Marcellus’ Consistent Compounders Philosophy identifies firms with high pricing power that helps sustain a wide gap between returns on capital employed and cost of equity. The portfolio holds such firms for 8-10 years on average and aims to deliver healthy returns with volatility like that of a government bond. We also made the first churn in our portfolio since inception – sold Gruh Finance.

In our first newsletter, we highlight one of the most unique characteristics of Indian economy and how the investment philosophy of Marcellus’ Consistent Compounders PMS is positioned to benefit from it.

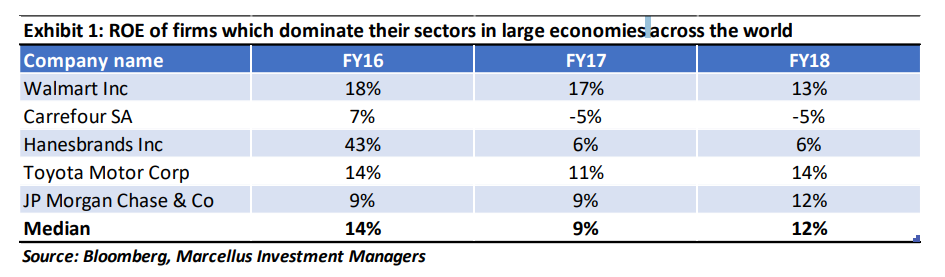

India is perhaps the only large economy where several industries are dominated by one or two players, and these dominant players make returns on capital employed (ROCE – earnings generated on each unit of capital employed on the balance sheet) significantly higher than the cost of capital (or COE – cost of equity) for several decades. For instance, it is not hard to find global players who dominate their industries – Walmart dominates US grocery retailing, Carrefour dominates French grocery retailing, Toyota dominates the mid-segment car market in Japan, Hanes dominates Europe’s innerwear market. However, none of these companies make ROEs substantially higher than their cost of equity (see table below).

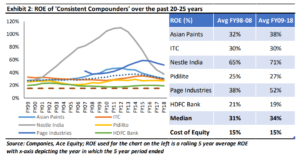

On the other hand, there are several industries in India where one or two companies not only have a dominant market share, their ROCEs have remained substantially above the cost of equity for decades in a row (see table

and chart below).

Most conventional valuation methodologies (P/E multiples or PEG ratios or Discounted Cash Flows) assume that this gap between ROCE and COE will compress over the next 5/10/15 years. This is because- as is often seen in the Western economies – a wide gap between ROCE and COE invites intense competition which forces the gap to narrow down as the dominant players compromise on the quantum of earnings generated on each unit of capital employed.

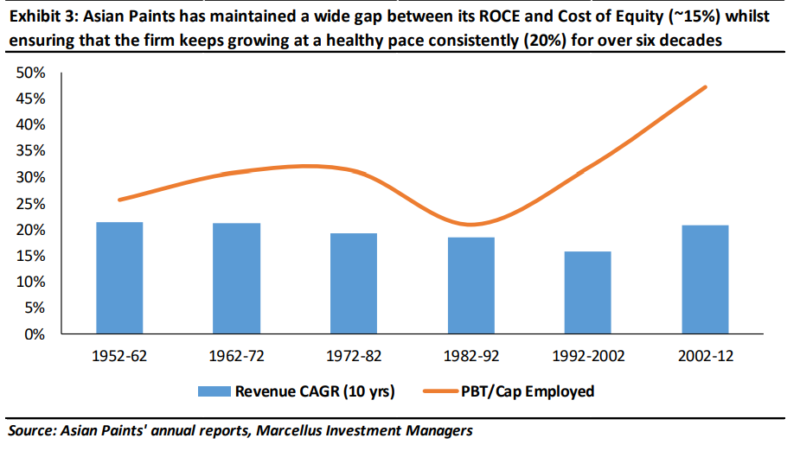

However, there are a few firms in India which have such a high pricing power / competitive advantage, that they can sustain a wide gap between ROCE and COE over very long periods of time. The chart on Asian Paints below probably the best example of such firms.

The gap between ROCE and COE is the free cash flow that a firm generates for its shareholders. Provided these firms sustain this wide gap whilst also growing their capital employed, they will give a healthy earnings growth, consistently over long periods of time, regardless of changes in the internal or external operating environment of these companies. We call these firms ‘Consistent Compounders’.

Once an investor builds a portfolio of such firms, all that he should do is hold them for long periods of time and benefit from the power of compounding of healthy returns, with the volatility in these returns being like that of a government bond!

