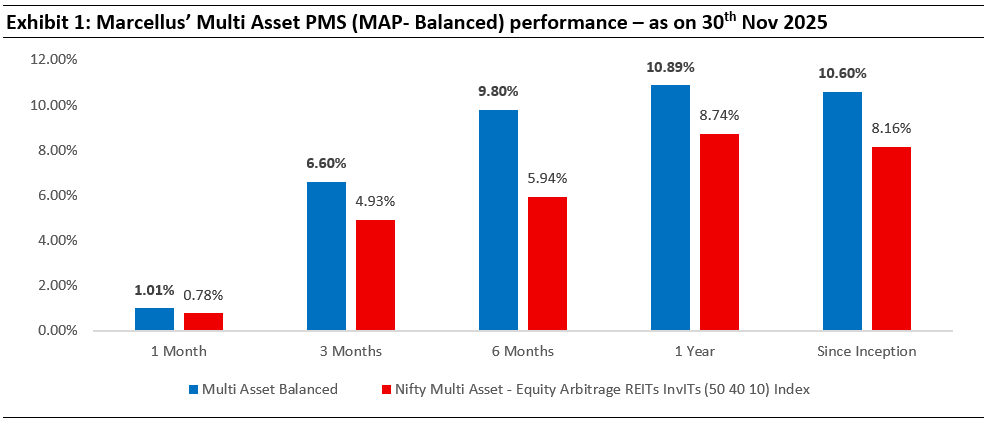

Since inception 15 months ago, Marcellus Multi-Asset PMS (MAP-Balanced) has outperformed its benchmark by 2.44% points and Nifty 500 TSR Index by 4.57% points (annualised, net of fees and expenses). At that time, Indian equities had run up significantly and seemed overvalued when macro growth had slowed, the earnings cycle had already peaked and risk aversion was on the rise due to an uncertain growth outlook. In this backdrop, an asset-allocation based diversification strategy seemed apt, and the results so far are encouraging. We continue to emphasise on goal-based asset-allocation as a means to achieve diversification and superior risk-adjusted returns over longer time periods. MAP endeavours to deliver that by capturing upside from the best performing assets classes, while minimising downside risk, within a rules-based framework (please find more details later in the newsletter).

MAP’s outperformance reinforces the importance of Diversification/Asset Allocation

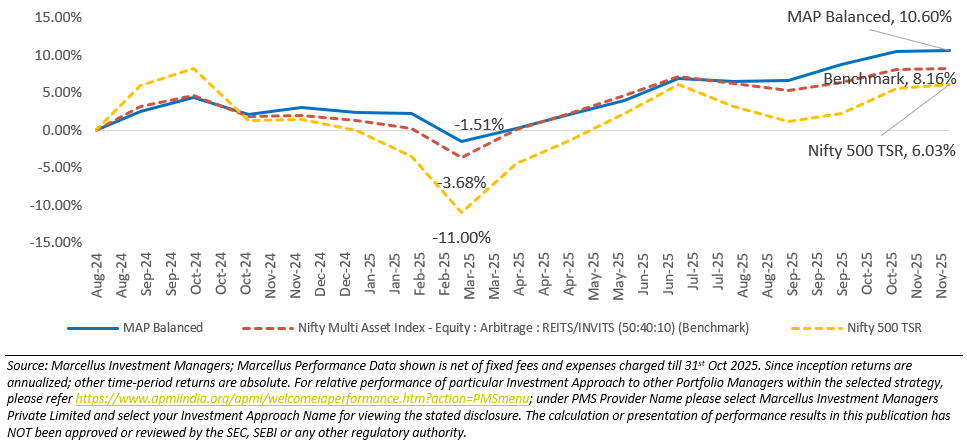

In the 15 months since we launched MAP, the Indian equity market has underperformed yield-bearing assets (debt/income and similar alternatives), gold and global equities. In this period, MAP delivered 10.60% annualised returns (net), outperforming its benchmark by 2.44% and the Nifty-500 Index by 4.57%. The outperformance couldn’t have come at a better time since it has helped reinforce the importance and benefits of Asset Allocation, which are particularly visible during periods of market volatility (for more insights please watch our recent webinar on Navigating Uncertainty with Asset Allocation)

MAP aims to protect downside, and also to capture upside to deliver superior ‘risk-adjusted’ returns

The most important outcome of an asset-allocation based diversified portfolio is to deliver superior risk-adjusted returns, which is typically achieved by:

