Our core philosophy in Marcellus CCP remains anchored in finding consistent compounders with clean accounts, deep moats and disciplined capital allocation. However, the drivers of that predictability have evolved over the past five years (after GST and Covid-19). Traditional moats, such as distribution in FMCG, are being disrupted by digital democratization. India’s K-shaped economic evolution has constrained sectoral growth beyond the top-10% households in pockets of discretionary consumption. At the same time, new high-ROCE engines are emerging in healthcare, tourism, and services. In this newsletter, we discuss the update to our ‘Quality Investing’ playbook: moving beyond a reliance on historical metrics to focus on specific flywheels of future predictability driven by capital allocation. By reducing risk correlation and avoiding valuation traps in fading franchises, we are positioning the portfolio to capitalize on India’s structural shifts.

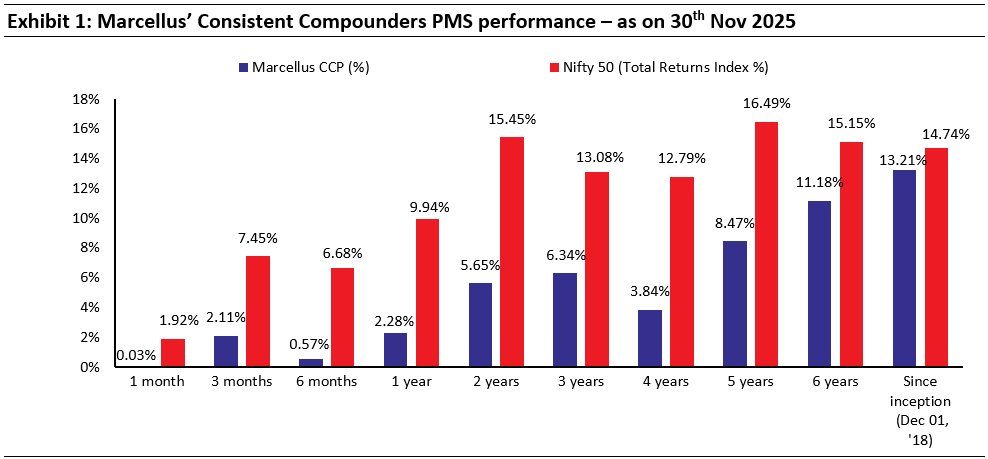

Source: Marcellus Investment Managers; Marcellus Performance Data shown is net of fixed fees and expenses charged till 30th Sep 2025 and is net of Performance fees charged for client accounts, whose account anniversary / performance calculation date falls upto the last date of this performance period; since inception & 3 years returns are annualized; other time period returns are absolute. For relative performance of particular Investment Approach to other Portfolio Managers within the selected strategy, please refer https://www.apmiindia.org/apmi/welcomeiaperformance.htm?action=PMSmenu, Under PMS Provider Name please select Marcellus Investment Managers Private Limited and select your Investment Approach Name for viewing the stated disclosure. The calculation or presentation of performance results in this publication has NOT been approved or reviewed by the SEC, SEBI or any other regulatory authority.

In the world of high-conviction investing, ‘the map is not the territory’ i.e. our understanding or representation of reality (the map) is not the same as reality itself (the territory). It serves as a reminder that our mental models and perceptions can differ significantly from the actual complexities of the world. This concept (‘the map is not the territory’ ), coined by Alfred Korzybski, emphasizes the importance of recognizing the limitations of our abstractions and the need to be cautious about confusing them with reality. This is both a risk we intend to avoid in our conviction-based CCP portfolio construction, as well as an opportunity we intend to capitalise on.

While our core philosophy remains anchored in finding predictability of cash flow with healthy growth over a very long time horizon, the “drivers” of that predictability in India have evolved dramatically over the last 3–5 years.

At Marcellus’ Consistent Compounders, we remain committed to the following cardinal principles in our stock picking and portfolio construction:

- Cleanliness of accounting and governance practices

- Predictability and Longevity over at least a 5-year horizon, ideally much longer than that

- High Growth (of Profits & Cash Flows) with high ROCE (representative of deep moats)

- Valuation Comfort (Buying neglected moats / growth drivers / optionalities)

- Portfolio Concentration (15-20 high conviction stocks with non-correlated risk profiles)

- Absolute Return Orientation (Bottom-up stock picking aiming to deliver a healthy outcome)

However, the correlation between historical fundamentals and our ability to predict using historical fundamentals has evolved. In this newsletter, we discuss how our “Quality Investing” playbook has undergone a significant update.

