The Global Compounders Portfolio (GCP) is Marcellus’ Global Equities strategy launched in October 2022. It invests in 30-40 deeply moated companies across developed markets—businesses that combine high returns on capital with prudent reinvestment and disciplined capital allocation. The aim has always been straightforward: to deliver long-term compounding of capital through ownership of exceptional franchises, while keeping volatility and behavioral errors in check.

We build this portfolio bottom-up, grounded in proprietary fundamental research and forensic accounting, complemented by a style-based risk framework (Torque) that helps us stay objective across market regimes. In essence, GCP seeks to capture the compounding power of great businesses—without being drawn into thematic exuberance or short-term market rotations.

Source: Marcellus performance data is shown gross of taxes and net of fees & expenses charged till 31st Oct 2025 on client account. Time period returns are absolute. S&P 500 Index refers to S&P 500 NTR Index which is benchmark index of GCP. Note: * Since Inception performance calculated from 31st Oct 2022., being the next business day after the account got funded on 28th October 2022. S&P 500 net total return is calculated by considering both capital appreciation and dividend payouts. The calculation or presentation of performance results in this publication has NOT been approved or reviewed by the IFSCA or US SEC. Performance is the combined performance of RI and NRI strategies. The information is for informational/educational purposes only and is not intended to be personal financial advice. Past performance is not indicative of future results, and market conditions may var

Marcellus’ GCP is through Separately Managed Accounts (i.e., SMAs, just like a PMS) via GIFT City (regulated by IFSCA). Invest in with a minimum investment amount of USD 75,000.

*Accredited Investors shall qualify eligible criteria as defined under IFSCA-IF-10PR/1/2023-Capital Markets dated January 25, 2024.

