Overview

Marcellus’ Consistent Compounders PMS invests in a concentrated portfolio of heavily moated companies that can drive healthy earnings growth over long periods of time. Portfolio construction involves a two-stage process:

- A filter-based approach to create an investible universe of 25-30 stocks

- In-depth bottom-up research of such companies in the universe to assess sustainable competitive moats to build a portfolio of 10-15 stocks that deliver healthy compounded earnings growth over long periods of time.

While the filters are applied annually, companies in the portfolio and in the coverage universe are monitored for sustainability of moats on a continuous basis through extensive primary and secondary research. Please check our newsletters (here and here), for a detailed discussion on some of the frameworks adopted in our research process on an ongoing basis.

Filter-based approach

We create a list of stocks using a twin-filter criterion of double-digit YoY revenue growth and return on capital higher than the cost of capital, each year for 10 years in a row. Next, we build a portfolio of such stocks and hold them patiently for long periods of time, with very little churn.

Where do we add value?

The Consistent Compounders Portfolio combines our deep-dive stock-specific research with the benefits of the filter-based approach explained earlier,to help generate outperformance of 4-5% per annum over and above these filter-based portfolios. This is achieved via 3 factors:

- Portfolio concentration: The filters might give a longer list of stocks which dilutes the reliance of the portfolio on outstanding companies. We narrow the portfolio down to 12-15 ultra-high-quality stocks.

- Identifying the real source of strong fundamentals: Many housing finance companies, for example, cleared the filter-based criteria in 2018 or in 2019, but their fundamentals had been aided by macro factors including low-cost money market funding and a booming real estate sector, which may not sustain in the future. Hence, our research-based approach did not accept most of these housing finance companies despite their healthy historical track record.

- Identifying one-off blips in historical fundamentals: Nestle India’s Maggi episode, for example, drove revenue growth of Nestle India below 10% in FY15. Similarly, the fall in crude oil prices to below US$30 per barrel caused a 6% product price cut by Asian Paints in FY17 which led to its revenue growth dropping below 10% YoY in FY17. Manual intervention in portfolio construction analyses the nature of these blips and on case-to-case basis we consider the inclusion of such stocks in the portfolio.

Fee Structure

Marcellus offers Consistent Compounders Portfolio with zero fixed fees. The Consistent Compounders PMS comes with zero entry load/exit load and with no lock-in.

We offer three fee structures:

| Regular Plan | Direct Plan | |||||

|---|---|---|---|---|---|---|

| Fixes | Variable | Hurdle | Fixes | Variable | Hurdle | |

| Fixed Only | 2% | 0% | NA | 1.50% | 0% | NA |

| Variable Only | 0% | 20% | 8% | 0% | 20% | 8% |

| Hybrid | 1% | 15% | 12% | 0.75% | 15% | 12% |

* High water mark applies for performance fees Minimum investment: INR 50 lacs

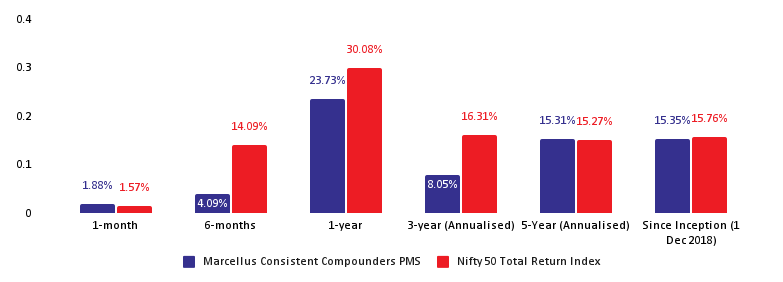

Performance

Performance (as of 31st March, 2024)

*For relative performance of particular Investment Approach to other Portfolio Managers within the selected strategy, please refer https://www.apmiindia.org/apmi/welcomeiaperformance.htm?action=PMSmenu. Under PMS Provider Name please select Marcellus Investment Managers Private Limited and select your Investment Approach Name for viewing the stated disclosure. Performance data shown is net of fixed fees and expenses charged till March 31st, 2024 and is net of annual performance fees (Except for Little Champs Portfolio) charged for client accounts whose account anniversary/performance calculation date falls upto the last date of this performance period. Since, for Little Champs Portfolio, performances fees are charged on cumulative gains at the third anniversary, of the respective client account, the effect of the same has been incorporated for client accounts whose third account anniversary falls upto the last date of this performance period. Performance data is not verified either by Securities and Exchange Board of India or U.S. Securities and Exchange Commission.

Invest with Marcellus’ Consistent Compounders

Get in Touch