The Anatomy of Predictability

We believe that our ability to deliver a healthy absolute return outcome to our clients over the long run requires consistent compounding of fundamentals of our portfolio constituents, with valuations reflecting a neglect of sustainable healthy growth drivers. We view predictability not as a straight line on a chart, but as a mechanism.

We look for a specific flywheel in the companies we own:

- Inefficiency in a Large TAM: The sector must have a massive Total Addressable Market (TAM) plagued by inefficiency (e.g. unorganized players, poor service, lack of trust).

- Structural Tailwinds: The TAM itself must be growing (e.g., financialization of savings, healthcare spend).

- The “Moat” as a Solution: The company must use a moat (e.g. innovation, brand, process, patent or scale) to solve the inefficiency, thereby protecting market share and generating high Return on Capital Employed (ROCE).

- Capital Allocation (Engine 1): Reinvesting cash flows to aggressively capture market share in the core business.

- Capital Allocation (Engine 2): Deploying capital to build new moated growth drivers before the core matures.

The Paradigm Shift – Why “History” is No Longer a Guide;

“If past history was all there was to the game, the richest people would be librarians.” — Warren Buffett

In his book “The Rise and Fall of American Growth,” Robert J. Gordon highlighted that in the USA, the period of 1880 to 1930 witnessed a radical economic “paradigm shift” driven by the Second Industrial Revolution. This paradigm shift fundamentally severed the connection to a harsh, primitive past by introducing transformative technologies like electricity, the internal combustion engine, indoor plumbing, and life-saving pharmaceuticals. These innovations did not merely improve efficiency but completely redefined the human experience.

The Indian economy went through such a paradigm shift during the early 1990s, benefits of which were reaped over the subsequent three decades. Its investment implications – on the one hand, it re-defined the winning sectors in the Indian stock market, making several historical (pre-1990) growth drivers redundant. On the other hand, over the period 2000-2020 the hunt for Indian stocks with high predictability of cash flows was reasonably correlated with their “History of Consistent Growth” over the preceding decade – due to the reasonable consistency of growth drivers for the economy over the 1990-2020 period. Today, this linkage with historical growth factors has been diluted again, given how the Indian economy has shifted across several dimensions, disrupting the old definitions of safety, especially after events such as GST implementation, UPI adoption and the Covid-19 pandemic. For example:

Dilution of “Distribution and Marketing as a Moat”:

Historically, FMCG giants won because they reached over five million outlets. They also used their scale to out-bid the competitors on prime-time TV advertising slots. Consumer’s trust on regional brands / unorganised players was significantly lower than what it was on brands run by large multinationals. These moats are evaporating. Platforms like Blinkit and Zepto are democratizing logistics. A D2C brand doesn’t need a 50-year-old distribution network to reach a customer in 10 minutes; they just need a listing. With the advent of digital marketing, it is now easier for a new brand to reach a consumer than ever before. Moreover, the consumer’s mindset has shifted from “trusted heritage brands” to “willingness to try new, niche brands.”

TAM constraints in some industries due to K-Shaped economic growth:

In India, low depth of consumption – a market structure where the majority of the population has limited purchasing power beyond basic necessities – has meant that high-value consumption does not spread evenly across the country. Instead, it concentrates in deep, isolated pockets—geographic or demographic islands where disposable income is high enough to sustain discretionary spending. Hence, once you move past the top 10-12% of the population (approximately 100-150 million people), disposable income drops sharply. Amidst this backdrop, the K-Shaped economic growth of the last decade has led to volume growth constraints for some discretionary consumption categories like premium innerwear, apparel and footwear.

Wallet share shift towards “Experiences”:

Post-Covid19, there has been a significant increase in consumer’s propensity to spend on experiences and services, mainly for the for top-10% households by disposable income. As basic needs are met, incremental income for such households is flowing into areas like travel and tourism rather than on buying more products. Some of these sectors, such as hotels, previously did not have businesses generating ROCEs above cost of capital. Cash flow metrics have radically improved in the sector post Covid as both the supply side (e.g. formats of hotels) as well as the demand side (both luxury as well as non-luxury traveller’s propensity to spend) has evolved meaningfully over the last 5 years.

The Healthcare Inflection Point:

Post-Covid19 pandemic, there has been a rapid rise in health awareness, particularly around chronic diseases. This is driving wallet share toward insurance, preventive diagnostics, and premium hospital care. Capital upcycle of the corporate hospitals has funded an aggressive expansion of pan-India hospital chains. Unit economics of some of these businesses have turned a corner from being unviable i.e. ROCEs less than cost of capital till five years ago, to healthy and sustainable levels of more than 15% ROCEs. Over the next decade, we expect a massive market share shift towards pan-India organized hospitals, diagnostics and health insurance players. With the invention and adoption of new drugs such GLP-1 Receptor Agonists used to treat type-2 diabetes and obesity, there could be further transformation of diagnostics, hospitals and insurance sectors. There exist several inefficiencies, the biggest one being around the conflicted incentive structures of players in the hospital and insurance industries, thereby adversely affecting the price and quality of healthcare. We expect to see innovation of new business models by high quality players in these industries, which could build moats prioritising patient outcomes while overcoming the conflicts of interest.