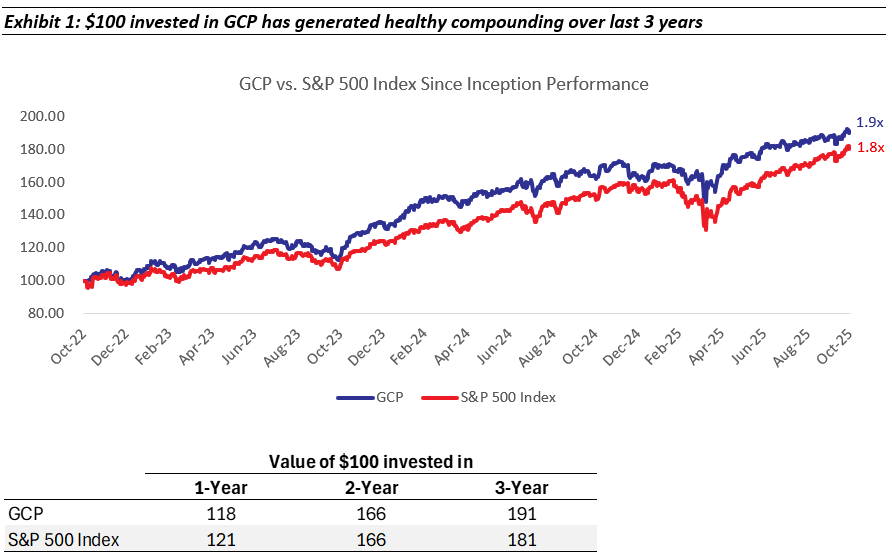

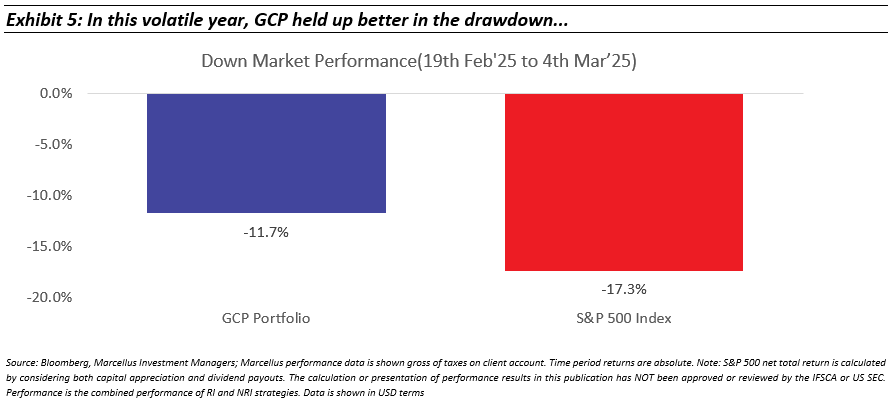

As the strategy marks its third anniversary, we look back on three years that have tested almost every aspect of investing – from abrupt policy reversals and inflation shocks to bursts of speculative enthusiasm and geopolitical uncertainty. Through all of this, the portfolio has remained true to its discipline, compounding in both absolute and relative terms while experiencing smaller drawdowns and lower volatility during challenging phases such as the U.S. banking stress of 2023 and the tariff-related correction earlier this year.

This outcome is consistent with our founding intent – to generate competitive returns with measured risk – and it would not have been possible without the trust and patience of our investors, who have allowed us to stay focused on process rather than noise.

A Narrow Market, a Broader Discipline

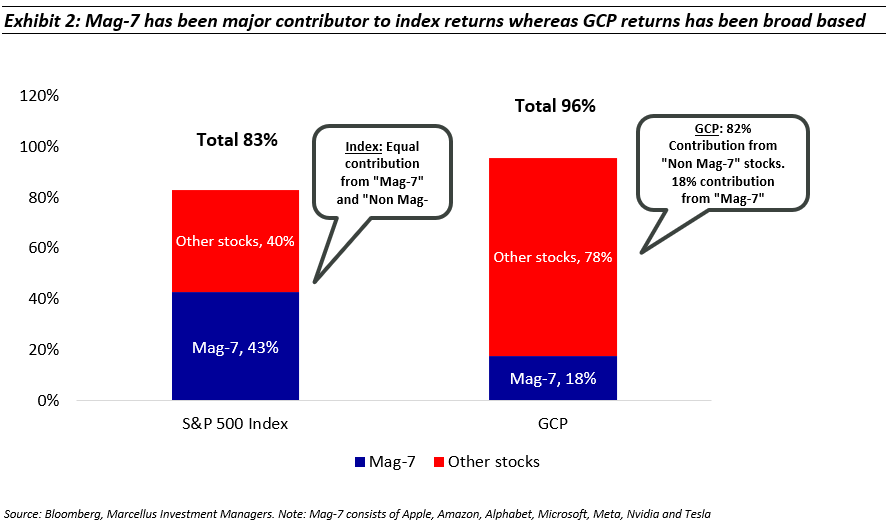

Over the past 36 months, global equity returns have become unusually concentrated. The top ten names in the S&P 500 now account for ~40 percent of its market capitalization, the highest share in decades. Outside those few, earnings progress has been steady but uninspiring, and valuation multiples have lagged.

Such concentration often tempts investors to chase what has worked. Our discipline has been to resist that urge. The GCP philosophy values consistency over momentum, and valuation over fashion. We have avoided extending exposure to the most crowded trades-not because we doubt their strategic relevance, but because their risk–reward asymmetry has become skewed.

The result of this prudence is that our performance has lagged briefly during the speculative rallies, yet the portfolio’s long-term compounding and risk profile have strengthened. Every previous cycle from the early 2000s dot-com phase to the 2020–21 liquidity boom – has reminded us that valuation always matters, eventually.

