High volatility in an equity portfolio creates zones of ‘excitement’ and ‘fear’ based on recent performance. This adversely affects the quality of decision making by equity investors. As a result, historically, investor returns in Indian equity funds have been lower than fund returns across different periods. Similarly, a recent example from the US – NYSE listed ARK Innovation Fund – highlights how investors as a whole, have lost money since the fund’s launch in 2014, even though the fund has delivered more than 30% CAGR over the past five years. Consistent compounding is an antidote to this phenomenon – the same performance CAGR, if delivered with low volatility means less emotional decision making by investors and hence allows them to benefit from compounding. Since inception, Marcellus’ CCP PMS returns (on a weekly rolling 12 month basis) have been significantly less volatile compared to the broader stock market.

Performance update – as on 31st January 2022

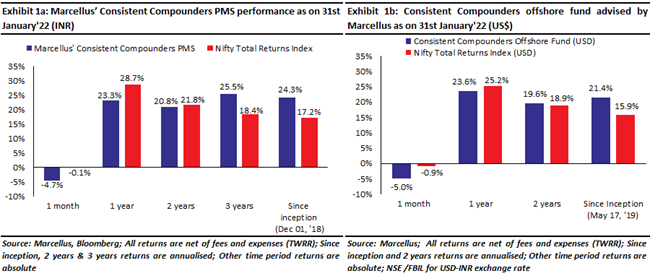

We have a coverage universe of around 25 stocks, which have historically delivered a high degree of consistency in ROCE and revenue growth rates. Our research team focuses on understanding the reasons why companies in our coverage universe have consistently delivered superior financial performance. Based on this understanding, we construct a concentrated portfolio of companies with an intended average holding period of stocks of 8-10 years or longer. The latest performance of our PMS and offshore fund (USD denominated) portfolios is shown in the charts below.

Mistakes investors make as they react to ‘fear’ and ‘excitement’

“We are all far less rational in our decision-making than standard economic theory assumes. Our irrational behaviors are neither random nor senseless: they are systematic and predictable. We all make the same types of mistakes over and over, because of the basic wiring of our brains.” – Dan Ariely in his book Predictably Irrational – The Hidden Forces That Shape Our Decisions (2008).

An article published last year (click here) highlighted conclusions from an Axis Mutual Fund study that investor returns in Indian equity funds have been consistently lower than fund returns across different periods by as much as 5.5% annually.

This effect is not limited to Indian funds. Consider the last few years’ experience of NYSE listed ARK Innovation Fund ETF (ARKK) as an example – ARKK invests at least two-thirds of its assets in equity securities of companies that offer new products or services that potentially changes the way the world works – the fund calls this ‘disruptive innovation’.

ARKK investors as a whole, have lost money since the fund’s launch in 2014, even though the fund has delivered more than 30% CAGR over the past 5 years. A recent Wall Street Journal article nicely summarises how this effect played out for ARKK investors.

‘In its first two full years, 2015 and 2016, ARK Innovation gained less than 2% cumulatively. Then it took off, rising 87% in 2017, 4% in 2018, 36% in 2019 and 157% in 2020. Yet, at the end of 2016, the fund had only $12 million in assets—so its titanic 87% gain in 2017 was earned by a tiny number of investors. By the end of 2018 ARK Innovation had only $1.1 billion in assets; a year later it still had just $1.9 billion. Only in 2020 did investors begin buying big-time. The fund’s assets tripled to $6 billion between March and July 2020. From September 2020 through March 2021, estimates Morningstar, investors deluged ARK Innovation with $13 billion in new money. Right on cue, performance peaked. ARK Innovation ended up losing 23% in 2021—even as the Nasdaq-100 index gained more than 27%. Not many investors captured the fund’s biggest gains. An immense crowd of newcomers suffered its worst losses.’

Why does this phenomenon play out?

High volatility in the price of an asset creates zones of ‘excitement’ and ‘fear’ in the minds of investors based on recent periods of either extremely strong or extremely weak performance respectively – see the two exhibits which follow showing how fund flows into ARKK shot up exponentially after the zone of excitement was created in second half of 2020 and first half of 2021. Towards the second half of 2021, the fund had started experiencing significant outflows when it delivered significantly negative returns in 2021.

“If we do nothing while we are feeling an emotion, there is no short- or long-term harm that can come to us. However, if we react to the emotion by making a decision, we may not only regret the immediate outcome, but we may also create a long-lasting pattern of decisions that will continue to misguide us for a long time.” ― Dan Ariely, in his book The Irrational Bundle: Predictably Irrational, The Upside of Irrationality, and The Honest Truth About Dishonesty (2013).

The higher the volatility of a portfolio (or a single stock), the greater is the possibility of making the mistakes that have been highlighted via the ARKK example and the Axis Mutual Fund study above. One of the simplest ways to avoid these mistakes is to invest in a portfolio which delivers low volatility and hence doesn’t cause excessive excitement or fear in the minds of the investors.

The chart below depicts this comparison across two different types of portfolios. Both Portfolio A as well as Portfolio B deliver the same 25% CAGR over three years. However, Portfolio A delivers the 25% CAGR with high volatility while Portfolio B delivers the same rate of compounding (25%) with low volatility. Despite the same long term CAGR of the two funds, investors are likely to make more money via Portfolio B compared to Portfolio A, because they will not decide to start / top-up / withdraw their investments from the fund based on emotions of fear or excitement. Hence,consistent compounding helps avoid such mistakes that equity investors otherwise make.

Investment implications for investors in Marcellus’ consistent compounding products

When it comes to ‘seeking excitement’ vs ‘return generation’, here are some aspects of Marcellus’ CCP that are worth noticing. Firstly, Marcellus’ Consistent Compounders PMS has historically delivered significantly lower volatility compared to the broader markets over a 12-month period. In Exhibit 4a you can see that the solid line (which is our PMS) jags around much less than the dotted line of Nifty50. In Exhibit 4b you can see that the Marcellus CCP bell curve is less fat i.e., less volatile than the Nifty bell curve.

Secondly, you can see in Exhibit 4b, that the downside risk i.e. the number of times negative returns kick in is much lower with the our PMS than with the Nifty50. And thirdly, you can see in Exhibit 4b, that the most frequent outcome i.e. the median return (which is measured where the height of the curve peaks) is much better for our PMS than it is for the Nifty50 Index i.e. ~30% per annum vs ~18-24% for the Nifty50.

As a result, besides generating healthy CAGR of returns over the long term, investors with our PMS also benefit from the superior consistency of healthy returns. Being boringly consistent is better than seeking excitement, for the same quantum of performance over the long term. That is why we at Marcellus are huge fans of cricketer Rahul Dravid. As we have explained in the opening chapter of our blockbuster bestseller, “Diamonds in the Dust: Consistent Compounding for Extraordinary Wealth Creation”, Dravid scored more runs in Test cricket than any other Indian player whose career overlapped with his. He played more balls than any other batsman in Test history and he won India more matches with his centuries than any other Indian batsman. However, he wasn’t the biggest star in Indian cricket and he didn’t get the biggest brands paying him the biggest bucks – that privilege belonged to cricketers who evoked ‘fear’ and ‘excitement’.

Regards

Team Marcellus