Unit Economics of ‘Internet Companies’:

After a decade of cash burn. Several internet-first businesses (food delivery, fintech, logistics) have crossed the inflection point of attractive unit economics. Some of them are now arguably more predictable than some legacy infrastructure companies.

Doubling of Marcellus CCP’s overall coverage universe:

Recognising the paradigm changes highlighted above, over the last 2-3 years, Marcellus CCP’s coverage universe has undergone doubling, both in terms of the number of stocks as well as the range of sectors covered. CCP portfolio continues to be concentrated around 15-20 stocks with an objective to maintain low churn and long investment horizons. However, FY25 was a year of abnormally high churn in the portfolio as we tried to reflect: a) addition of new high growth companies in the portfolio, while also focusing on reducing risk-correlation amongst portfolio constituents; b) reduction in allocation towards companies which have undergone a structural moderation in their growth profiles; and c) focus on valuations to avoid risks of de-rating and capture potential upsides from potential upgrades to expectations baked into the share prices.

The Risk Radar – Where Valuations are Trapdoors

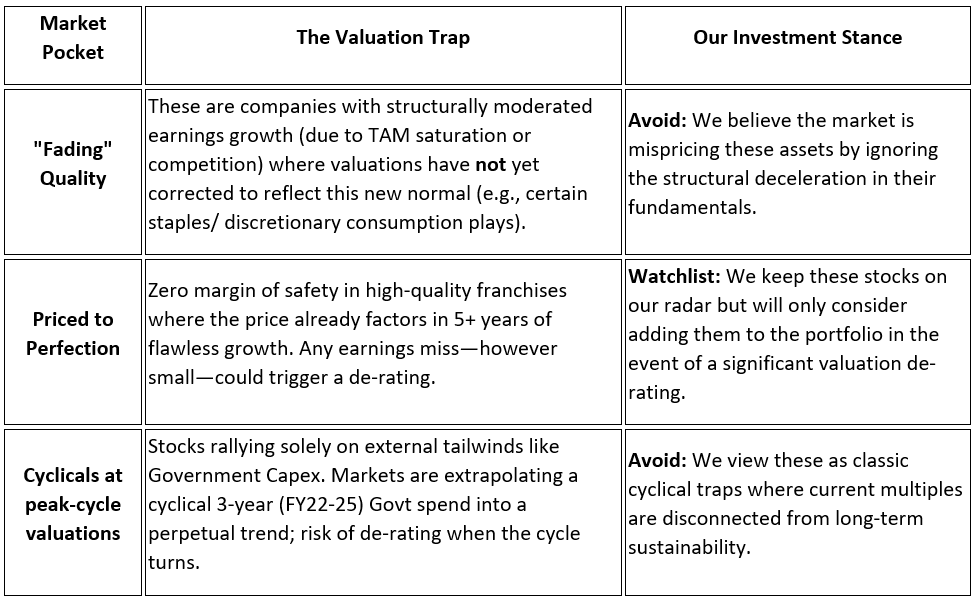

We are currently avoiding three specific pockets of the market where we believe the risk-reward is unfavorable:

The Hunting Ground – Where We Find Comfort in Valuations

Despite elevated indices, based on our contrarian conviction, when it comes to valuations, we have identified two fertile grounds for deployment:

1. “Growth Surprise” Compounders: Areas where valuations appear rich (optically high P/E), but there exists a significant potential for earnings surprise. We are willing to ‘optically pay up’ for quality where we believe the consensus earnings estimates are too conservative. For example – some of our portfolio stocks from building materials, retail and CDMO export sectors.

2. “Capital Allocation” based quality upgrades : We are accumulating businesses with inconsistent long term historical earnings growth, but high predictability today based on recent capital allocation decisions. Their current valuations reflect weakness in historical fundamentals. However, we believe these businesses are going through an inflection point of upgrade in the quality of their cash flow generation. For example – some of our portfolio stocks from the auto, auto comps, classifieds, hospitals and logistics sectors.