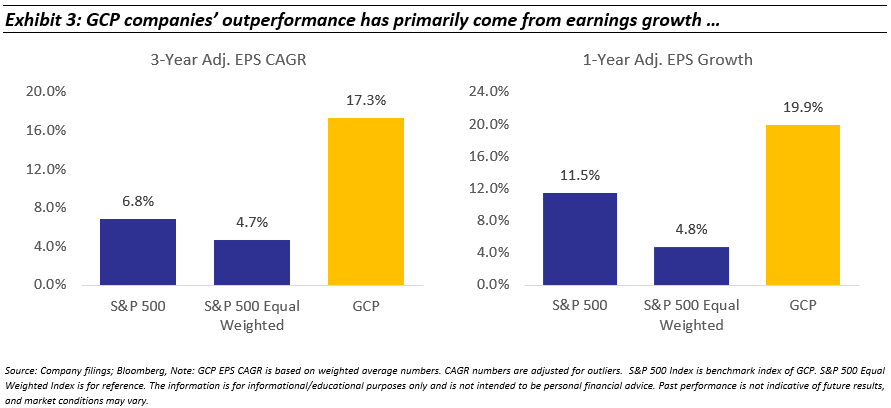

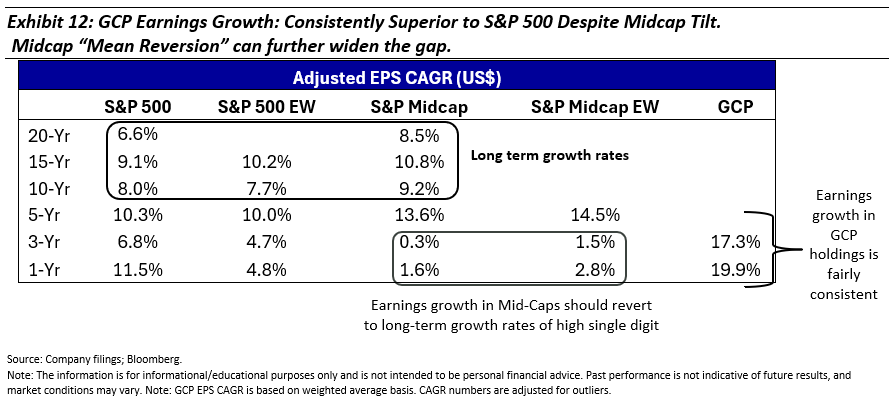

GCP Companies Delivered Earnings Growth

Since inception, GCP holdings have compounded their aggregate earnings per share in the mid-teens – well above the broader market’s high-single digit/ low double-digit pace—despite operating with a higher exposure to mid-cap names

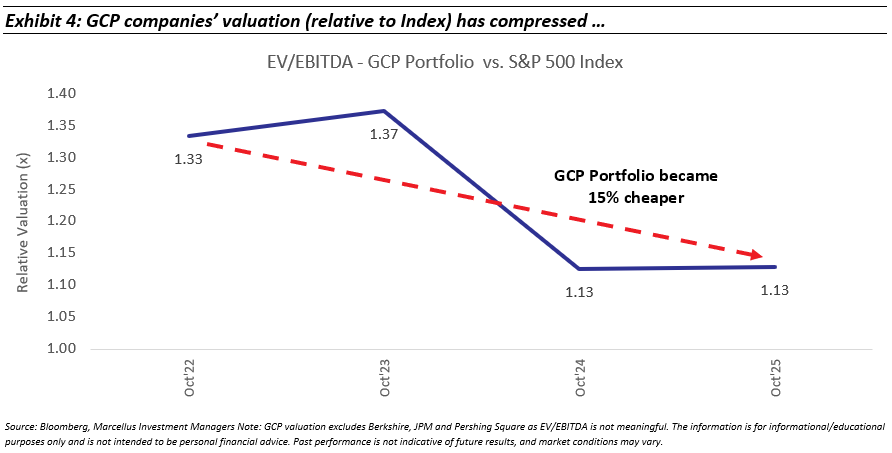

Importantly, this growth has come with no valuation tailwind: portfolio multiples have actually compressed while index valuations have expanded

That combination—rising fundamentals, falling valuations—suggests that intrinsic value creation is running ahead of price (when looked through a relative lens). In investing, this quiet widening between what businesses deliver and what markets recognise is often the seed of future returns.

From a risk perspective, the portfolio’s three-year realised beta has been roughly 88 percent of the S&P 500’s, and its maximum drawdown about 20% lower than the broader market. This is not incidental: it reflects the underlying design of the strategy, which tilts toward companies with steady cash-flow generation, conservative balance sheets, and management teams that treat capital as a scarce resource.

Where the Compounding Came From – Notable Winners

Our return drivers have been diverse, cutting across industrials, infrastructure, and premium consumer names rather than a single theme.

- Amphenol has continued its decades-long discipline of programmatic M&A—over 50 bolt-on acquisitions in a decade, all integrated quietly and efficiently. Its ability to reinvest free cash flow at high incremental returns exemplifies the kind of steady compounding we seek.

- Parker Hannifin’s integration of Meggitt has exceeded expectations. The company has expanded margins and de-levered faster than consensus anticipated, validating our preference for engineering businesses that blend cyclical exposure with structural resilience.