This sounds very simple, but simple is not always easy! The first challenge is that whilst it is easy to find firms like Maruti Suzuki which maintain their industry dominance (>50% market share of cars in India), their average ROCE (for the last 10 years) is only 17% – like that of Toyota and Hanes highlighted above. The second challengeis that amongst firms that sustain a wide gap between ROCE and COE, there will be examples like Hindustan Unilever (HUL) which do not find avenues to grow their capital employed and hence, despite maintaining >80% ROCE over the past 10-15 years, end up generating an annualised earnings growth of only 8% (CAGR) over this same period. The third challenge is that even if an investor holds stocks like Asian Paints in his portfolio (healthy ROCE with healthy growth), lack of enough conviction in the fundamentals of firms like Asian Paints leads to a less than ideal percentage allocation in the portfolio and shorter than ideal holding period of such stocks in the portfolio.

Marcellus’ Consistent Compounders benefits from the resilience of India’s middle-class households

Our PMS Portfolio consists of 12 stocks which we believe are ‘consistent compounders’. Interestingly, all these stocks belong to small-ticket B2C (business to consumers) sectors like banks,FMCG, apparel, footwear,diagnostic labs (retail) and home building materials. As a result, the portfolio benefits from the scale, relentlessdrive and resilience of Indian middle-class households by taking part in the evolution of day-to-day basic needs of these households.

Gruh Finance exit – Our first portfolio churn since inception

During the month of January 2019, we executed the first exit in our portfolio since inception. We had allocated 8% of our AUM (assets under management) to shares in Gruh Finance – an HDFC Ltd subsidiary providing home loans to sub-prime borrowers predominantly in Gujarat, Maharashtra, Rajasthan, Madhya Pradesh and Karnataka.

The competitive advantages of Gruh are around its ability to maintain asset quality discipline, access to low cost of funds, and high operating efficiencies. Amongst the various factors contributing to these competitive advantages, were the following three factors: a) the stellar quality of its board of directors, which included the senior management team of HDFC Ltd; b) the quality of Gruh’s management team led by Sudhin Choksey; and c) a gradual (rather than rapid) pace of geographical expansion over the past 20 years, which helped Gruh

understand its borrowers better.

On the evening of 7th January 2019, HDFC Ltd announced the sale of Gruh Finance to Bandhan Bank which meant that all our clients were being offered shares of Bandhan Bank in exchange to the shares held in Gruh Finance. Given the nature of this transaction, we had concerns around the sustainability of the three sources of competitive advantages highlighted above, and hence – after a long overnight discussion – our Investment Committee accepted the proposal to exit Gruh Finance from all our client portfolios first thing on the morningof 8th January.

We sold Gruh Finance for all our clients at Rs 281 per share on 8th January at 9.15am. Another NBFC, Bajaj Finance, has replaced Gruh in our clients’ portfolios.

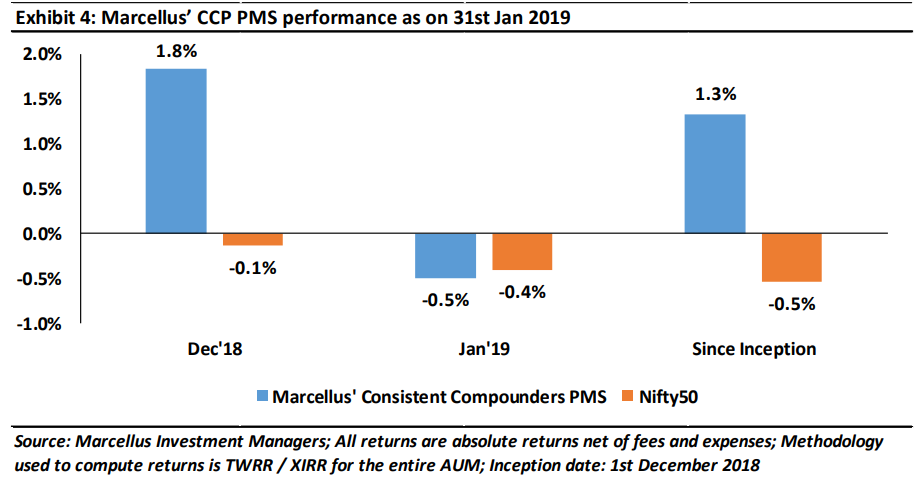

Performance update – Marcellus’ Consistent Compounders PMS – as on 31st January 2019

Given the longevity of fundamentals of our portfolio companies, we don’t expect the portfolio to churn more than one stock per year on an average (i.e., no more than 5-10% expected average churn).

If you want to read our other published material, please visit https://marcellus.in/blog/

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this email in any shape or form. Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

Copyright © 2018 Marcellus Investment Managers Pvt Ltd, All rights reserved.

This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient if not the addressee should not use this message if erroneously received, and access and use of this e-mail in any manner by anyone other than the addressee is unauthorised. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. Any opinions or advice contained in this email are subject to the terms and conditions expressed in a duly executed contract or written agreement between Marcellus Investment Managers Private Limited and the intended recipient. No liability whatsoever is assumed by the sender as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus Investment Managers Private Limited may be unable to exercise control or ensure or guarantee the integrity of the text of the email message and the text is not warranted as to its completeness and accuracy.