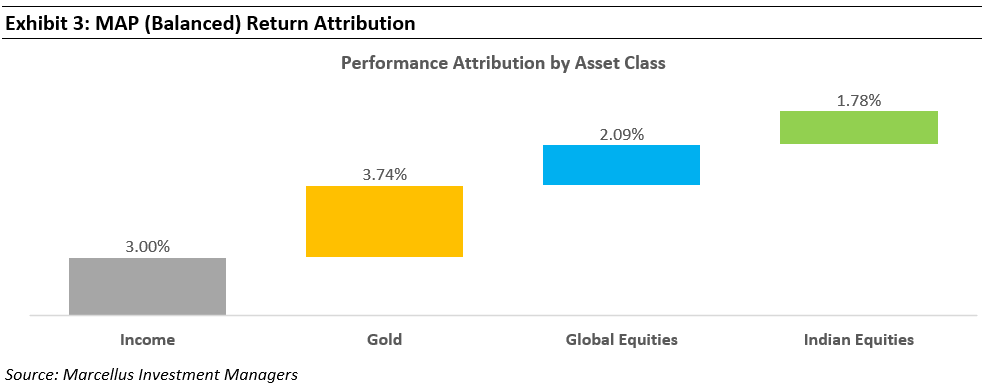

a) Capturing the upside of the best performing asset class – MAP benefitted from the upside captured in yield-bearing alternatives (such as REITs) along with the ‘diversifiers’ – gold and global equities. MAP delivered ~14% absolute returns vs ~8% for the Nifty 500 TSR Index.

b) Mitigating downside risks (or reducing volatility) by limiting exposure to the worst performing asset class – MAP benefitted from a lower than ‘ideal’ allocation to Indian equities which underperformed other asset classes in the portfolio. At the same time, higher allocation to Income (eg. Arbitrage) protected downside risks, resulting in a drawdown of -1.5% vs -11% for the Nifty 500 Index.

Underlying factors prevailing at the time of launching MAP

Around inception of MAP, the Indian economy and the equity market appeared at a possible inflection point; with equities having run up significantly and seemingly overvalued at a time when macro growth had slowed and the earnings cycle had already peaked. Concurrently, global market volatility and growth uncertainty was adding to rising risk aversion. In many ways, the time was apt to put the asset-allocation based diversification approach to test. Hence, apart from just diversifying across asset-class, a tactical positioning across asset classes at inception, appeared more compelling (more on tactical allocation later in the newsletter).

More specifically, around 15 months ago, the broader Indian Equity market seemed overvalued amidst an earnings growth slowdown. Nifty 50 Index had delivered 24% CAGR returns over 4 years, supported by strong PAT growth of 22% CAGR in the post-covid recovery (FY21-24). However, earnings growth had begun to slow down towards the end of FY24 but without any commensurate de-rating in the forward PE multiple, indicating a worsening risk-reward ratio.

In essence, the factors above prompted the following actions:

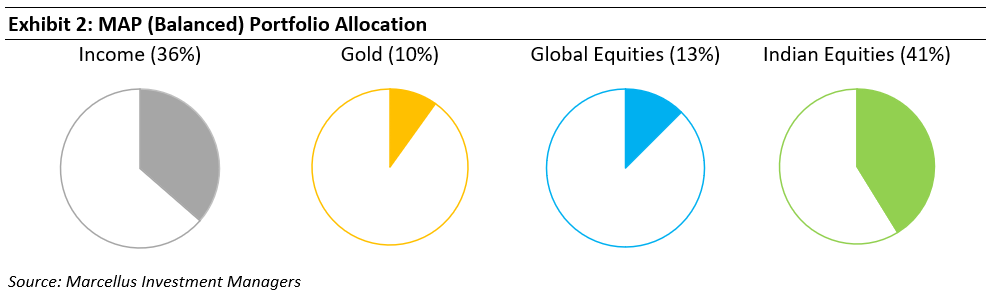

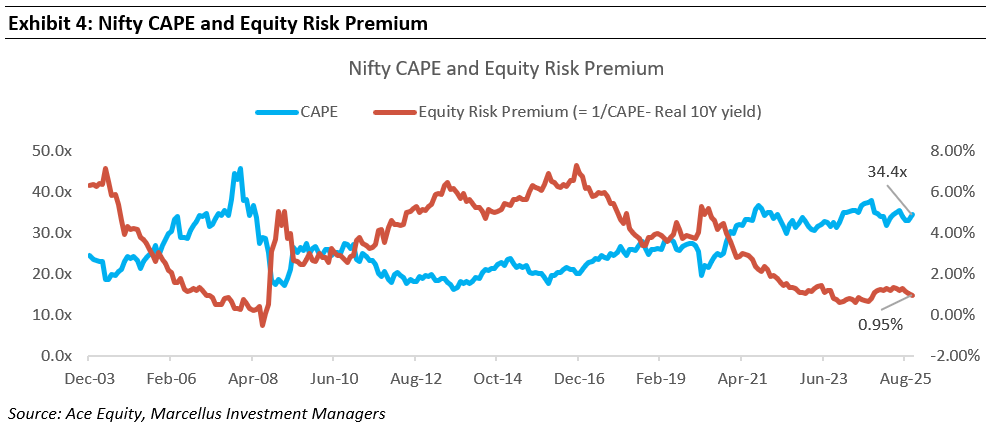

a) Under-allocating to Indian Equities – The under-allocation was predominantly driven by peak valuations for Indian Equities. The Cyclically Adjusted Price to Earnings ratio (CAPE) – an inflation adjusted, relatively stable and noise-free PE ratio – for the broader market indices (Nifty 50, Nifty 500 etc) were 2-3 standard deviations above their historical long-term averages and continues to do so. (For a detailed discussion on CAPE, refer to our newsletter from Sep 2024 – MeritorQ: CAPE Fear)

b) Over-allocating to Income and yield-bearing alternatives (such as REITs) – Income (eg. Arbitrage funds) and similar alternative asset classes, that have low correlation to equities, can hedge against short to medium term equity drawdowns. Within income/debt, REITs/INVITs have matured as an alternative asset class with multiple office and retail REITs (and INVITs) getting listed. These have low correlation with equities, debt-like yield (with better tax treatment) and opportunity for capital appreciation, thereby offering a unique, high-quality contrarian asset class to Indian investors.

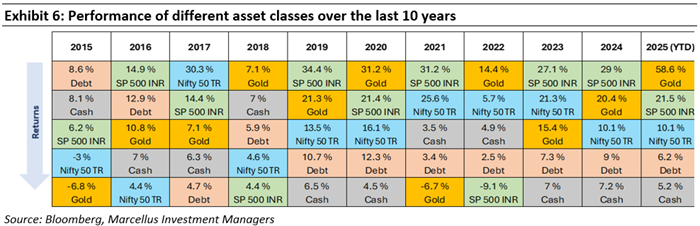

c) Maintaining sufficient allocation to Diversifiers: Assets classes such as Gold and Global Equities (particularly US), which typically have a low correlation with Indian Equities, play a significant role in protecting downside risks during periods of drawdown or consolidation in the Indian market. The low correlation amongst these asset classes is on account of them being priced in USD which plays an important role in diversifying away local risk factors that directly impact Indian equities and the INR.

Key underlying principles driving Marcellus MAP

1. Diversification in perpetuity: MAP is designed to always maintain a diversified portfolio across uncorrelated / lowly-correlated asset classes. With Indian Equities and Income/Debt as the two main asset classes, Gold and Global Equities play important roles as diversifiers.