- Heico and Transdigm have benefited from the post-pandemic rebound in aerospace and the gradual upcycle in defence spending. Both continue to demonstrate pricing power and scarcity value in specialised niches.

These businesses—industrial, unglamorous, but highly efficient—illustrate how steady execution beats thematic excitement over full cycles.

Learning from the Setbacks

Not every call has worked as intended, and some have offered valuable lessons.

· Danaher was one such case. We underestimated how long the biotech/life-sciences downturn would persist and how management’s capital-allocation focus might shift post-leadership transition. When evidence accumulated that recovery would take longer, we trimmed our position, but that was much late.

· Copart, another example, has seen near-term challenges from rising insurance premiums and a growing number of uninsured vehicles in the U.S. salvage market. We view these as cyclical headwinds rather than structural issues. Its network density, data systems, and auction platform remain formidable advantages, and we maintain a smaller, patient allocation.

The common thread across these decisions is the willingness to reassess without bias—to recognise when thesis timelines stretch, and to redeploy capital accordingly. Objectivity, not loyalty, defines longevity in compounding.

The Last Six Months: Navigating a Narrow and Speculative Momentum-Driven Market

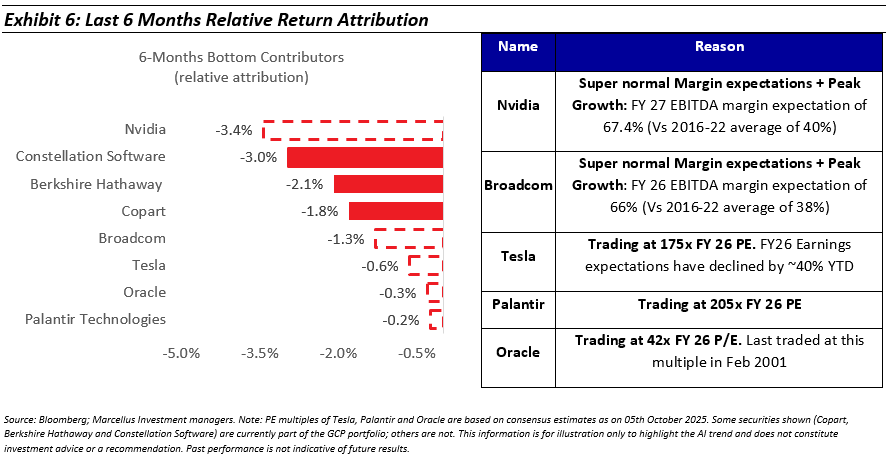

Over the past six months, even though the portfolio did well in absolute terms, but underperformed its benchmark by ~8% . When we look at the relative detractors relative to the benchmark ~6% of drag is due to not owning companies like Nvidia, Broadcom, Tesla, Oracle and Palantir. The primary reason has been our underweight exposure to AI-related mega-cap stocks, which have continued to dominate index performance since mid-2025. This narrow rally coincided with muted re-rating in areas where GCP is overweight—industrial enablers, infrastructure services, and premium consumer franchises—despite these businesses continuing to deliver robust earnings growth and maintain strong balance sheets.

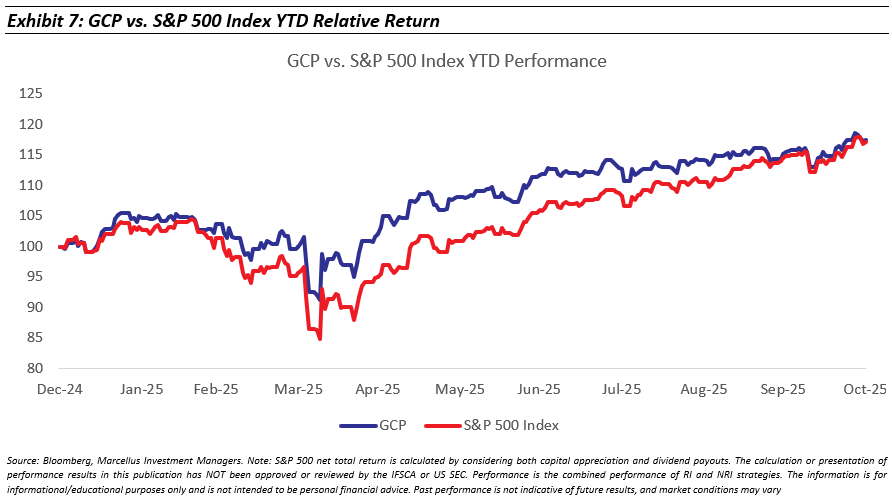

To some extent, the recent relative underperformance also reflects GCP’s resilience during the earlier tariff-led market correction, when the portfolio declined far less than the broader indices. As markets rebounded sharply, that earlier downside protection naturally translated into less room for a mechanical recovery.

