johnson.

Conclusion

The discussion in this newsletter in no way an indictment of investing in high growth innovation led sectors but rather a simple documentation of opportunities that tend to get overlooked in ‘narrative’ led markets. At the end of the day, our key focus in GCP is to identify fundamentally strong companies trading at cheap to fair market value vis-a vis their own earnings potential. To that end we frequently look at less fashionable companies without paying much heed to the ‘in thing’ at that moment.

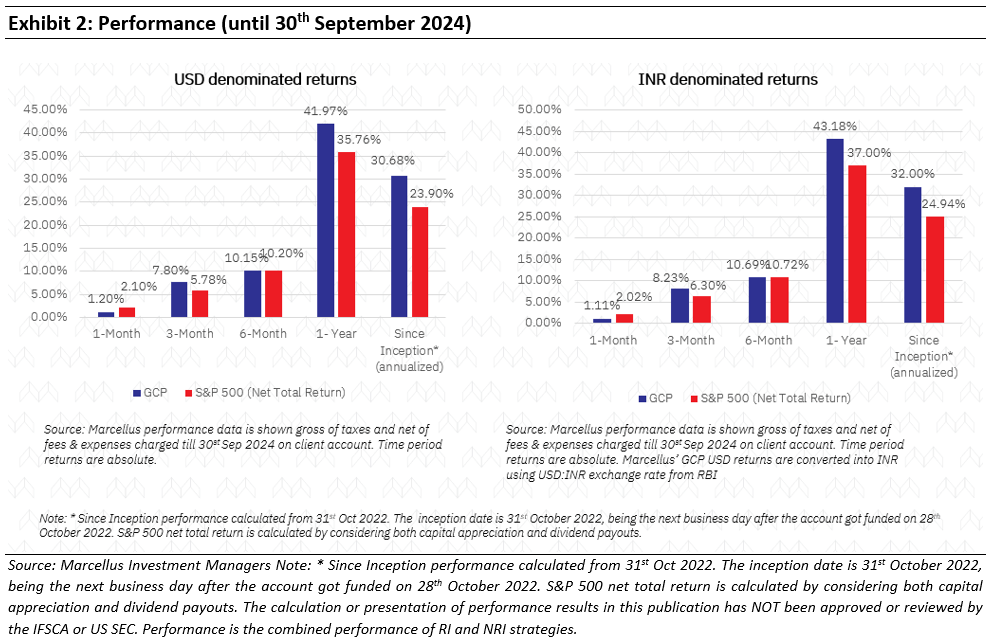

Our portfolio construction has thus remained relatively underweight the Magnificent-7 companies (Apple, Amazon, Alphabet, Microsoft, Nvidia and Tesla) and has yet outperformed the S&P500 by 16.22% over the last 23 months.

Regards,

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/