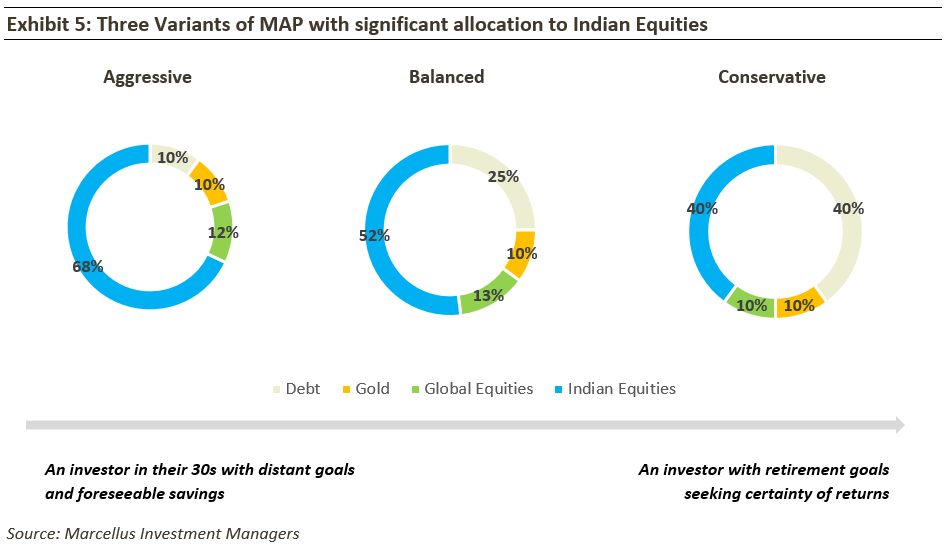

2.Significance of Indian Equity allocation: While debt and other asset classes can protect against short-to-medium term equity drawdowns – equities are actually relatively less risky from a ‘real return’ (beating inflation) perspective over the longer term. Hence, all versions of MAP have meaningful baseline exposure to Indian equities (refer Exhibit 4 below). Our objective, at the very least, is to deliver above inflation returns in the Conservative portfolio; the Balanced portfolio aims to deliver returns in line with the multi-asset benchmark; while the Aggressive portfolio strives to outperform the benchmark (all returns net of fees and expenses).

3.Tactical allocation: Changes to asset allocation that are done basis expected returns and short-term trends of each asset class and are completely rules based. For eg. when equities are overvalued, it implies low future expected returns. Therefore, when overvalued equities deviate from their initial ‘recommended’ allocation by a large magnitude (per our rules-based framework), we significantly reduce the allocation to equities and increase the allocation to other underperforming asset classes.

4. Rebalancing at client portfolio level: Different clients invest at different points in time and therefore rebalancing is done at their individual portfolio level, basis deviations from current recommended Tactical Asset Allocation (TAA) adjusted portfolio.

5.No conflict of interest – In order to mitigate conflicts arising from Marcellus’ own PMS portfolios, in MAP we only invest in Direct MFs, ETFs, and actively traded securities.

6.Fund selection based on consistent performance and cost: We strive to strike a balance amongst factors such as length of track record, variability of returns, downside risk and cost. Hence, we prefer to buy MFs and securities that have a long track record, rank high on past returns vs risk (or consistency of risk-adjusted returns), and have low expense ratios.

Investment Details:

- Product Structure: PMS

- Minimum Investment: ₹50 lakhs (as per regulations)

- Transparent fee structure: 0.50% Fixed Fee per annum (charged quarterly on average daily AUM)

- Eligibility: Available only for Resident Indians

Please write to invest@marcellus.in for further details on MAP or reply to this email.

While understanding the theory of asset allocation is vital, applying it to your unique financial situation is where the real value lies. Before you read about our framework below, we invite you to discover the specific asset mix that aligns with your personal risk profile and financial objectives. We have designed this platform to help take the guesswork out of your portfolio construction. Click the link below to get your personalized asset allocation assessment: https://plan.marcellus.in/auth

The Importance of an effective Asset Allocation

While the tool above helps customize your specific plan, the framework remains universal. An ideal asset allocation is a function of:

a) Financial goals and risk appetite: Investors usually invest with specific goals such as financing children’s education, owning real estate, building retirement fund or simply creating legacy wealth. In addition to goals, it is equally important to ensure alignment with one’s risk-taking ability. For example, while the average return profile of an asset class may align with one’s future goals, if they are unable to bear the inherent downside risk in that asset class (say -10% or -25% or -50%), they may be better off looking for an alternative asset or may even tweak their goals to align with an asset that offers optimum risk-reward.

b) Diversification – for superior risk-adjusted returns: As discussed earlier, diversification provides exposure to diverse asset classes and market opportunities. It ensures one owns the best performing assets regardless of market cycle since it takes the guesswork out of picking individual securities and timing the market.