It is worth noting that, despite this near-term divergence, GCP remains ahead of the benchmark on a calendar-year-to-date basis, with healthy absolute returns driven by consistent earnings compounding across core holdings.

In hindsight, we could have been more responsive in adjusting our positioning to capture part of the rebound. Recognising this, we enhanced our risk-assessment framework in September 2025, improving how we monitor style tilts and factor exposures within Torque. Going forward, we intend to apply this framework more dynamically, ensuring that our behavioural biases are less reflected in portfolio construction and that our positioning remains balanced across shifting market regimes.

We view this past six-month phase as transitory rather than structural. The underlying fundamentals of our holdings remain strong, valuations attractive, and the businesses we own continue to compound intrinsic value steadily.

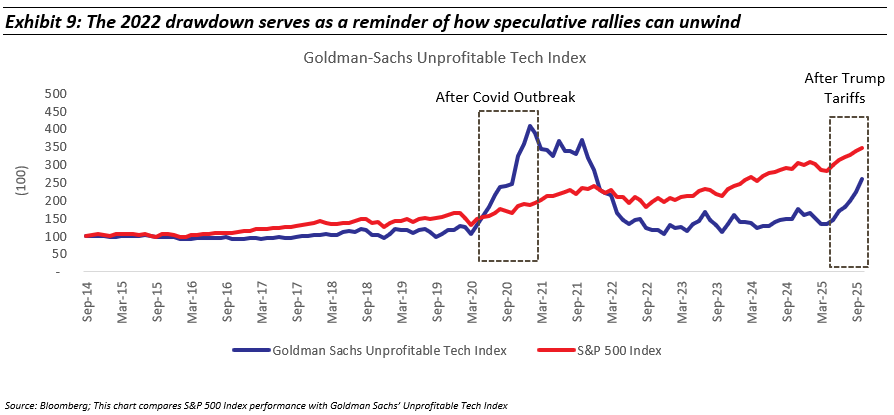

2025 saw a Speculative Surge in Unprofitable Growth Stocks – A Group We Knowingly Avoid

Calendar year 2025 has been exceptionally strong for unprofitable, speculative high-growth. Many of these names, seeing valuations rise sharply despite limited visibility on profitability. This is not an unusual phenomenon.

Such bursts of speculation tend to appear late in liquidity or innovation cycles, when enthusiasm outpaced fundamentals. The most recent parallel was 2022, when a similar rally in unprofitable tech gave way to sharp drawdowns once rates rose and earnings failed to follow through.

We have consciously avoided this group of companies, recognising that while a few may evolve into meaningful long-term franchises, the hit rate historically has been low. Picking the eventual winners in such phases is more a matter of luck than process. Our approach remains to participate indirectly—through the enablers, suppliers, and disciplined operators that underpin the ecosystem’s growth but maintain profitability and pricing power throughout the cycle. This discipline may cost us participation in speculative bursts, but it also helps preserve capital when narratives fade, as they eventually do.

The AI Cycle and the Nature of Prudence

No recent theme has captured investor imagination quite like artificial intelligence. Hardware manufacturers, data-centre operators, and select software platforms have seen exceptional valuation gains. While the technology’s long-term potential is undeniable, its near-term economics remain uncertain.

For the AI build-out to be sustainable, its benefits must eventually diffuse across the broader economy-improving productivity, corporate margins, and consumer utility. Until that diffusion becomes visible, much of today’s investment resembles the early infrastructure phase of past technology cycles: heavy capital spending, modest returns, and optimism priced to perfection. We may have missed the first leg of the rally, but chasing it at this stage of the cycle appears far riskier than the market acknowledges.