The weighted average FY27 P/E multiple of our current portfolio is 39x. Although this is a premium of 1.8x compared to Nifty50’s valuations, it is justified by earnings growth and ROCEs which are more than twice that of the benchmark index’s long term averages. Risk to this stance remains a compression in the gap between fundamentals of Nifty50 and our portfolio companies.

2QFY25 fundamentals of CCP’s current portfolio holdings and outlook

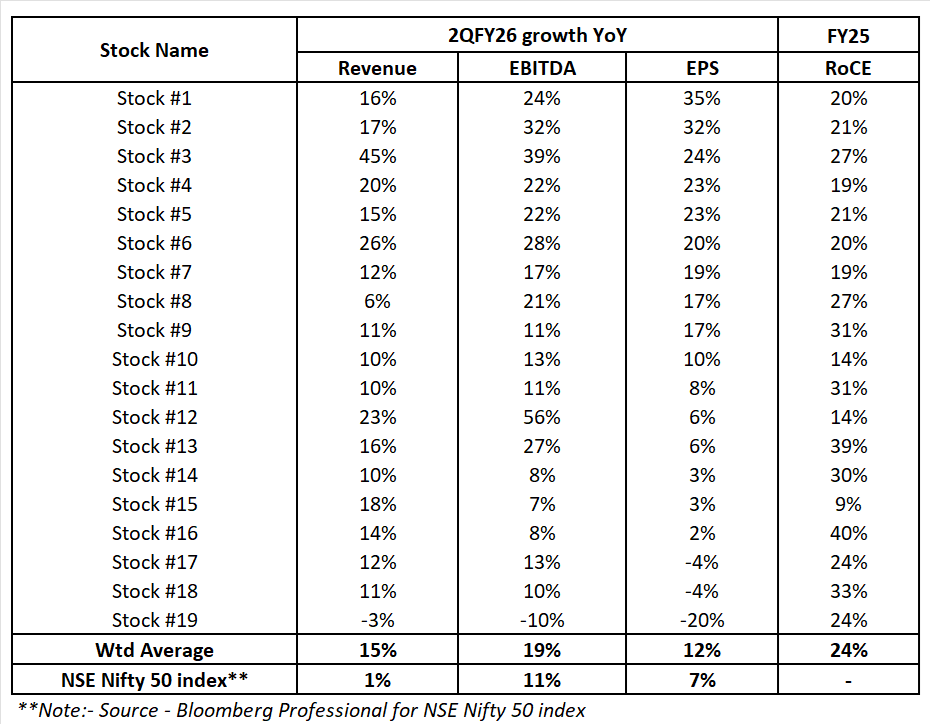

Marcellus CCP’s current constituents have delivered YoY growth in Revenue/EBITDA/EPS of 15%/19%/12% during 2Q FY25, against Nifty50’s 1%/11%/7% respectively. The portfolio weighted average ROCE in FY25 was 24%, with a 3-year average reinvestment rate (FY23-25) of c.80%.

Outlook: Positioning for Resilience

“Any year that you don’t destroy one of your best-loved ideas is probably a wasted year.” — Charlie Munger

Buying into Pessimism, Trimming Optimism: True to our absolute return orientation, we have used the recent volatility to rebalance the portfolio. We have increased position sizes in quality franchises where we believe the market has priced in excessive pessimism, specifically in Trent, Info Edge, and CMS. To fund these high-conviction bets, we have trimmed exposures in stocks that have rallied significantly over the last 12 months, including top contributors like Narayana, Eicher and a few lenders. This counter-cyclical capital allocation allows us to lock in gains while seeding the next leg of compounding.

Tailwinds and Structural Shifts Looking ahead, we see two distinct tailwinds for our portfolio companies:

- Policy Catalysts: The recently announced GST rate cuts are likely to help the fundamentals of our holdings with high exposure to autos and B2C consumption.

- Increase in allocation to high-growth sectors such as Healthcare: We remain convinced that healthcare services are in the early innings of a 10-15 year structural rise in penetration. Our portfolio is heavily weighted towards organized players in hospitals, diagnostics, and insurance who are best positioned to capture this shift from unorganized to organized care.

The Case for “Quality” in a Moderating Economy We expect “Quality” as a style factor to do well over the next few years. As broader economic growth moderates (from Nifty50’s 24% EPS CAGR over FY21-24 to mid-single digit growth over the last six quarters), the gap between average companies and exceptional ones is likely to widen. In such an environment, companies that rely on their own internal strengths—deep moats and prudent capital allocation—to generate growth will stand apart from those reliant predominantly on external economic tailwinds.

Risk to Our View: We remain vigilant regarding one key risk – given the elevated valuations of the broader indices combined with weak earnings growth, a significant market correction remains a possibility.