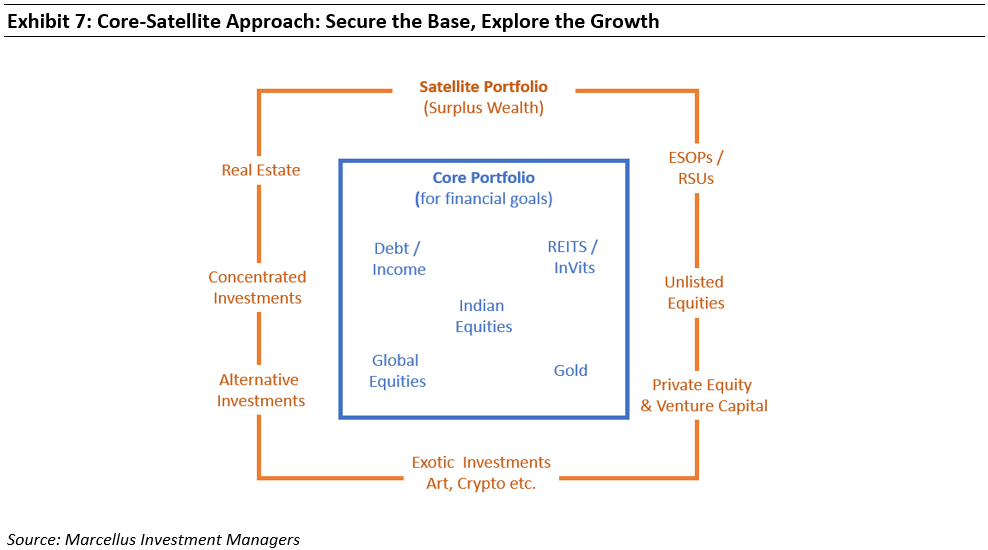

c) Core vs Satellite Approach – Secure the Base, Explore the Growth:

i) Core Portfolio: One that is directly aligned with one’s stated goals and objectives. It funds your goals and should be diversified across core asset classes:

- Broad-based, readily accessible

- Flexible and highly liquid

- Reliable returns

- Low to moderate Cost

ii) Satellite Portfolio: Surplus funds that are available after core goals are catered for and therefore can be invested in ‘non-core’ assets:

- Specialized and harder to access

- Inflexible and less liquid

- High risk, high return

- Need superior investment management skills which can come with higher costs

- Asymmetrical Risk Return Mechanism

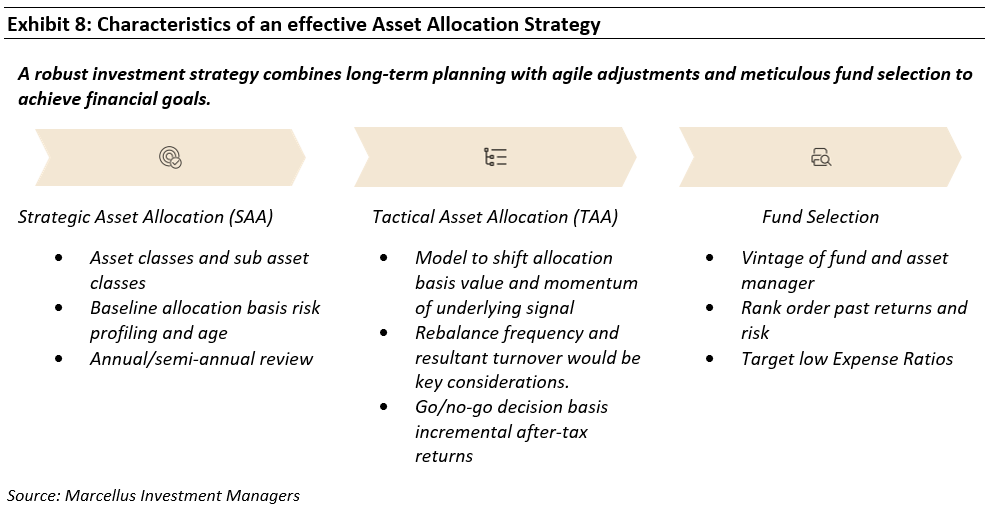

d) Periodic rebalancing to address gaps/deviations relative to one’s ‘ideal’ asset-allocation: A goal-based asset-allocation, adhering to one’s risk appetite, doesn’t exist in isolation, ie, it is not a one-time exercise. Asset-allocation requires periodic (say annually) monitoring and rebalancing – for eg. re-allocating from high performing assets to under-performing assets and vice-versa. Re-balancing can be Strategic or Tactical, as discussed below.

i) Strategic Re-balancing – This broadly means bringing your portfolio’s allocations back to it’s ideal level (basis your goals and risk tolerance) whenever the actual allocations significantly deviate from their ideal levels.

For example – in a bull run, rebalancing may suggest that you sell overgrown allocation of equities (which would have become expensive in the bull run) to buy more gold (which usually underperforms and become more attractive investment during equity bull runs). This boosts returns when the cycle normalizes.

ii) Tactical Re- balancing – Tactical rebalancing involves temporarily deviating from the strategic asset allocation to benefit from short term market opportunities or to mitigate risks during unfavorable conditions – while maintaining the overall long-term investment strategy.

For example – In an over-heated equities market, reduce equity allocation below its ‘strategic or ideal allocation’ and increase debt and income above its ‘strategic or ideal allocation’. Consequently, as the market corrects down to a normalized level (ie mean reversion), switch equity allocation back to its target (or strategic) levels.

Regards,

Team Marcellus