Our decision to remain underweight this cluster stems from that asymmetry. We continue to participate indirectly through enablers such as Amphenol, TSMC, and Siemens Energy, but avoid businesses who are likely over earning (astronomical margins) and/or whose valuations already embed outcomes still years away. In our experience, the discipline to wait for earnings confirmation remains the most reliable form of prudence.

A Broader Economic Context

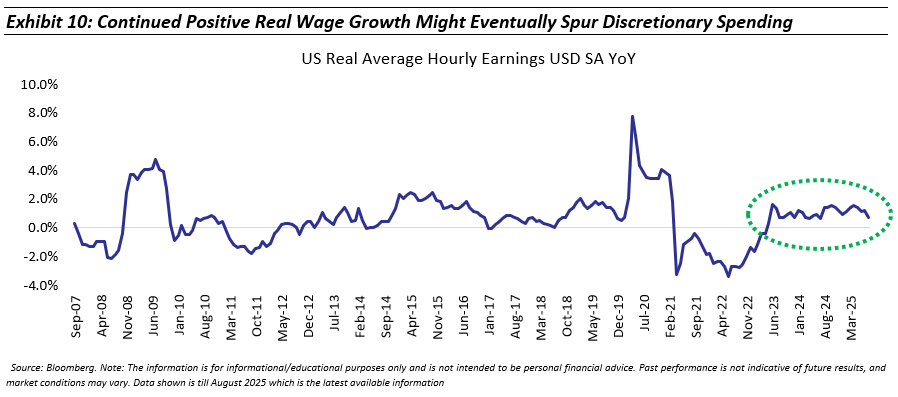

The U.S. economy remains resilient but uneven. Real wage growth is positive, and corporate leverage—at least among larger firms—appears manageable. AI-related capital expenditure could change that over time, but for now, balance sheets remain sound.

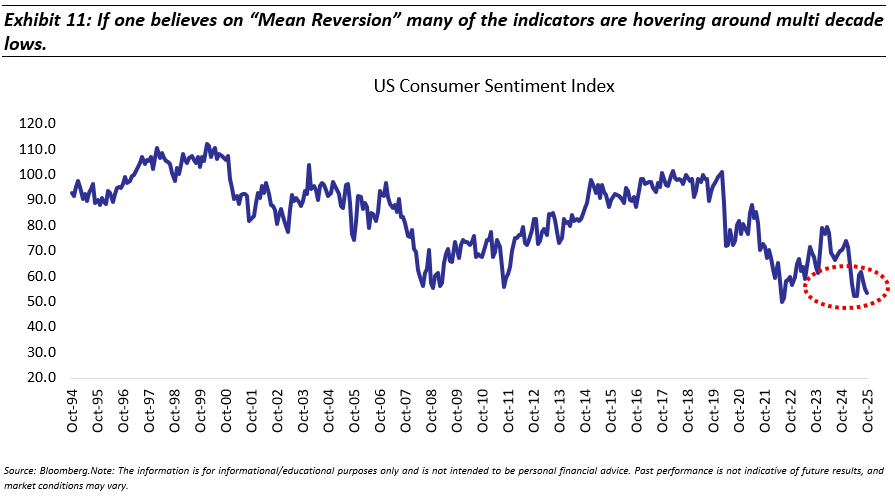

That said, the global macro environment is far from comfortable. Most major economies are now burdened with elevated public and private debt, and the U.S. is no exception. Federal debt has crossed historic thresholds, limiting fiscal manoeuvrability and increasing sensitivity to interest-rate shifts. Across the developed world demographic pressures are intensifying, and geopolitical uncertainty continues to distort trade and capital flows. These concerns have also driven a renewed preference for perceived stores of value such as gold, reflecting the broader unease around debt sustainability and financial repression. Sentiment indicators such as consumer confidence, housing activity, and small-business optimism are hovering near historical lows. Manufacturing has been in contraction for most of the past three years, and outside AI-driven projects, corporate investment remains subdued.

Yet, even within this imperfect backdrop, the relative position of the U.S. economy remains stronger than most—supported by corporate profitability, financial depth, substantial productivity improvement, and institutional resilience rather than short-term policy tools

We see this backdrop as balanced. Inflation has moderated, the Federal Reserve is likely past the peak of its tightening cycle, and the fiscal impulse is broadly neutral. If suppose monetary easing begins in 2026, market breadth—both in earnings and valuations—could begin to normalise, favouring the segments where we are overweight: industrial enablers, infrastructure operators, and quality mid-cap compounders

In Europe, incremental tailwinds are emerging around defence, energy transition, and industrial re-shoring—multi-year themes that align well with several of our holdings.

The alternate scenario is that the U.S. slips into a full-fledged recession. In such an event, no equity market would remain untouched. However, as past corrections have shown, GCP tends to display stronger relative resilience, supported by the stability of its underlying businesses and the portfolio’s lower volatility profile. While this “hard landing” scenario is not our base case, we remain positioned to navigate it if it unfolds. Our central expectation remains one of rotation rather than recession – a gradual broadening of leadership beyond the current narrow set of market winners.

Why Valuation Discipline Still Matters

It is worth repeating that valuation is not about pessimism—it is about probabilities. When the top decile of U.S. companies trades at multiples two standard deviations above their long-term averages, the distribution of future outcomes becomes narrow. Conversely, the median stock, trading near historical norms, often offers the best balance of upside and protection.

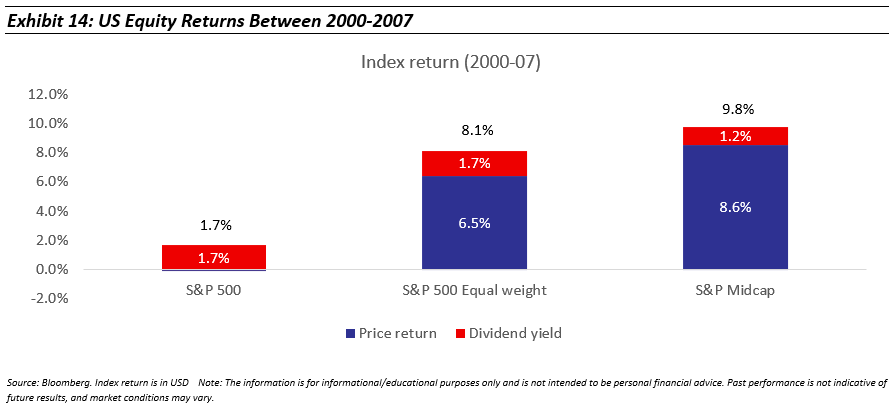

The valuation gap between the S&P 500 large-cap index and the broader U.S. market is now among the widest seen in two decades. The last time such dispersion appeared was during the early 2000s. Between 2000 and 2007, when the headline S&P 500 delivered close to zero total return, the S&P MidCap Index compounded at roughly 8–10% in USD terms. History does not repeat but it rhymes.

That period is an important reminder: when the market looks expensive at the surface, it does not mean opportunity has disappeared. Great businesses trading at fair prices continue to create value underneath the averages. Our task is to find those pockets of resilience and allocate to them with discipline. With GCP we are trying to do the same. Staying disciplined, consistent, and systematic in allocation – rather than reacting to short-term exuberance – is what ultimately drives long-term compounding.

Reflections on Three Years

Looking back, three observations stand out.

- Narratives evolve faster than fundamentals. Most businesses change incrementally; markets rewrite their stories daily. Our job is to separate story from substance.

- Earnings durability remains the anchor. Over long horizons, compounding of free cash flow explains almost all shareholder returns.

- Objectivity is the rarest edge. It is emotionally hard to hold steady when consensus shifts—but the willingness to do so is what preserves compounding.

Our focus in the coming years will remain unchanged: own businesses that can sustain healthy return on capital, reinvest prudently, and treat minority shareholders fairly. We will continue to prioritise valuation discipline and capital preservation, believing that long-term wealth creation is as much about avoiding mistakes as about finding winners.

The past three years have reinforced the importance of this approach. We thank our investors for their trust, patience, and perspective — qualities that allow such a philosophy to work through cycles.

As the father of modern portfolio theory, Harry Markowitz sums it, “Diversification is the only free lunch in investing.”

In our recent webinar, we dive deeper into the importance of diversification, asset allocation and the need to diversify into assets that are least corelated. This is precisely where India and the US go hand in hand as investment destinations.

Interested to learn more?

Dive into the full discussion here: https://youtu.be/r7s3N2oZXGA

In the meantime, let us know your thoughts on diversification by replying to this email.

Happy Investing!

Regards,

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/